EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

For the full findings, download the EY Attractiveness Survey, Malta, October 2022.

For the past 18 years we have presented the findings from the EY Malta Attractiveness Survey, which gathers the views of foreign investors here in Malta. As you are all aware the past two surveys were presented virtually.

This was challenging not only from a communication aspect, but also due to the mere fact of simply not knowing when, or in which year, we will all get together again for such an event. Looking back, social distancing for conferences was just a small price to pay in order to ensure the safety of our most vulnerable people in society. Modern medicine and brave medical professionals pulled us through some dark times, and we really owe them a debt of gratitude.

Malta Future Realised

So, what exactly has changed since we all met three years ago in October 2019?

For starters, the event has been re-branded to Malta Future Realised. We want this event to encompass all aspects of life in Malta and felt that the conversations emanating from the event were already doing so to a large degree.

We want to explore the economy and who it’s working for, its sustainability, the impact of technology and how we can improve our lives, skills and how our educational system can excel — and so much more.

The results of the survey, which we have consistently undertaken over the last 18 years, will remain the foundation of the event and provide the key insights for our discussions.

Ronald Attard | EY Central, Eastern and Southeastern Europe & Central Asia (CESA) Strategy and Transactions Leader, and Managing Partner at Ernst and Young Malta Limited

Malta Attractiveness Survey 2022 - Key Results

Attractiveness index

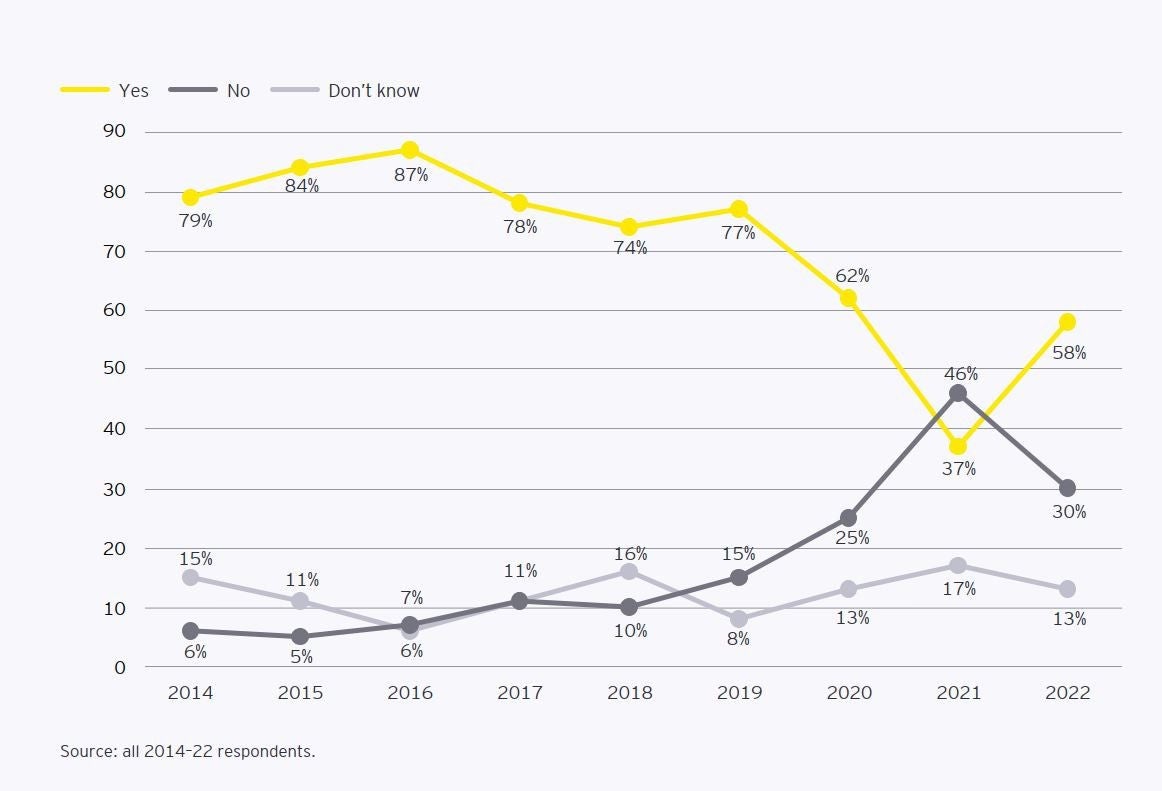

This year’s Malta Attractiveness Survey was carried out just after the country was taken off the FATF grey list in June 2022. This positive news appears to have lifted investor sentiments. At 58%, the overall country FDI attractiveness rating bounced back to the results seen in 2020. There was also a corresponding improvement in the decrease in number of respondents who expressed the view that Malta is not attractive.

