EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

From contract manufacturing to innovation-driven growth, EMS has huge potential in India.

In brief

- India's electronics manufacturing services industry is growing, driven by higher share of outsourcing in India by Original Equipment Manufacturers (OEMs), developing component ecosystem and government incentives.

- The shift from plain vanilla contract manufacturing to Original Design Manufacturing (ODM) caters to the evolving needs of OEMs for product innovation.

- Although players in the mobile space have the highest scale, presence in application segments like automotive, industrial and medical give higher margins.

India is expected to become an electronics manufacturing powerhouse over the next decade driven by increasing domestic demand and improving export competitiveness. Domestic production has nearly doubled between FY17 and FY22 and is expected to further increase at a CAGR of 24% between FY22 and FY27.

One of the pillars of the growing electronics manufacturing industry in India is electronics manufacturing services (EMS). EMS consists of services such as designing, manufacturing, testing, distributing, and servicing electronic components and assemblies for OEMs.

In recognition of the industry’s potential and to support it further, over the recent years, the Indian government has introduced many schemes, incentivizing electronics manufacturing. The Production Linked Incentive (PLI) Scheme addresses challenges associated with high cost of capital in India. It provides 4% to 6% incentive on incremental sales of goods manufactured in India and targets specific sectors within India’s electronics industry.

Growth in domestic electronics production will be majorly driven by technology adoption, increasing affordability and sustainability.

Industry 4.0 is contributing to the growing demand for electronics as industries integrate digital technologies such as artificial intelligence, automation, and data analytics to optimize their processes, improve efficiency, and enhance productivity.

Increasing affordability and mobile penetration has created a strong market for electronic devices ranging from smartphones to home appliances.

Focus on sustainability is another major driver as the automotive sector, among others, is transforming. For example, production of electric vehicles (EVs) has driven up the demand for electronics such as the battery management system (BMS).

Growth drivers for India’s EMS market: Increased outsourcing to EMS players, China plus one strategy and domestic electronics ecosystem development are the key demand drivers.

