EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Rapid performance improvement

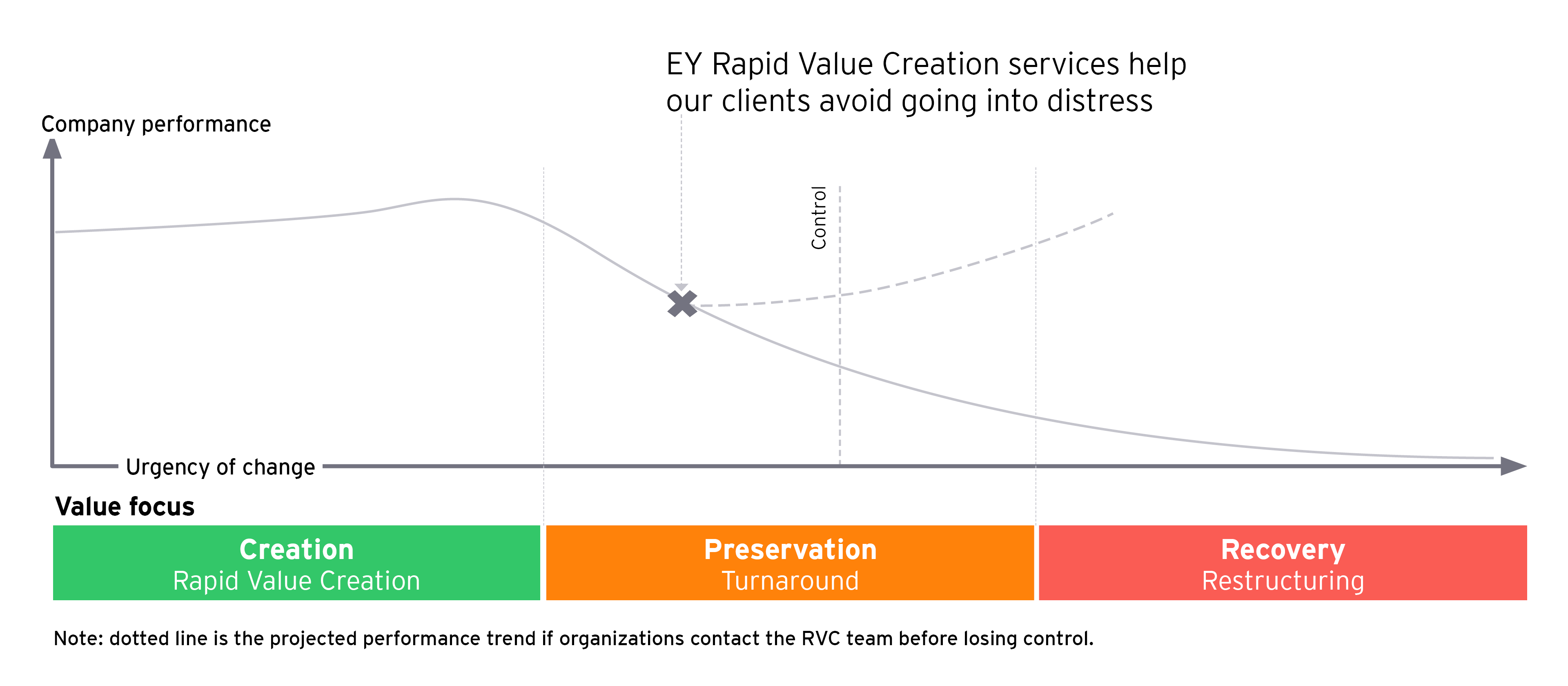

In virtually all industries today, companies are determining the best path to navigate the COVID-19 pandemic, geopolitical uncertainty and sector disruptions. Time is of the essence. Business leaders must consider and implement immediate actions to rapidly improve performance.

What EY can do for you

Most businesses are likely to experience operational challenges and underperformance at some point. While the root causes can be buried below the surface, the negative impact can be highly visible — profit warnings, declining performance metrics, failure to achieve project milestones, loss of customer contracts or management departures.

Whether a business is in crisis or simply faced with a challenge, we help management teams identify the issues, stabilise the business and provide tangible results quickly.

