EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Sustainable Finance remained a hot topic in 2024. While the SFDR RTS review has been put on hold, discussions regarding the review of level 1 regulation have advanced and important legislative pieces have been published, such as CSDD. In this article, we will provide you with a recap of the main regulatory developments of the year, and some insights about what to expect in 2025.

Funds’ name Guidelines

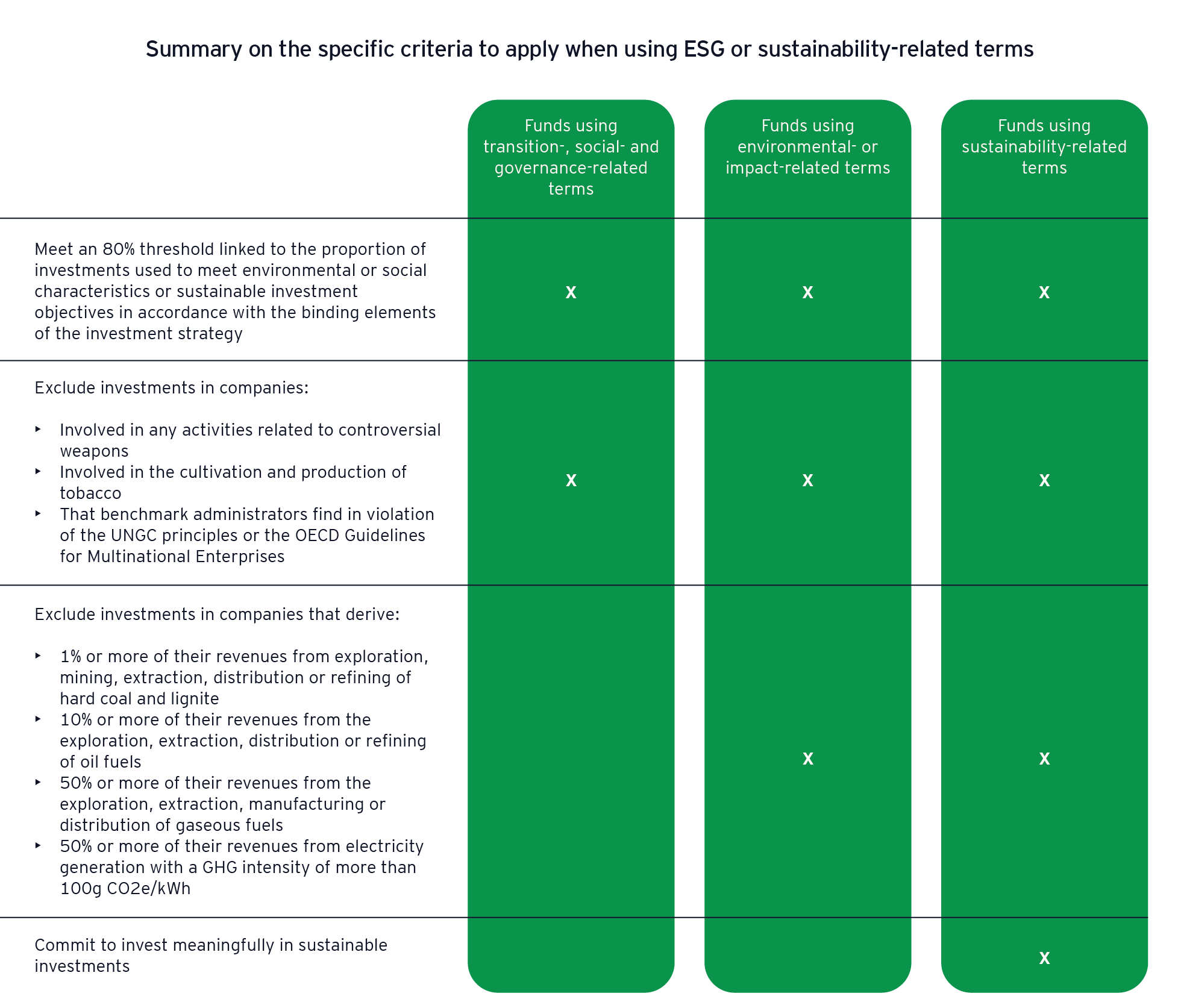

After many months of discussion, the European Securities and Markets Authority (ESMA) finally released on 21 August 2024 its final Guidelines on the use of ESG and sustainability-related terms in the names of financial products. These Guidelines establish criteria for incorporating specific ESG-related terminology into fund names. Newly launched funds have been required to adhere to these guidelines since 21 November 2024. Existing funds have been granted a grace period, allowing them until 21 May 2025 to align with the new standards and ensure compliance.1

Summary on the specific criteria to apply when using ESG or sustainability-related terms

Discussions around the interpretation of the Guidelines

Since the publication of the final report, the industry has been discussing about the interpretation of specific topics and about the application to specific products, such as:

