EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Overview

Note:

Figures throughout this report are calculated based on the prior corresponding period, unless otherwise stated.

ANZ, NAB and Westpac’s full year reporting periods ended on 30 September 2022. CBA’s full year reporting period ended on 30 June 2022.

Unless otherwise specified, references to ‘the banks’ or ‘the major banks’ in this article refer to the ‘big four’ Australian banks: ANZ, CBA, NAB and Westpac.

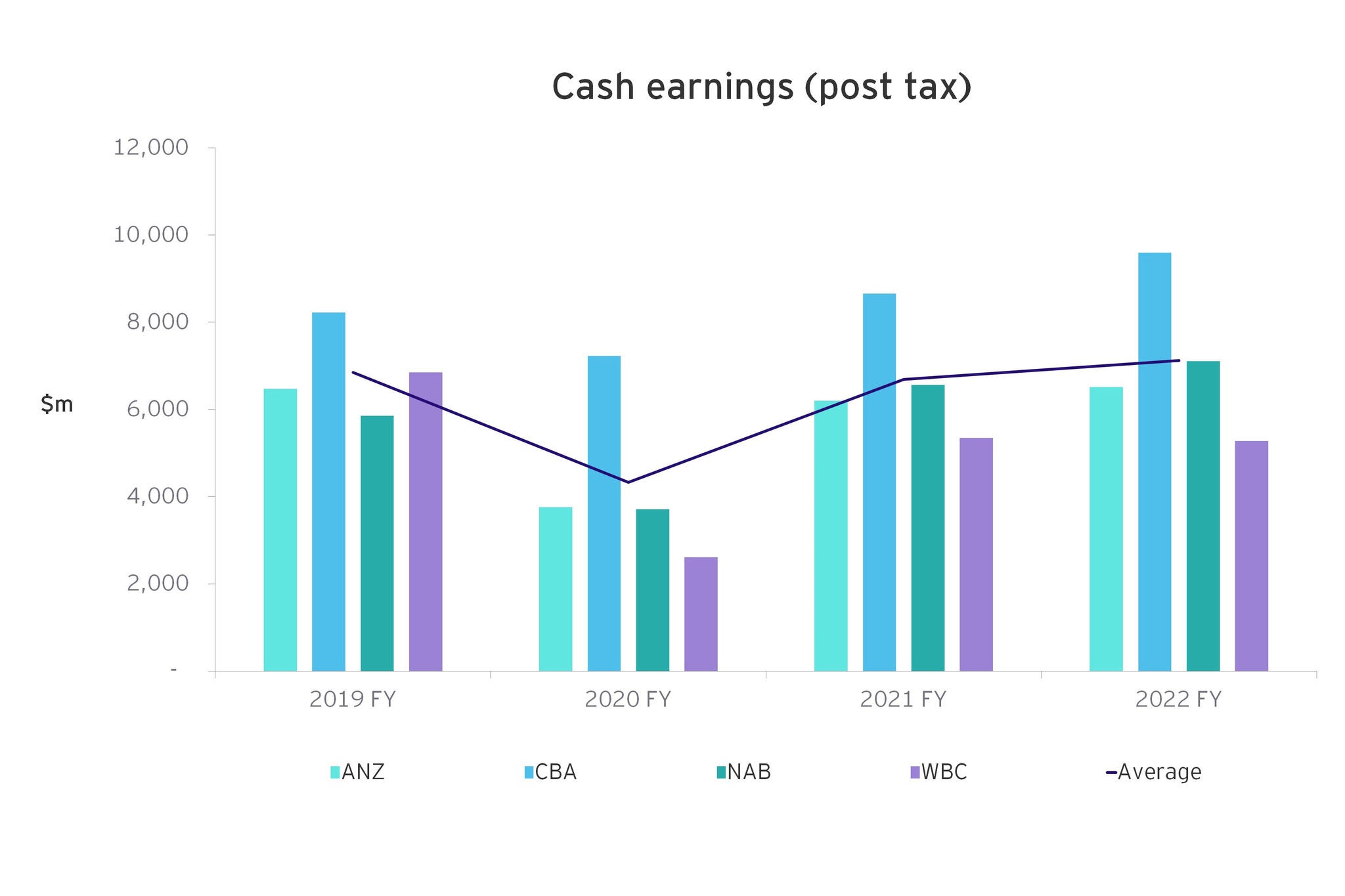

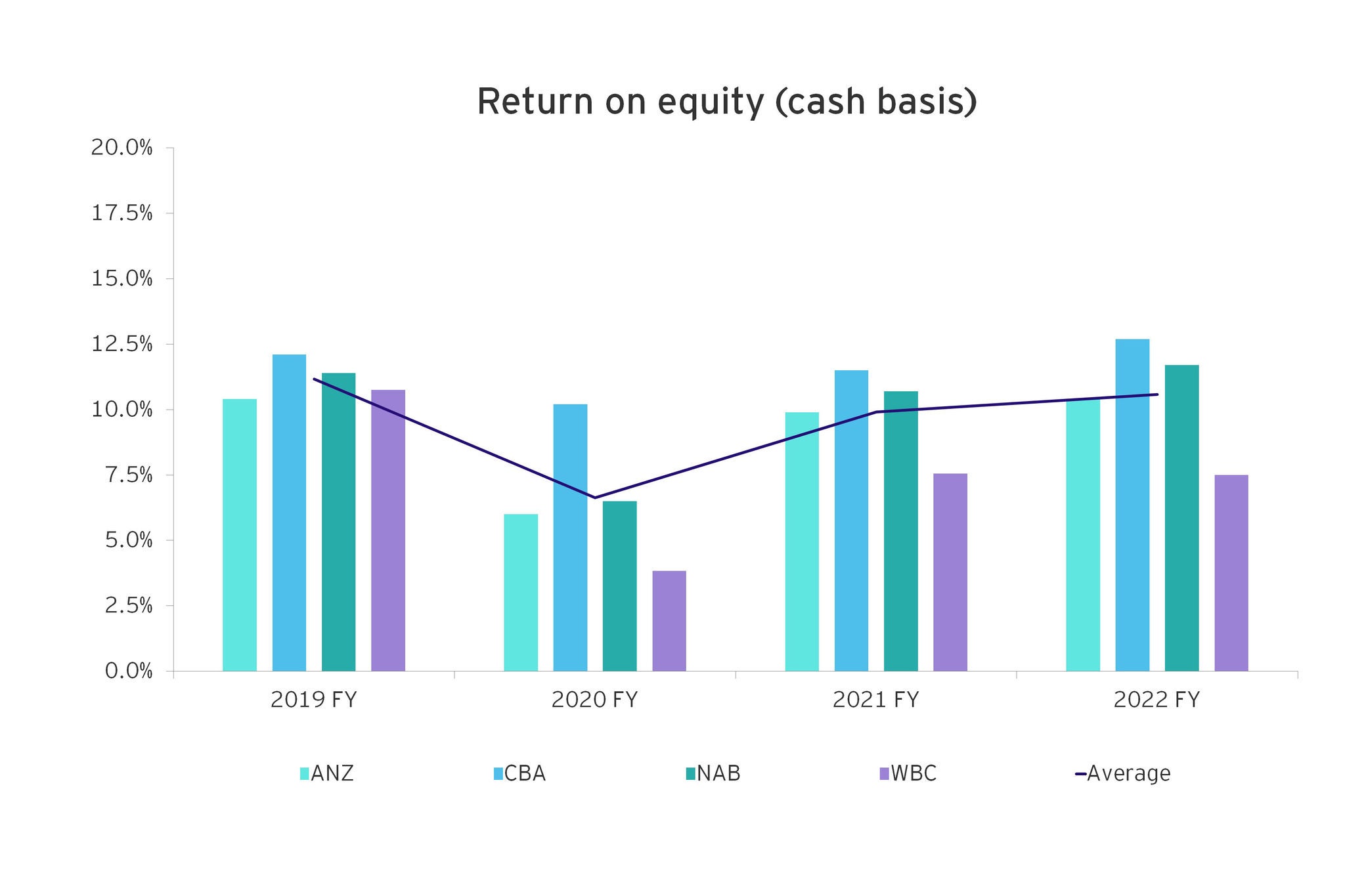