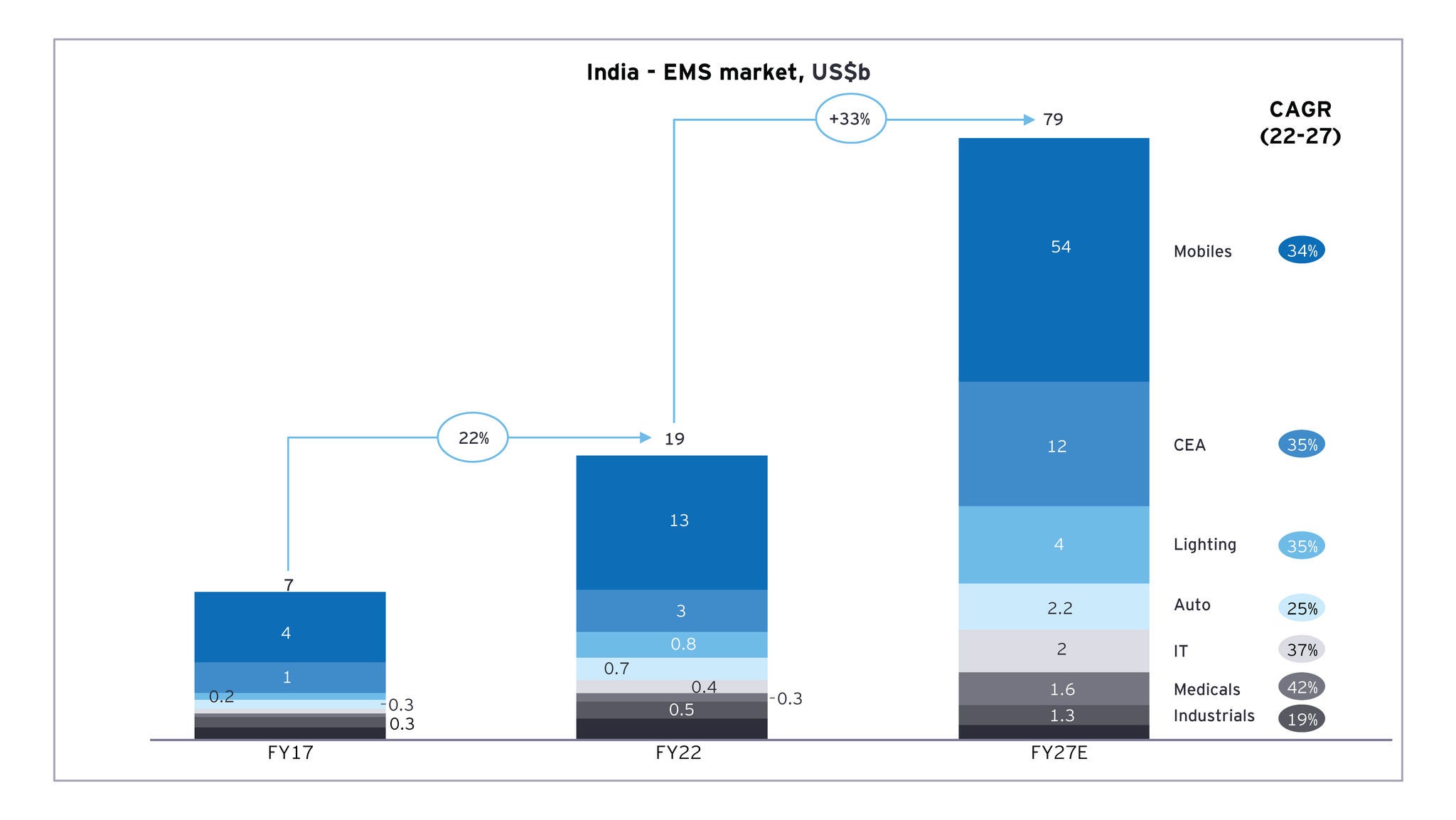

Over the next five years, the EMS market in India is expected to reach US$80 billion, providing growth opportunities to strategic and financial investors. A large chunk of this growth will be seen in mobiles and consumer electronics and appliances, followed by lighting, auto, and others.

In addition to increasing domestic demand, many global electronics manufacturers are moving their outsourced manufacturing operations from geographies such as China to India to ensure that supply chains remain uninterrupted. Other factors such as rising cost of manufacturing in China, trade disputes, and the Indian government's efforts to attract foreign investment in the electronics sector are in favor of the Indian EMS sector.

Several OEMs in the country are outsourcing a larger share of their manufacturing to domestic EMS providers due to reasons such as increasing complexity of electronic products, the need to reduce costs, and their desire to focus on core competencies.

Focus is shifting from traditional contract manufacturing to ODMs

In response to the changing demand, the EMS landscape has been evolving rapidly, with a noticeable shift from traditional contract manufacturing to ODM. These two approaches are distinct as each caters to specific OEM needs.

Contract manufacturing, historically the dominant model, involves EMS players sourcing components, manufacturing, assembling, and supplying finished products to OEMs based on the latter’s specifications. The ODM model represents a more comprehensive approach as, in addition to contract manufacturing services, ODM companies take on the responsibility of designing products according to OEMs’ specifications. This includes product conceptualization, prototyping, and design iterations, all carried out in close collaboration with the OEM. Furthermore, ODMs’ services encompass logistics, and after-sales support, thereby offering a holistic solution to OEMs.

Large global MNCs and large Indian firms seek ODM services as they require a higher degree of product innovation, customization, and end-to-end support. ODMs enable OEMs to bring unique products to market swiftly and efficiently, often tapping into the latest technological advancements and market trends.