This bounce back in confidence should be welcomed by investors and policymakers alike but, while perceptions have improved, it is worth noting that the rating still falls short of the very high confidence levels achieved prior to 2020.

FDI Attractiveness Scoreboard

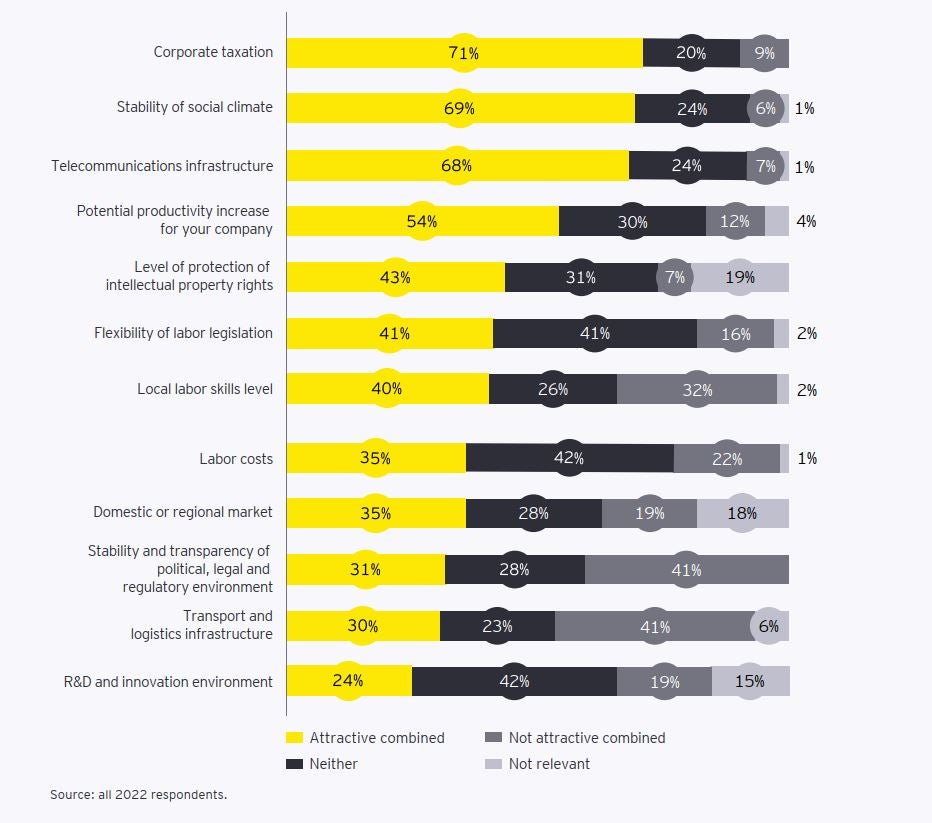

As in previous years, corporate taxation (71%) is once again viewed as the parameter that most existing foreign investors think is attractive. The second-strongest parameter is the stability of social climate (69%), an increase of 11 percentage points compared with 2021. Telecommunications infrastructure (68%), which has been another strong parameter over the last few years, ranks third on the scoreboard.

The stability and transparency of the political, legal and regulatory environment, a parameter that used to score highly on Malta’s attractiveness scoreboard, is now seen to be attractive by 31% of respondents, up 14 percentage points from 2021. While 41% still state that it is not attractive, this compares with 64% in 2021, at the time of Malta's grey listing. The three parameters that cover labour, previously ranked fourth to sixth on the attractiveness scoreboard, are now in sixth to eighth position. In 2022, they are the only parameters that have seen percentage declines over one year. The attractiveness of labour costs (35%) saw the biggest decline, with a 12-ppt decrease, followed by local labour skills level (40%), which decreased by 10 ppts, and flexibility of labour legislation (41%), which decreased by 4 ppts.