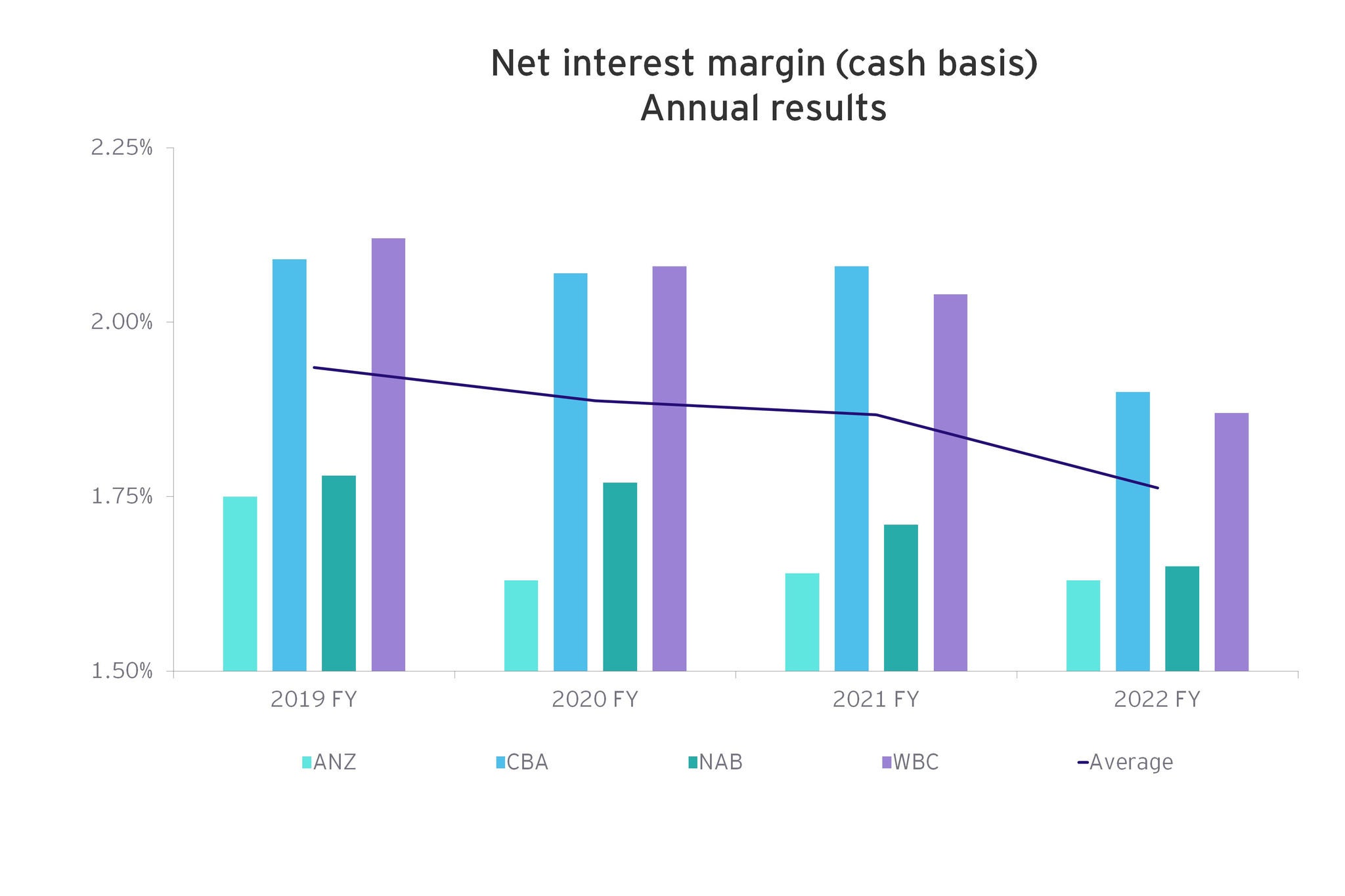

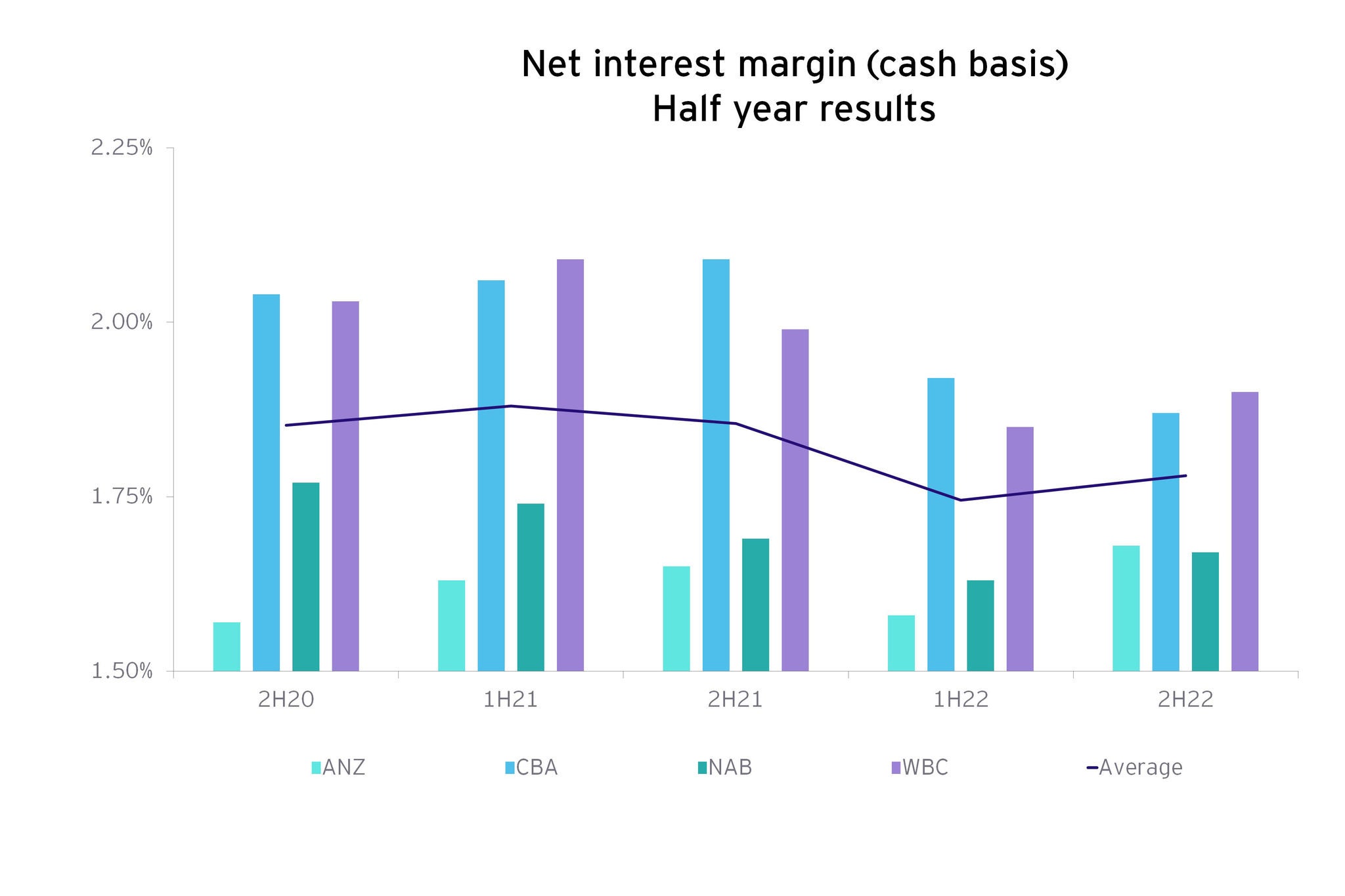

The major banks delivered a solid full-year result. While the average net interest margin (NIM) continued to decline year-on-year, rapid increases in the cash rate since May supported loan revenues and margins in the second half for most of the banks, as they actively managed mortgage and deposit pricing. Asset quality remained strong, with loan losses at low levels. Return on equity continued to trend upwards, reflecting earnings improvements.

