EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

82% of European financial services boardrooms include directors with political experience, helping the sector navigate the 2024 election super cycle and ongoing geopolitical uncertainty

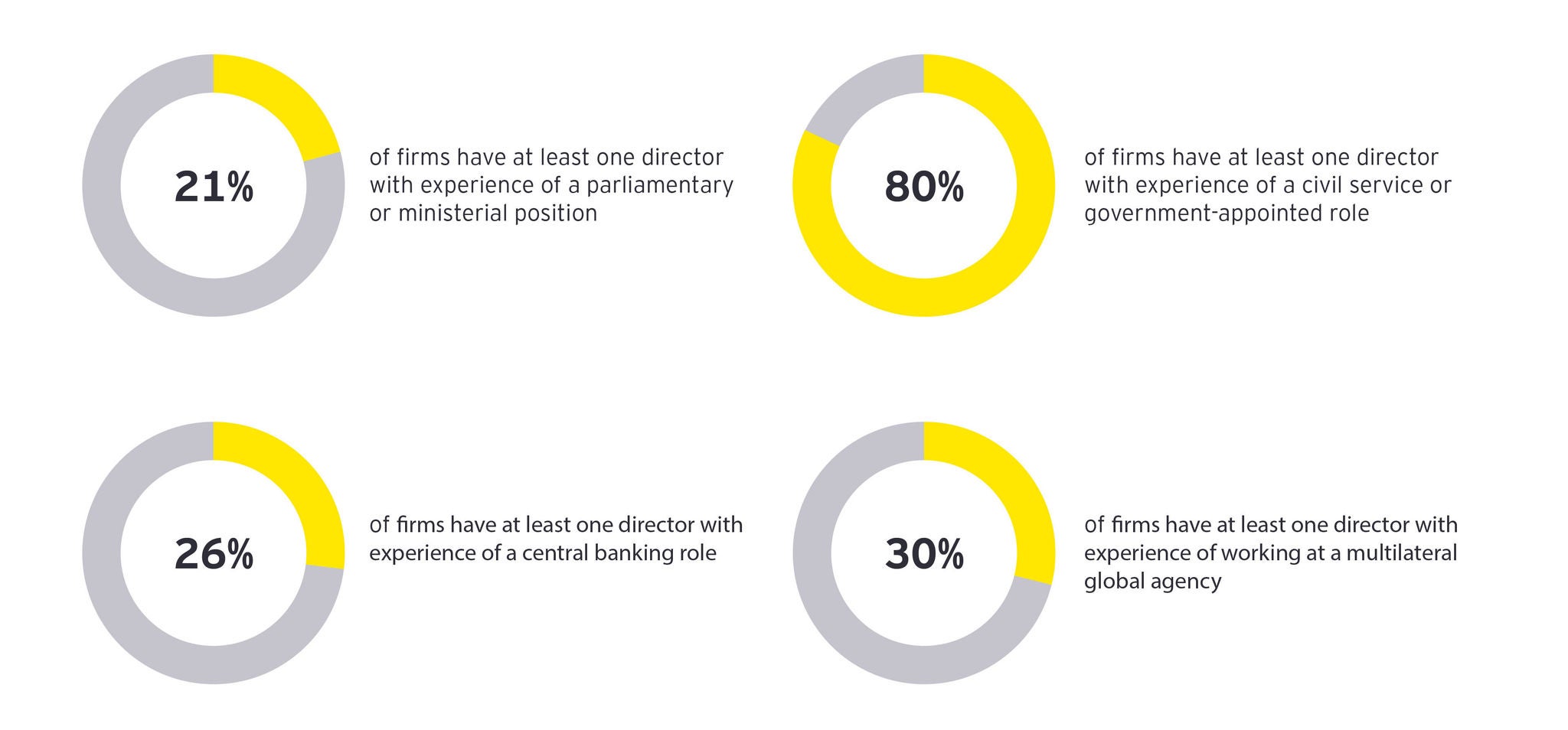

- POLITICAL EXPERIENCE: 82% of European financial services firms’ boards have at least one director with experience of a parliamentary, civil service or government-appointed role; 21% of firms have at least one director who has been a member of parliament or a government minister

