EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Following two years of little-to-no growth, the eurozone credit cycle is turning a corner, with strong bank lending forecast from 2025

- Total eurozone bank lending forecast to grow 3.1% in 2025 and 4.2% in 2026, up from just 0.2% over 2023 and 2024

- Eurozone mortgage lending forecast for no growth this year (0.0%), with contractions in France, Spain and Italy, before climbing to 2.8% in 2025 and 4.1% in 2026

- Eurozone bank-to-business lending forecast to return to growth this year – despite contractions in Italy and Spain – rising from -0.1% in 2023 to 0.5% in 2024, 3.1% in 2025, and 4.2% in 2026

- Demand for consumer credit to slow to 0.9% over 2024, before rising to 3.0% in 2025 and 4.2% in 2026, despite a second year of contraction in the German market

Despite mortgage lending in Europe expected to record its lowest growth in over a decade this year, the latest EY European Bank Lending Economic Forecast suggests that the region is turning an economic corner, and from 2025 will report solid and strengthening growth across all lending categories.

The EY European Bank Lending Economic Forecast is modelled on data from the European Banking Authority and the national central banks for Germany, France, Spain and Italy, which collectively account for over three-quarters of the eurozone by GDP.

The eurozone economy is forecast to grow 0.8% this year and 1.4% in 2025, up from 0.5% in 2023. This is largely driven by an accelerating recovery of German’s heavily industrialized market, in addition to the expectation that interest rates fall and inflation continues to ease – albeit slowly – across the economic region next year.