Source: EY analysis

Source: EY analysis

However, significant and interconnected global threats are challenging economies around the world and the list of countries that are slowing or likely to recess is growing. Rising and broadening inflation is prompting monetary policy tightening in many economies at the same time as tight energy supplies disrupt normal production and consumption. The Australian economy is not immune. As well as being impacted by slower growth across its trade partners’ economies, inflation is surprising on the upside and new supply side challenges are emerging, including floods, building on the factors already impacting the economy’s potential.

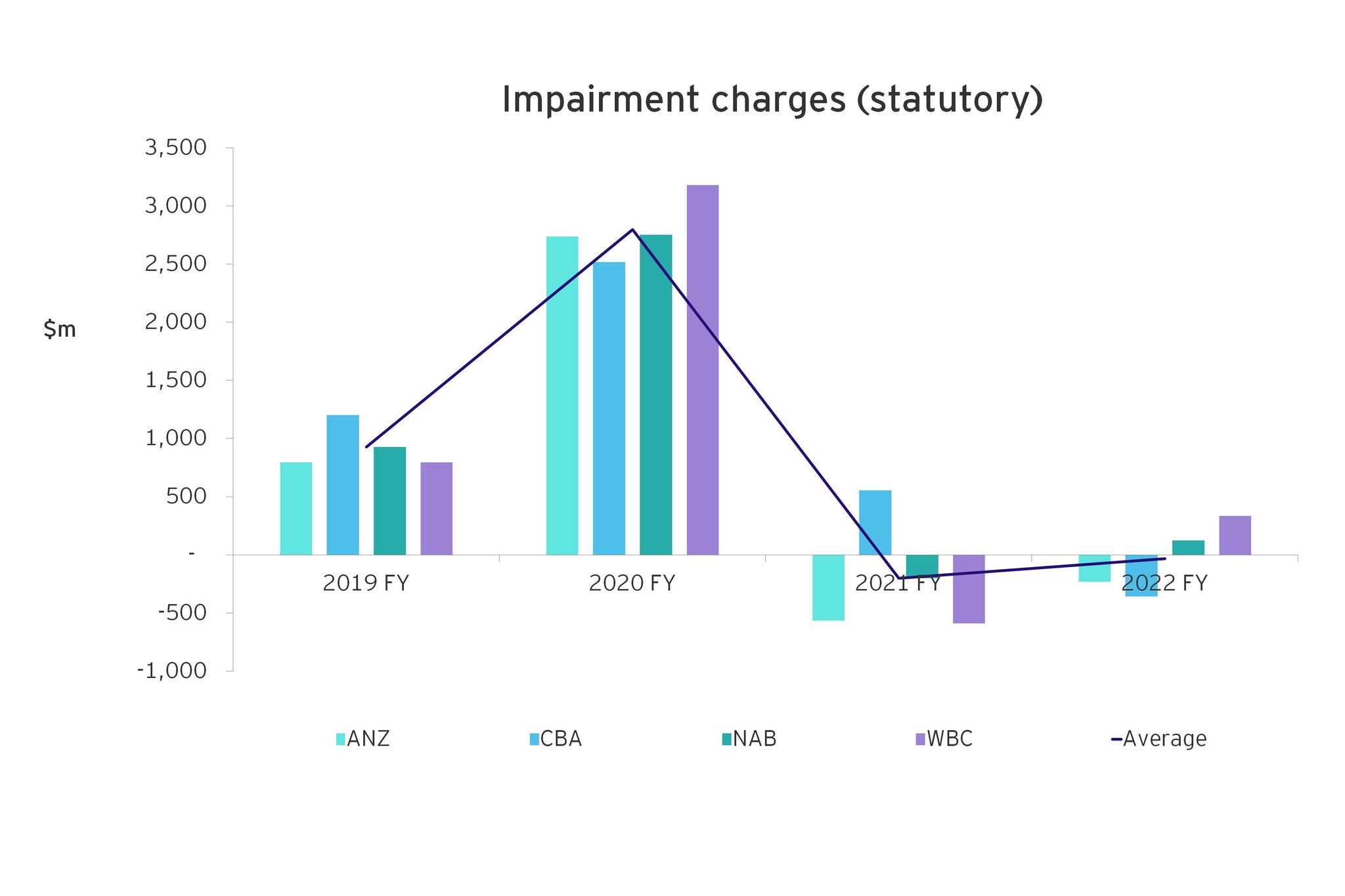

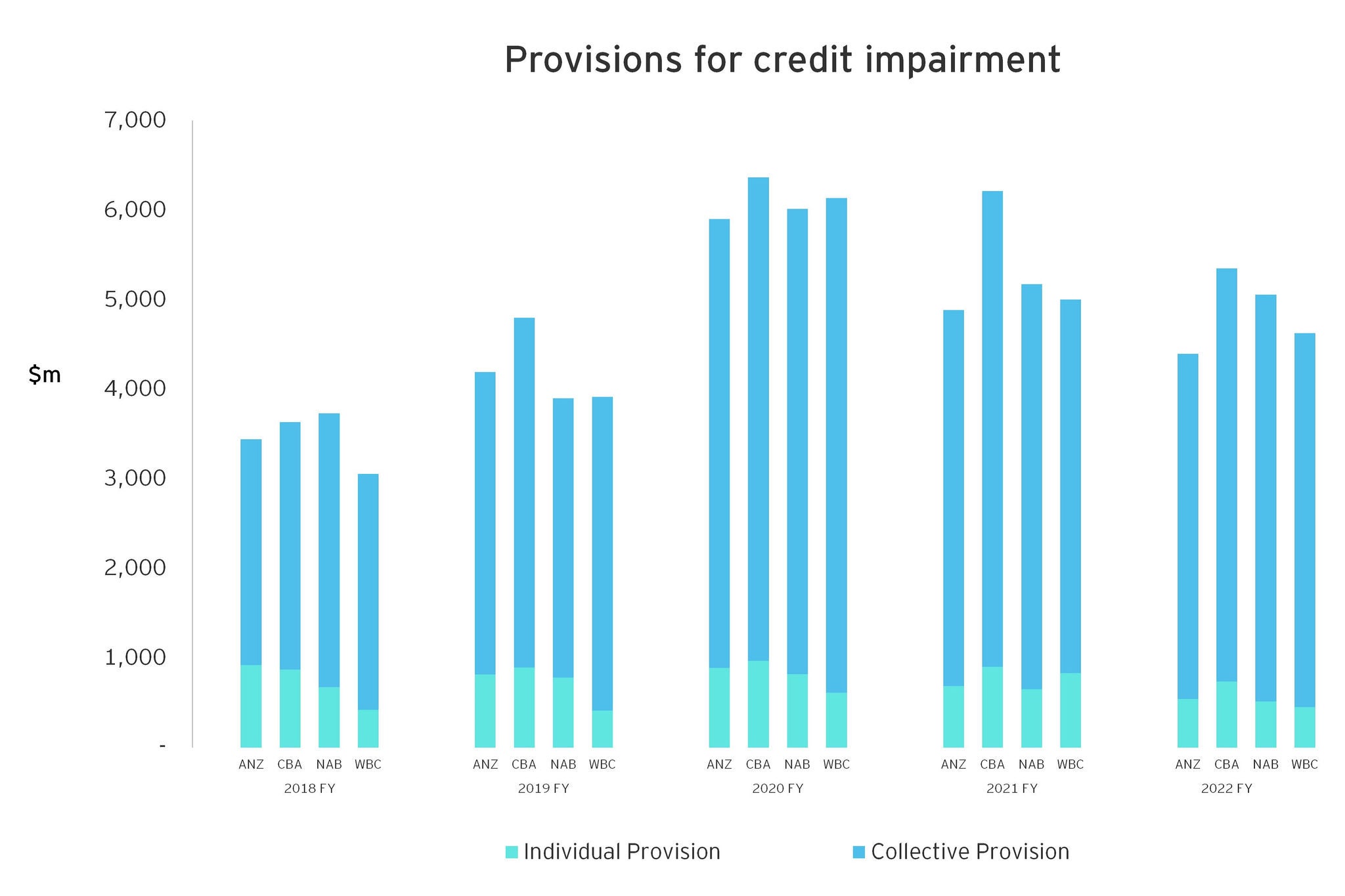

Against this uncertain economic backdrop, the banks have reviewed potential future loan losses and revised forward-looking adjustments for ongoing risks, including inflationary pressures, rising interest rates, supply chain disruptions and labour market challenges.

