Chapter 1

Three challenges to sustainable profitability

Despite growth prospects, banks must address three key challenges to deliver sustainable profitability.

Three key challenges to deliver sustainable profitability

1. Cost pressures

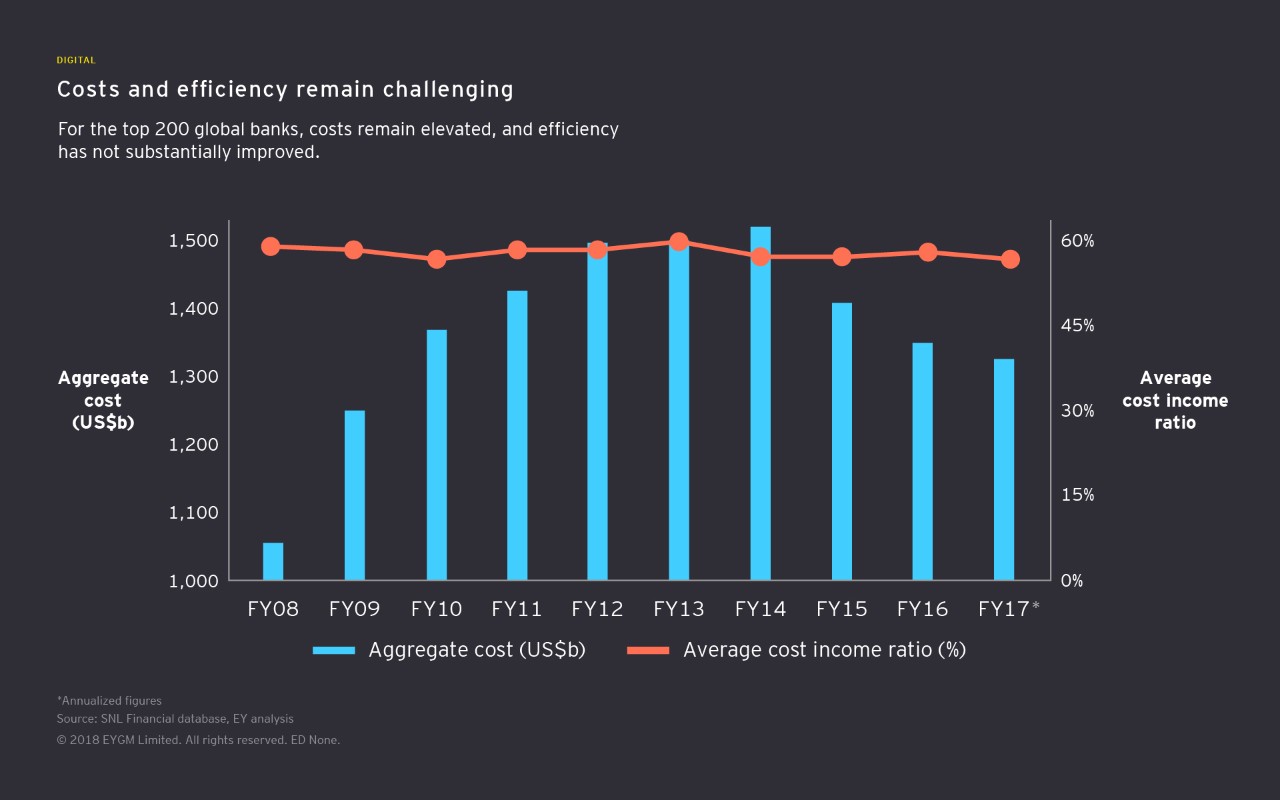

Our analysis of the world’s largest 200 banks shows that although aggregate costs fell slightly in recent years, they remain more than 25% above 2008 levels. Also, average cost-to-income ratios barely budged in the last decade, reflecting higher compliance costs, the burden of maintaining legacy systems, and elevated restructuring and litigation charges.

Our survey reveals that most bankers expect costs to increase over the next three years, as the moderate reductions in regulatory-related spending are reallocated to growth initiatives and cybersecurity. On average, bankers expect a 2.1% cost increase over the next three years.

2. Subdued income expectations

Estimates suggest that after three US Federal Reserve rate hikes in 2017 and an expected three additional increases in 2018, net interest income for the largest US banks could increase by 5% in 2018 and 2019.

However, rate increases do not take place in a vacuum. For example, higher interest rates would naturally lead to a rise in defaults and loan losses, increasing the cost of credit and offsetting improvements in net interest income.

