EY se refiere a la organización global, y puede referirse a una o más, de las firmas miembro de Ernst & Young Global Limited, cada una de las cuales es una entidad legal independiente. Ernst & Young Global Limited, una compañía británica limitada por garantía, no brinda servicios a los clientes.

On May 17th, 2023, the Chamber of Deputies approved the mining royalty bill that had been under discussion for several years in parliament, after several and substantial modifications were made to the original bill.

The bill still needs to pass a constitutional review on some of its provisions by the Constitutional Court, after which the bill will be ready for promulgation by the President.

In general terms, the approved bill establishes that mining operators will be subject to an ad-valorem component and an operating margin component, according to their level of sales and the type of minerals exploited. The sum of these components will correspond to the Mining Royalty to which mining exploiters will ultimately be subject, notwithstanding it may be capped because of a maximum taxation limit that considers the royalty, corporate income taxes, and final taxes.

Below you may find a summary of the bill’s main provisions, as they were approved by parliament:

1. Taxpayers covered

The bill defines that both components of the mining royalty will apply on mining exploiters, defined as “any person, natural or legal, who extracts mineral substances subject to a mining concession, and sales them in any production stage the substances may be in”.

2. Ad-valorem component

An ad-valorem component of a 1% rate will be applicable to mining exploiters whose annual sales of copper are higher than the equivalent of 50,000 metric tons of fine copper (MTFC). This component will apply only to sales arising from the sale of copper.

On the other hand, when in a commercial exercise the “Adjusted Mining Operational Taxable Income” (“RIOMA”) is negative, the ad-valorem component to be paid will correspond to the positive amount resulting from subtracting from the ad-valorem component the negative amount of the RIOMA.

3. Operating margin component

The operating margin component will vary depending on the sales volumes of the mining exploiter, along with whether more than 50% of its annual production is copper.

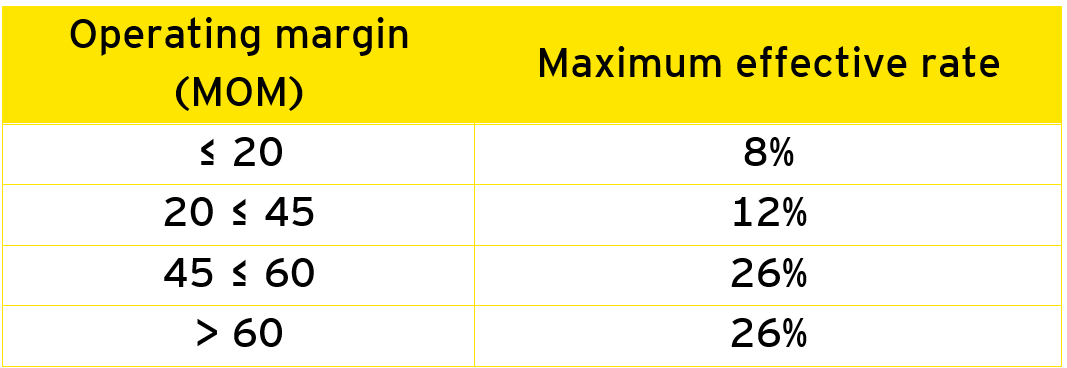

i) Mining exploiters with more than 50% of income coming from copper, producing more than 50,000 MTFC, will pay a tax rate ranging from 8% to 26%. The rate will be determined based on the mining operating margin (“MOM”).

MOM is defined as the quotient resulting from dividing the “Adjusted Mining Operational Taxable Income” (RIOMA; see below for its definition) over the mining operational income of the taxpayer, multiplied by a hundred.

However, this component will not be applicable in case the RIOMA is negative in a given tax year.

