The climate crisis and pandemic have heightened interest in environmental, social and governance (ESG) issues. Yet, many companies have been struggling to understand the link between their level of commitment to ESG factors and long-term value.

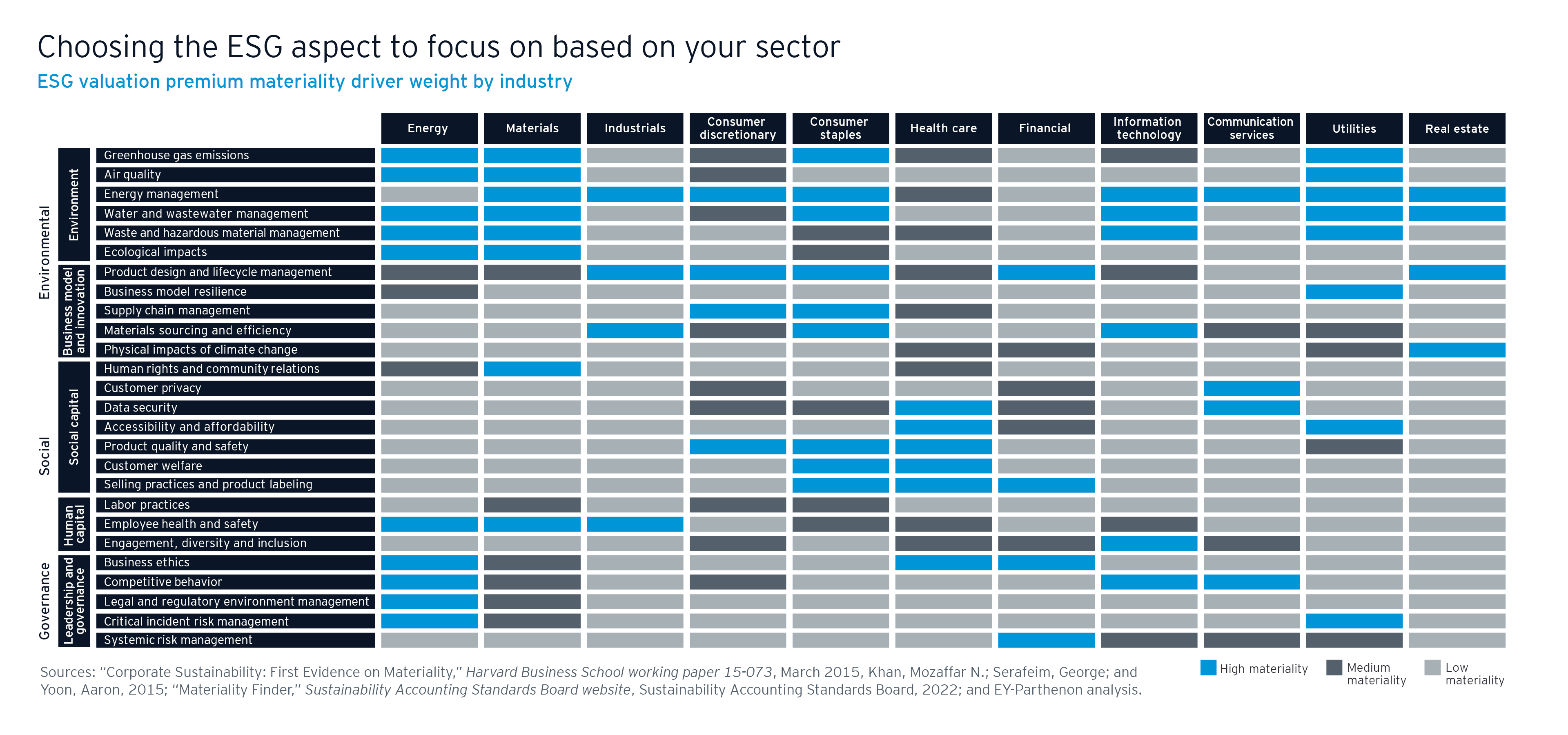

ESG encompasses a broad range of issues. Environmental factors include biodiversity, climate change, pollution and resources, and water security. Social factors can cover customer responsibility, health and safety, human rights and community, and labor standards. Governance includes anti-corruption initiatives, corporate governance, risk management and tax transparency.

Since the 1980s, boards have been heavily influenced by American economist Milton Friedman’s view that businesses serve society best when they maximize shareholder value. ESG matters were traditionally considered outside the scope of fiduciary duty, with the board and management often, at best, considering it an ancillary topic under the ambit of corporate social responsibility, or at worst, taking an out-of-sight, out-of-mind approach.