3. New competition

Banks face increased competition from new market entrants, including digital banks and FinTechs. Leading banks are forced to respond, investing in technology to prevent customer leakage and preserve their value chain.

In our FinTech Adoption Index 2017, we report that “consumers are drawn to FinTech services because propositions are simpler, more convenient, more transparent and more readily personalized.” This is especially the case in traditionally profitable parts of the banking value chain. For example, adoption of FinTech providers for money transfer and payment services rose from 18% in 2015 to 50% in 2017, with 65% of consumers anticipating they would use such services in the future.

Such disruption is not restricted to emerging markets that lack traditional banking infrastructure. Banks in developed markets are equally at risk. The bottom line is that banks need to realize that competitive threats are continuing to evolve and prepare to battle these disrupters in the marketplace.

Related article

Chapter 2

Three risks could inhibit innovation

Risks are shifting from unambiguous regulatory and compliance demands to ever-evolving risks that demand creative, holistic strategies.

Bank leaders are focused on three risks in particular.

Cyber risk

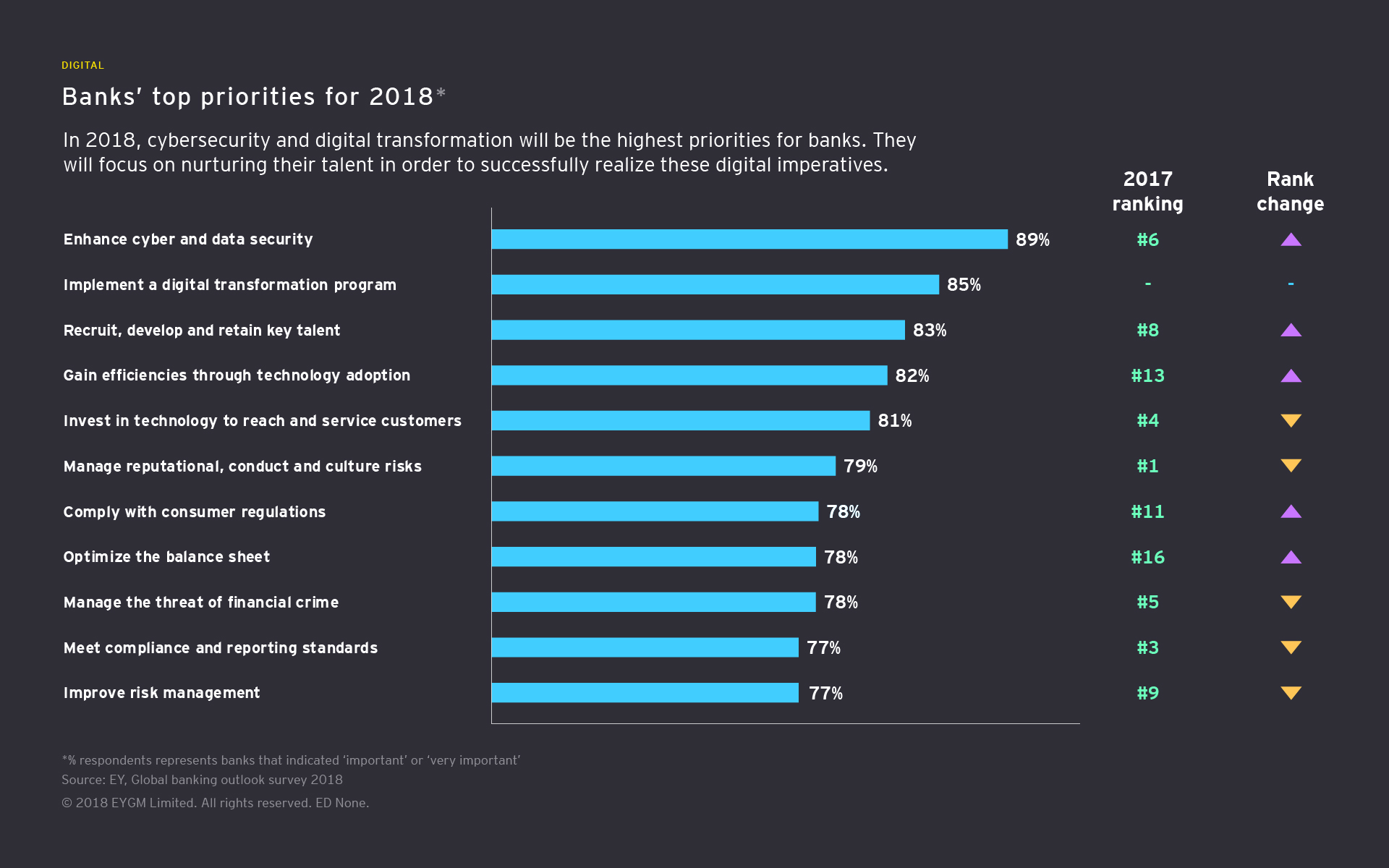

Our survey reveals that addressing cybersecurity is the top priority for banks in 2018. Artificial intelligence and advanced analytics can play a key role in the prevention of cyber attacks, reducing conduct risk and improving transaction monitoring to prevent financial crime.

