EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Decade-low European mortgage growth forecast this year and next, as high borrowing costs and a weak economy drive down

- Eurozone mortgage lending forecast to grow just 1.5% in 2023 and 2.4% in 2024 – the lowest growth over a two-year period in a decade – with only slightly higher growth of 3.3% (net) forecast in 2025

- Demand for consumer credit to slow to 1.6% over 2023 and only grow 1.9% in 2024, down from 2.7% in 2022

- Bank-to-business lending forecast to grow 2.7% this year before slowing to 2.2% in 2024 – with expected contractions in the Italian and Spanish markets

- Eurozone non-performing loans to rise only marginally this year, with Spain and Italy forecast to report the highest ratios due to their high volume of variable-rate mortgages

Mortgage lending across the eurozone is expected to record decade-low growth in 2023 and 2024, according to the latest EY European Bank Lending Economic Forecast, as high borrowing costs, weak economic growth and falling housing market sentiment drive down demand. In net terms, mortgage loans are expected to rise just 1.5% in 2023 and 2.4% in 2024, representing the slowest growth in a decade.

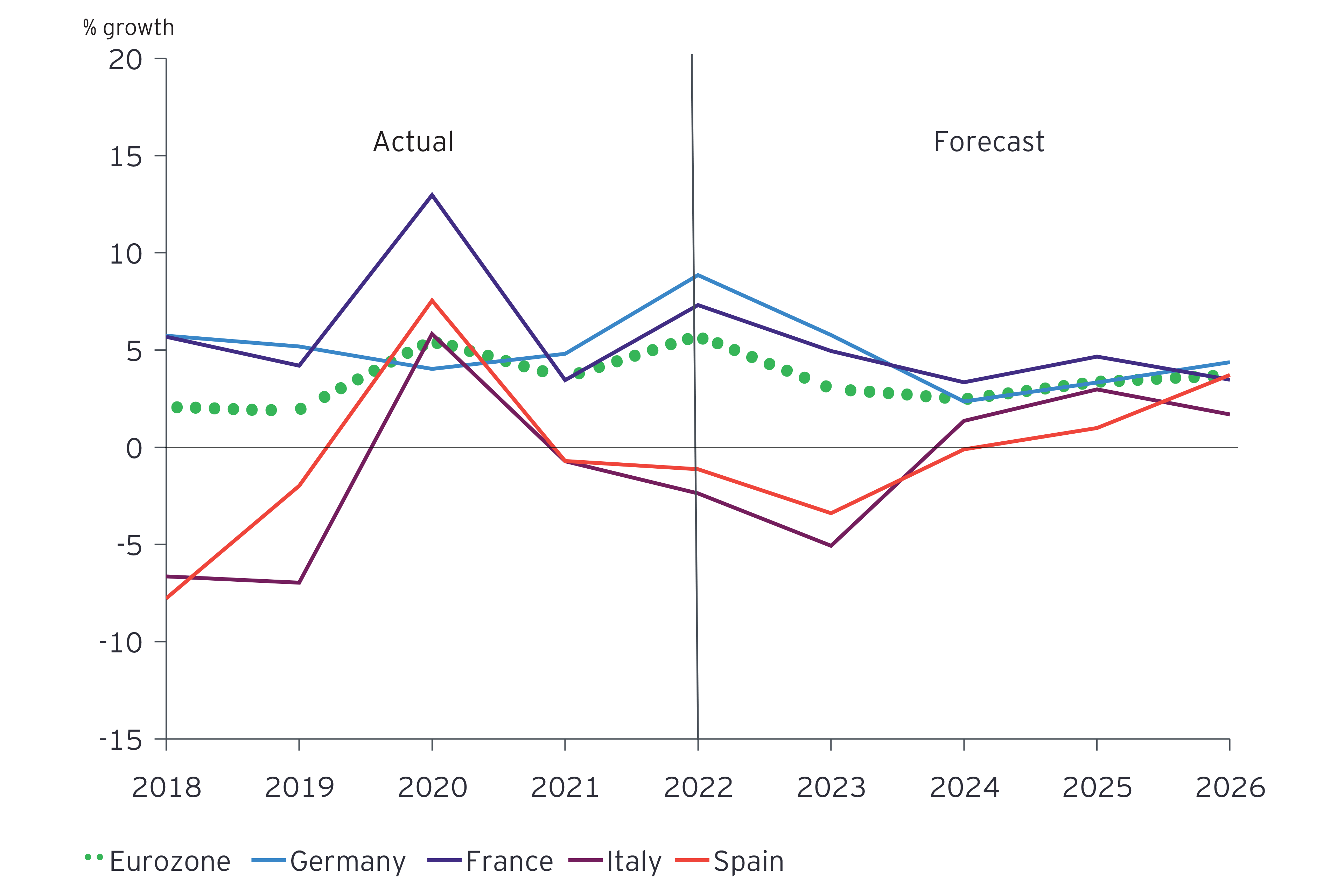

While the eurozone economy is forecast to grow just 0.5% over 2023, and 0.6% in 2024, total bank lending is expected to report modest growth of 2.1% in 2023, although this is a fall from a 14-year high of 5% year-on-year growth in 2022. Lending volumes will slowly start to pick up, with growth reaching 2.3% in 2024, 3.2% in 2025 and 3.3% in 2026, provided the European Central Bank rate cuts expected in 2024 materialise. Overall, this should reduce the cost of household and corporate loans and boost demand for credit.

Eurozone bank lending to houesholds and firms

Source: Oxford Economics/Haver Analytics

Omar Ali, EY EMEIA Financial Services Managing Partner, comments: “Europe’s major economies continue to operate in a highly challenging environment. Interest rates are at their highest since the eurozone was formed, geopolitical tensions have risen, and this year whilst inflation and energy prices are easing, they remain elevated. The housing market is taking the biggest hit. For households across Europe, high living and borrowing costs mean fewer people are buying houses, which means mortgage lending is falling to the lowest level in a decade.

“Looking forward, European banks face a balancing act to maintain robust balance sheets, reduce costs and continue supporting customers. The progress firms have made to digitalise – despite a succession of economic shocks and slow growth – will stand them in good stead for longer-term success, especially as we look to stronger growth from next year.”

Mortgage lending growth to slow to lowest level in a decade

Mortgages account for almost half of total lending within the eurozone, and the forecast slowdown in mortgage growth to 1.5% in 2023 and 2.4% in 2024 represents the weakest year on year increase over a two-year period in a decade, and a sharp deceleration from growth of 4.9% in 2022. Subdued housing market sentiment (notably in Germany), higher borrowing costs and continued tightening of lending criteria are acting to reduce both demand and mortgage availability.