However, with increased consumer, regulatory and capital markets scrutiny, this approach has exposed companies to reputational and brand equity risks. It also increasingly exposes them to shareholder pressures, resulting in an erosion of shareholder value in very real ways.

As ESG becomes a key boardroom topic with a direct link to value, it is now more important than ever for companies to assess the role of ESG in their corporate strategy — and view it as the seed that can help crystallize transformation.

Importantly, companies need to truly embrace ESG principles, rather than just greenwash their current strategies with token actions. How they embrace ESG and bring that into their corporate practices can make a difference to their valuations.

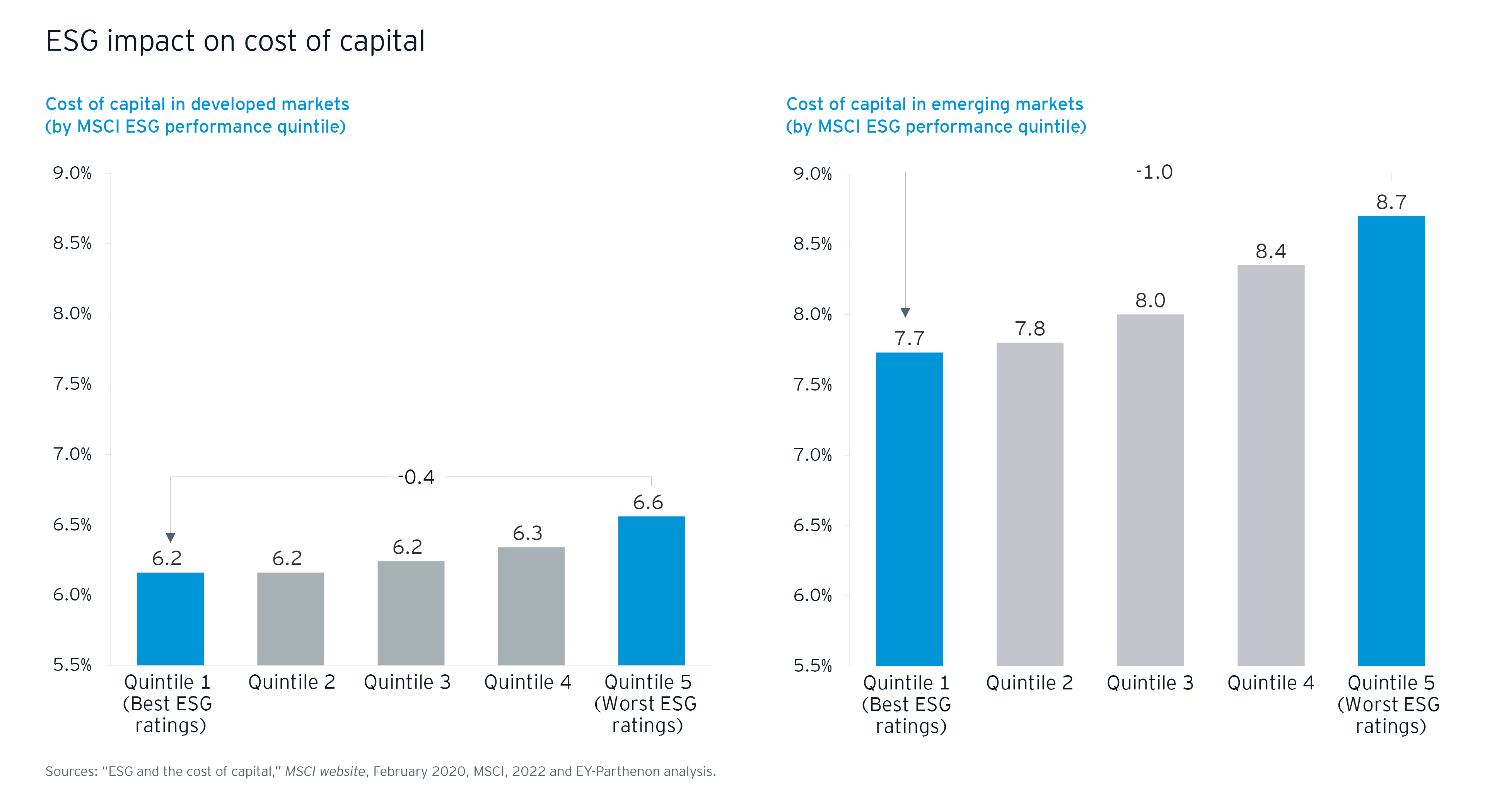

Impact on cost of capital

ESG factors have been found to be positively correlated with financial performance and attractiveness to investors. There is a mismatch between the growing amount of investment dollars looking for genuine ESG leaders and the limited supply of these companies. This can result in a lower cost of capital for companies that embrace ESG and demonstrate tangible success.