However, given the cybersecurity talent shortage and the ever-evolving nature of technology, costs are likely to be substantial and could reduce investment in other areas, such as optimization. To meet this challenge, banks should plan to collaborate more with their peers and better leverage the ecosystem by sharing data on external cyberattacks, for example.

Reputational and conduct risk

Our survey finds that banks are increasingly concerned about managing reputational and conduct risks. Improving culture is critical for limiting the sizable risks associated with poor organizational behaviors.

Banks are also looking for new ways to manage the risks associated with financial crime and anti-money laundering compliance and are increasingly using technologies, such as advanced analytics, machine learning, robotics and artificial intelligence, to support these efforts.

Fragmented regulation

The post-crisis global regulatory alignment is fragmenting as certain jurisdictions begin considering regulatory relief. This is particularly evident in Europe, where some structural reform proposals were rolled back; in the UK, which is currently negotiating the terms of its exit from the European Union; and in the US, where the Trump Administration appears poised to repeal large parts of the Dodd-Frank Act.

Still, banks should not expect compliance requirements to loosen. In fact, pressure on banks is likely to increase, as supervisors around the world each implement their own particular version of the Basel reforms and as regulators set the rules under which banks must deal with the challenges posed by new technologies.

Related article

Chapter 3

Greater digital maturity is critical to future success

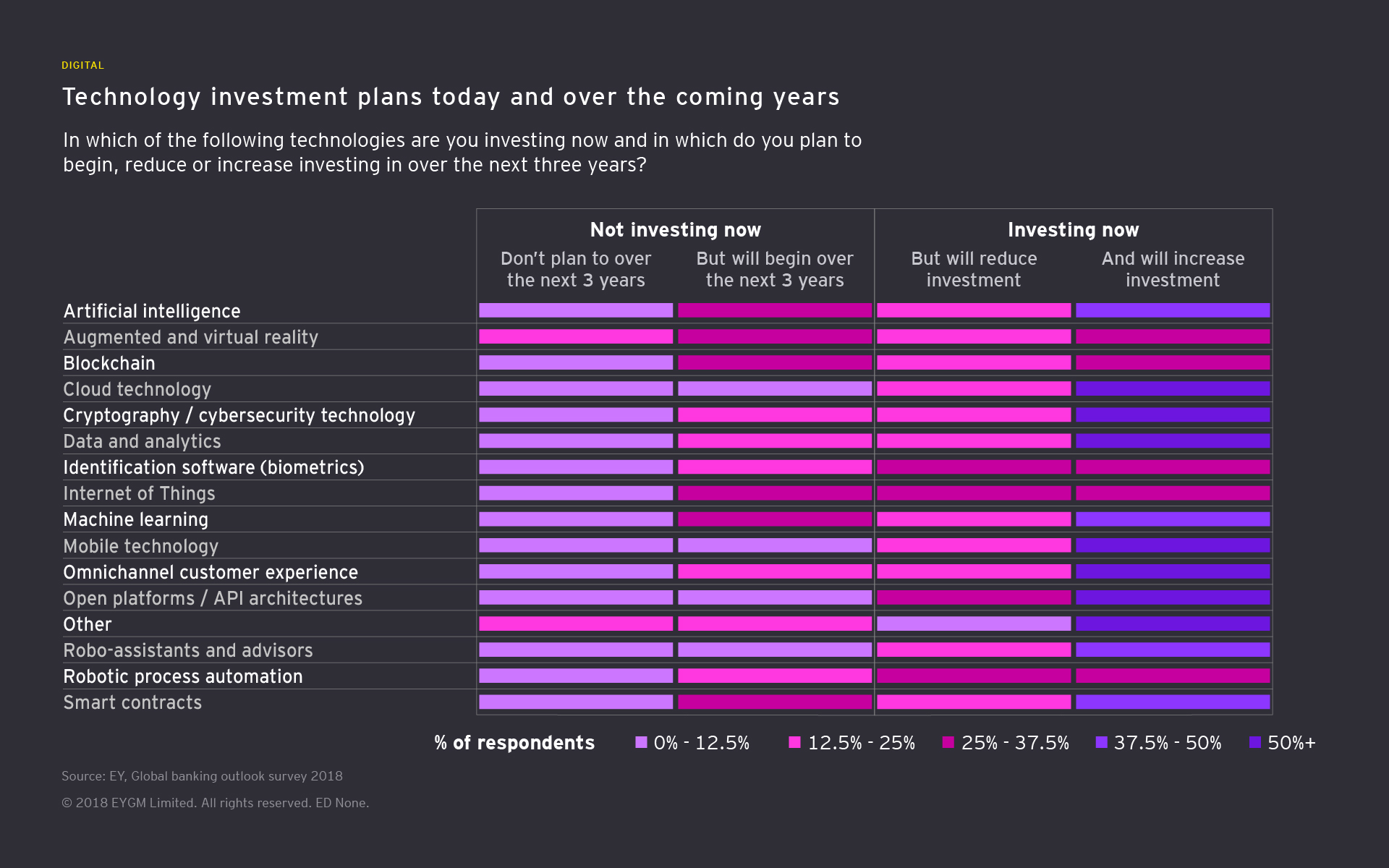

To become digitally mature, banks must understand how different technologies can benefit business, operational and organizational strategies.

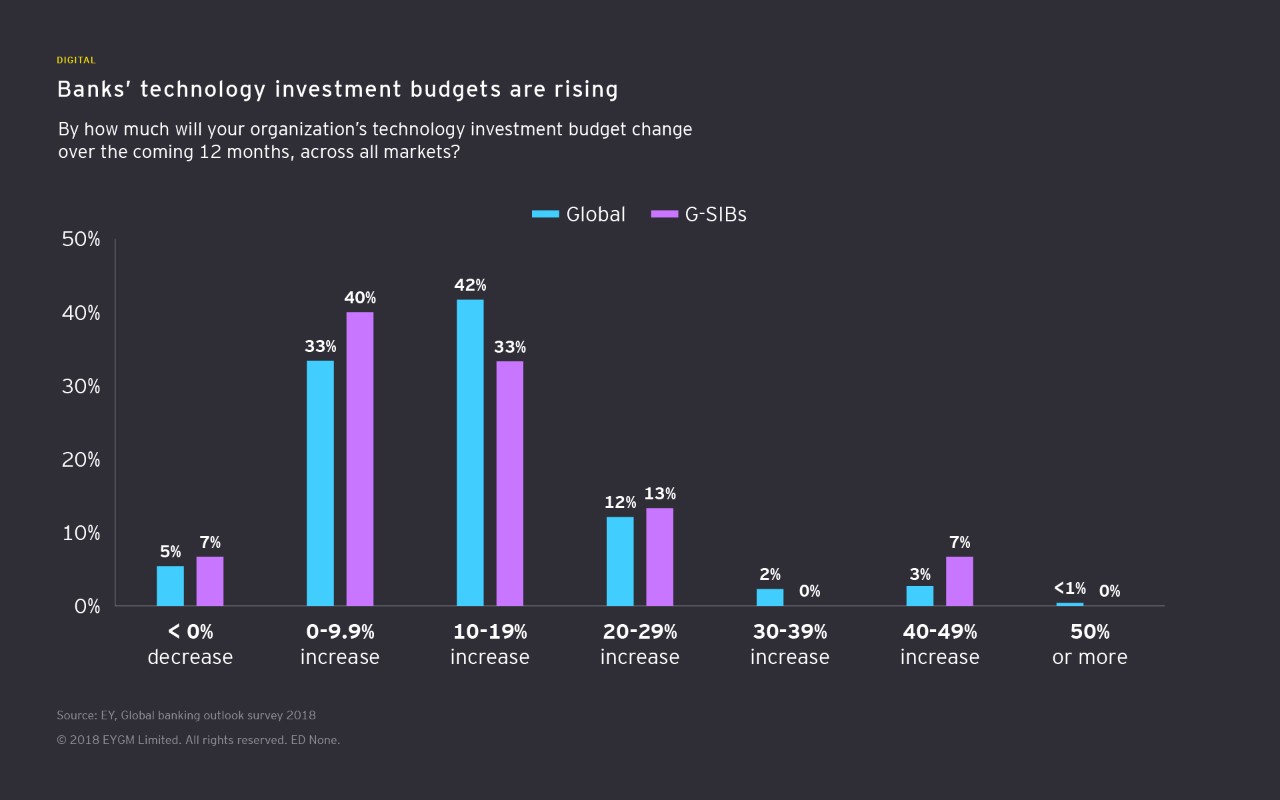

Of the five stages of digital maturity (not pursuing, beginning, transitioning, maturing and digital leadership), most global banks consider themselves as transitioning. Reflecting this, two-thirds anticipate their technology investment budgets to rise by more than 10% in 2018 as they mature. We question, however, whether this spending can necessarily lead to digital leadership.