1. Specific topics:

- PAB/CTB exclusions for Green Bonds, Social Bonds and Sustainability Bonds

- Assets in scope of PAB/CTB exclusions

- For products with “sustainable” in their name, how to calibrate the “meaningful” criteria

- Transition criteria

- Term usage: PAB & CTB, and other reserved terms

- Usage of generic terms (e.g., ESG)

2. Specific products:

- Index funds

- Funds of funds

- Funds with an investment period

- Funds closed to subscription

- Funds using a derivative to build exposure to a risky asset (synthetic replication, structured funds, formula funds, etc.): applicability of the exclusions

- Formula funds and structured funds: applicability of the thresholds

CSSF Circular 24/863

On 21 October 2024, the CSSF informed market participants of the publication of CSSF Circular 24/863, thereby implementing the Guidelines on funds’ names using ESG or sustainability-related terms into the Luxembourg regulatory framework.

The CSSF reminds market participants that the Guidelines will start applying to new funds three months after the publication date of the Guidelines in all EU official languages, i.e. on 21 November 2024, with a further six-month transition period for existing funds, so that the Guidelines will apply as from 21 May 2025 to existing funds.

In this context, the CSSF reminds market participants of the following principles:

- Funds’ names should not be misleading, as the disclosure of sustainability characteristics should be commensurate with the effective application of those characteristics to the fund.

- The CSSF expects adequate disclosure in the precontractual documentation of elements supporting the use of ESG or sustainability-related terms in funds’ name.

- The list of ESG and sustainability-related terms mentioned in the Guidelines is not exhaustive. Accordingly, market participants are expected to review the names of all the financial products they manage and assess, on a case-by-case basis, whether the Guidelines apply to those products.

- Finally, the CSSF expects market participants to closely monitor and take due consideration of any further developments on this topic at European level.

SFDR Review

Following the publication of the EU Commission’s Summary report2 on the answers received as part of the Consultation on the implementation of SFDR, the European Supervisory Authorities (ESAs) issued on 18 June 2024 their opinion on the assessment of SFDR implementation.

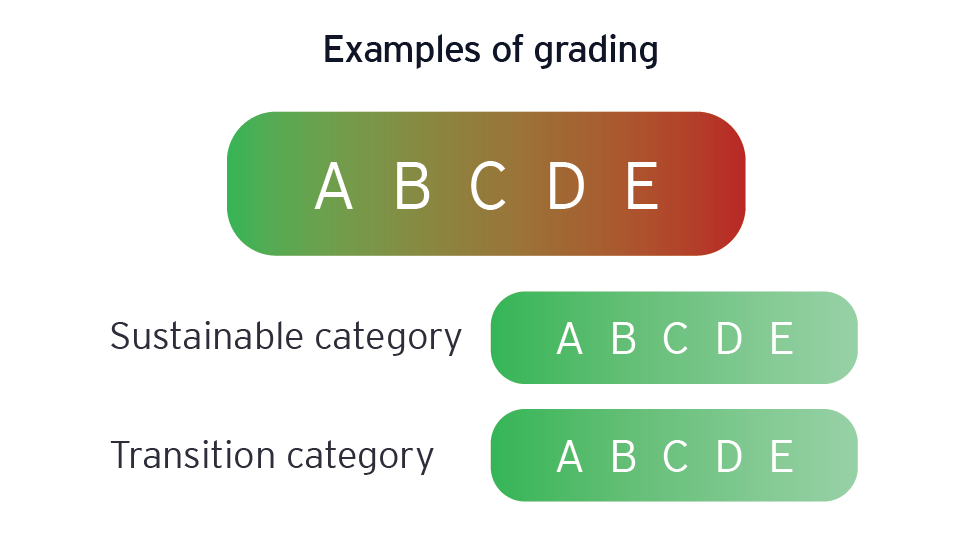

In its opinion, the ESAs suggested, inter alia, that financial market participants should use simple and clear categories for financial products to ensure consumers understand the purpose of the products. The ESAs provided the following examples of categories:

- Sustainable category: focus on sustainable investments, clear and objective minimum criteria, EU Taxonomy basis for environmental sustainability

- Transition category: focus on transition investments, mix of KPIs, consider initial ambitious but realistic share of investments that can grow over time

- Non-categorized products: products that do not fulfil the conditions to fall under the proposed categories

In addition, the ESAs recommended that the European Commission should consider the introduction of a sustainability indicator, which would grade financial products.