Biggest risks facing Malta’s FDI attractiveness

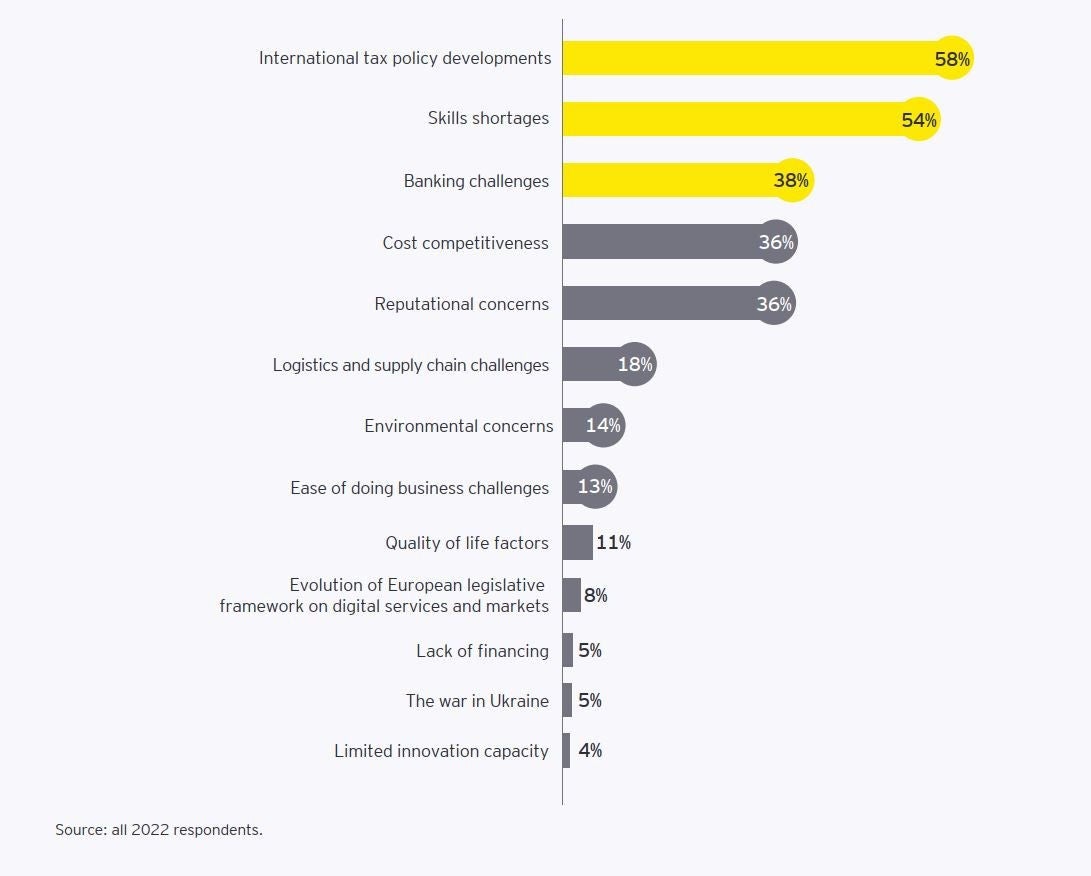

With corporate taxation ranked as Malta’s strongest FDI parameter, the changes brought about by international tax policy developments are considered by 58% of respondents to be Malta’s greatest risk for the next three years. These are followed by skills shortages (54%), banking challenges (38%), cost competitiveness (36%) and reputational concerns (36%). Only 5% believe the war in Ukraine will affect Malta’s FDI attractiveness.