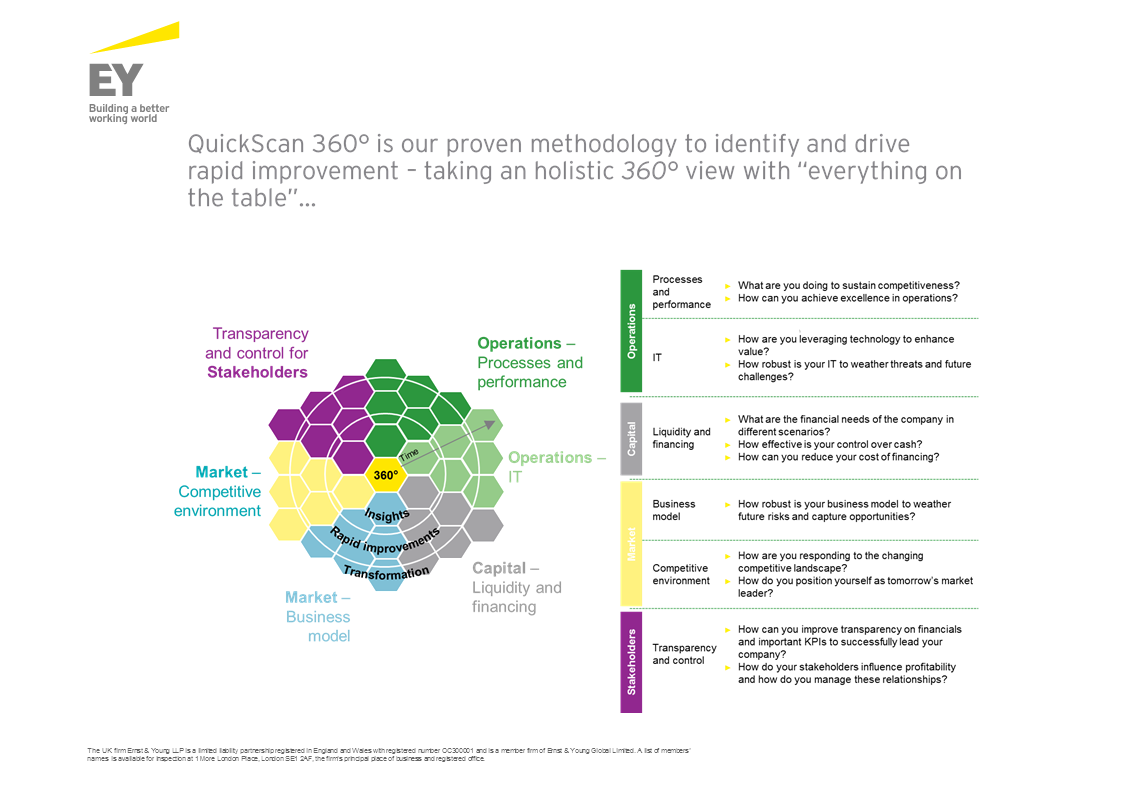

We dive into the issues across operations, market, capital and the full range of stakeholders, and deploy financial and operational professionals to improve cash flow, enhance shareholder value and provide a sustainable growth platform.

Common challenges we help you to solve:

|

Creation |

Preservation |

Recovery |

|

|---|---|---|---|

|

Indicators |

|

|

|

EY value proposition

How we can help

Whether a business is in crisis or simply faced with an operational challenge, our team is experienced in helping management teams identify and prioritise the most critical issues, stabilise the business, establish a leadership and stakeholder consensus around the solution and deliver tangible results quickly.

We seek to transform outcomes by:

- Identifying and prioritising the most critical business issues

- Establishing a leadership and stakeholder consensus around the solution

- Delivering tangible results quickly

More information on our Quickscan 360 approach can be found here.

- Fast impact

- Targeted approach

- sustainable value

- Proven track record of maximizing value and performance improvement

- Hands-on support from seasoned professionals, including interim management and contract research organization services

- A “future-back” perspective, incorporating a customer impact and investor lens

- Broad, integrated offering with full suite of industry, functional and operational capabilities

- Pragmatic and sustainable answers, not “slash and burn” strategies

- Promotion of a collaborative methodology to identify real opportunities with a focus on long-term value creation

Addressing your cost and capital needs today to fund your future for tomorrow

SG&A and operations

Where can I streamline my business operations to be more cost efficient and resilient to fluctuations in revenues?

- Operating model: Only 35% of large companies say they are making good progress in their digital transformations.

- Labor productivity: 70% of organizations believe that productivity is a concern with remote working.

- Third-party spend: 50% of Fortune 100 companies' expenditures involve third parties.

- EY employs leading practice tools such as ZBB to identify which cost levers a company should pursue to maximize profitability.

Revenue and margin

In what areas do opportunities exist to optimize products and customers to drive topline growth and gross profit?

- Cost of goods sold: 41% of companies are accelerating plans to automate as a result of the coronavirus, which will impact the cost of goods.

- Price and promotions: 20% of manufacturer revenue is invested on trade promotions (pdf).

- Customer demand: Responding to changing customer trends, 75% of organizations selling direct to consumers will offer subscription services by 2023.

Capex and cash

Where can we free up capital from operations that can be redeployed for growth or for a stronger balance sheet?

- Working capital: The average amount of working capital carried by companies amounts to 5% of total revenue.

- Capital portfolio: The average real estate costs at most companies amounts to 3%-5% of total revenue.

- Tax savings: The average indirect tax burden at most companies amounts to 25% of total personnel expenses.

Our team brings you:

- A practical, hands-on approach

- Insightful operational and sector experience

- Analytical tools to establish fast facts about performance

- Financial background, bringing rigour to decision making

- Deep experience of working quickly in an uncertain environment

- Client tailored solutions

Our latest thinking

Reframing the future of an iconic skiwear brand

EY-Parthenon helped BOGNER refinance, reshape and return to profitability in spite of the COVID-19 pandemic. Learn more.

How do CEOs reimagine enterprises for a future that keeps rewriting itself?

EY-Parthenon CEO Outlook 2026 explores how leaders use AI, transformation and portfolio strategy to navigate uncertainty and drive sustainable growth.

Three ways to improve your forecasting and scenario planning

New forecasting and scenario planning methods based on sound data analysis help businesses meet changing customer demands due to pandemic. Read more.

How EY can help

-

Our Strategy Consulting teams help CEOs achieve maximum value for stakeholders by designing strategies that improve profitability and long-term value.

Read more -

Our Corporate Finance consultants leverage deep financial and capital markets experience to help CFOs drive sustainable value. Learn more.

Read more -

Learn how EY-Parthenon M&A Advisory Services teams can help enable strategic growth through integrated M&As, joint ventures and alliances.

Read more -

Our divestiture services can help you with portfolio management to improve value from carve-out, spin-off or joint venture. Get in touch today.

Read more - Read more

-

Our private equity portfolio company value creation team can help create differentiated value faster and maximize returns. Learn more.

Read more