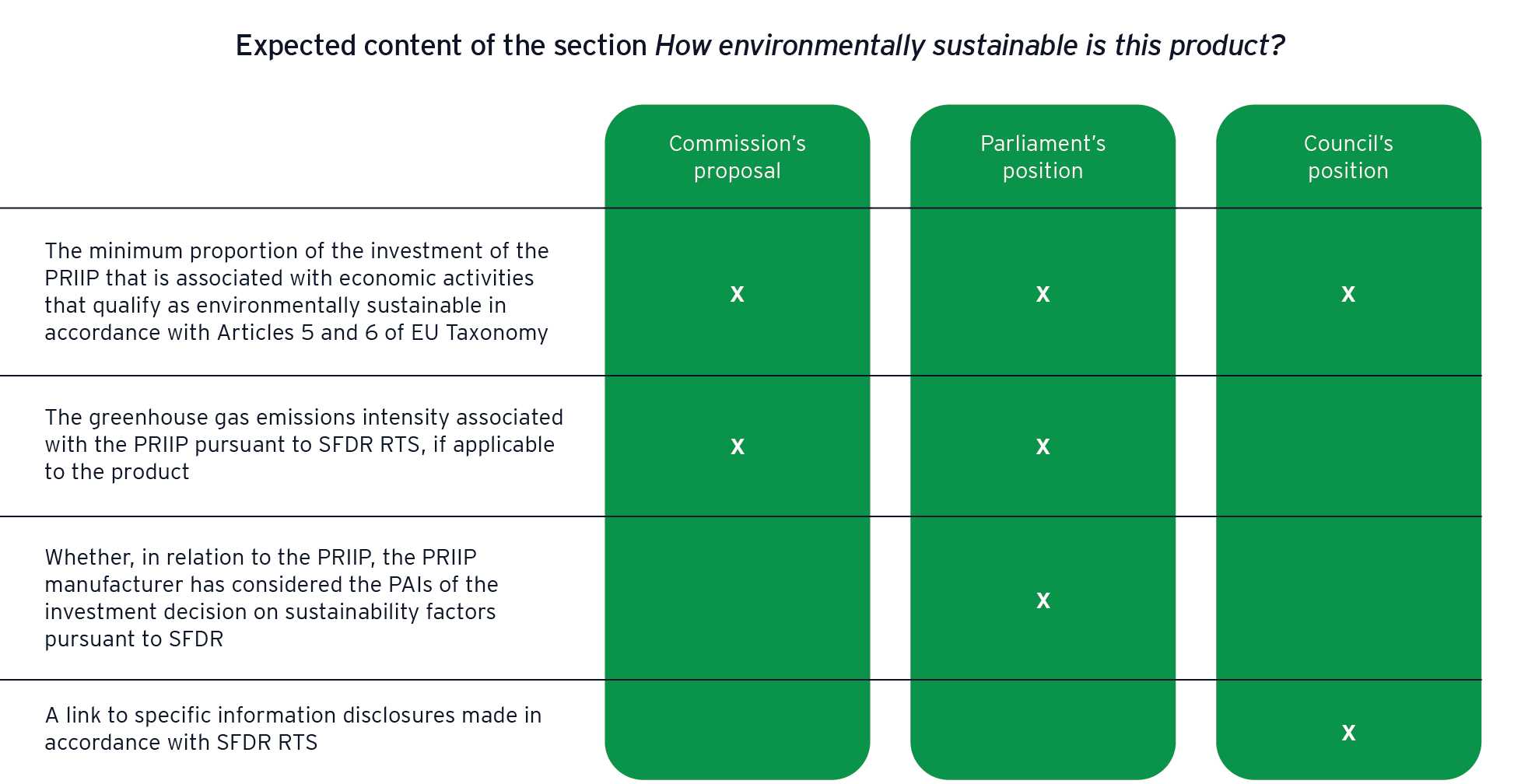

It is worth mentioning that as part of the Retail Investment Strategy (RIS), PRIIPs Regulation is expected to be amended in order to include disclosures of sustainability-related information. The section How environmentally sustainable is this product? appears in both the Commission’s proposal and in the positions (of the Council and the Parliament), however with different requirements:

Expected content of the section How environmentally sustainable is this product?

ESAs’ clarification on SFDR

On 25 July 2024, the ESAs published a consolidated FAQ providing additional guidance on SFDR regarding, inter alia, disclosures, look-through approach and product design.

Disclosure

- The registered AIFM must ensure that all relevant information pursuant to Article 104 of the SFDR is made available on its website. This may include the financial product’s own website or the website of the group to which the registered AIFM belongs if such website corresponds to the website of the AIFM. If there is no website, then the AIFM should establish a website in order to comply with Article 10 of the SFDR.

- Disclosures under SFDR cannot override behavioral obligations in other EU legislation. For example, AIFMs must comply with Article 18(5)5 of Delegated Regulation (EU) 231/2013 in addition to the disclosure requirements set out in SFDR.

- The current SFDR RTS requires separate disclosures for each high impact climate sector (on an aggregated basis for each high impact sector). For the avoidance of doubt, the calculation should be performed so that each high impact sector is aggregated and disclosed separately.

- In order to fulfil the requirements in Article 10(1)(c)-(d) SFDR, there is no need to publish the actual documents referred to in Article 6(3) and 11(2) SFDR. Nevertheless, the ESAs’ supervisory expectation is that the obligation to publish the information referred to in Article 10(1)(c)-(d) (i.e., the information referred to in Article 8,9 and 11 SFDR) should be fulfilled by publishing the templates in Annexes II-V of the SFDR RTS.