Presence in Malta in 10 years’ time

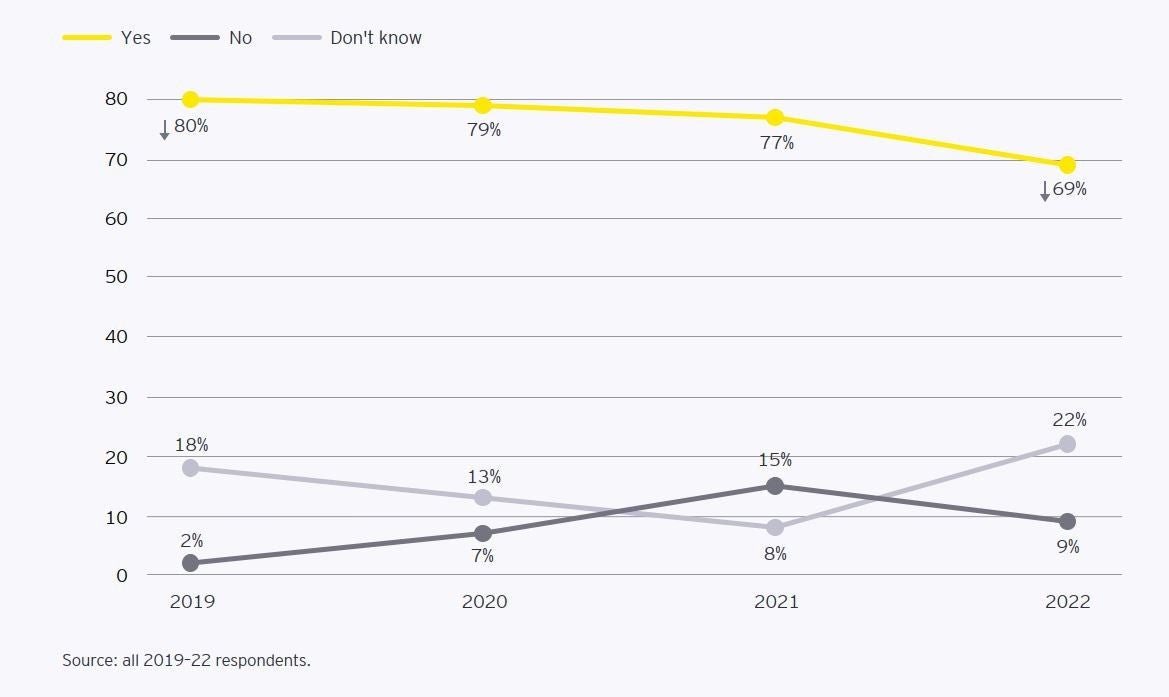

A majority (69%) of existing FDI companies surveyed still believe their future is in Malta. While the last year has seen a decrease in “no” responses, the number of “don’t know” responses has increased, with many respondents commenting that, in today’s fast-changing economic and geopolitical environments, a 10-year prediction has become increasingly difficult to make.

Skill challenges

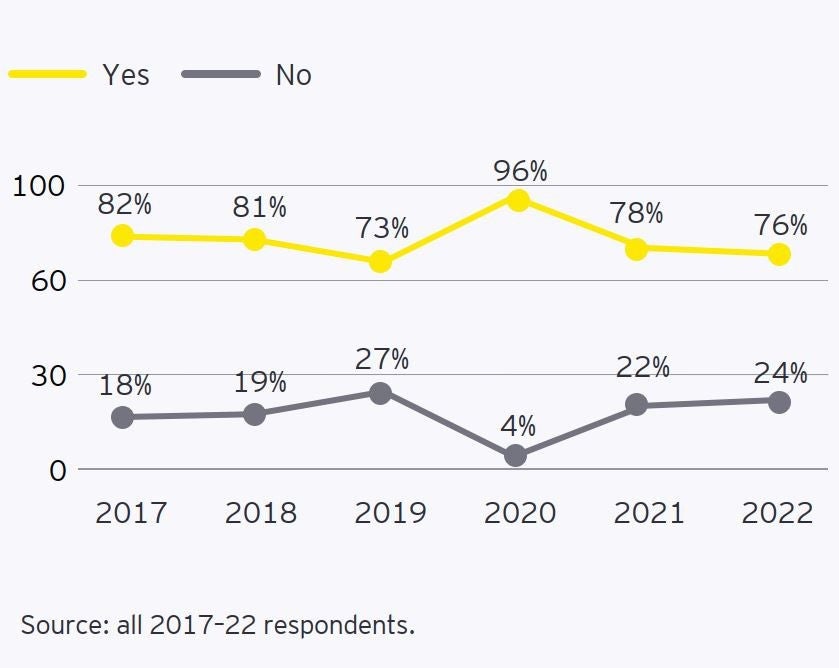

Companies’ ability to retain specialized personnel has remained high and in line with the last year and pre- pandemic levels.