- MACROECONOMIC AND GEOPOLITICAL EXPERTISE: Over a quarter (26%) of European financial services firms’ boards have at least one director who has previously worked at a central bank, and 30% of boards have a least one director who has held a role at a multilateral global agency, including at the UN, the IMF, the OECD, or the World Bank

- COUNTRY FOCUS: Swiss (33%) and French (30%) headquartered financial services firms are most likely to have at least one director with previous ministerial or parliamentary experience

- SECTOR FOCUS: European banks have a larger number of board directors with political expertise than the region’s insurers and asset managers

The majority (82%) of European financial services firms' boardrooms include at least one director with experience of either a ministerial or parliamentary position or a civil service or government-appointed role, providing crucial expertise amid the 2024 election super cycle, according to the latest EY European Financial Services Boardroom Monitor.

In addition, more than a quarter (26%) of firms (equating to 3% of all directors tracked) have at least one director with experience of a central banking role, and 30% of firms (4% of directors) have at least one director with experience of working at a multilateral global agency, including the UN, the IMF, the OECD, or the World Bank.

Political experience of directors by firm

The latest EY European Financial Services Boardroom Monitor – which charts the profile, experience, training and skillsets of board directors across the MSCI Europe Financials Index – finds that despite the relatively low total number of individual directors with senior political experience, it is broadly distributed across Europe’s financial services firms.

While just 17% of all directors tracked have experience of a ministerial or parliamentary position or have had a civil service or government-appointed role, this equates to over eight in ten firms (82%) having at least one board director with senior political expertise to draw upon when navigating political change.

The 15% of all board directors who have held a civil service or government-appointed role are distributed across 80% of all firms; the 2% of all directors who bring the more senior experience of a previous parliamentary or ministerial role within government are distributed across 21% of firms; and the 3% of directors who bring central banking experience are distributed across just over a quarter of firms (26%).

A third (33%) of financial services firms in Switzerland and 30% of firms in France have at least one board member with ministerial or parliamentary experience, compared to just 14% of German firms, 13% of Italian firms and 11% of UK firms.

No European firm has appointed a director with ministerial or parliamentary experience in the past 12-month period.

Omar Ali, EY Global Financial Services Leader-elect, comments: “During a year of major elections – across Europe and globally – boards with directors who understand the inner workings of government, economies, and the dynamics underpinning policymaking are well- positioned to navigate change, especially in an increasingly challenging geo-political environment. While there can be risks to political appointments, and the level and nature of experience varies widely, it’s clear that European chairs of financial services companies see political and public office experience as a valuable part of building a resilient board.

“As domestic and international politics increasingly impacts markets, the ability to draw on the unique perspectives of individuals who’ve run government departments, regulated industries, managed monetary policy decisions or advised multilateral agencies can be invaluable. During times of major change, upheaval, and uncertainty, prior political experience brings both differentiated perspective and important strategic insight.”

Steering firms through macroeconomic and geopolitical uncertainty

The EY Boardroom Monitor data indicates that firms are gradually equipping their boards with macroeconomic expertise. During the past 12 months – a period of elevated interest rate holding and anticipated cuts from global central banks – 9% of firms monitored appointed a director with central banking experience, building on the 7% of firms in the previous 12-month period.

At a macro level, the past two years have presented a range of new and compounding challenges for firms operating across borders, not least due to elevated geopolitical tensions and uncertainty in Europe. Across all board directors monitored, 4% have held a role at a multilateral global agency – either at the United Nations, the International Monetary Fund, the OECD, or the World Bank. This equates to 30% of European financial services firms.

Appointments in this area have, however, showed signs of slowing. In the past 12 months, 6% of firms have appointed a director who has held a role at a multilateral global agency, compared with 13% of firms in the previous 12-month period.