- With regard to the exchange rate, in order to comply with the requirements of the quarterly calculation and the enterprise valuation at fiscal year-end, financial market participants should use the exchange rate at the end of the fiscal year end for all the reference points.

Responsibility to ensure compliance of investments with the definition of sustainable investments

- The financial market participant manufacturing the financial product is responsible for compliance of sustainable investments with the definition of sustainable investments in Article 2(17) SFDR.

- The responsibility to ensure compliance of investments with the definition of sustainable investments in Article 2(17) SFDR remains with the financial market participant offering the financial product making those investments. If a financial product invests in underlying financial products with potentially different application of Article 2(17) SFDR, the delegating financial market participant must ensure that any investments considered sustainable investments conform to its own application. If the financial product makes investments in investee companies in a delegation arrangement that do not comply with the delegating financial market participant’s application of sustainable investments, then that investment is not a sustainable investment for the delegating financial market participant’s financial product. The financial market participant providing the financial product must have a sustainable investment application of its own and the financial market participant is responsible for ensuring compliance of the investments with its sustainable investment application – irrespective of whether management is delegated or not.

- The ESAs have prepared a table showing how the calculations of sustainable investment can be done either at the economic activity or the investment level. This table displays hypothetical financial product examples with illustrative, hypothetical objectives and investment strategies. The three hypothetical products in the table are a climate product (bond focus), an SDG Product (bond focus) and a social impact product (equity focus) and their respective objectives are stated in the subsequent brackets. Companies and economic activities are likewise hypothetical cases.

Look-through approach

- Where a sustainable investment is an investment in another financial product, such as a UCITS fund, the financial market participant should look through the underlying investments of that financial product to ensure that the investment qualifies as a sustainable investment under Article 2(17) SFDR and to assess the proportion of sustainable investments accurately. If a financial product invests in other financial products that make sustainable investments with potentially differing applications of Article 2(17) SFDR, the financial market participant should ensure that the underlying investments of the other SFDR financial products comply with its own application of Article 2(17) SFDR. In order to understand how the underlying investments apply Article 2(17) SFDR (or Article 17(1)(g) of Commission Delegated Regulation (EU) 2022/1288), the financial market participant may refer to documentation of underlying financial products for their application (and proportion) of sustainable investments used by those financial products, however, financial market participants should carry out normal due diligence processes set out in the relevant sectoral legislation. The financial market participants are responsible for ensuring that the underlying investments comply with the requirements of Article 2(17) SFDR even where financial market participants rely on the underlying investments’ documentation.

- Real assets like cars or real estate held in SPVs or holding companies do not require a good governance practice check, only investee companies do. In other words, SPVs or holding companies whose purpose is to hold real assets like cars or real estate, would be considered investee companies for which good governance checks would not have to be made.

- In accordance with SFDR RTS, companies qualify as “companies active in the fossil fuel sector” when they "derive any revenues from exploration, […] of fossil fuels […]". The financial market participant has therefore to include the aggregated investments in all companies that are active in the fossil fuel sector under its disclosure of PAI indicator 4 in Table 1 of Annex I of the SFDR RTS.

- In cases where financial market participants are aggregating the adverse impacts of their financial products or their financial products invested in other financial products (such as fund of funds), there should be a look-through approach to the investee companies causing the GHG emissions. I.e., the PAI indicator 1 (GHG emissions) is calculated from the underlying investee companies, irrespective of whether the investment in them is direct or indirect (the indirect one would for e.g., be an investment through a UCITS).

- The PAI indicators measure the financed emissions of the financial market participant’s investments. For the PAI indicators’ GHG calculations, financed emissions belonging to each scope from investee companies should be allocated to the same scope at the financial market participant level. For instance, investee companies’ Scope 1 and 2 GHG emissions should be allocated to the financial market participant’s Scope 1 and 2 GHG emissions in the PAI indicators.

Product design

- Article 9(3) SFDR is neutral in terms of product design. A financial product that applies all the requirements applicable to PABs or CTBs as laid down in Commission Delegated Regulation (EU) 2020/1818 can therefore fall within the scope of Article 9(3), even if it is not passively tracking a PAB or a CTB or it has not designated a PAB or a CTB as a reference benchmark.

- The fact that this financial product applies the exact same requirements as those applicable to PABs or CTBs can be used by the financial market participant to explain how the continued effort of attaining the objective of reducing carbon emissions is ensured in view of achieving the objectives of the Paris Agreement. In other words, a financial product applying the exact same requirements would be considered equivalent to a financial product that has an objective of carbon emission reduction that falls within the scope of Article 9(3) SFDR using an active investment strategy..

- The disclosures applicable to financial products in the SFDR RTS apply equally to financial products that passively track PABs or CTBs.

