EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

DigiTreasury – EY’s Treasury Analytics Platform

About DigiTreasury – Treasury Technology Solutions

DigiTreasury is a highly configurable and modular integrated analytics platform enabling organizations to make better decisions for treasury management. It offers small and complex organizations multi-entity support, near real-time access to information, and advanced scenario-based analytics for risk and performance management.

- Harness your underlying treasury data: Our aim is to allow organizations to harness and analyze underlying treasury data for historic and predictive analysis that are typically not met by a traditional enterprise resource planning (ERP)/treasury management system (TMS) solution.

- Leverage our pre-configured library of KPIs: We have an inbuilt library of 100+ pre-configured analysis in DigiTreasury that have been built over time keeping client experiences across sectors in mind.

- Seamlessly connect with your internal and external system: The solution has been designed to ensure it can connect with your ERP, TMS and market information systems seamlessly. It also provides data entry screens for greater end-use flexibility.

- Simulate advanced scenario analysis and dynamic dashboards: The onscreen dynamic dashboards and visualization allow organizations for click of the button simulation and scenario analysis, giving you the power to get enhanced decision support.

DigiTreasury modules

Our solution cuts across six key treasury functions and provides a modular approach with the flexibility to choose and deploy the entire suite, a specific module or a subcomponent of a module.

Download our brochure

Our modules:

DigiTreasury capabilities

- Integrates with internal and external systems

- Aggregates and standardizes manual and system data through a data lake

- Offers C-Suite specific reports and insights for decision support

- Provides web-based user interface and workflow solutions

- Sends email alerts and exception reporting capabilities

- Accessible on mobile and other handheld devices

- Supports the chatbot functionality for dynamic reporting

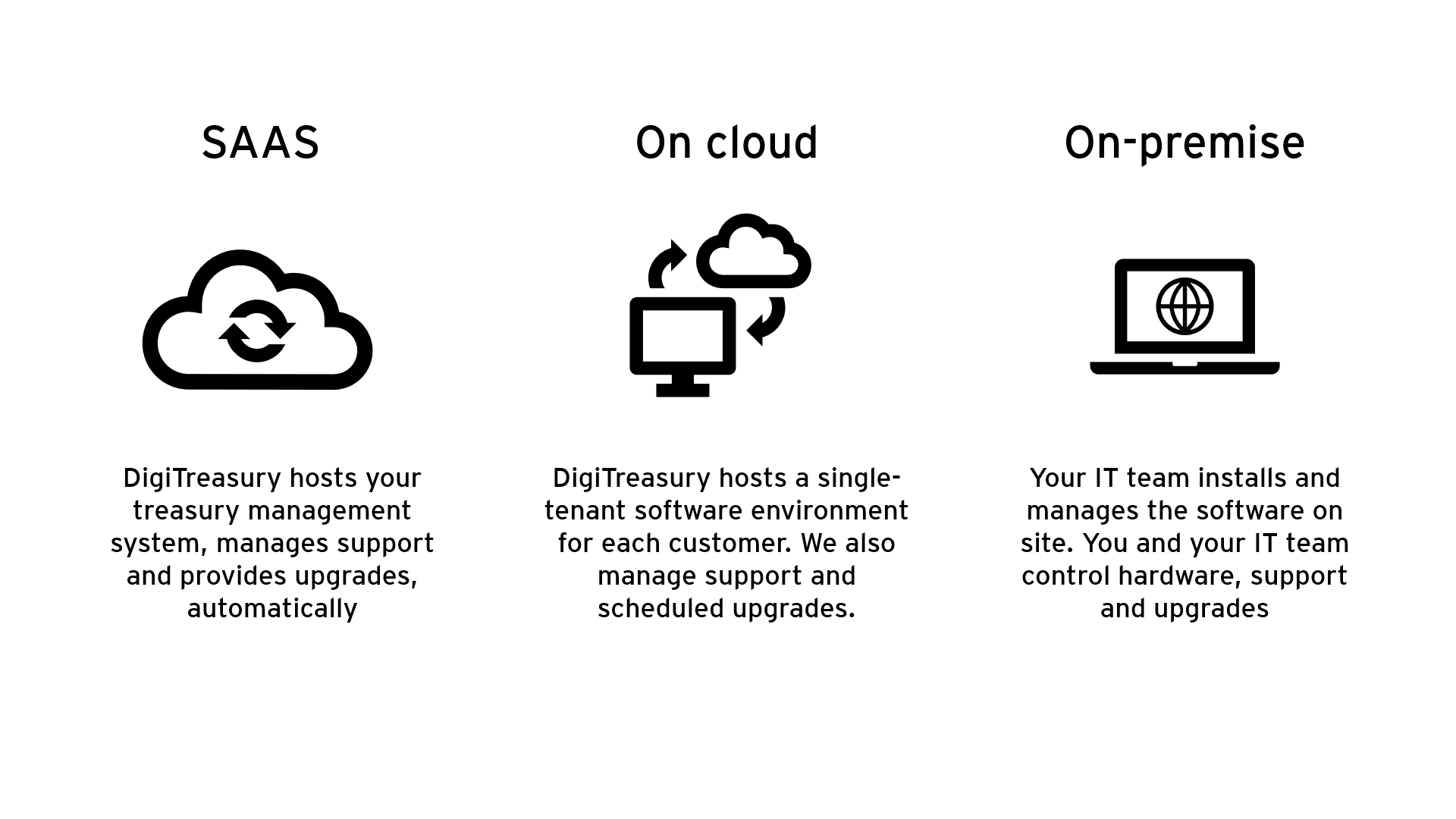

Deployment models

Our solutions can be implemented in any one of the three models: SAAS, on cloud or on premise

Our latest thinking

How treasury technology helps navigate today’s financial landscape

Discover how treasury tech reshapes finance: streamlined transactions, enhanced risk control, and strategic insights for tomorrow's financial world.