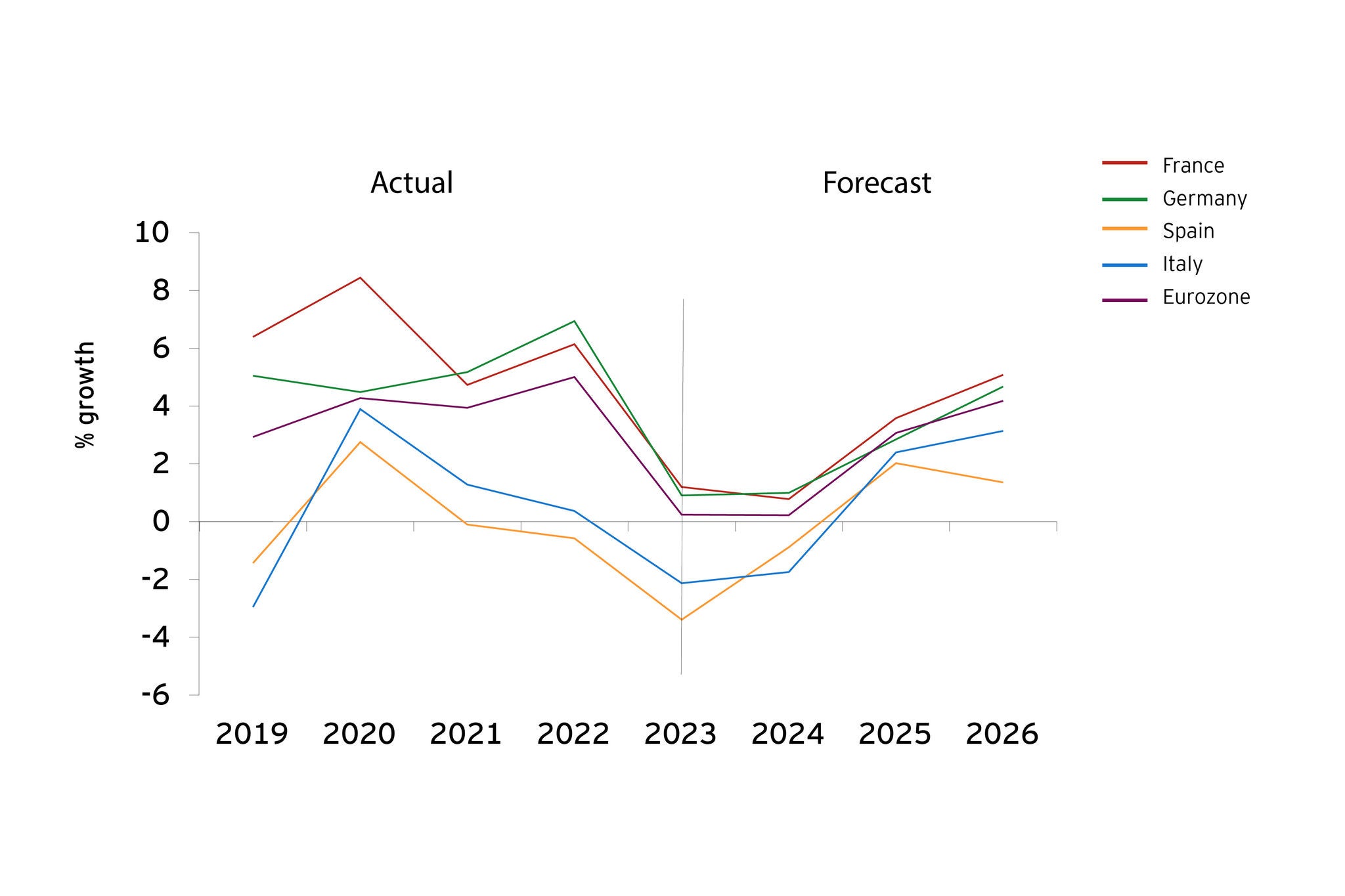

Total bank lending in Europe’s four largest markets – which represent around three-quarters of the eurozone economy – grew just 0.2% in 2023 and is expected to mirror this rate in 2024. But, provided interest rates fall next year as expected loan demand from businesses and consumers is forecast to rise significantly from 2025, with total bank lending growing a much stronger 3.1% in 2025, 4.2% in 2026, and 3.9% in 2027.

Eurozone bank lending to household and firms

Omar Ali, EY Global Financial Services Leader, comments: “The light at the end of the tunnel for Europe’s major economies is getting brighter, and the prospect of growth is becoming more certain. The expected interest rate falls and slowly easing inflation next year will provide a less challenging operating environment and should boost borrowing activity. The housing market continues to be the most impacted, with flat growth this year, but as living and borrowing costs come down, home-buying, as well as the demand for credit from both consumers and businesses should pick up again.

“As the economic environment improves, banks will be able to shift their focus more heavily to their growth and transformation agendas, to support longer-term success. Despite low growth and a succession of economic shocks over recent years, firms have made good progress on digitalising their businesses, and with the prospect of stronger growth from next year, the pace and activity can ramp up.”