Other clarifications

- EPM techniques (such as those referred to in Article 51(2) of the UCITS Directive (Directive 2009/65/EC) can only fall within the “remaining portion” if used for hedging or liquidity purposes, not when used for any other purpose.

- Money market funds (“MMFs”) should not automatically be considered as liquidity in Article 9 financial products. Whether such an investment can be considered as part of the “investments for certain purposes such as hedging or liquidity” for Article 9 financial product depends on the type of money market fund invested in, for e.g. whether the MMF qualifies as cash equivalent under IFRS accounting rules (i.e. if it is readily convertible to known amounts of cash and subject to an insignificant risk of changes in value).

ESAs third report on Principle Adverse Impact

On 30 October 2024, the European Supervisory Authorities (EBA, EIOPA, and ESMA) released their third annual report on SFDR Principal Adverse Impact (PAI) disclosures.6 The report evaluates how financial institutions disclose the negative impacts of their investments on people and the environment, along with actions taken to mitigate these impacts.

Key findings include:

- Improvements in PAI Accessibility and Quality: Financial institutions have made PAI disclosures more accessible and improved the quality of information at both entity and product levels.

- Compliance Gains: National Competent Authorities (NCAs) noted slight improvements in SFDR compliance within their respective markets.

- Recommendations and Best Practices: The report advises NCAs on achieving consistent supervision of disclosure practices and suggests good practices for clarity and simplicity in disclosures, based on a survey of NCAs.

It also calls on the European Commission for a comprehensive review of the SFDR framework.

