EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Click on 19th Malta Attractiveness Survey | EY - Malta to download the full report.

EY Malta’s 19th Malta Attractiveness Survey reveals what current investors think about Malta during Future Realised Conference

The findings from EY Malta’s attractiveness survey – the 19th edition of an annual study conducted among existing FDI companies in Malta – were launched today with investors providing their views on what makes Malta an attractive location to invest in or the areas for improvement.

Attractiveness Index

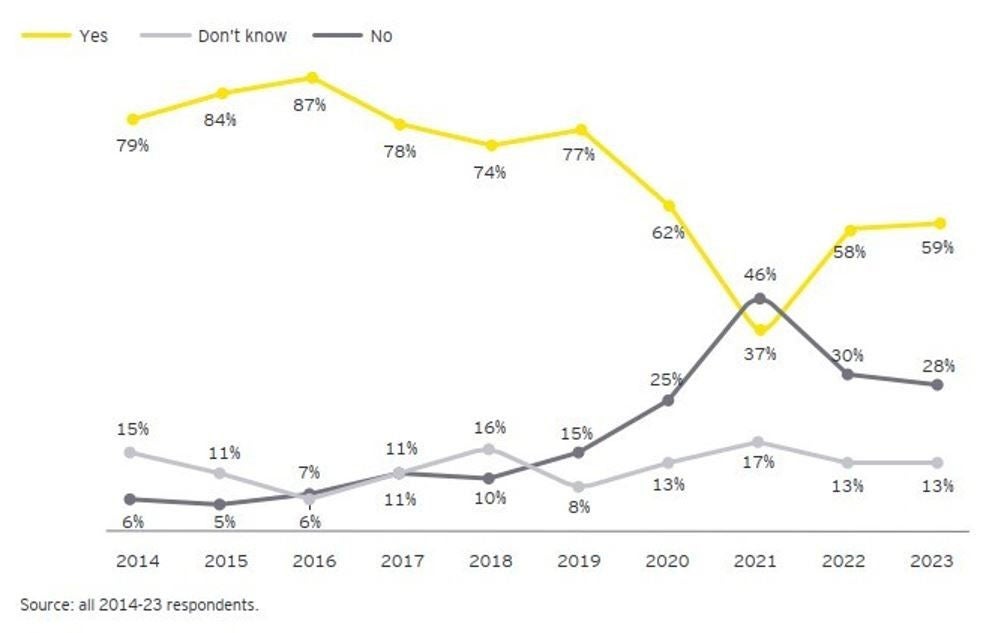

Fifty-nine percent of existing FDI investors affirm Malta's investment appeal, a figure that remains unchanged from 2022, marking a notable upswing from the post-COVID-19 era of 2021. However, despite this upward trajectory, the current FDI attractiveness ratings have not yet regained the exceptional confidence levels observed in the years prior 2019.

