EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Special purpose acquisition companies (SPACs)

In IPO

The team

What EY can do for you

Our EY professionals began focusing on SPACs more than a decade ago, well before they became a “mainstream” alternative for companies looking to access the capital markets. Since then, our integrated, independent and objective teams have assisted on more than 100 SPAC transactions and counting across various target company industries, as well as 20-plus cross-border transactions. We have been involved in 14 of the 20 highest total equity value deals completed since 2016, according to SPAC Research.

Our breadth of experience encompasses transactions that involve umbrella partnership corporations (Up-Cs), carve-outs, multiple targets and other complex structures. Our deep-rooted experience and extensive history navigating the opportunities and risks of the SPAC market, combined with our market leadership in taking companies public, uniquely positions EY professionals to help SPAC sponsors and target companies evaluate opportunities, make transactions more efficient and achieve their strategic goals.

What EY can do for you

At Ernst & Young LLP, we have a dedicated practice that supports SPACs and target company leadership teams from identification through post de-SPAC. Our breadth of experience encompasses transactions that involve Up-C, carve-outs, multiple targets and other complex transaction structures.

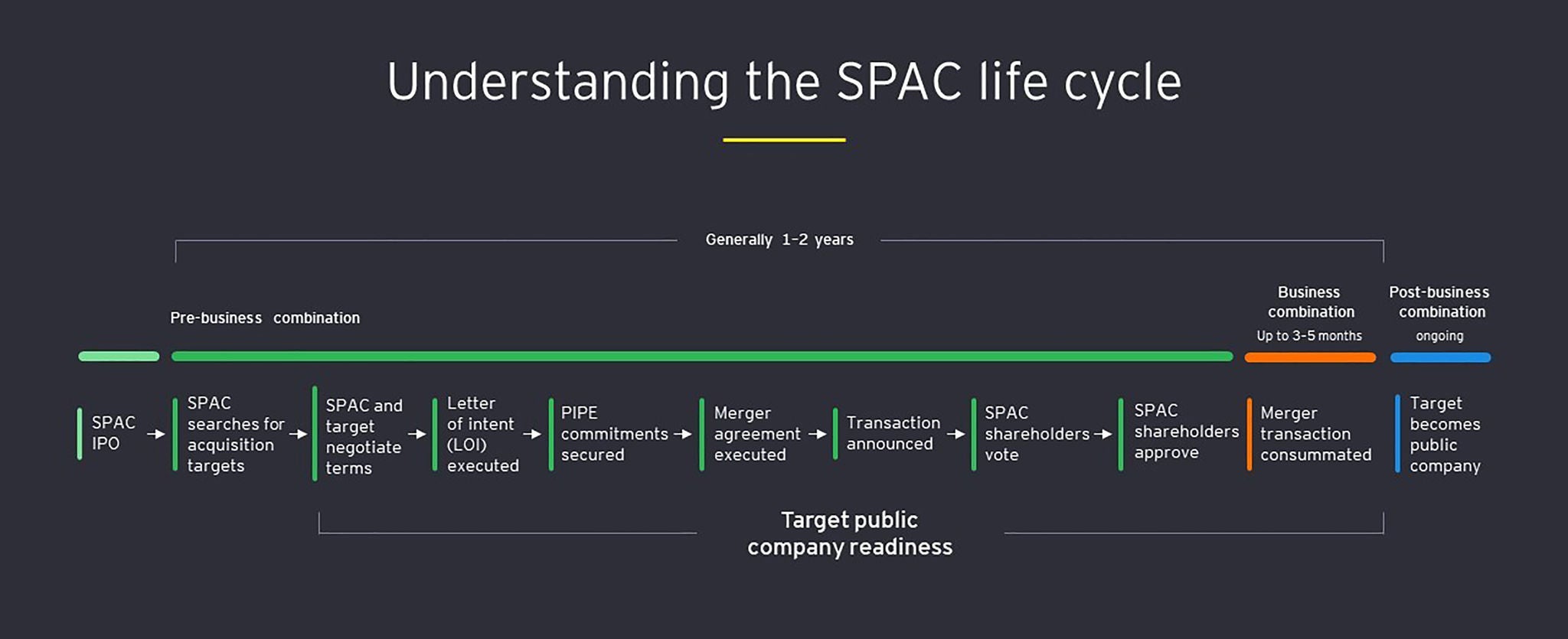

Throughout every phase of the SPAC life cycle, we’ll provide independent capital markets perspectives to boards and management teams on all elements of deal preparation, process, execution and after-market considerations. Our professionals leverage decades of experience from bookrunning IPOs, SPACs and various other capital markets transactions to provide a full spectrum of advisory services across equity capital products and strategies, giving clients tailored advice and integrated, unbiased recommendations across the capital structure.

The evolutionary rise of the SPAC is transforming and reshaping our capital markets. Regardless of market conditions, we are here to help you navigate your journey.

The team

Our latest thinking

How winning entrepreneurs rise above uncertainty to accelerate growth

Winning entrepreneurs distinguish themselves through conviction, a spirit of innovation, an appetite for growth and risk-taking.

Three considerations for spac readiness and sox compliance

Companies seeking to ride the SPAC wave must address three key aspects to make the most of it. Learn more