EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

The EY Net Zero Centre brings together EY’s intellectual property, strategic insight, expertise and deep knowledge in energy and climate change leadership to solve the big problems ahead as we move towards net zero emissions by 2050.

Read more

Carbon credits and carbon markets unpacked

Carbon credits are an essential part of the decarbonisation toolkit, smoothing the transition to net zero.

A range of terms are used when discussing carbon offsets. The EY Net Zero Centre defines:

- Carbon credit: A certified and transferrable instrument representing the avoidance or removal of one metric tonne of CO2 or equivalent greenhouse gases.

- Avoidance: Emissions that would have occurred under a defined ‘business-as-usual’ scenario, but that were prevented due to an offset project.

- Removal: CO2 or other gases that have been extracted from the atmosphere and safely stored.

Carbon credits are created by offset projects and can be retired to counterbalance the equivalent volume of residual emissions by the credit retiree.

Far from being a cover for inaction, carbon credits can enable faster, more impactful action. Evidence shows that businesses using carbon credits often set more ambitious emissions reduction targets than those that do not.

EY analysis finds that combining high-integrity credits with ambitious internal abatement lowers decarbonisation costs by 45%-65% in Paris-consistent scenarios, compared to relying solely on internal measures.

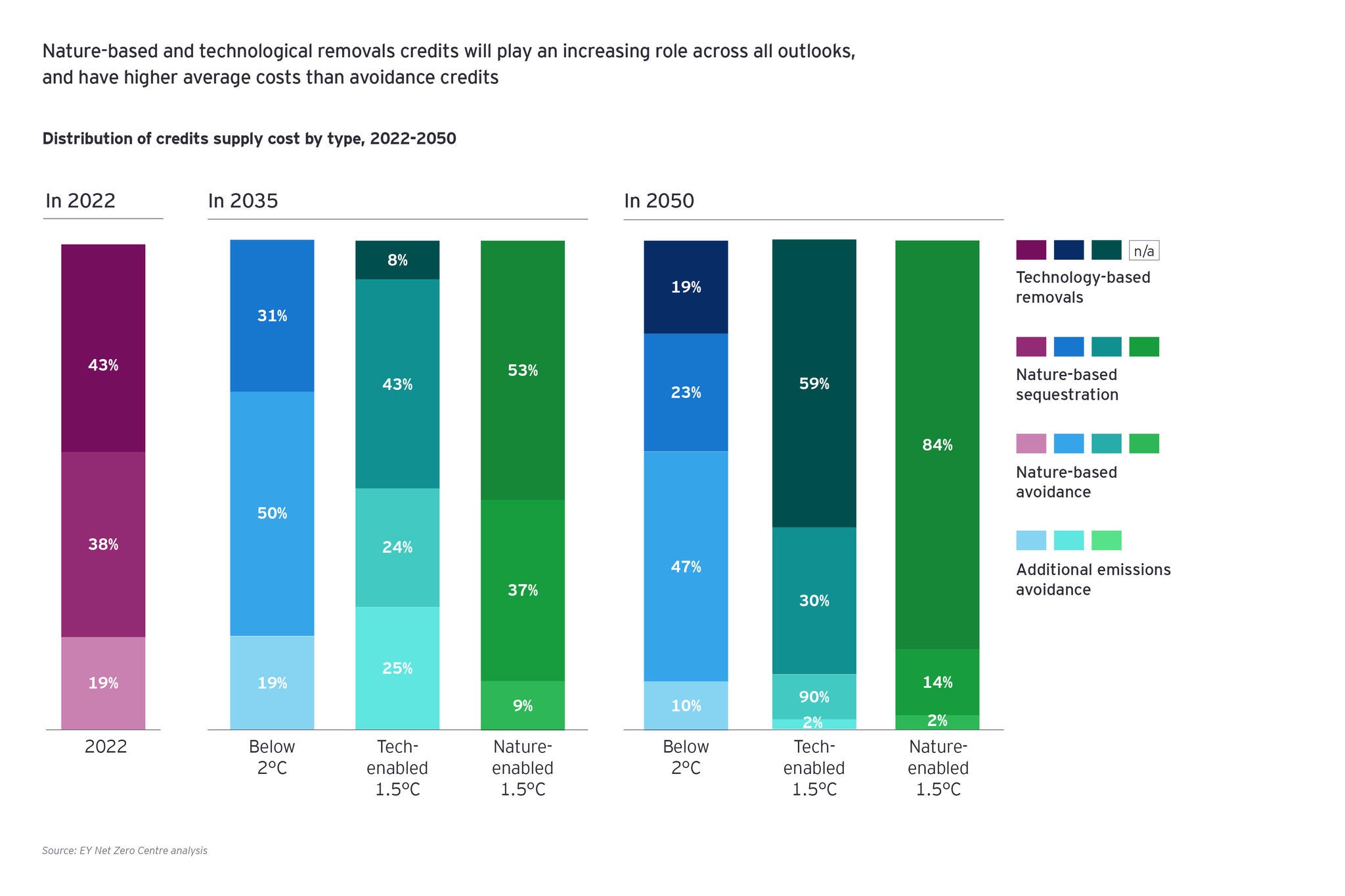

But increasing demand, a race to quality and rising unit supply costs will result in carbon credits becoming harder to find and costlier to purchase.