FDI Attractiveness Scoreboard

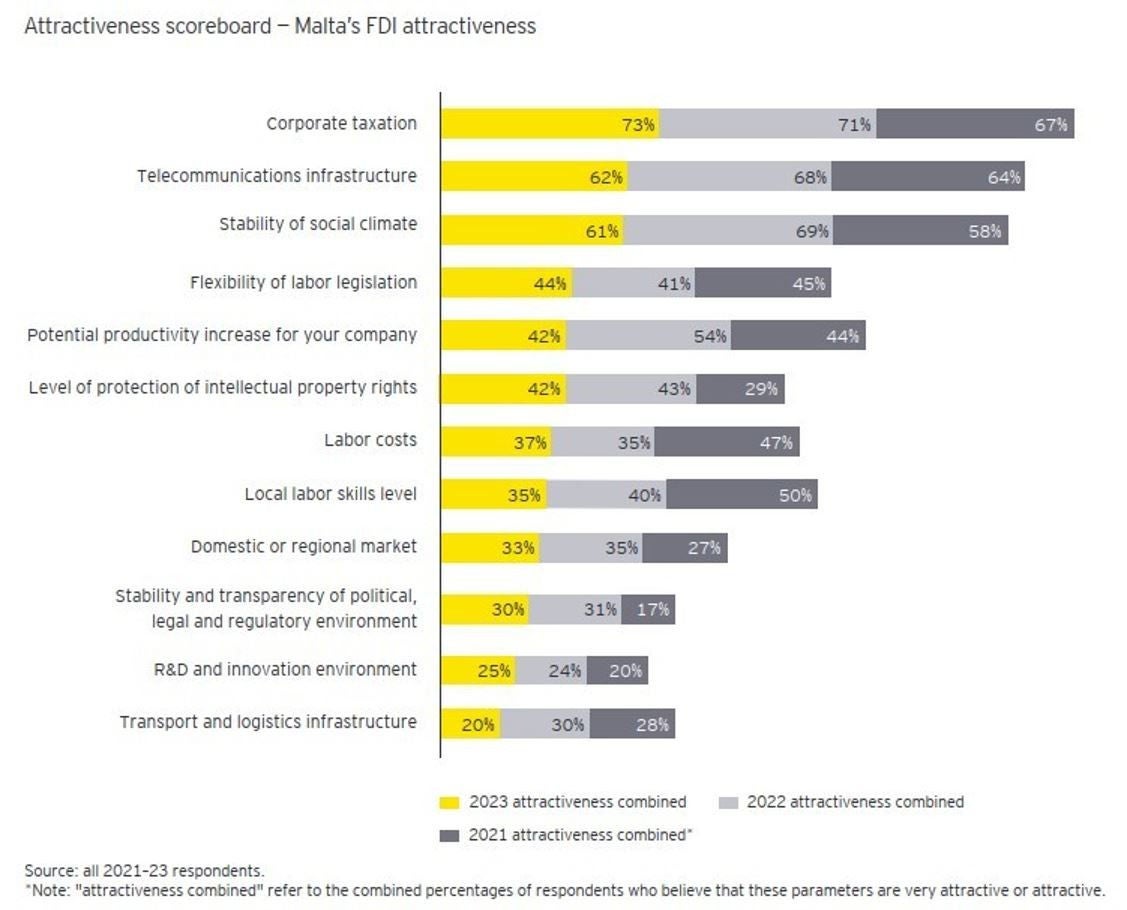

As in previous years, corporate taxation (73%) is viewed as the parameter that makes Malta attractive as an investment destination. This is followed by its telecommunications infrastructure (62%), which slightly surpasses Malta's social environment stability (61%). From an attractiveness standpoint, both the stability of the social climate and the telecommunications infrastructure have decreased by 8% and 6% respectively when compared with the results of 2022.

Flexibility of labour legislation, which ranked sixth last year, can now be found in fourth position on the attractiveness scoreboard. The attractiveness of labour costs (37%) increased slightly from 2022 (35%), whereas the attractiveness of local labour skills level decreased by 5% (from 40% to 35%), and flexibility of labour legislation (44%) increased by 3%.

Only one-fifth of respondents find transport and logistics infrastructure to be favourable. This is a further deterioration of 10 points when compared with 2022. Despite a minor improvement over last year’s result, Malta's R&D and innovation environment (25%) remains on the lower end of the attractiveness scoreboard.