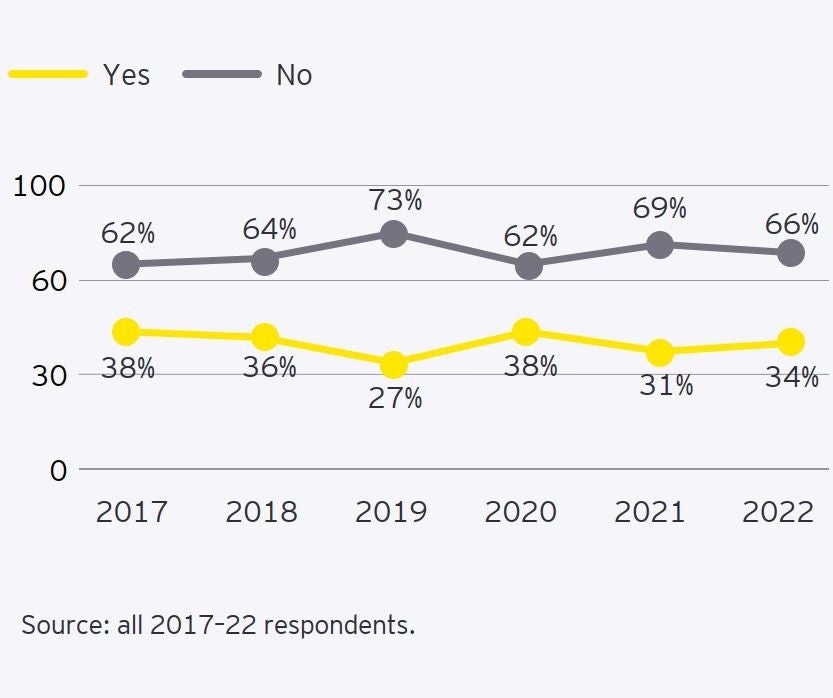

However, because of the country’s economic expansion, Malta’s skill supply has been unable to keep up with increasing demand for specialized skills. In 2022, 66% reported not being able to find the required specialized skills in the local labour market. However, this is a slight improvement on the last year, which indicates that the challenge is being tackled on several fronts and, positively, not worsening further.

