EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Discover how our clients are achieving their sustainability targets through ground-breaking innovation and cutting-edge technology. Tune in to gain insights into their future outlook on sustainability.

Know more

Transition and mitigation challenges

Despite being one of the largest emitters of CO2 globally, India maintains a low per capita electricity consumption compared to developed nations. Looking forward to 2050, the industrial sector is expected to dominate energy consumption, while solar energy could potentially constitute a significant portion of the generation mix. However, rapid growth in the transport sector presents challenges, projected to account for 31% of energy demand by the end of the century.

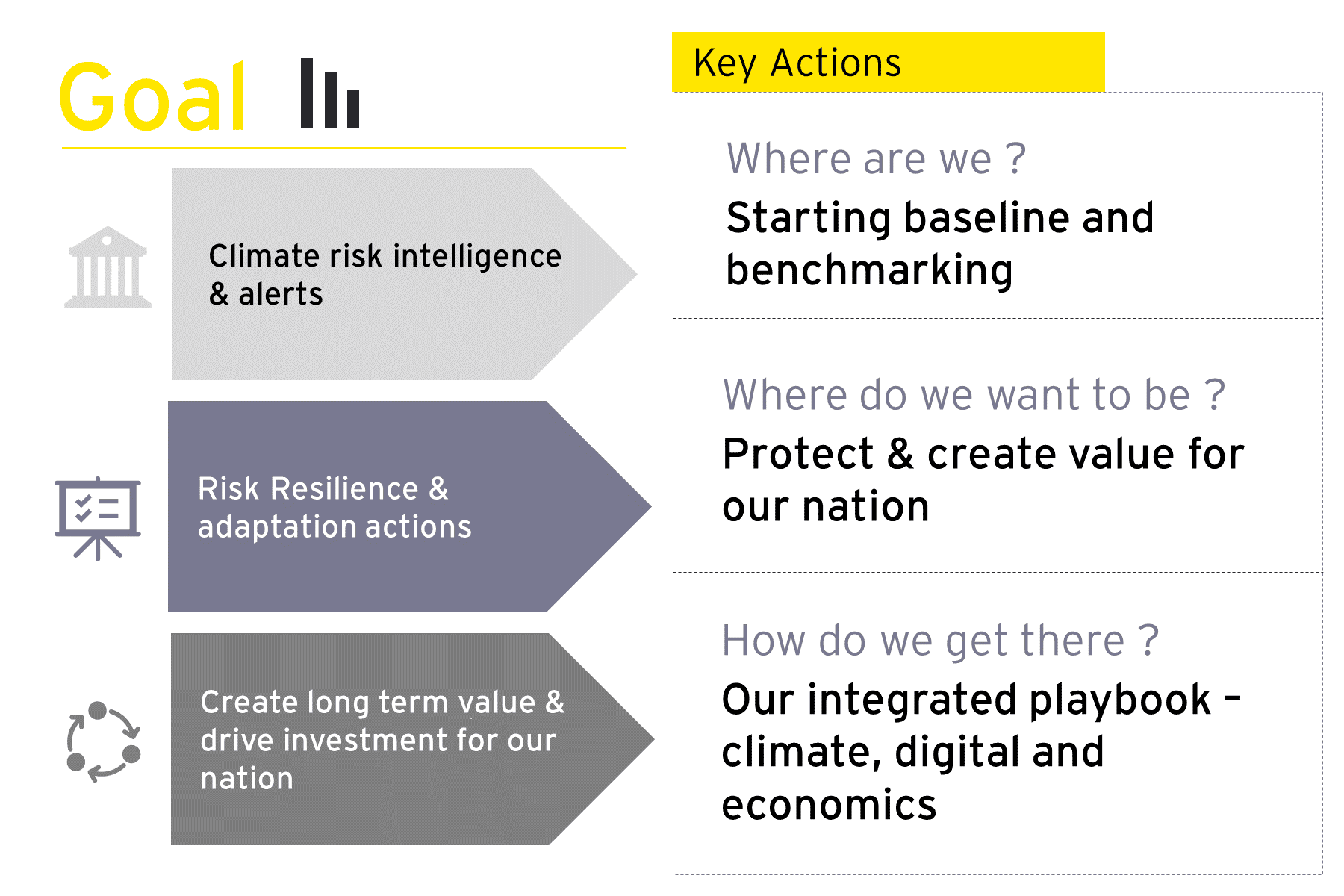

Anticipated Climate impacts include severe heatwaves, increased flood damages, and coastal vulnerabilities, with projected GDP losses exceeding 10% by 2050. The Further, our analysis indicates that majority of India Inc. is not yet aligned with the Paris Climate Agreement, risking the loss of a global competitive advantage.

Emerging technologies like artificial intelligence and data analytics can help predict climate scenarios, uncover hidden trends in climate data and offer valuables that can lead to informed decisions and carbon footprint reduction in India.

Financial mechanisms and adaptation gap

Financial institutions play a vital role in this transition by creating innovative funding for sustainable projects. Bridging the financing gap and managing climate adaptation is important to make India resilient to future climate challenges. Ultimately, achieving sustainability requires not just strong policies but also robust financial backing. In 2022, India approved the country’s first Sovereign Green Bonds Framework, the proceeds from which will be used to finance green projects under themes like renewable energy and climate change adaptation. The Reserve Bank of India (RBI) also issued a host of enabling guidelines to mobilize financing for tackling the challenges associated with climate change.

Strategic pathways

India's approach to climate action involves a multi-faceted strategy that includes enhancing renewable energy adoption, improving energy efficiency, and transforming transportation networks. The nation aims to reduce its greenhouse gas emissions intensity by 45% by 2030 and achieve 50% cumulative electric power installed capacity from non-fossil fuel-based energy resources by the same year. India has also focused on creating a regulatory environment that promotes sustainability, led by regulators like the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI).

While India has domestic policies promoting renewables, energy efficiency and sustainable practices, a comprehensive plan to manage the potential job losses and regional disparities caused by transition actions is yet to be implemented.

Conclusion

Addressing climate change and sustainability requires a collective effort, and India Inc. must approach this challenge with both strategic thinking and genuine concern. It is essential to integrate climate change awareness from the boardroom to the classroom, ensuring that everyone from top executives to young students understands its importance.

Analyzing the impacts, risks, and opportunities (IRO) associated with climate change is crucial for India's sustainability agenda. By developing a credible Net Zero Transition Plan, we can unlock capital and foster growth while navigating the challenges and opportunities that arise in this process.

Embedding sustainability and artificial intelligence across the value chain can provide real-time visibility and help address inefficiencies, enhancing overall operational effectiveness and environmental sustainability within the country.