Biggest risks facing Malta’s FDI attractiveness

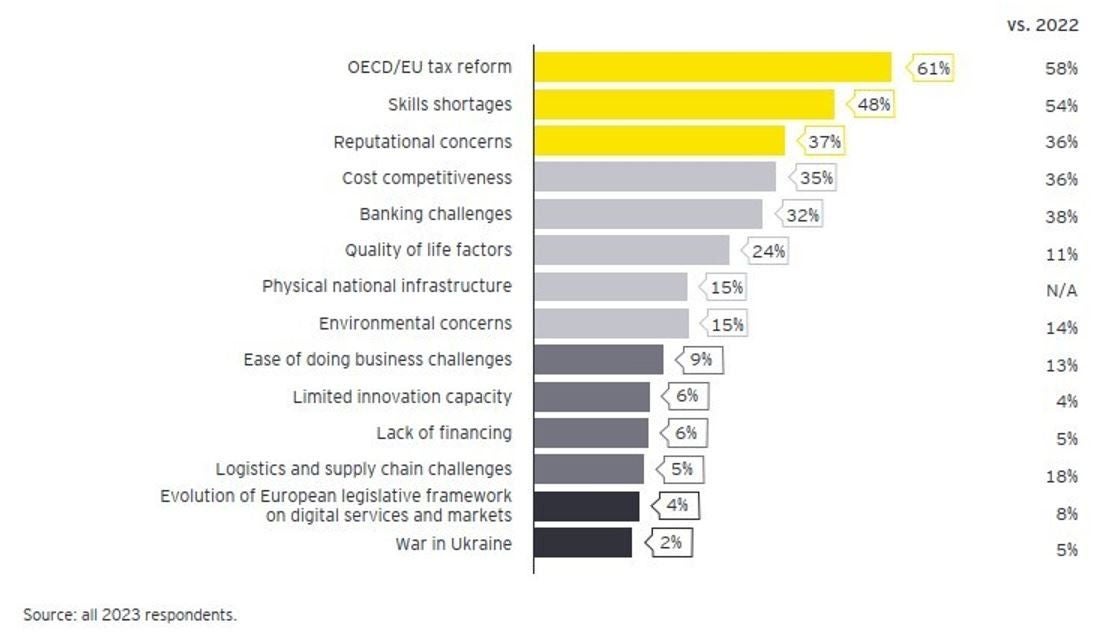

With corporate taxation ranked as Malta’s strongest FDI parameter, the changes being brought about by international tax policy developments are considered by 61% of respondents to be Malta’s greatest FDI-related risk for the next three years. The other substantial risk that respondents have highlighted are skills shortages (down from 54% in 2022), reputational concerns, cost competitiveness, and banking challenges follow.

The biggest changes compared with last year’s results are, on the one hand, an increased importance being placed on quality of life factors (from 11% in 2022 to 24% in 2023) and a decrease in the perceived risk of logistics and supply chain challenges (from 18% in 2022 to only 5% in 2023).

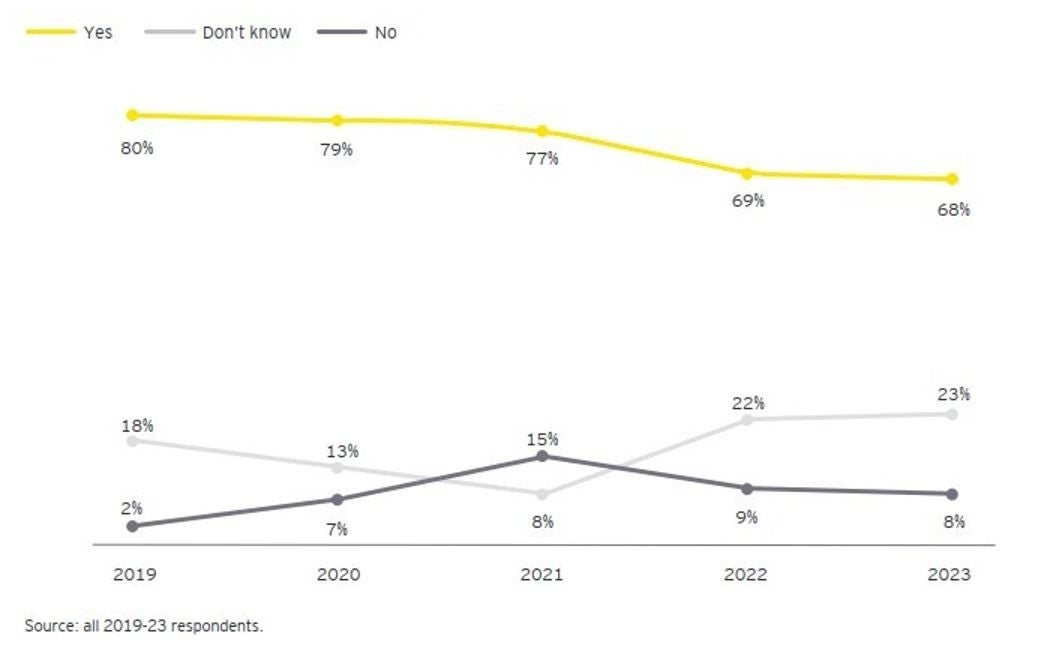

Presence in Malta in 10 years’ time

In today's dynamic economic and geopolitical context, forecasting a decade into the future presents a substantial challenge for investors. Despite this, a majority (68%) of surveyed FDI companies affirm their commitment to maintaining their operations in Malta. This number has seen a gentle decline, down from a high of 80% in 2019.