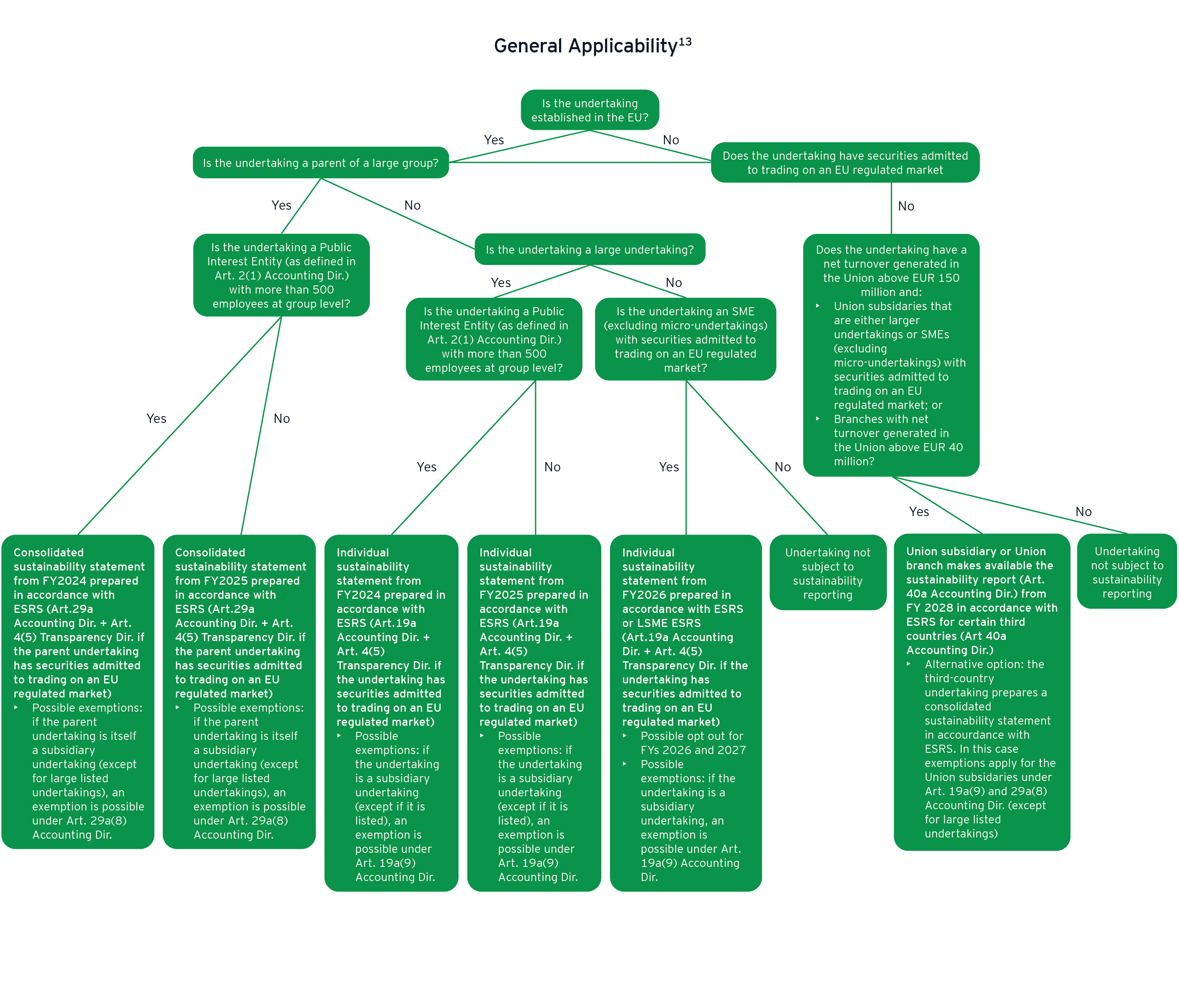

CSRD

On 7 August 2024, the European Commission published a Draft Notice on the interpretation of certain legal provisions in Accounting Directive,7 Audit Directive,8 Audit Regulation,9 Transparency Directive,10 European Sustainability Reporting Standards (ESRS) Delegated Act11 and SFDR12 as regards sustainability reporting. This Draft Notice clarified, inter alia, the application scope of CSRD.

Key clarifications impacting fund industry

Financial institutions (other than insurance undertakings and credit institutions) are included in the scope of Articles 19a and 29a of the Accounting Directive where they meet both of the following requirements:

- They are undertakings incorporated as a type of undertaking listed in Annex I or II of the Accounting Directive

- They are either large undertakings or SMEs (excluding micro-undertakings) with transferable securities admitted to trading on an EU regulated market (Article 19a of the Accounting Directive) and/or parent undertakings of a large group (Article 29a of the Accounting Directive)

UCITS and AIFs, in turn, are exempted from reporting sustainability information under the Accounting Directive even if these financial products are in the scope of the Accounting Directive.14 Regarding ETFs, as long as they are either a UCITS or an AIF, the same exemption will apply. However, investment fund managers may fall under the scope of the sustainability reporting obligations under Articles 19a and 29a of the Accounting Directive if they fulfill the aforementioned criteria.

Pension funds are not covered by the exclusion from the sustainability reporting requirements set out in Article 1(4) of the Accounting Directive.

ESRS Implementation Q&A Platform

In order to support market players in their path towards CSRD compliance, the EFRAG has compiled explanations from the ESRS Q&A platform in one consolidated document. EFRAG has started the collection of questions related to ESRS through the EFRAG ESRS Q&A Platform on 24 October 2023. EFRAG will release explanations following due process on a regular basis. Explanations are non-authoritative in nature, answer technical questions on ESRS by showing where in the standards the content is provided and how to navigate them accordingly.

CSRD transposition updates

On 25 October 2024, the Chambre des Députés of Luxembourg published amendments to the CSRD draft transposition to address some of the comments raised by the Conseil d'Etat. Some technical changes have been incorporated, including, for example, an amendment on the filing of CSRD reports for companies that publish a CSRD report but are exempt from publishing a consolidated management report.

CSRD developments on digital tagging

On 30 August 2024, the ESRS Set 1 XBRL Taxonomy and a separate XBRL Taxonomy for Article 8 disclosure requirements (the Article 8 Taxonomy) were published by EFRAG. The ESRS Set 1 XBRL Taxonomy provides a structured framework for digitally tagging sustainability information, with the aim of providing data that is easily accessible, comparable, and transparent, enabling stakeholders to efficiently analyze and utilize environmental, social and governance (ESG) information for decision-making.

The taxonomies are now in the process of adoption by ESMA, the European Commission, the European Council and the Parliament.

It is not expected that companies will need to report sustainability information according to the ESRS Set 1 XBRL Taxonomy and the Article 8 Taxonomy before 2026.