Sustainability also remains firmly on the banks’ agenda, as governments, regulators and investors look to banks to drive decarbonisation and wider sustainability initiatives. At the same time, the banks must manage the financial and operational risks associated with climate change.

Download the bank results dashboard summary here

.

Slowing housing market

Rate increases are working as intended to slow the pace of borrowing for residential housing

Demand for both residential mortgage and business credit remains elevated, but residential mortgage growth is slowing. Total housing credit grew 7.3% over the 12 months to September but has been slipping from its recent high of 7.9% earlier in the year as both owner occupier and investor lending slows.1 Business credit has continued to grow strongly amid robust and resilient business conditions, increasing by 14.7% over the 12 months to September.2 However, business confidence is softening.

Housing credit availability is expected to be more constrained over FY23 on the back of anticipated further rate increases and tightened loan serviceability hurdles for borrowers. This will place further downward pressure on national house prices, which have fallen 6.5% across capital cities following a 25.5% rise through the upswing.3

The housing slowdown is a major concern, as residential mortgages account for the majority of lending revenue.4 Home loans are therefore a key battleground.

While average NIM continued to fall year-on-year, the compression over recent periods looks set to ease, at least in the short term. Second half NIM showed improvement for banks with 30 September year ends, underpinned by interest rate rises and careful management of mortgage versus deposit rate increases. However, the margin benefits will likely be eroded by ongoing competition over the medium term.

Source: EY analysis

Source: EY analysis

.

Competition is heating up

Non-major banks with new value propositions are capturing market share

The housing slowdown is intensifying competition for customers. New borrowers are being wooed with significant discount pricing and cashback incentives by lenders seeking to grow their mortgage books. As fixed rate mortgage holders roll off low rates over the next two years, a surge of borrowers will be looking for the best deal.

The major banks still hold the lion’s share of the banking sector’s housing loans, accounting for nearly 80% of the market.5 But their share has slipped from 83% in 2017 to 79% in June 2022, driven by increased competition from other lenders.6

Investment by several non-major banks in new technology and redesigned processes to boost mortgage efficiency has paid off, driving strong growth for these players (albeit off a low base). Winning propositions are shortening ‘time to yes’, taking a customer-centric approach and emphasising digital solutions. Brokers are also key to this growth, with brokers facilitating 68% of all new residential home loans in the June quarter.7 As a result, lenders need value propositions that cater for both the broker and the customer experience.

.

Taking a digital-first approach

The banks are striving for customer centricity, with digital solutions focused on customer needs

In today’s market, providing safe, convenient, hyper-personalised and innovative experiences is an entry requirement for financial services providers.

To deliver these experiences, the banks are investing in data and analytics to enhance customer insight capabilities, intelligent automation and digital platforms to serve customers better. The priority is digital solutions that create easy and frictionless customer journeys. This includes mortgage origination, with each major bank launching, or planning to launch, a direct online mortgage offering.

Increasingly, banks are seeing cloud-based technology as a route to not only reduce costs but also drive productivity and innovation, creating new value and revenue streams. Developments in cloud services, open banking and payments (e.g., NPP) will make it easier for banks to pull trusted data from across the organisation for analysis. This will allow them to share data more effectively across functions and analyse it more thoroughly, to generate better insights.

.

Reining in operating costs

Inflationary pressures are a counterweight to cost management efforts

Despite the major banks’ strong management of operational expenses, these expenses have increased for the majority of them over the year.

The major banks are focusing on productivity and simplification to address cost pressures. They are simplifying and digitising front-, middle- and back-office processes to drive top-of-funnel growth, increase efficiency and reduce costs. However, costs will continue to be driven up by wage and other cost inflation pressures, as well as the digital investment needed to support growth strategies.

Banks need a new cost transformation approach to eliminate complexity and drive operating effectiveness in process, data, systems and controls.

While many of the cost levers available to banks are not new, banks need to consider their cost transformation more strategically. For example, transformation needs to deliver on all four cost objectives: reduction, flexibility, scalability and transparency.

