If consumers expect to be able to perform more buying tasks online than they could in the past, the quality and nature of the experiences they seek is also changing. Dealers and OEMs alike are offering AR and VR enhanced brand experiences — several EV makers use AR/VR technology to enhance the purchasing experience, often via tech-enabled experience centers. These centers can showcase in car tech and new models via AR ad VR technology, offer virtual test drives and even virtual factory tours — all without the need for holding physical stock on site, reducing costs and the amount of space required.

Making waves in the metaverse

The latest and perhaps the ultimate immersive experience of 2022 is the metaverse, a high-tech alternative universe, which by 2024 is touted to create US$800b of business opportunity — across sectors as diverse as the arts and media to manufacturing and real estate — according to industry estimates.2

On one level, the metaverse is just the latest upgrade to the AR/VR brand experience that many are already providing. But its real commercial potential lies in the opportunities for creating a huge range of margin-enhancing revenue streams at practically zero marginal cost, and also in its appeal to future cohorts of Gen Z car buyers, who will likely expect OEMs to be in the metaverse in the same way that their parents expected them to have a website.

Our analysis also suggests that EV manufacturers are taking a “build it, and they will come” approach to this novel technology, busily embracing the metaverse even if those revenue promises have largely yet to materialize. Several automakers are using the metaverse to enhance the customer experience, while some prioritize overall brand promotion, and a select few are leveraging it for product launches.

The distribution dilemma

EVs are intrinsically lower maintenance than ICE cars, a factor that has catalyzed a shift toward direct-to-consumer EV sales (even from some legacy OEMs), and an industry-wide shift in the relationship between consumers, dealers and OEMs toward an agency model.

The agency model — which sees ownership of vehicle inventory to be sold remain with the OEM or its sales company, rather than with the dealership as has historically been the case — offers OEMs several advantages. For one thing, it makes the provision of that integrated seamless customer journey easier, as there is much less back-and-forth between dealer and OEM systems to cause friction. It also provides better control of pricing and multiple opportunities to upsell and cross-sell along the way. And it gives them a more direct connection with the customer.

Agents of change

For dealers, the agency model is something of a mixed blessing. In return for fixed fee per vehicle (and likely reduced costs from simpler operations and a smaller real estate footprint) the dealer’s role becomes that of “last mile” distribution and delivery of vehicles already ordered and paid for via the OEM.

In the light of the reduced servicing requirements of EVs, how dealers can use their existing relationships with long-term customers to generate new and alternative sources of revenue may prove to be an important consideration as this shift continues.