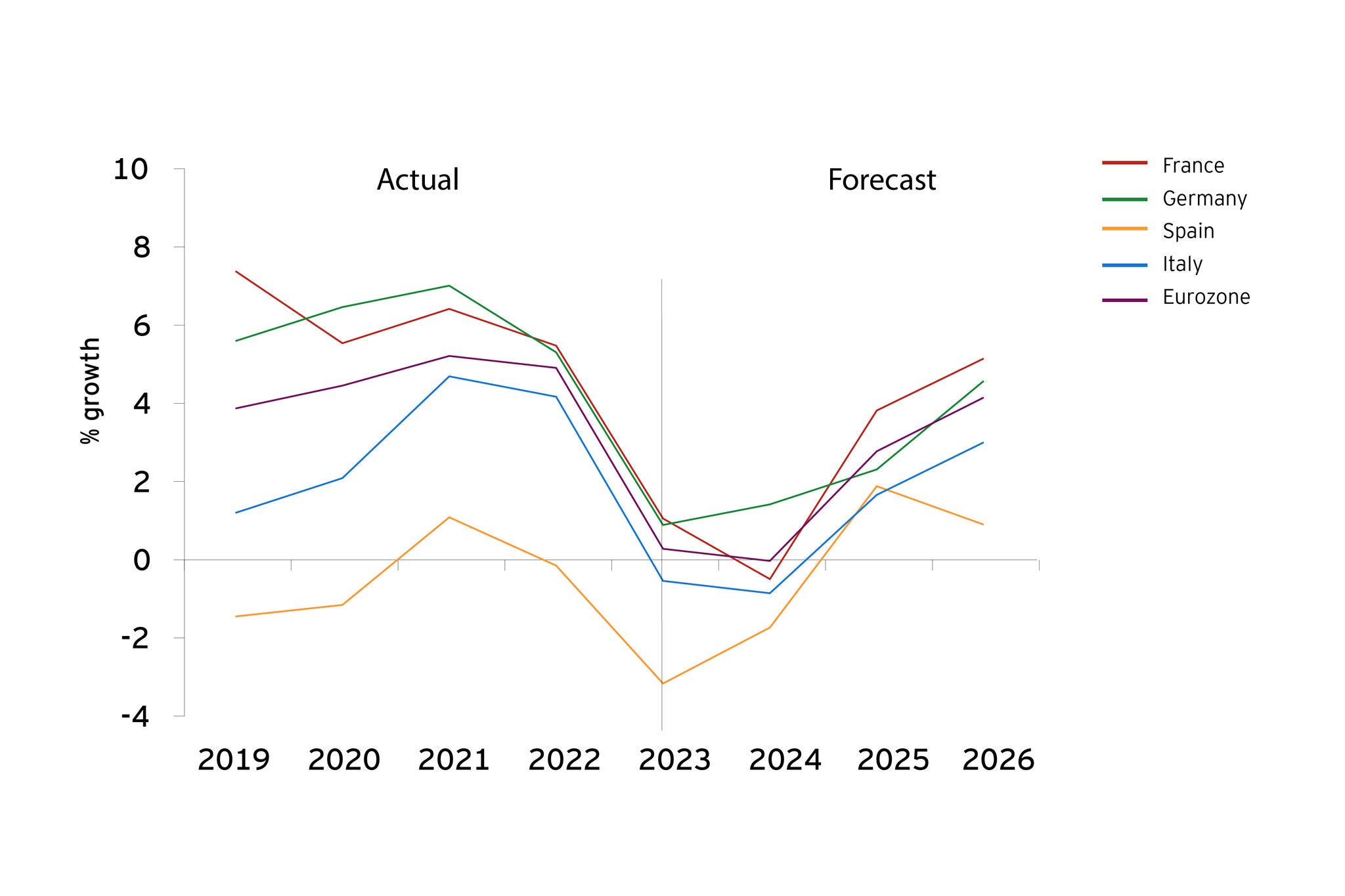

Mortgage lending set for no growth in 2024, but will pick up next year

Mortgages account for almost half of total lending within the eurozone, and the forecast 0.0% mortgage growth in 2024 is the weakest in EY European Bank Lending Economic Forecast data history (in 2014 growth was 0.2%), and a sharp deceleration from 4.9% growth in 2022. Subdued housing market sentiment (notably in Germany), higher borrowing costs and continued tightening of lending criteria are acting to reduce both demand and mortgage availability, but this is set to change from 2025 as economic growth settles in.

Mortgages account for almost half of total lending within the eurozone and are forecast to stagnate in 2024 after 2023's modest 0.3% gain marking a sharp deceleration from growth of 4.9% in 2022. The last time mortgage lending was this weak was in 2014 in the wake of the eurozone crisis.

The EY European Bank Lending Economic Forecast predicts that mortgage growth will reach 2.8% in 2025, 4.1% in 2026, and 3.8% in 2027.

