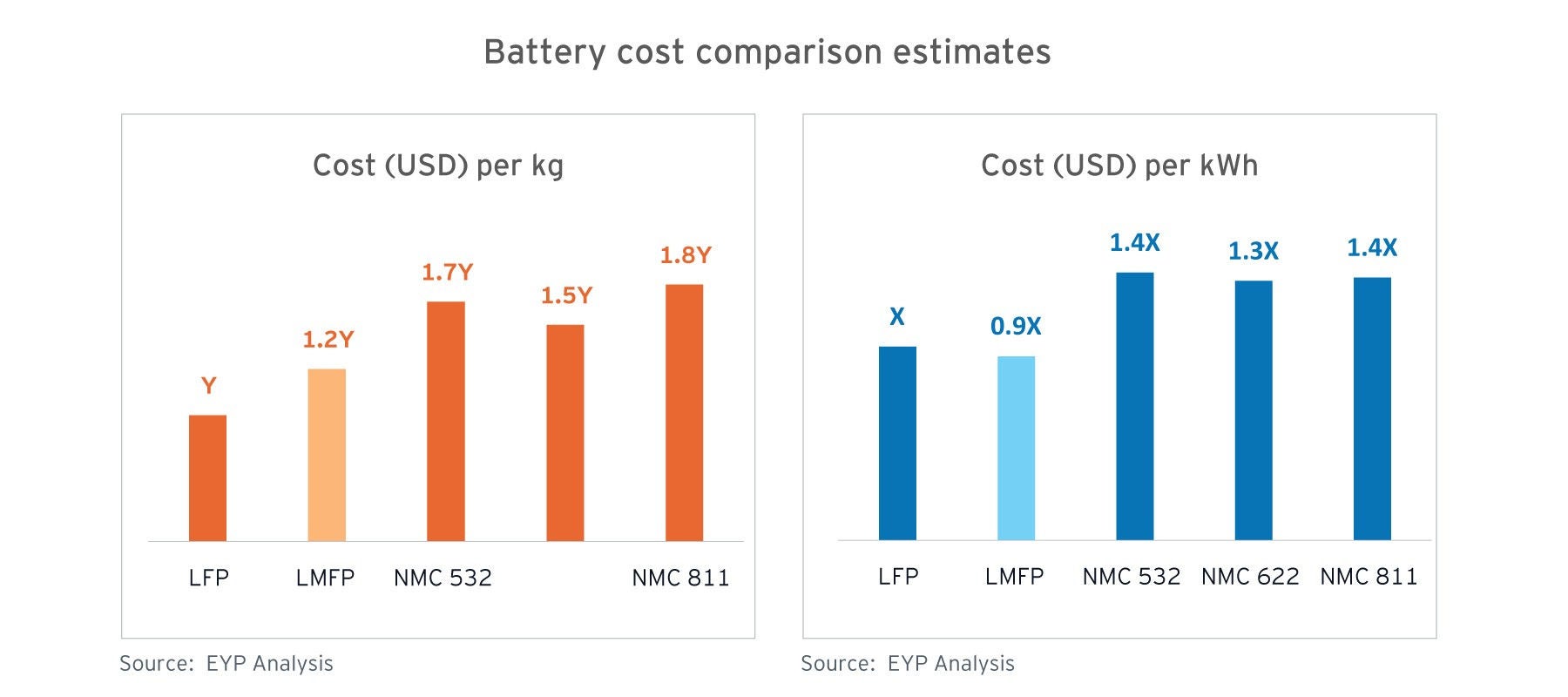

Various organizations are currently exploring ways to further reduce the cost of LMFP technology. Currently, the LMFP manufacturing process is similar to that of LFP, utilizing iron phosphate as a precursor mixed with lithium and manganese salt. However, there is a potential shift towards using powdered manganese-iron ore and phosphoric acid in the future, a change that could contribute to cost reduction.

Manufacturers are actively pursuing the use of low-cost materials in LMFP production. One of the largest global battery manufacturers incorporates low-cost metal oxides, while another manufacturer uses common inorganic chemical raw materials. These efforts aim to not only reduce costs but also enhance electrochemical performance through techniques such as ion doping and carbon coating.

However, LMFP batteries do exhibit some disadvantages, including poor conductivity and life cycle limitations. Beyond technological advancements in batteries, their properties can be enhanced through blending with different chemistries. For example, blending LMFP with NCM (Nickel Cobalt Manganese) due to their similar voltages can create a hybrid cathode active material. This hybrid material is not only safer but also more cost-effective than NCM, with only a minor drop in performance. During the initial stages of commercialization, many OEMs may opt to combine LMFP batteries with ternary materials. This strategic blending offers several advantages, such as low costs and high safety and energy density.

The rise of LMFP

Battery OEMs are increasingly directing their focus towards the production of LMFP batteries in the coming years. One of the largest manufacturers plans to release an LMFP battery within this year, while another has already launched its LMFP battery in a conference in China. Additionally, a leading EV manufacturer is actively developing its own LFMP composition.

In the Indian market, it is important to meet consumers’ specific needs, a battery that is safe and has a long battery life while remaining cost effective. The unique climatic and road conditions can greatly impact battery performance. This makes the thermal stability of NCM batteries a cause for concern and LFP batteries have gained dominance. However, for higher energy density requirements - where LFP is not ideal- LMFP is likely to become a worthy contender. In fact, a domestic battery manufacturer has achieved a significant milestone by claiming to offer India’s first LMFP batteries for the EV industry.

Another factor to consider is the li-ion battery manufacturing value chain being established, which is backed by the government via the Advanced Chemistry Cell Production Linked Incentive (PLI) Scheme. As the current LMFP manufacturing process is on similar lines as LFP, it would be easy for battery OEMs to shift from one to the other to expand. Currently, there is no foreseeable dominant chemistry manufacturing coming up in India. While most players benefitting from the PLI Scheme have not yet expanded on their plans for battery manufacturing, an electric two-wheeler producer is going to start manufacturing NMC 2170 by 2023. Another player, who was not included under the PLI scheme, has launched its first manufacturing factory in Bengaluru and is producing LFP and lithium titanium oxide cells.

Way ahead

The need of the hour is nickel and cobalt-free alternatives to avoid supply chain constraints and high costs. LFP has already established a base in the EV market and has taken a hefty market share. With LMFP added to the portfolio, a low-cost, high-range, safe, and dependable battery future is on the table.

The article was first published on Why are all eyes on LMFP - an LFP battery with Manganese booster?