So what will digital leadership look like? What will digital maturity require?

Digital maturity

62%The number of global banks who expect to be digitally mature in 2020, compared with just 19% in 2017

Digital maturity is not simply a function of the types of technologies banks invest in. Digitally mature banks require a deep understanding of how each technology can benefit business, operational and organizational strategies. Banks can then allocate meaningful budgets to the technologies that drive sustainable efficiencies, rather than trying to invest in every new technology.

As our survey suggests, in-house solutions continue to lose favor but are more favorable than acquiring an entity. Leading organizations are aggressively seeking internal simplification and are increasingly using external utilities, platforms and managed services. This type of banking ecosystem lays the foundation for digital maturity.

However, banks must hold third-party providers and partners in this ecosystem to strict standards, and new models for sharing risk must be developed.

Chapter 4

Six ways to prepare for innovation-led change

The questions banks need to be asking themselves now.

Banks must answer six key questions to ensure they are ready for innovation-led change.

1. Does my strategy account for rapidly changing revenue and profit pool?

Implementing new technology independent of strategy is ineffective. Banks need a clear strategy that defines their operating model and identifies key markets, customers and products. The strategy should be frequently reassessed, given the pace of technological change.

2. What is my role in the ecosystem, and how do I innovate efficiently?

As banks reduce the number of in-house functions and seek partners to drive innovation, it is critical they foster a deep understanding of their competencies and deficiencies. They must also develop a clear view of which processes a partner might be able to do better, or at a lower cost, or both.

The most successful banks will participate in a new, broader type of financial ecosystem. The culture will be one of collaboration, not protectionism. Relationships with FinTech firms, utilities, managed service providers and even competitors will be common.

3. How do I implement strategic change in a rapidly evolving digital environment?

New technologies do not necessarily drive a need to use them. There is often limited advantage to being a first mover, and any advantage can be quickly eroded by fast followers who learn lessons from first movers.

According to Celent, banks spend approximately 75% of their IT budgets on maintaining legacy architecture, often on tactical patches that embed poor processes that then propagate to new technology. For example, robotic process animation can radically reduce costs, but applying robotics to existing procedures may just reinforce inefficiencies.

One attractive solution to this problem is launching a greenfield digital bank to which banks can migrate customers. It is a costly proposition that management can be reluctant to implement, even if it does drive long-term success.

4. How do I change my talent to support a more digital business?

The stars of the future might well be internal entrepreneurs, as opposed to those who excel at in-house development. This brings implications for talent acquisition at all levels of an organization. Other talent-related trends include automation that frees up humans to perform more value-added tasks, and the migration of talent from banks to technology firms and service providers.

A heightened focus on internal cost reduction may seem threatening to the retained organization and existing employees may wonder “Will software robots eliminate my role? Will my experience and skill set be appreciated in the new world?” These are understandable concerns, and banks must prevent a “them vs. us” mentality that reduces motivation and can lead to a talent exodus.

5. Am I sufficiently considering new risks and the need to embed cybersecurity in my strategy?

As the pace and scale of technological change accelerate, the perimeters between internal and external risk are blurring. Banks must successfully manage these developing risks to maintain high levels of digital trust.

By infusing cybersecurity concepts and practices throughout the organization, banks are better able to identify and mitigate digital risk. Banks create value when the rationale for cybersecurity shifts from preventing breaches to enabling innovation and growth.

6. How do I transform my technology and the technology organization?

Digital maturity is a moving target. The most successful banks understand where emerging technologies support strategic objectives and don’t get caught up in hype about new, unproven technology. The marks of a true digital leader are organizational flexibility and agility.

Banks need to demonstrate to supervisors (and other stakeholders) that they understand the risks associated with new technologies and pursue innovation in a way that enhances — or at least maintains — operational and financial resiliency.

Resumen

To be more successful, banks need to become digitally-mature. Innovation-led change can help banks become digital leaders.