Retaining specialised personnel

Finding the required specialized skills in the local labor market

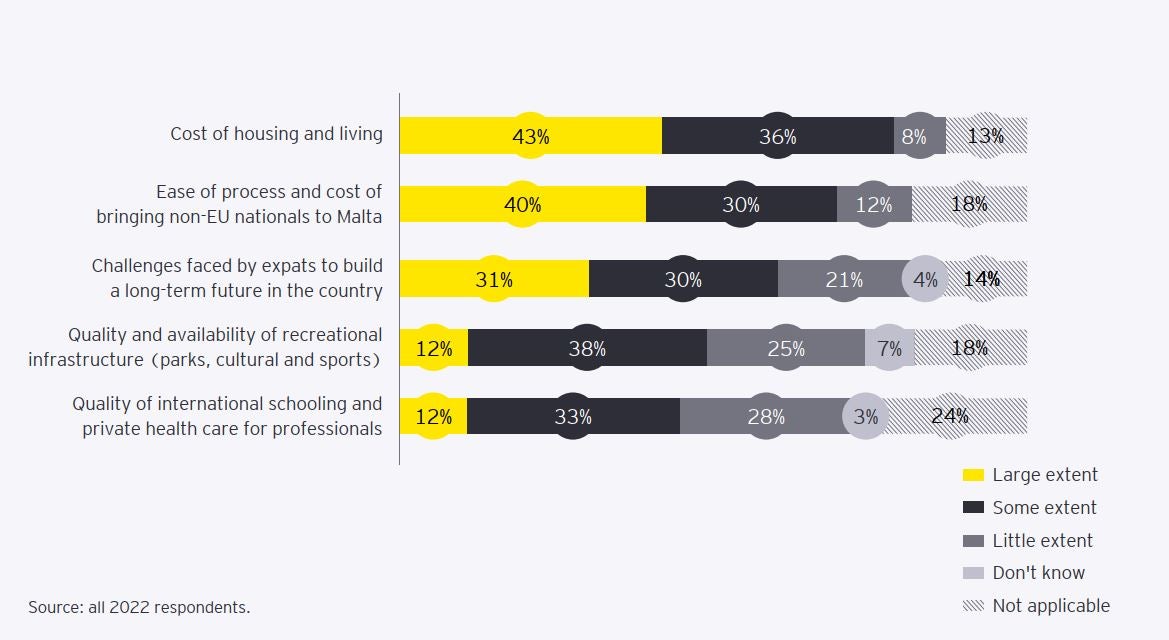

Impact of external factors on respondents’ financial performance

Respondents were asked how their financial performance is currently being impacted by various external factors. The largest impact on financial performance was due to increased costs (excluding logistics) as a direct result of COVID-19, which impacted 66% of investors to a large or some extent. Sixty percent were impacted as a result of increased operating costs due to inflation following the war in Ukraine. 58% were impacted due to increased logistic costs as a result of COVID-19 and ongoing supply chain challenges. On the other hand, 29% are experiencing a loss of revenue from source markets as a direct result of the war in Ukraine.

Priorities to remain globally competitive

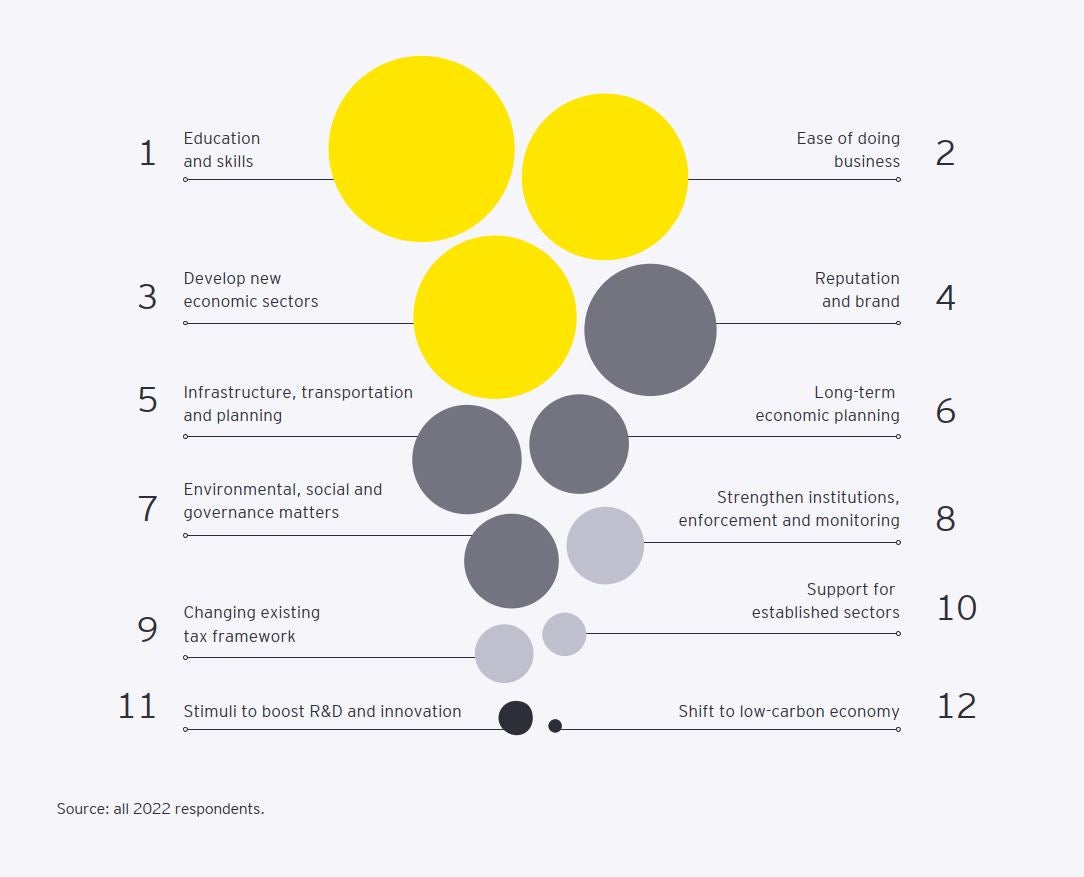

The top priority to remain globally competitive is education and skills, followed by ease of doing business and developing new economic sectors.

Summary

Malta Attractiveness Survey 2022 - Key findings