The EY European Bank Lending Forecast predicts that mortgage growth will reach 3.3% in 2025 and 3.2% in 2026.

Eurozone mortgage lending

Source: Oxford Economics/Haver Analytics

Business lending growth to continue to slow in the short term

Growth in eurozone bank lending to business is set to fall from the recent peak of 5.5% in 2022 (the fastest since 2008) to 2.7% this year and just 2.2% in 2024, with contractions in the Italian and Spanish markets. Weaker growth in 2024 largely reflects the impact of higher corporate borrowing costs on business investment and associated borrowing.

Despite the challenging economic outlook and ongoing market uncertainty, lending to businesses is expected to pick up from 2025, when growth is forecast at 3.1%, before reaching 3.5% in 2026, as interest rates fall and economic conditions improve, helped by lower inflation and investment by Next Generation EU programme (NGEU) funds.

Eurozone business lending

Source: Oxford Economics/Haver Analytics

Business lending growth to continue to slow in the short term

Growth in eurozone bank lending to business is set to fall from the recent peak of 5.5% in 2022 (the fastest since 2008) to 2.7% this year and just 2.2% in 2024, with contractions in the Italian and Spanish markets. Weaker growth in 2024 largely reflects the impact of higher corporate borrowing costs on business investment and associated borrowing.

Despite the challenging economic outlook and ongoing market uncertainty, lending to businesses is expected to pick up from 2025, when growth is forecast at 3.1%, before reaching 3.5% in 2026, as interest rates fall and economic conditions improve, helped by lower inflation and investment by Next Generation EU programme (NGEU) funds.

Eurozone business lending

Source: Oxford Economics/Haver Analytics

Loan losses expected to rise marginally

A weak eurozone economy is likely to drive a rise in non-performing loans (NPLs) across all forms of bank lending, but the EY European Bank Lending Forecast does not expect a significant increase over the next few years. Moreover, any rise is still expected to remain well below levels during and after the eurozone debt crisis. Non-performing loans as a share of total loans across the eurozone are forecast to rise to 2% in 2023 and 3.1% in 2024, from 1.8% in 2022, as the lagged effect of higher interest rates builds. For context, non-performing loan ratios peaked at 8.4% in 2013.

Spain and Italy are forecast to see the highest ratios of non-performing loans in 2023, at 2.3% and 2.7% respectively, partly due to the high volume of variable-rate mortgages in both markets, which leave borrowers more exposed to higher costs.

Tighter post-Global Financial Crisis regulation and lending criteria should mean mortgage borrowers are better able to deal with higher rates, while the savings built up by households during the pandemic and low unemployment rates across the region should provide a cushion of support against rising debt servicing costs. On the corporate side, an improved outlook for both energy prices and inflation, and recent evidence of a rise in profit margins should act to limit a rise in the share of non-performing business loans.