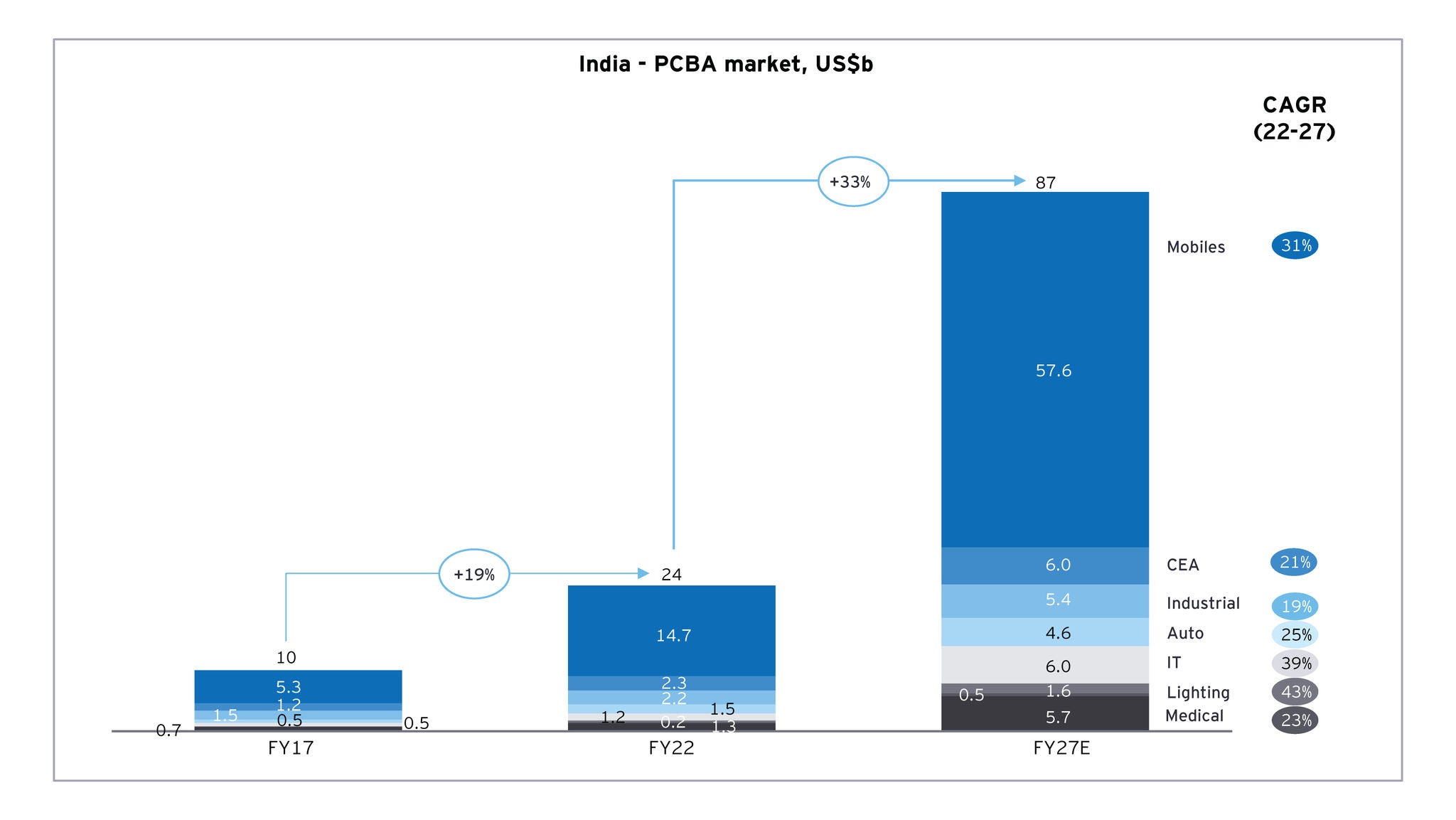

The printed circuit board assembly (PCBA) market in India is expected to provide larger opportunity, growing at a CAGR of 30% in the next five years due to its supply to both in-house OEMS and EMS players.

India’s electronic component market: it is largely import dependent with sourcing primarily from China.

India depends on imports from China, South Korea, Vietnam, and other East and Southeast Asian countries for electronic components like semiconductor devices, printed circuit boards (PCBs), etc. To position India as the global hub for EMS, Indian government has approved a modified program for semiconductors and display fab ecosystem, with an outlay of US$10 billion and several incentives to develop the semiconductor and display manufacturing ecosystem in India.

Next steps for the EMS players in India

EMS players are now shifting their focus in the value chain from traditional box build to design and PCB assembly. Though segments such as mobiles and consumer electronics have the largest scale, many EMS players are entering low volume high margin segments such as industrial, medical, and automotive.

Also, as EMS players explore value creation opportunities, they must bridge the opportunity and performance gap to achieve full potential of their businesses.

Download the full pdf

Summary

Driven by growing demand of electronics, export competitiveness and encouraging government policies, the Indian EMS sector is expected to grow significantly in the next few years. EMS players have shifted their focus from box build to design and PCB assembly and achieve higher margins. With the huge opportunity pool ahead, EMS players will need to bridge the opportunity and performance gap to achieve full potential of its business and deliver maximum value to its stakeholders.

How EY can help

-

Transformation Consulting services at EY integrate strategy, transactions, and technology to drive accelerated growth for end-to-end enterprise change.

Read more -

EY-Parthenon sector strategy consulting teams have deep sector strategy experience and can help your business challenge the status quo. Learn more.

Read more -

Supply chain consulting services & solutions at EY helps optimizing supply chain management and operations, boosting agility, efficiency, and resilience

Read more

Related articles

Key trends shaping India's US$45b building products market

India's building products industry is evolving with trends in eco-friendly and sustainable materials, smart systems, and modern living preferences.

Emergence of advanced materials across key manufacturing sectors in India

Learn how investment in end-use industries spurs innovation and use cases for advanced materials and boosting advanced manufacturing growth across India.

EY Tech Trends Chapter VII: Industry 4.0 is redefining the ‘smart’ industry

Industry 4.0 technologies like IoT, AI, ML, 5G, AI and 5G are enabling organizations to scale operations, accelerate processes & enhance safety and efficiency.