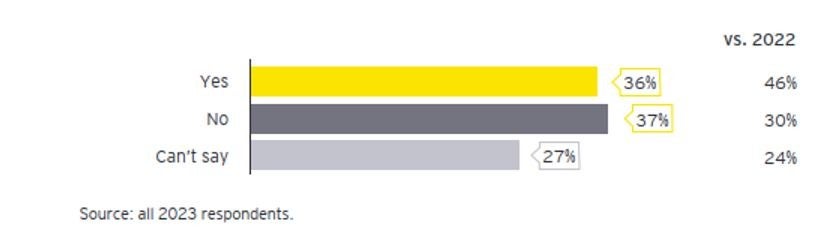

Expansion Plans

More than one-third of investors in Malta are planning to expand their operations in the coming year.

At 36%, this is close to the expansion plans reported during the COVID-19 pandemic (at 39% in 2021) but 10ppts less than the 46% that indicated expansion plans in 2022, a year buoyed by a post-COVID-19 recovery.

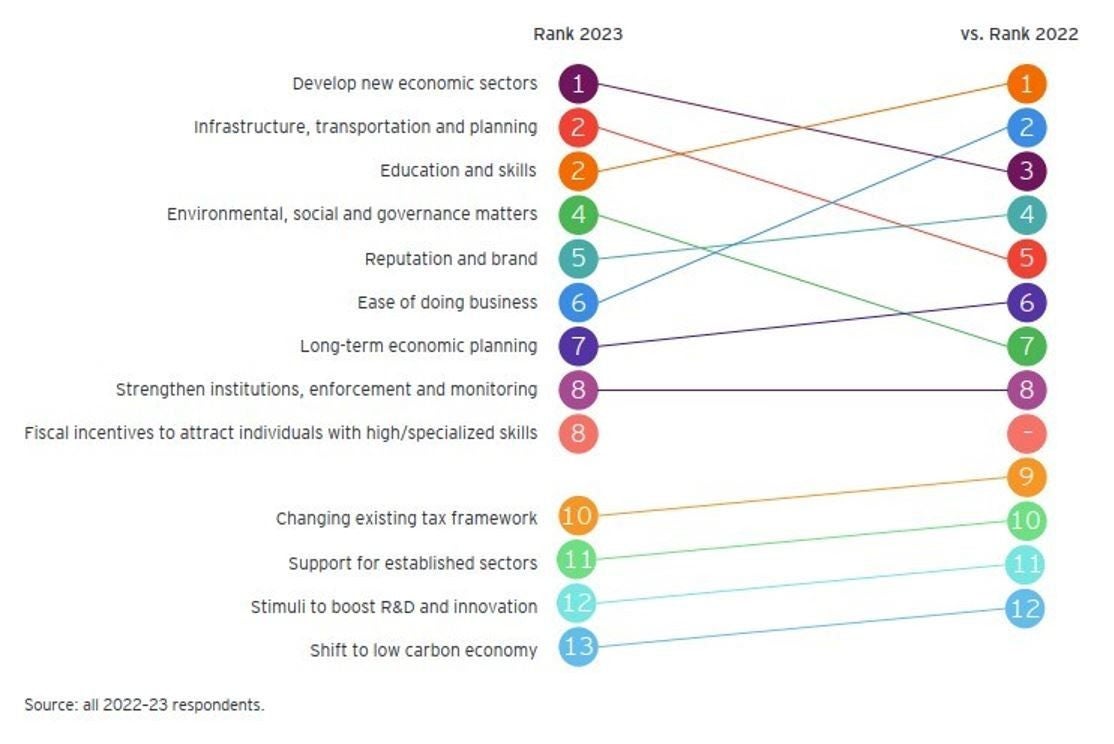

Priorities to Remain Globally Competitive

Investors emphasize the importance of developing new economic sectors as a top priority for maintaining global competitiveness. This year, it has moved to first place, highlighting the need for a renewed focus on diversifying Malta's economic landscape. The push toward new sector development is accompanied by a clear need for improved infrastructure, including transportation and planning, which have moved up to hold joint second place. Meanwhile, education and skills, while still deemed crucial, have moved to joint second place after ranking first last year. This shift highlights a balanced approach, where investors see the need for Malta to advance in multiple areas simultaneously.