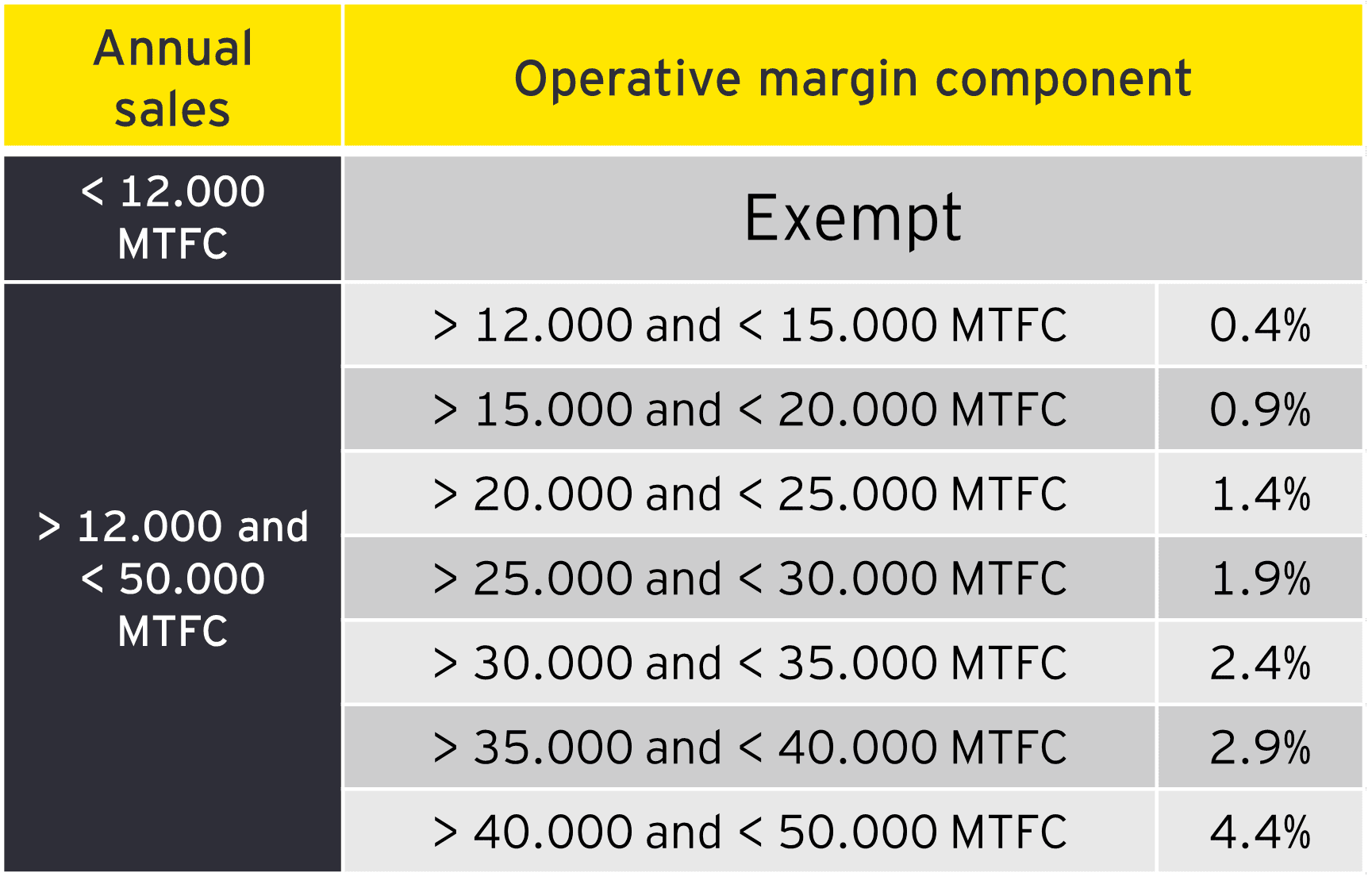

ii) Mining operators with less than 50% from copper sales (or with 50% or more, yet producing 50,000 MTFC or less), will be subject to the following tax rates based on the equivalent of their annual sales of MTFC:

- Less than the equivalent of 12,000 MTFC: Exempt.

- More than the equivalent of 12,000 but less than 50,000 MTFC: The marginal tax rates to fluctuate between 0.4% and 4.4% depending on the levels of production.