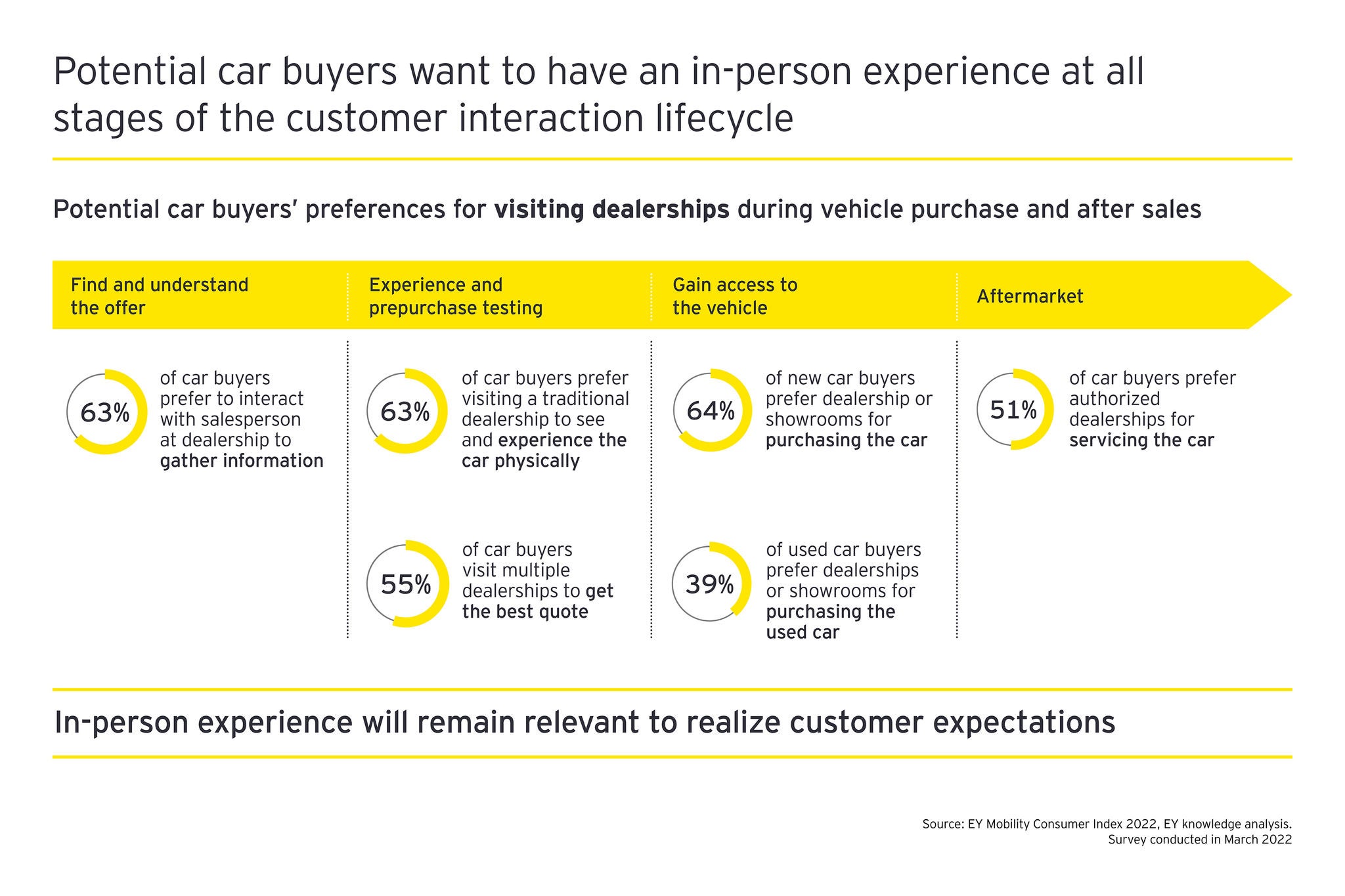

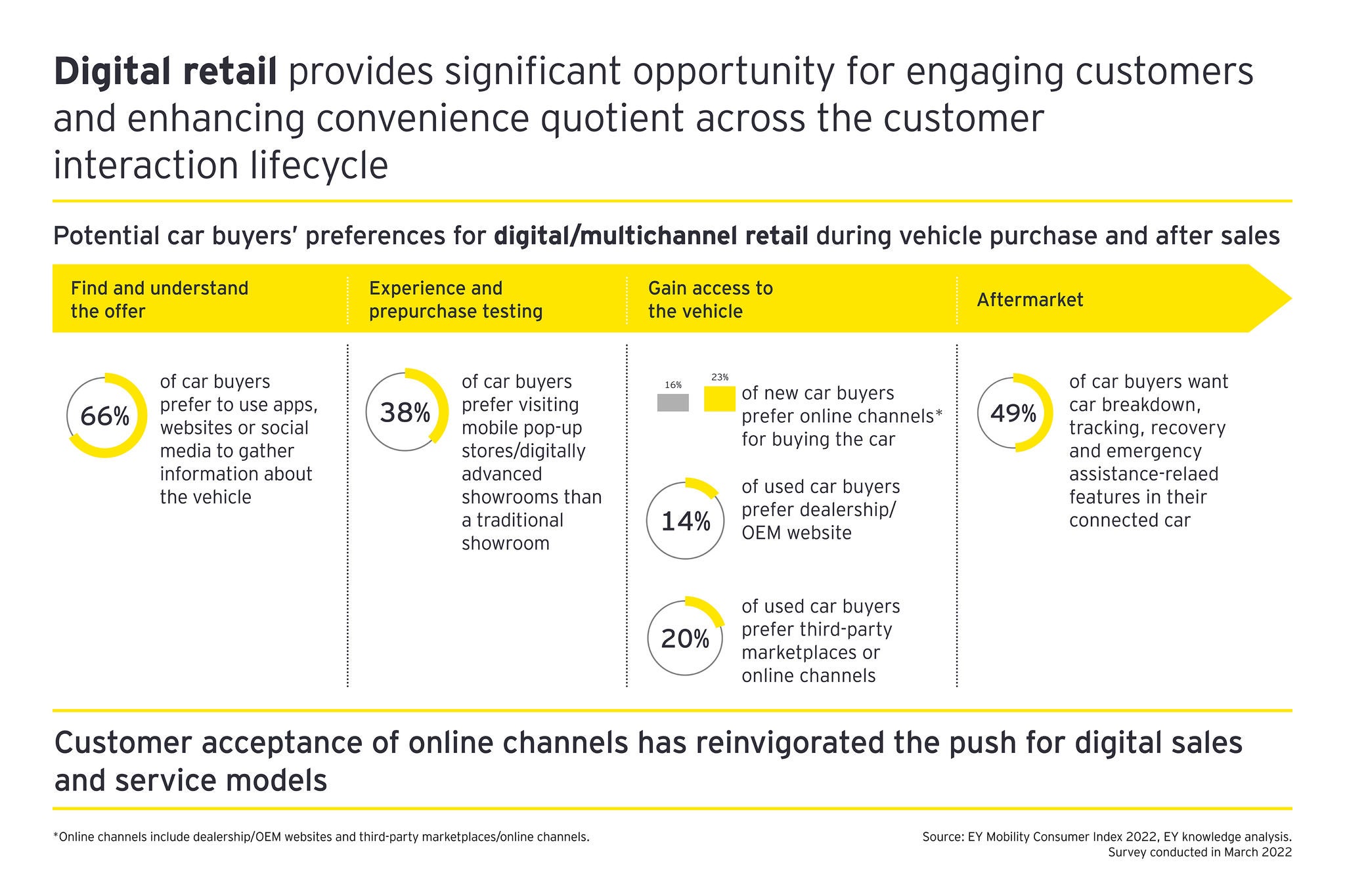

There is as yet no “one size fits all” solution to the distribution dilemma, and OEMs are still experimenting to find the right balance between direct sales, dealer sales and the agency model. Some pure play EV makers who started out with direct-only sales models are looking to develop their own dealer networks, while others are dialing back on their level of physical presence in favor of direct sales. By contrast, some legacy OEMs have adopted direct-only sales for their EV models, while others are rightsizing and reconfiguring their dealership footprints to deliver a more integrated experience and maximize revenue opportunities. Given this trend, the future of the physical retail network is expected to be less dense, with OEMs and dealers leveraging an omnichannel model as the customer journey becomes increasingly digital.

Toward a seamless tomorrow

Dealers and OEMs have already become used to a world where getting a sale is no longer just about having the best product, the smartest salespeople and the most competitive deal. Now they will also have to evolve beyond competing for the wow factor of who has best online or virtual experience, to who can offer the best customer lifetime experience.

The goal of a customer experience is a seamless digital marriage of online, offline and virtual elements. OEMs and dealers have tested and developed many of the individual elements of that experience; the challenge now is how to best integrate them into a unified whole. The leaders of tomorrow, whether OEM or dealership, will be those that offer consumers the seamless buyer experience they expect, with the physical touchpoints they still need, via whatever medium they choose.

To conclude, here are three important considerations for OEMs and other stakeholders as they transition away from the old product-centric worldview and distribution model toward this seamless integrated future:

- Keep delivering for dealers: The transition to alternate distribution models would require changing roles, revenue opportunities and expectations from dealers. Keeping dealers onside will be crucial for OEMs as they seek to get closer to the end customer.

- Boost digital skills: A new era requires an enhanced skillset — working in an experience center is not the same as in a traditional showroom. OEMs will have to provide ongoing digital and technical training if they are to successfully integrate both online and offline.

- Assess required investments: New digital infrastructure and experience centers (and skills, as above) will require greater levels of investment from OEMs.