They recognize the vital role of broad development, including infrastructure and skills enhancement alongside sectoral expansion, in reinforcing Malta’s position in a continually changing global environment.

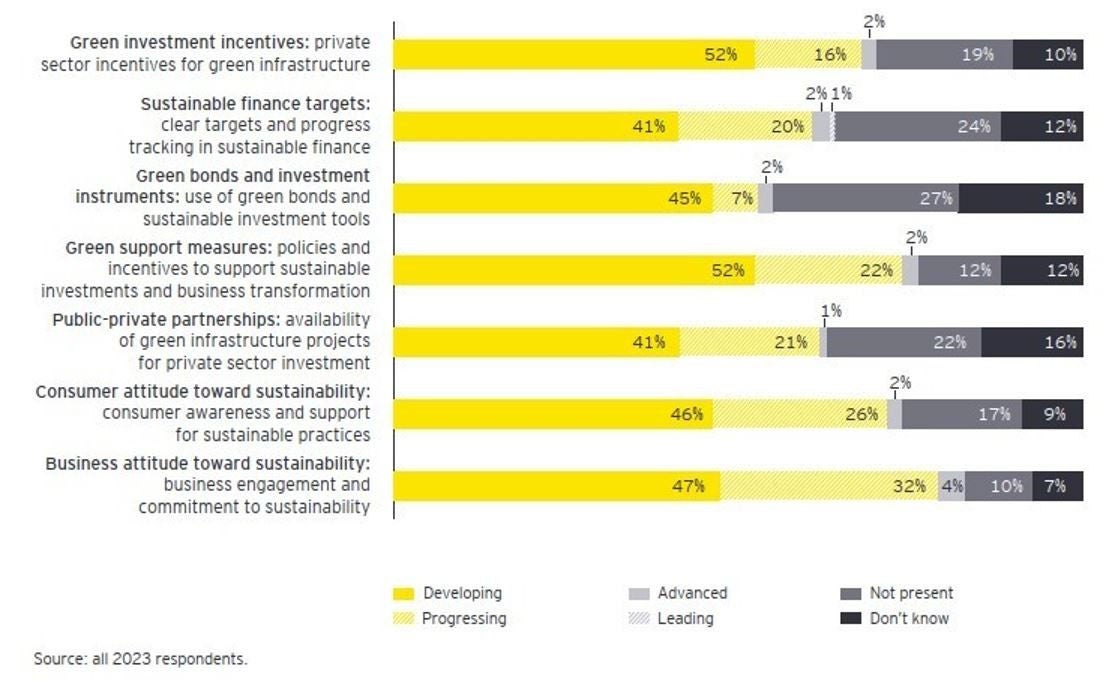

Malta’s Progress on Sustainability Related Factors

The respondents’ perception of Malta’s rank across a number of sustainability factors shows that all factors listed are in a developing stage.

The sustainability factor with the highest positive ranking overall is business engagement and commitment to sustainability, followed by policies and incentives to support sustainable investments and business transformation. The lowest ranking is given to the use of green bonds and sustainable investment tools, followed by clear targets and progress tracking in sustainable finance.