Eurozone mortgage lending

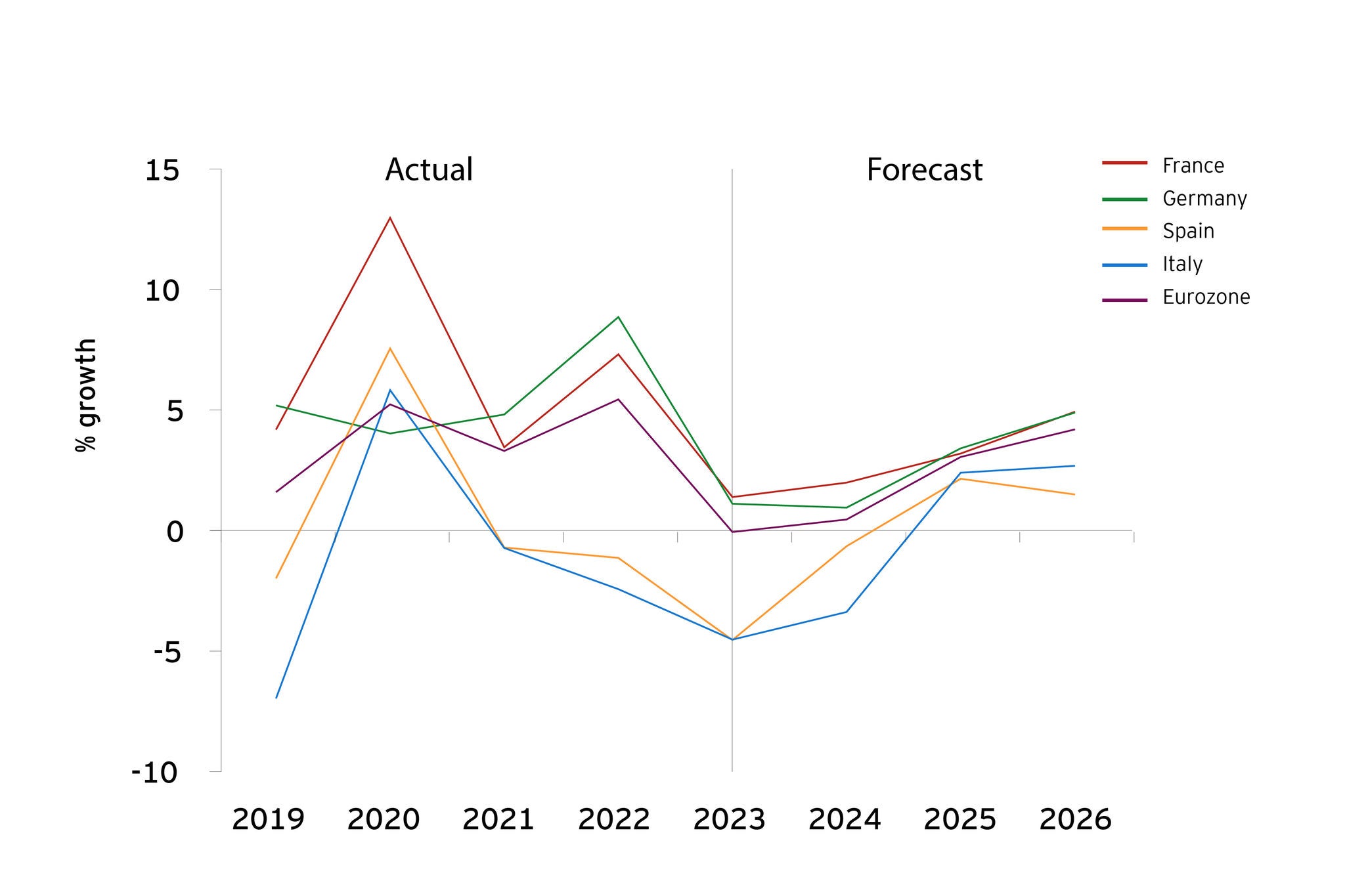

Business lending growth to pick up from 2025

Eurozone corporate lending is forecast to grow to a weak 0.5% growth this year from last year’s 0.1% contraction, and reach a new peak of 4.2% in 2026, driven by strong predicted growth in France and Germany. The weak growth expected this year is largely the tail-end result of recent high corporate borrowing costs on business investment and associated borrowing, which are expected to now start to ease.

Eurozone business lending

Consumer credit trajectory on the up

Despite low forecast growth in European unsecured lending this year (0.9%), demand is expected to rise from next year as inflation falls albeit slowly, labor markets strengthen, and consumer confidence rises. While growth is expected to remain below pre-pandemic levels (which averaged 5% between 2015-19), consumer credit in Europe is forecast to rise 3.0%, in 2025, 4.2% in 2026 and 3.9% in 2027. France and Italy are expected to see the highest rise in demand, while Germany and Spain report the lowest growth in unsecured lending.