Omar Ali, EY Global Financial Services Leader-elect, comments: “Monetary policy is in focus again this year, which makes board directors with central banking experience attractive to financial services companies. For firms managing capital ratios, major liabilities, risk books and investment strategies across the global economy, the wealth of experience that former decision-makers from central banks bring to bear can be invaluable.

“The recent tightening cycle will have been a new experience for younger generations across the financial services sector, so having senior directors with experience of working through similar challenging economic conditions can offer a valuable level of governance and leadership insight. The same is true of directors who have worked at some of the world’s leading multilateral institutions, as they provide unique perspectives that can only come with experience.”

Banks marginally better equipped with political and macroeconomic expertise than insurers and asset managers

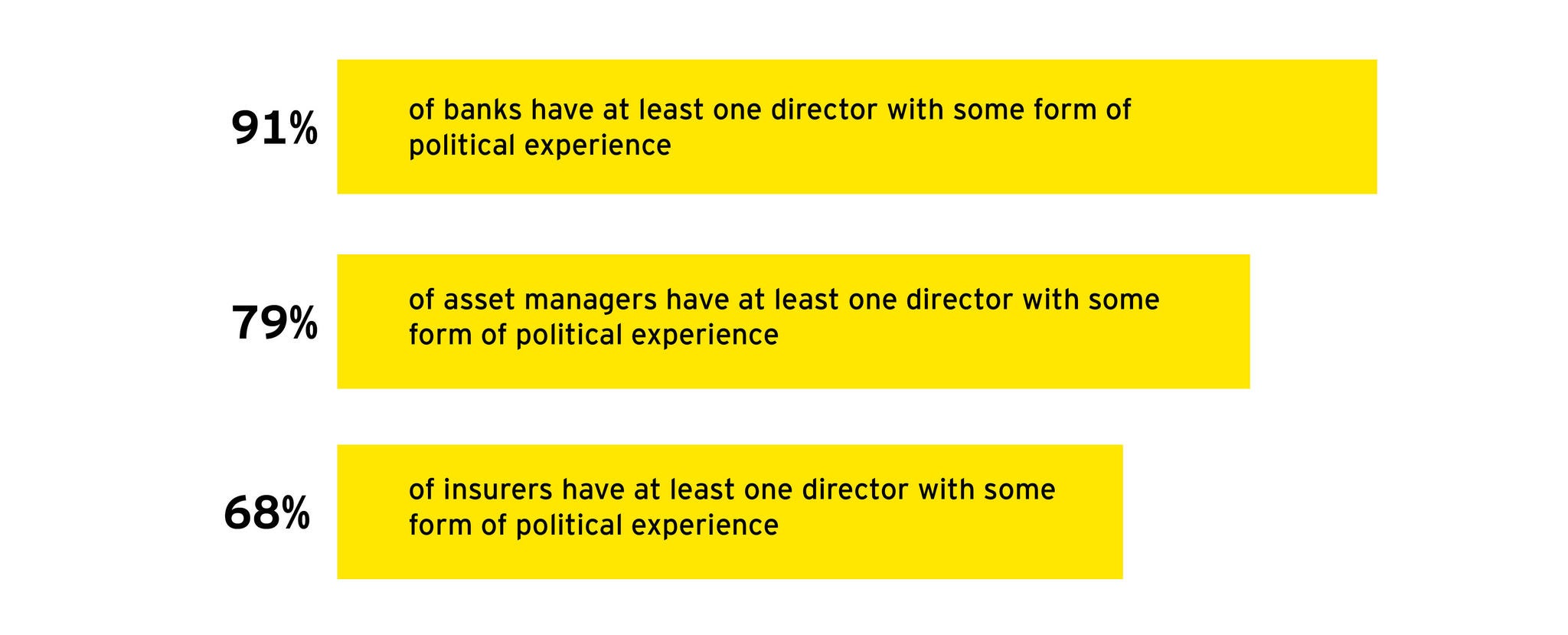

Across European financial services firms, banks lead insurers and asset managers in terms of overall board-level political experience. Ninety-one per cent of banks monitored have some form of board-level political experience, while 79% of asset managers and 68% of insurers have similar experience. Looking at the director population, 19% of all board members at banks have political experience, compared with 14% at asset management firms and 13% at insurance firms.