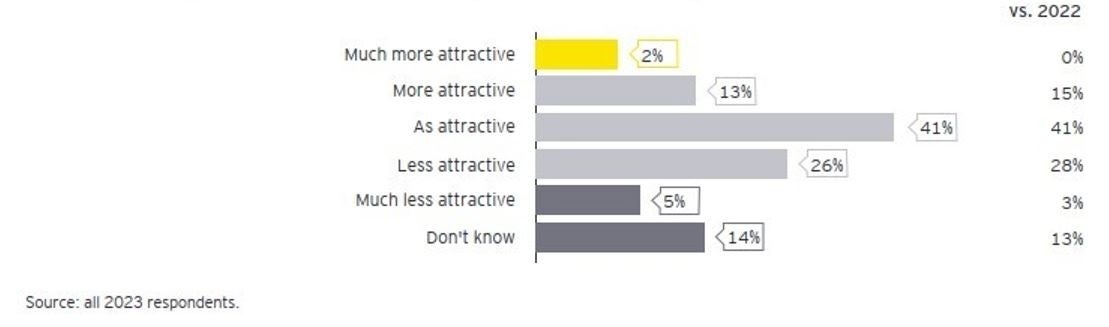

Technology-Related Factors Attractiveness Compared to Other European Countries

Notwithstanding Malta’s small size, 41% believe Malta is as attractive as other European countries in terms of technology related factors that influence investment. Twenty-six percent say it is less attractive and only 5% said it is much less attractive, while on the other hand, 13% of respondents think it is more attractive.

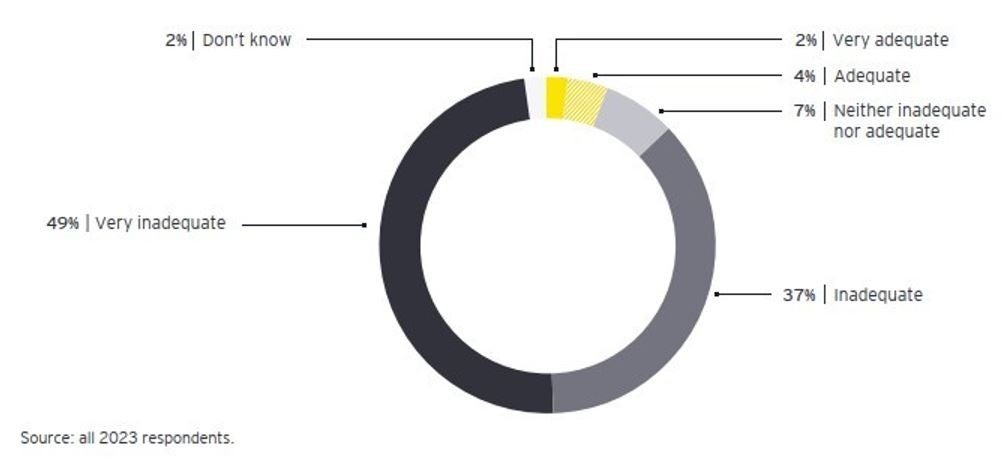

Planned Infrastructure for Population Growth

Eighty-eight percent of respondents consider Malta’s planning and preparedness for population growth in terms of infrastructure development to be inadequate. This is split between 50% of respondents that consider this to be very inadequate and 38% that find it to be inadequate. Only 6% are positive about this parameter and find it to be adequate.

