EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Advanced materials is likely to be a US$10 billion market in India by 2028.

In brief

- Advanced materials market was valued at US$5 billion in 2021 and is expected to grow at a CAGR of about 10-12%.

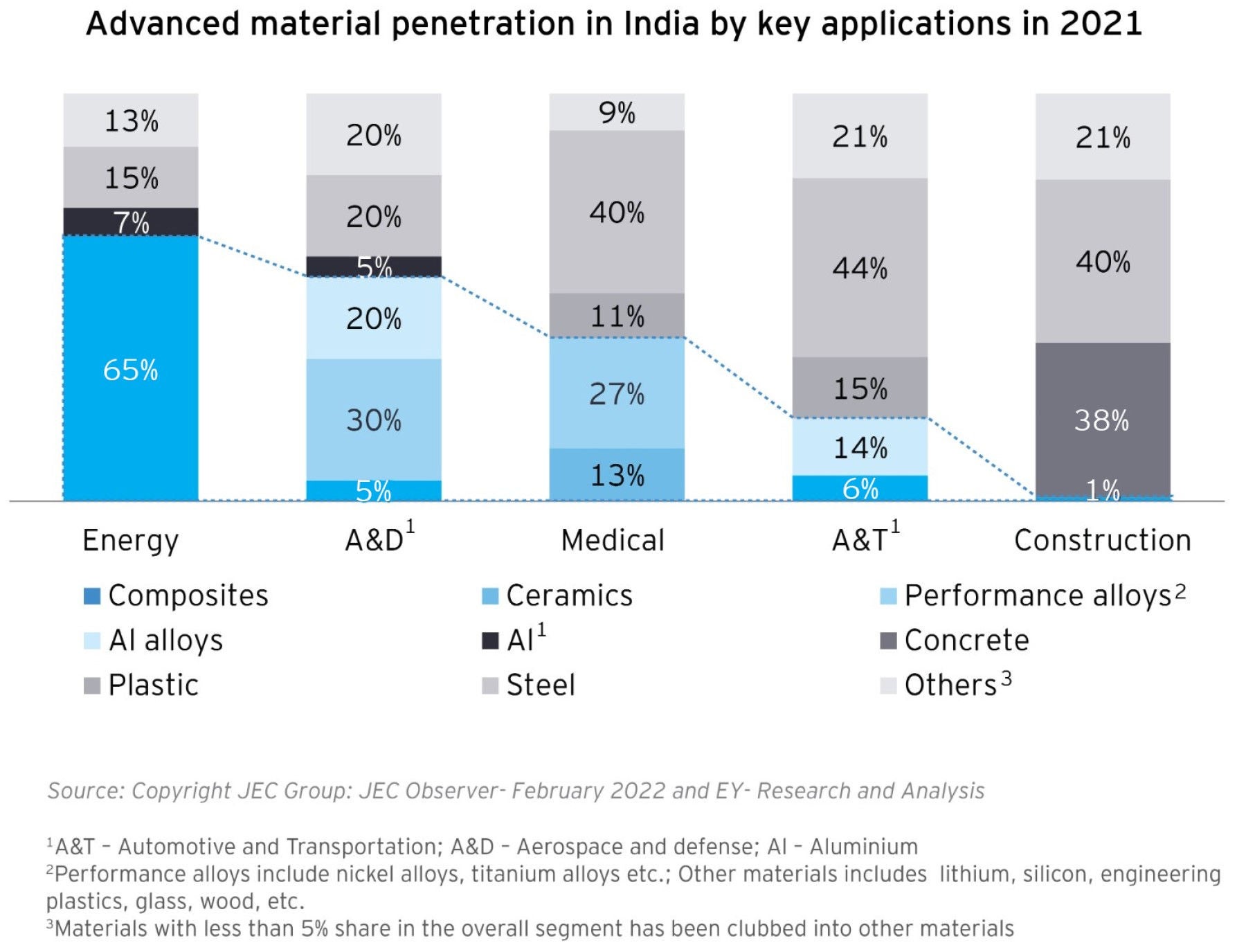

- Renewable energy, medical and aerospace/defense sectors have high penetration of advanced materials currently driven by the use of composites, ceramics and performance alloys.

- Materials used in product manufacturing have a direct impact on manufacturers' revenue and margins and can assist them in creating product differentiation and driving market share.