Eurozone consumer lending

Loan losses expected to rise marginally, but not present material risk to economies

While non-performing loans (NPLs) across all forms of bank lending are predicted to rise year on year, levels remain well below those recorded following the eurozone debt crisis where ratios peaked at 8.4% in 2013.

NPLs as a share of total loans across the eurozone are forecast to rise to 2.0% in 2024 and 2.3% in 2025 and 2026.

France, Spain and Italy are forecast to see similar, higher ratios of NPLs in 2024, at 2.7%, 3.0% and 2.9% respectively, partly due to the high volume of variable-rate mortgages in both markets, which leave borrowers more exposed to higher costs.

Tighter post-Global Financial Crisis regulation and lending criteria should mean mortgage borrowers are better able to deal with higher rates, while the savings built up by households during the pandemic and low unemployment rates across the region should provide a cushion of support against rising debt servicing costs. On the corporate side, an improved outlook for both energy prices and inflation, and recent evidence of a rise in profit margins should act to limit a rise in the share of non-performing business loans.

Nigel Moden, EY EMEIA Banking and Capital Markets Leader, comments: “For the first time in four years, lending is not expected to contract across any loan category in 2025, as GDP growth picks up across all of the major markets. Following years of low lending growth, Europe’s banks are ready to play a key role in supporting consumers and businesses across the region.

“This forecast signals an opportunity for firms to rebalance corporate priorities. The necessary focus on managing balance sheets and capital buffers in challenging economic times has provided a robust foundation from which the banking sector can now pivot to a more growth-oriented agenda. We expect to see even more focus on transformative technology, innovation and sustainability in 2025 and beyond.”

Germany – currently the most challenged G7 economy

The German economy is expected to stagnate this year as the heavily industrialized market continues to be impacted by global trade tariffs, high interest rates and energy prices. Overall, German GDP is forecast to stagnate in 2024 (0.0% growth) – representing the worst economic performance in the G7 this year – followed by 0.9% in 2025 and 1.6% in 2026.

The prospects for bank lending growth in Germany this year are expected to remain weak, and growth in overall bank lending is forecast to pick up slightly from 0.9% in 2023 to 1.0% in 2024, from a near-term peak of 6.9% in 2022.

Mortgage lending in Germany is predicted to grow 1.4% in 2024 from 0.9% in 2023 before rising to 2.3% in 2025, 4.6% in 2026, and 4.3% in 2027. Germany is the only major eurozone market not to expect a contraction in its mortgage market this year.

Consumer credit is forecast for negative growth (-0.9%) in 2024. While German consumer behaviour is less prone to unsecured lending than other markets, this will be the second consecutive year of contraction before achieving 1.2% growth in 2025 and 3.4% in 2026, linked to inflation falling and real-time wages increasing.

On the corporate lending side, the business loan growth is expected to decelerate to 0.9% growth this year – from 1.1% in 2023 and a peak of 8.9% in 2022 – as weak overseas demand for manufactured goods, tight monetary policy, and elevated uncertainty impacts business investment.

France – demand for credit boosted by Olympic Games

The French economy is currently broadly tracking in line with the eurozone average, and French GDP growth is forecast at 1.2% in 2024. Looking further ahead, the EY European Bank Lending Economic Forecast predicts annual GDP growth at 1.1% in 2025, followed by 1.5% in 2026.

The French economy is highly linked to domestic demand and is less impacted by changes to global trade and export flows than its German neighbours. Currently domestic demand for credit in France is weak, highly influenced by the current political instability. The mortgage market in particular is experiencing a sharp slowdown of flows, and this year will contract 0.5%, before rising by 3.8% in 2025 and 5.1% in 2026.

Total bank lending is forecast to rise just 0.8% in 2024, down from 1.2% in 2023 and 6.1% in 2022. Growth is expected to pick up from next year, rising 3.6% in 2025 and 5.1% in 2026.