Board level political experience of firms by sector

Across Europe's financial services sector:

More than a quarter (26%) of banks have at least one board member with experience of being a member of parliament or government minister, compared to 20% of insurers and just 11% of asset managers. This equates to 3% of all board members at banks, compared with 2% of all board members at insurers and 1% at asset managers.

More than nine in 10 (91%) banks have at least one board member with experience in a civil service or government-appointed role, compared with 79% of asset management firms, and 64% of insurance firms. Eighteen per cent of all board members at banks have experience in a civil service or government-appointed role, compared with 13% at asset management firms and 12% at insurance firms.

In terms of geopolitical expertise, 37% of banks have at least one board member with experience of having worked at a multilateral global agency, relative to 24% of insurers and 21% of asset managers. Five per cent of all board members at banks have experience of having worked at a multilateral global agency, compared with 3% of board members at asset management firms and 2% of insurance firms.

The insurance sector leads other sectors in terms of central banking experience. Thirty-two per cent of insurers have at least one board member with a background in central banking, compared with 30% of banks and 11% of asset managers. Three per cent of all board members at both insurers and banks have experience in central banking, compared to just 1% at asset management firms.

ENDS

EY European Financial Services Boardroom Monitor - data overview

Notes to editors:

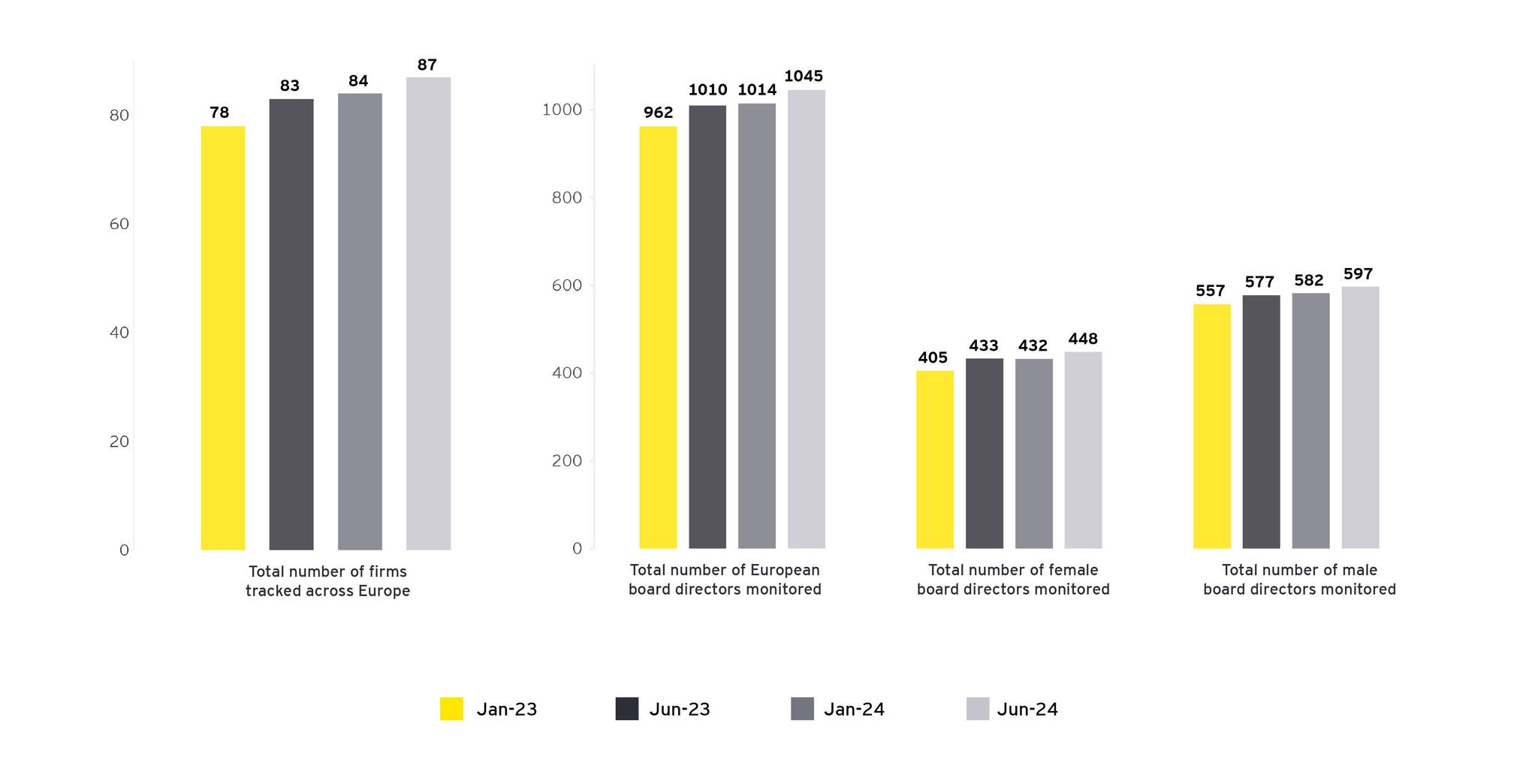

- This is the fifth launch of the EY European Financial Services Boardroom Monitor, and data is current to 31st May 2024.

- The EY Boardroom Monitor is supplemented with a sentiment survey of 300 European financial services investors, where 84% of respondents state that political experience in the boardroom significantly influences their decision to invest.

About the EY Boardroom Monitor

- The EY Financial Services European Boardroom Monitor tracks the experience, background, and skillsets of board members across a defined universe of financial services firms to create a broad picture of the gaps in expertise and possible pressure points within the listed European financial services markets.

- The EY Financial Services European Boardroom Monitor tracks and analyses data across a wide range of factors, including gender and age, as well as professional experience and skills. It does not track the race and ethnicity of board members, as there is no standardized format for directors to disclose against.