Businesses in India are pivoting toward new-age or advanced materials, such as composites, ceramics, advanced aluminum alloys and performance alloys. This transition is driven by the demand from various end-use industries due to their better performance efficiency, lower weight and cost effectiveness.

EY report, ‘Advanced materials: the emergence of new-age materials across key manufacturing sectors in India’ states that India is witnessing a surge in demand for these new-age materials and in some cases, penetration is on par with global benchmarks. Significant investment in end-use industries is driving innovation and use cases for advanced materials, which create transition-based opportunities for manufacturers as they draw up plans for sustainable growth.

Trends and opportunities: from energy to construction

1. Energy sector: penetration in key renewable energy applications to reach 70% by 2028

The energy sector is witnessing higher demand for clean energy, thus pushing capacity expansions in wind and solar and increasing focus on energy storage. As a result of this, the advanced material market is expected to reach US$1.96 billion in 2028 from US$0.99 billion in 2021.The growth is driven by demand for materials such as carbon, glass composites, silicon, lithium and nickel that are used in wind blades, photovoltaic cells, batteries and smart grids.

2. Aerospace and defense: Penetration in key structural applications to reach 65% by 2028

Aerospace and defense industry is transitioning to lightweight and hypersonic aircraft with drones also becoming an integral part of the ecosystem. With a CAGR of 8% to 10%, the advanced materials market in this sector is expected to hit US$0.55 billion in 2028 from US$0.31 billion in 2021 driven by rising demand for super alloys and composites for structural applications as well as shape memory alloys and piezoelectric materials for sensors and active control components in autonomous aircraft and drones.

3. Healthcare: penetration in implants and prosthetics to reach 45% by 2028

Healthcare trends such as 3D printing, nanotechnology and smart prosthetics are driving the demand for advanced materials. The market is anticipated to reach US$300 million in 2028 from US$130 million with 12% to 14% CAGR. The demand will be majorly driven by increasing consumer preference for ceramic implants and other materials such as titanium and alloys, silicon, biomaterials across applications such as prosthetic limbs, spinal screws and sensors, among others.

4. Automotive and transportation: penetration in key passenger vehicle applications to reach 25% by 2028

Automotive sector is witnessing a surge in demand for advanced materials driven by the need for light weighting to meet higher fuel efficiency norms and extended battery range. The market is estimated to witness a 10% to 12% CAGR from 2021 to 2028 to reach a sizable market of US$3.83 billion from US$1.83 billion. The demand is for materials such as glass and carbon composites, lithium, silicon, and nickel across applications such as battery casings, body panels, temperature and pressure sensors.

5. Construction: penetration in key structural and non-structural applications to almost double by 2028

Smart cities are expected to be one of the biggest pockets of demand within the building and construction sector, thus spurring the need for advanced materials. Greater adoption of modular construction as well as sharper focus on sustainability is increasing the need for green and lightweight substitute materials. The market is currently valued at US$0.6 billion to grow by a CAGR ranging from 12% to 14% to reach US$1.41 billion by 2028. Materials such as glass, carbon and wood composites along with green steel are being used, majorly finding applications in structural components, walls, rebars, facades, metro tunnels among others.

Materials as value creation levers for manufacturers

Leading players across these key end use industries are proactively adopting advanced materials for product manufacturing in India, which is expected to have a direct impact on their revenue and profit margins.

Aligning to customer preferences, such as improved performance and lighter

weight, will assist manufacturing sector in India in creating product differentiation, which will not only drive market share but also give them pricing power.

The sustainability issue that lies with traditional materials present manufacturers with an opportunity to innovate and disrupt markets. This will also help them protect margins in a post–COVID-19 world of disrupted supply chains and re-aligned government priorities.

The article is also contributed by Ishank Kataria, EY Parthenon.

Download the full pdf

Summary

There is growing demand for advanced materials across key manufacturing sectors in India, with penetration being at par with global levels in a few sectors. Increased investments in end-use industries are spurring innovation and application scenarios for advanced materials. As a result, manufacturers in India can take advantage of transition-based opportunities and plan for sustainable growth.

Related articles

How India can fill the credit gap to fuel economic growth

Discover how debt has played a crucial role in driving economic growth. Learn more about credit gaps in India.