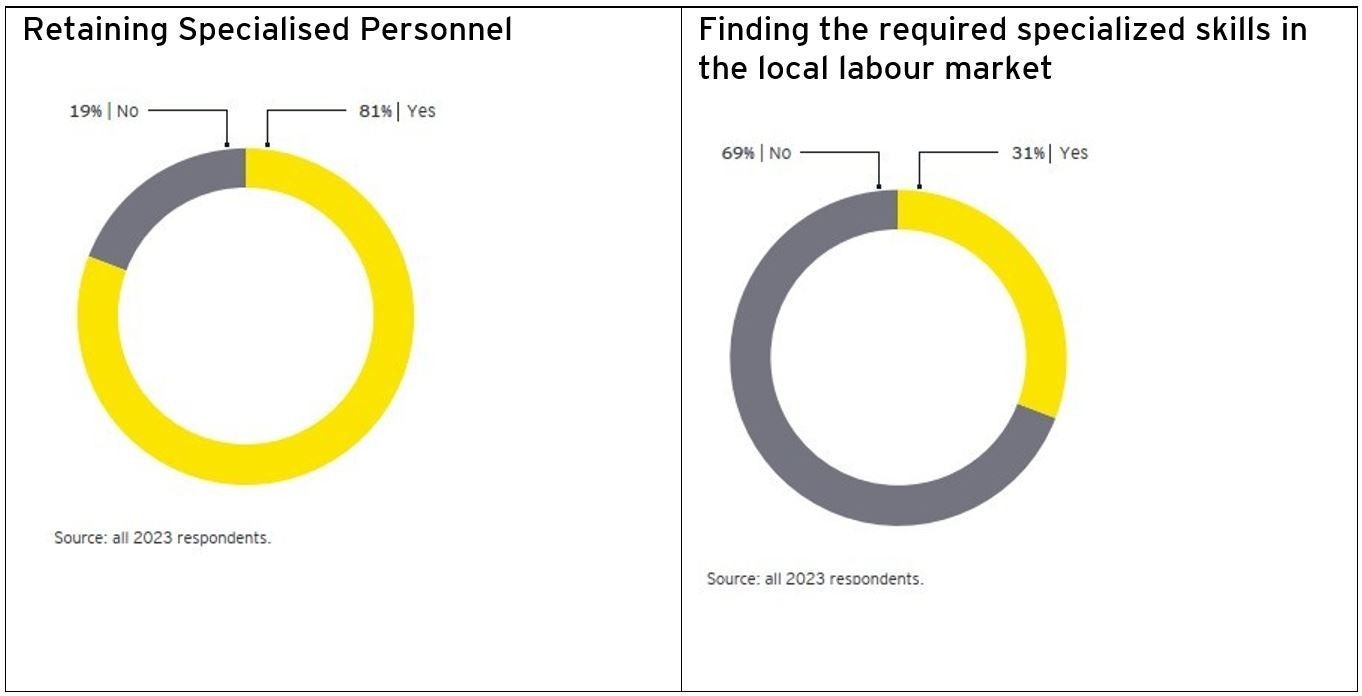

Skills Challenges

Companies’ ability to retain specialized personnel has remained high and in line with the previous year and pre-pandemic levels.

Still, challenges to find the required specialized skills persist. For a number of years, Malta’s skill supply has been unable to keep up with the increasing demand for specialized (and other) skills. Sixty-nine percent of this year’s cohort reported not being able to find the required specialized skills in the local labour market. This is slightly higher than the previous years’ survey results (66%).

View from EY Malta

In his opening address during the Malta Future Realised Conference, Ronald Attard, EY Malta Country Managing Partner, stated: “59% of FDI investors affirm the island's appeal, very much consistent with the level in the previous year. While good to see that the majority of investors do perceive Malta to be attractive, the immediate question is why the numbers are not as high as those of a few years back.”

Looking at Malta’s most attractive feature for FDI, he underlined external factors which may soon come into play: “Beyond the immediate, investors express concerns about the implications of international tax policy changes, skill shortages in the longer term, and the island’s reputation. These concerns emphasize the critical need for strategic and timely action, especially when the country’s tax regime continues to be a significant draw for many investors.”

As infrastructure enters the national debate he commented on the delicate balance between economic growth and labour challenges: “The existing strain on Malta's infrastructure, intensified by continual economic, workforce, and tourism growth, is immediately apparent. Concurrently, challenges in the labour market, marked by a demand for specialized talent amid low unemployment and increasing labour costs, further dent the island’s current attractiveness.”

On this he posed a number of questions: “Is it time to profoundly re-evaluate our investment incentivization strategy? Is it time for a radical overhaul in the education system? Should we stop talking of creating more jobs but start targeting more jobs in specific sectors? Can we leverage our existing skills base – both homegrown and imported – in industries such as gaming and pharma to establish Malta as a small European centre of excellence in AI, bio tech and more?”

Attard also commented on the growing push towards sustainability: “We need to ensure that sustainability is at the forefront of our planning to ensure the preservation of our environment, culture and industries. Both public and private sectors have an important role to play in accelerating the sustainability agenda. As a nation, we must ensure that we have the right tools and talent to face sustainability challenges. Reaching net zero should not only be a compliance goal but a value goal.”

Summary

Click on EY Malta Attractiveness Survey 2023 Report to download the full report