Strategic cost transformation is not for the fainthearted. The level of transformation required can be daunting, requiring experienced talent. Transformation teams must be capable of managing complex security and privacy requirements while integrating multiple legacy systems and connecting operational silos.

.

Bolstering balance sheets

The banks are maintaining a conservative funding position amid tightening financial conditions and market uncertainty

The banks are facing higher funding costs in a rising interest rate and bond yield environment. They also have a significant, but manageable, refinancing task ahead of them to replace the low-cost funding of the Reserve Bank’s Term Funding Facility.

In the chase for cost effective funding, the banks are competing not only for loans but also deposits. Non-major banks are ramping up competition via competitive deposit offerings. The major banks continued to experience good deposit growth over FY22, with aggregate growth of 9%.

The banks will maintain conservative balance sheet settings in response to the prevailing market uncertainty, with large capital buffers and prudent overlays. CET1 and liquidity coverage ratios remain comfortably above minimum APRA requirements. Recent falls in liquidity coverage ratios (LCRs) have been driven by a reduction in each bank’s allocation of the committed liquidity facility, which is being wound up over 2022. LCRs are now back to similar levels as before the COVID-19 pandemic.

.

Preparing for deteriorating asset quality

Expect volatility in the back book as cost-of-living pressures take their toll on consumers’ financial health

Asset quality remains strong across the major banks but is likely to come under pressure soon, driven by cost-of-living pressures, higher interest rates and falling house prices.

At-risk borrowers include those with mortgages provided at their maximum borrowing capacity and at ultra-low rates during the pandemic, and customers with high debt-to-income ratios. The proportion of the major banks’ new housing loans with high LVRs (90% or more) has been trending down over recent quarters. However, around 7% of new loans in the June quarter were at LVRs of 90% or higher, and more than a quarter of new lending over the year to June has been to borrowers with DTI ratios of six or more.8, 9

With a likely deterioration in asset quality looming, the major banks are stress testing portfolios, kicking the tyres on credit models and constantly reviewing lending standards. As rates and recessionary pressures continue to rise, the banks are likely to build further provisions in anticipation of increases in impaired and past due loans.

On the upside, low unemployment coupled with high household savings and equity buffers should provide resilience. Any increase in non-performing loans will be from very low levels. Recently strengthened collections capabilities mean the major banks are better placed to manage new loan impairments, reduce future loan losses and work with borrowers on customised payment strategies and solutions.

Source: EY analysis

Source: EY analysis

.

Investing more in cybersecurity

Recent cyber incidents have focused attention on potential gaps in how customer data is managed, underscoring the need for banks to test their cyber resilience

In light of recent cyber incidents, banks are incorporating additional controls and enhancing monitoring. Their focus should be:

- Data security and privacy – Are customer and personal data stores identified and adequately protected using appropriate encryption and data loss prevention controls?

- Architecture – Are internal and external-facing IT environments designed with security as a key principle, particularly application and data interfaces, network zoning and cloud connections?

- Incident response – Are incident response plans in place and regularly tested?

Boards, too, have increased their attention on cybersecurity and have a critical role to play in risk management by:

- Setting the cultural tone – Demonstrate that cybersecurity and privacy risk are critical business issues by increasing the board's and/or committee’s time and effort spent discussing the topic.

- Staying up to date – Use frequent briefings to understand new cybersecurity and privacy issues and threats as a result of the shift to remote work.

- Strength-testing the cybersecurity risk management program (CRMP) – Ask for the CRMP to be independently assessed by a third party, with direct feedback to the board.

- Monitoring evolving practices – Stay attuned to evolving board and committee cybersecurity oversight practices and disclosures, including benchmarking against peers.

- Embracing ‘Trust by Design’ – Design new technology, products and business arrangements with cybersecurity in mind.

Replay our Banking in uncertain times webcast

where we discuss how banks should respond to

risks emerging from the challenging

medium-term outlook.

Summary

Deteriorating global economic conditions and increasing recessionary risk suggest that short term windfalls from the interest rate environment will be offset by a more challenging medium-term outlook for the local banking sector than might have been expected at this time last year. However, the major banks’ resilient FY22 results position them well to navigate a path through the challenging times ahead. Those that successfully manage the margin opportunities from rising interest rates will capture the upside from this changing market.