CS3D

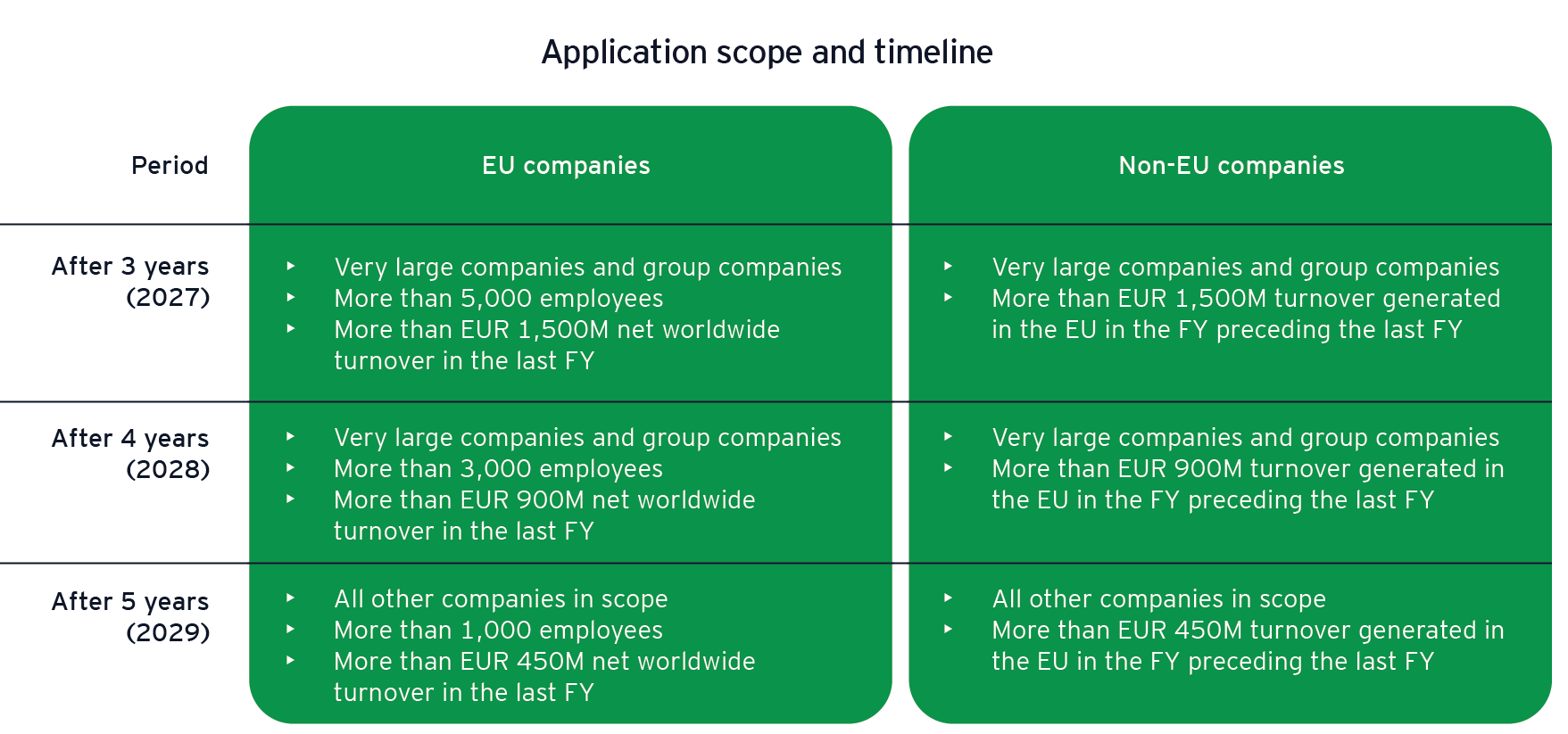

On 24 July 2024, the Directive (EU) 2024/1760 of the European Parliament and of the Council of 13 June 2024 on corporate sustainability due diligence (CS3D) was published in the European Union Official Journal. Applicable both to EU and non-EU companies (see detailed scope in the table below), CS3D lays down rules on:

- Obligations for companies regarding actual and potential human rights adverse impacts and environmental adverse impacts, with respect to their own operations, the operations of their subsidiaries, and the operations carried out by their business partners in the chains of activities of those companies

- Liability for violations of the aforementioned obligations and

- The obligation for companies to adopt and put into effect a transition plan for climate change mitigation which aims to ensure, through best efforts, compatibility of the business model and of the strategy of the company with the transition to a sustainable economy and with the limiting of global warming to 1,5 °C in line with the Paris Agreement