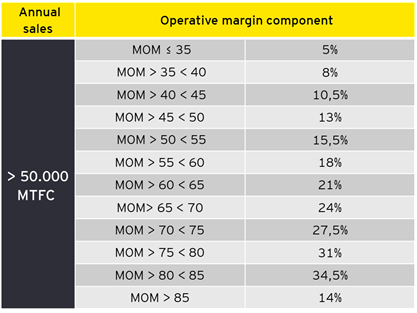

- More than the equivalent of 50,000 MTFC: Progressive tax rates ranging between 5% and 14% depending on the operating margin.

- Taxable base

Mining exploiters shall apply the respective tax rates on the “Adjusted Mining Operational Taxable Income” (RIOMA), which considers the taxable base of the corporate income tax subject to the following adjustments: - Additions:

- Mining royalty (component on the mining margin only)

- Expenses and costs linked to income arising from sources other than the sale of mining products. In case such expenses of costs can be linked simultaneously to both sources of income, they’ll be considered in the same proportion each type of income represents over total income.

- Interest as stated in N°1 of article 31 of the Chilean Income Tax Law (“ITL”).

- Carry-forward losses.

- Deductions resulting from accelerated depreciation.

- The difference –in case it exists– between organization and start-up expenses (as in article 31 N°9 ITL) deducted in a period inferior to 6 years, and the proportion that would have otherwise been deducted in case such expenses were deducted linearly in 6 years.

- Payments made as a result of the sale of minerals, leases or usufruct of mining properties, or any agreement arising from enabling a third party to exploit a mining site. Also, any portion of the purchase price of a mining property determined as a percentage of the sale of mining products or the buyer’s profits.

- Deductions:

- All income not derived directly from the exploitation of mining products.

- Annual depreciation that would have been deducted in case the accelerated depreciation regime hadn’t been opted for.

- Calculation of sales

For the purposes of either component of the mining royalty, sales will consider the average of annual sales of the last six commercial years, for which purpose taxpayers will have to comprise the total sales value of mining products including that from related parties (insofar as those related party can also be considered “mining exploiters”). Related parties shall be understood to those referred to in number 17 of article 8 of the Chilean Tax Code.

In case the taxpayer registers sales for less than six years, the average will consider the years starting from the first year the taxpayer registers actual sales.

4. Maximum potential tax burden

The bill incorporates a limit to the maximum taxation of mining royalty taxpayers (called the "maximum potential tax burden"), considering income tax, royalty, and final taxes (i.e., Global Complementary or Additional Tax) to which their owners will be subject upon profit distributions.

Specifically, it is established that when the sum of the First Category tax, mining royalty (both components), and the final tax that the owners would pay in case profits were fully distributed exceeds 46,5% of the operational profitability (as defined in section 3 i), above) then the royalty will be adjusted in such a way that it does not exceed said 46,5% (in case of mining exploiters with sales below the equivalent to 80,000 MTFC, the cap is lowered to 45,5%). For this purpose, the final tax of shareholders will consist of such figure resulting of applying a 35% on the company’s net taxable income, less the corporate income tax paid in the same exercise.

5. Provisional Monthly Payments

The bill introduces Provisional Monthly Payments (PPM) which taxpayers must make on account of the annual royalty to be filed and paid in April after the end of the respective commercial year.

PPMs are calculated as a percentage of the gross monthly income (perceived or accrued) of the taxpayer, derived from the sale of mining products. Said percentage will depend on the variation of the ratio between the royalty effectively paid the prior year and the PPMs made during such year (which may increase or decrease the PPM). Whenever the foregoing cannot be determined (because of a negative operating margin, absence of sales the prior year or other cause) the PPM is set to 0.3%. Moreover, the PPM rates are to be adjusted quarterly according to the variation of copper prices, under a methodology set forth by the bill.

6. Obligation to report financials

Mining exploiters shall also be bound to report their annual financial statements (both individual and consolidated) to the Chilean Financial Market Commission (the equivalent to the US SEC), which must be audited by a regulated auditing company and contain a note on the ownership of the mining entity. Quarterly financials must also be reported.

7. Transitory provisions

The Mining Royalty will enter into force as of January 1st, 2024. As a result, the current tax on the mining activity, set forth in the ITL, will be effectively repealed in that very date.