EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Insights

Asking the better questions that unlock new answers to the working world's most complex issues.

Services

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

Industries

Discover how EY insights and services are helping to reframe the future of your industry.

See more

Case studies

Advanced Manufacturing

How a manufacturer eliminates cost and value leakages with AI-ML

03 Jul 2024Vinayak vipul

About us

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

See more

Top news

Recent Searches

Trending

-

Diversify, innovate and decarbonize coking coal for India's steel vision

India's steel vision 2050: Enhancing coking coal security and sustainability with strategic policy and tech interventions for a competitive edge.

11 Dec 2024 Mining and metals -

Tech-forward preventive vigilance to enhance governance

Embrace tech innovation for proactive fraud risk management and foster a culture of integrity with our tech-forward vigilance strategies.

12 Dec 2024 Forensics -

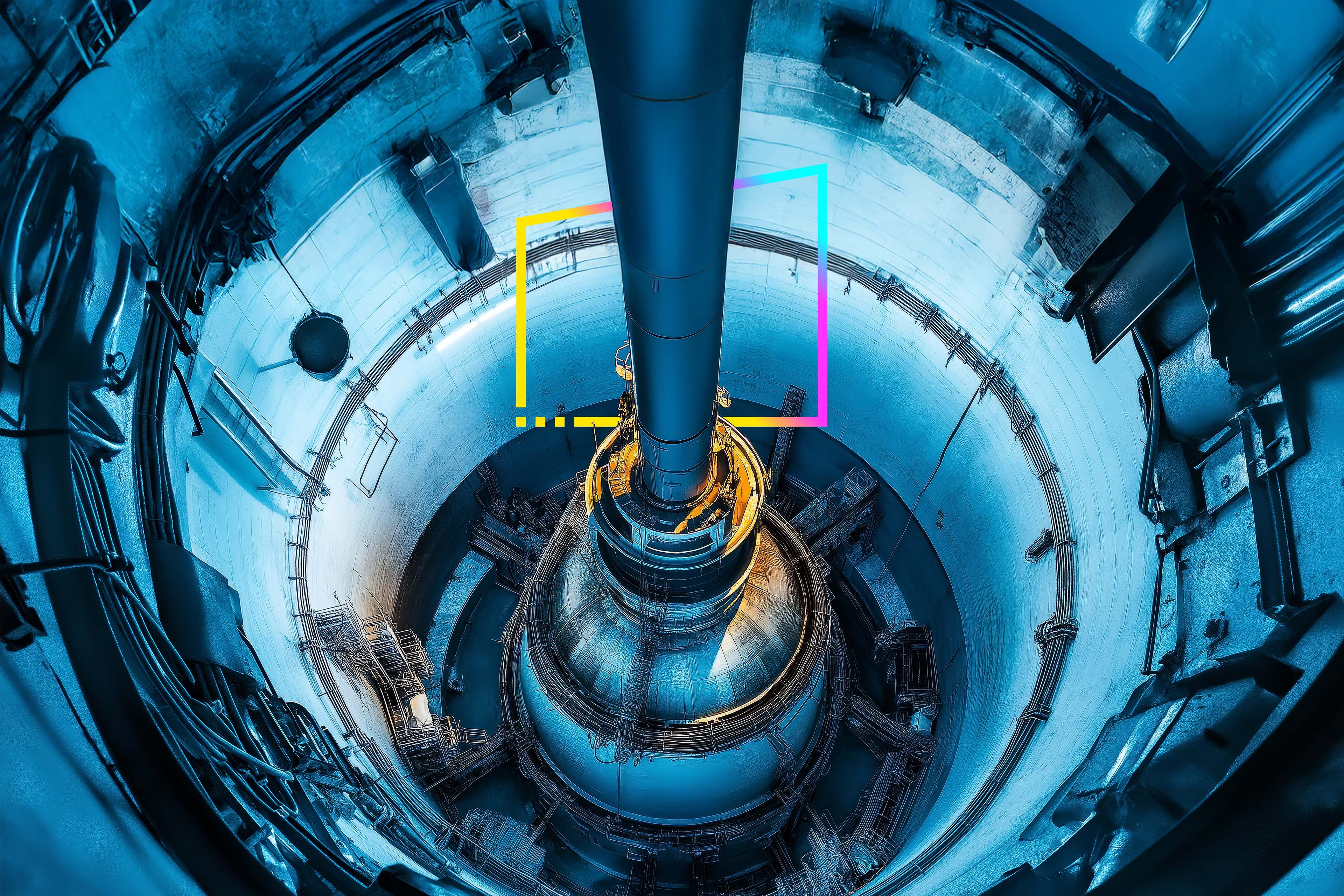

COP29: Why global efforts must reinvigorate towards nuclear power

COP29: Explore why tech companies' AI operations and advanced nuclear tech are key to revitalizing global clean energy efforts.Image – team will share with new brand identity

05 Dec 2024 Power and utilities

Reserve Bank of India (RBI) permitted cross border share swap arrangements under the automatic route

Indian companies have now been permitted to issue or transfer equity instruments in exchange for the equity of foreign entities under the automatic route.

Although the same were historically permitted under the regulations, however, RBI in the recent years had adopted a stance that Overseas Direct Investment (ODI)-Foreign Direct Investment (FDI) swap arrangements required prior RBI approval in light of the definition of ‘equity instruments’ under FDI Guidelines which only included equity shares and convertible instruments of an Indian company, inferring that only India-to-India swap was permissible under the automatic route.

Source: Ministry of Finance Notification S.O. 3492(E) dated 16 August 2024