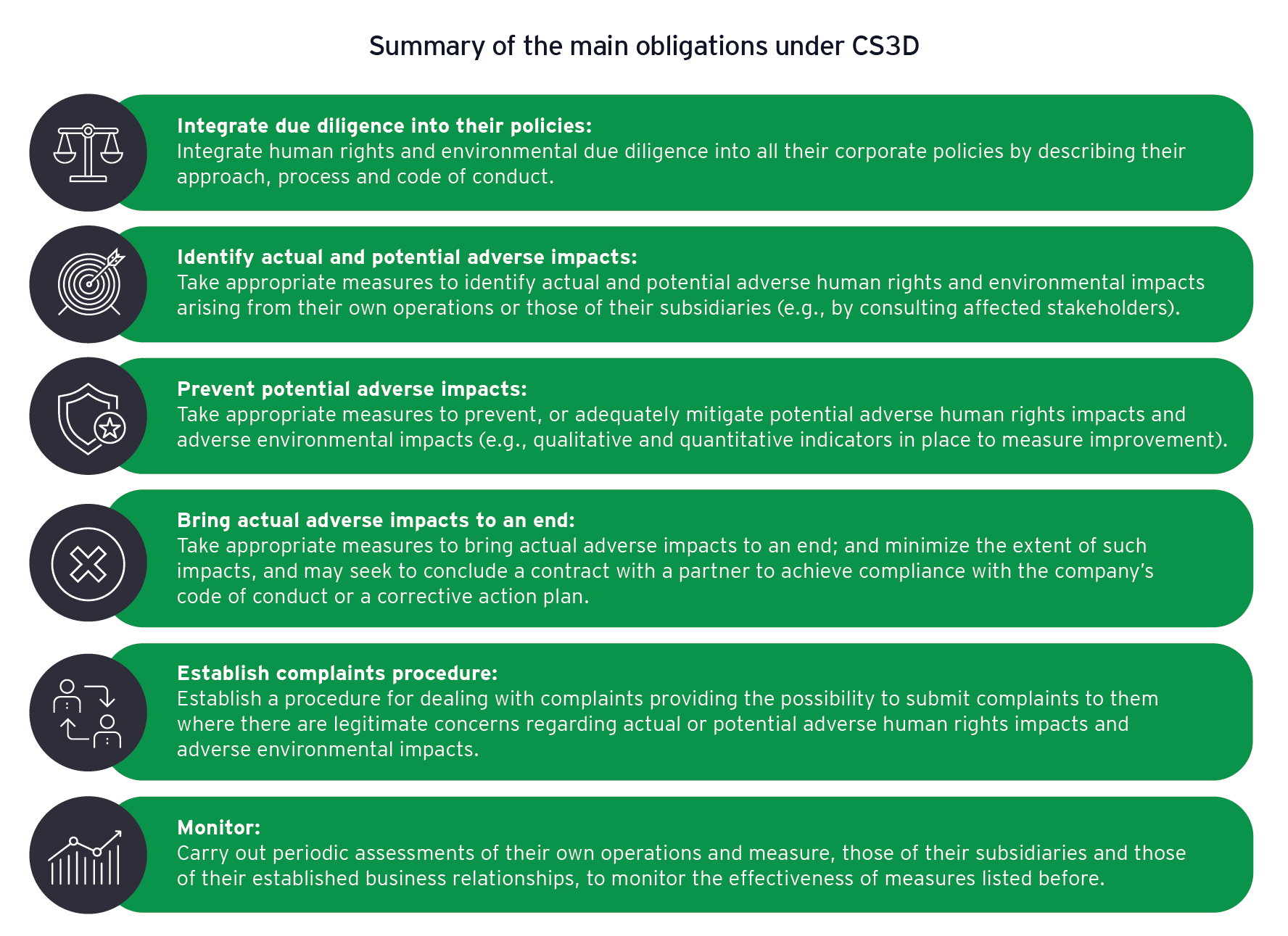

CS3D requires companies to, inter alia, integrate due diligence into their policies, identify actual and potential adverse impacts, prevent potential adverse impacts, bring actual adverse impacts to an end, establish complaints procedure, and perform periodic assessments.

In order to avoid duplicating reporting obligations, CS3D should not introduce any new reporting obligations in addition to those under CSRD as well as the reporting standards that should be developed under it. In order to comply with their obligation of communicating as part of the due diligence under this Directive, companies should publish on their website an annual statement in at least one of the official languages of the Union, within a reasonable period of time, but no later than 12 months after the balance sheet date of the financial year for which the statement is drawn up, unless the company is subject to the sustainability reporting requirements provided for in CSRD. In cases where a company is not required to report in accordance with CSRD, the statement should be published by the date of publication of the annual financial statements. The annual statement should be submitted to the designated collection body for the purpose of making it accessible on the European Single Access Point (ESAP).

The requirement on companies which are under the scope of this Directive and at the same time are subject to reporting requirements under CSRD to report on their due diligence process should be understood as a requirement for companies to describe how they carry out due diligence as provided for in this Directive.

Companies that are not subject to NFRD should report on the matters covered by CS3D by publishing an annual statement on their website. The statement is to be published by 30 April each year covering the previous calendar year.

What is the impact of CS3D to financial undertakings?

CS3D mandates the European Commission to submit a report to the European Parliament and to the Council, by 26 July 2026, on the necessity of laying down additional sustainability due diligence requirements tailored to regulated financial undertakings with respect to the provision of financial services and investment activities, and the options for such due diligence requirements as well as their impacts, in line with the objectives of CS3D. If needed, this report should be accompanied by a legislative proposal.

While a new text is not in force, financial undertakings are not directly in the scope of CS3D, but they may be indirectly impacted in relation to their upstream business partners. CS3D determines that the chain of activities covers the activities of the companies’ upstream and downstream business partners, however for regulated financial undertakings, the definition of the term “chain of activities” should not include downstream business partners that receive their services and products.

Although regulated financial undertakings are only subject to due diligence obligations for the upstream part of their chains of activities, the specificities of financial services as well as the MNE Guidelines15 provide indications of the types of measures that are appropriate and effective for financial undertakings to take in due diligence processes. Regulated financial undertakings are expected to consider adverse impacts and to use their so-called “leverage” to influence companies. The exercise of shareholders’ rights can be a way to exercise leverage.

Financial undertakings should carry out periodic assessment only of their own operations, those of their subsidiaries and those of their upstream business partners.

Summary

Sustainable Finance remained a hot topic in 2024. Meanwhile the SFDR RTS review has been set on hold, the discussions regarding the review of level 1 regulation have advanced and important legislatives pieces have been published, such as CS3D. In this article, we will provide you with a recap of the main ESG regulatory developments of the year and also with some insights about what to expect in 2025.