Consumer credit is forecast to rise 1.6% in 2024, up from 1.0% in 2023, then rise 4.5% in 2025 and 5.6% in 2026. The Paris Olympics provided a boost this year.

Growth in business lending is also expected to rise over 2024 to 2.0% from 1.4% in 2023, then to 3.2% in 2025 and 4.9% in 2026.

Spain – fourth and final year of lending contraction

Spain is currently the fastest growing of the largest economies and is predicted to achieve 2.8% GDP growth this year. This relatively strong growth is linked to having a predominantly services-focused economy, low relative dependency on energy-intensive industries and the ongoing recovery in the tourism sector.

However, in terms of total bank lending, the EY European Bank Lending Economic Forecast predicts the market will contract for a fourth year, but to a lesser degree (by -0.9% this year compared to 3.4% in 2023). Among the categories of lending, only consumer credit is forecast to report a rise in 2024, of 0.7%, before rising to 2.0% in 2025 and 2.1% in 2026.

Business lending is expected to contract -0.7% this year (again, for the fourth year in a row), before rising by 2.2% in 2025 and 1.5% in 2026.

On the mortgage side, EY European Bank Lending Economic Forecast predicts a -1.7% contraction this year in large part due to the structure of Spanish mortgages. The majority of Spanish home loans are variable rate contracts, which means the housing market is exposed sooner to rising interest rates than many other eurozone countries. Growth in mortgages will return from 2025, at a rate of 1.9%.

Italy – slow growth in 2023

Italy – a typically a low growth economy – is expected to achieve 0.8% GDP growth this year and 1.1% in 2025, with inflation averaging 1% over 2024.

In terms of overall bank lending, the forecast predicts a second year of contraction (-1.7% in 2024), before rising to 2.4% in 2025 and 3.1% in 2026.

Mortgage lending is forecast to contract -0.9% this year, down from -0.5% in 2023, but grow in 2025 by 1.7%, and in 2026 by 3.0%.

Consumer credit is forecast to slow to 3.5% this year from 5.4% in 2023, while business lending is expected to contract for a fourth year (-3.4% in 2024), before returning to growth of 2.4% in 2025 and 2.7% in 2026.

ENDS

About the EY European Bank Lending Economic Forecast

The EY European Bank Lending Economic Forecast is modelled on data from the European Banking Authority and the national central banks for Germany, France, Spain and Italy, which collectively account for over three-quarters of the eurozone by GDP.

Related news

Global IPO divergence widens as Americas and EMEIA surge and Asia-Pacific slows

LONDON, 27 JUNE 2024. Globally, in the first half (H1) of 2024 there were 551 listings raising US$52.2b in capital, a 12% decrease in the number of IPOs and a 16% drop in proceeds raised year-on-year (YOY).

LONDON, 19 June 2024. The global automotive industry is on the cusp of a $660b revenue opportunity, as it shifts its focus away from internal combustion engine (ICE) vehicles to electric vehicles (EVs), according to new EY analysis.

EY announces 9 key recommendations to boost investment and make Europe more competitive

LONDON, 19 JUNE 2024. The EY organization is calling on European institutions and national governments to take nine actions to help attract more foreign direct investment (FDI), with the publication of the second installment of its Europe Attractiveness Survey 2024.

Record energy investments are failing to keep the world on track for the 2030 renewables target

LONDON, 18 JUNE. Despite last year’s surge of US$1.8 trillion in clean energy investment, including US$660 billion earmarked for renewables, investment remains below what is needed to meet the COP28 target of tripling renewable capacity by 2030.

LONDON, June 18, 2024 — The EY organization today announces a significant milestone in the launch of Microsoft Dynamics 365 Sales for EY people across the globe, paving the way for how global professional services organizations establish more unified, customer-focused sales operations.

LONDON, Monday 17 June 2024: The majority (82%) of European financial services firms' boardrooms include at least one director with experience of either a ministerial or parliamentary position or a civil service or government-appointed role, providing crucial expertise amid the 2024 election super cycle, according to the latest EY European Financial Services Boardroom Monitor.