- The EY Financial Services European Boardroom Monitor is comprised of disclosable, publicly available data on board appointments at listed banks, wealth and asset managers, FinTechs and insurers across the UK, Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden and Switzerland, using the MSCI European Financials Index as the core universe.

- This release incorporates a survey of 300 European and UK-based fund managers who have, or are able to have, exposure to European financial services companies within their portfolios. The survey asks about the biggest risks to European Financial Services companies and where investors see the biggest skillset gaps within boardrooms.

Related news

Foreign direct investment in Europe declines for first time since pandemic

LONDON, 2 MAY 2024. Foreign direct investment (FDI) into Europe declined in 2023, falling by 4% compared with 2022, and has dropped to 11% lower than in 2019, just before the COVID-19 pandemic hit, according to the annual EY European Attractiveness Survey 2024 – the most in-depth and long-running annual analysis of FDI into the continent.

Resilient CEOs prioritize AI investments now and decarbonization next

LONDON, 1 MAY 2024. CEOs are feeling more hopeful about their immediate prospects and the actions they need to take now to create capital for investment in future growth.

LONDON, 30 April 2024. The EY organization today announces an alliance between SAP Fioneer, a world-class software solution provider for financial services, and EY ifb SE to help facilitate software selection, business transformation, training and change management in the financial services industry.

LONDON, April 23, 2024 – Companies around the world could be at risk of losing out in the race for talent and driving business resilience because they are failing to mobilize their workforce effectively and create opportunities for flexible work experiences, according to the EY 2024 Mobility Reimagined Survey.

LONDON, April 17, 2024 – The EY organization today announces the launch of EY OpsChain Contract Manager (OCM), a transformative blockchain-enabled solution for contract management. EY OCM helps enterprises to execute complex business agreements, supporting confidentiality, helping improve time efficiency, and achieving cost reduction, with automatic adherence to the agreed terms.

LONDON,16 April 2024. The EY organization’s latest research with Saïd Business School, at the University of Oxford, reveals new insights into what happens when a transformation program’s leadership believes a transformation has or will go off-course and intervenes with the intent of improving its performance (turning points).