Nigel Moden, EY EMEIA Banking and Capital Markets Leader, comments: “Over the course of this year, as interest rates and geopolitical tensions have risen, Europe’s economy – and the banks that underpin it – have been tested to new limits. However, the economic challenges are not producing the cracks in the banking sector that many might have expected a decade and a half ago, reflecting the work made by the region’s financial institutions to build high capital buffers and strengthen their financial positions, and ultimately, to absorb economic strain.

“While bank lending growth is set to slow in the short term, the picture further out is one of recovery. It might be slow, but, in the absence of further, major unforeseen challenges, we expect steady economic and lending volume improvement. Despite the forecast rise in loan losses, impairment levels are expected to remain far below those recorded post-financial crisis, and growth in new demand for loans from next year should help to counter some of the impact.”

Germany – the only major eurozone economy to shrink this year

The German economy is the only one of the major eurozone economies forecast to shrink this year, largely due to higher interest rates, headwinds facing its export markets and the effect of prolonged high energy prices on the industrial base. Overall, German GDP is forecast to shrink 0.2% in 2023, and grow by 0.1% in 2023 and 1.8% in 2025.

The prospects for bank lending growth in Germany this year are expected to be weak, although forecast to outperform a number of other eurozone markets. Growth in overall bank lending is forecast to slow from 6.9% in 2022 to 3.8% in 2023. Mortgage lending is predicted to grow 1.6% in 2023 – the weakest since 2009 – following 5.3% growth in 2022.

Consumer credit is forecast to see a 0.4% increase in 2023 before growth accelerates to 1.8% in 2024. On the corporate lending side, the stock of business loans is expected to slow to 5.8% growth – from 8.9% in 2022 – before decelerating further to 2.4% in 2024, as the effect of weak overseas demand for manufactured goods, tight monetary policy, and elevated uncertainty is felt on business investment.

France – demonstrating greater resilience than eurozone peers

The French economy has recently displayed more resilience than the wider eurozone. French GDP growth slowed to 0.1% in Q3 from 0.6% in Q2 2023, although this disguised a robust performance from domestic demand. Overall, the EY European Bank Lending Forecast forecasts annual GDP growth at 0.9% this year, followed by 0.6% in 2024 and 2% in 2025.

Total bank lending is forecast to rise 3.7% in 2023, down from 6.1% in 2022, and then slow slightly to 3.5% in 2024. Consumer credit is forecast to rise 2.4% in 2023, down from 3.5% in 2022, and growth in business lending is expected to slow over 2023 to 5% from 7.3% in 2022, then to 3.3% in 2024.

Spain – mortgage lending has fallen sharply in 2023

Following a relatively strong start to 2023, Spanish GDP is forecast to grow 2.4% in 2023. This is principally because of Spain’s services-focused economy, lower dependency on energy-intensive industries than some of its peers and an ongoing recovery in the tourism sector.

However, in terms of total bank lending, the EY European Bank Lending Economic Forecast predicts a contraction of 2.1% in 2023, reflecting weakness in late 2022 and early 2023. Among the categories of lending, only consumer credit is forecast to report a rise. The EY European Bank Lending Forecast predicts consumer credit growth of 0.4% in 2023.

Business lending is expected to contract -3.4% this year before broadly flatlining in 2024. On the mortgage side, EY European Bank Lending Forecast predicts a -1.5% contraction this year in large part due to the structure of Spanish mortgages. The majority of Spanish home loans are variable rate contracts, which means the housing market is exposed sooner to rising interest rates than many other eurozone countries.

Apart from business lending, a return to growth is expected across all forms of lending from next year, and total bank lending is forecast to rise 0.6% in 2024, and 1.6% in 2025.

Italy – slow growth in 2023

Italy only narrowly avoided a technical recession in Q3 2023, as GDP flatlined following a 0.4% contraction in Q2 2023. GDP growth is forecast at 0.7% this year and 0.6% in 2024. However, as momentum improves, improved growth is forecast (1.2% in 2025).

In terms of overall bank lending, the forecast predicts a contraction of -1.9% in 2023. Mortgage lending is forecast to rise 1.1% this year, down from 4.2% in 2022. Consumer credit is forecast to rise 4.5% this year, while business lending is expected to contract -5.1%, before returning to growth of 1.4% in 2024. Similar to other major eurozone economies, all forms of lending are forecast to see a rise in 2024 (of 1.1%), with growth picking up to 2.5% in 2025.

ENDS

Notes to editors:

About the EY European Bank Lending Economic Forecast

The EY European Bank Lending Economic Forecast is based on economic forecasts using data from the European Central Bank, and covers the eurozone, Germany, France, Spain and Italy.