EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Drive business growth with technology transformation solutions at EY - integrating tech, operations & architecture to build agile, data-driven organizations

Read more

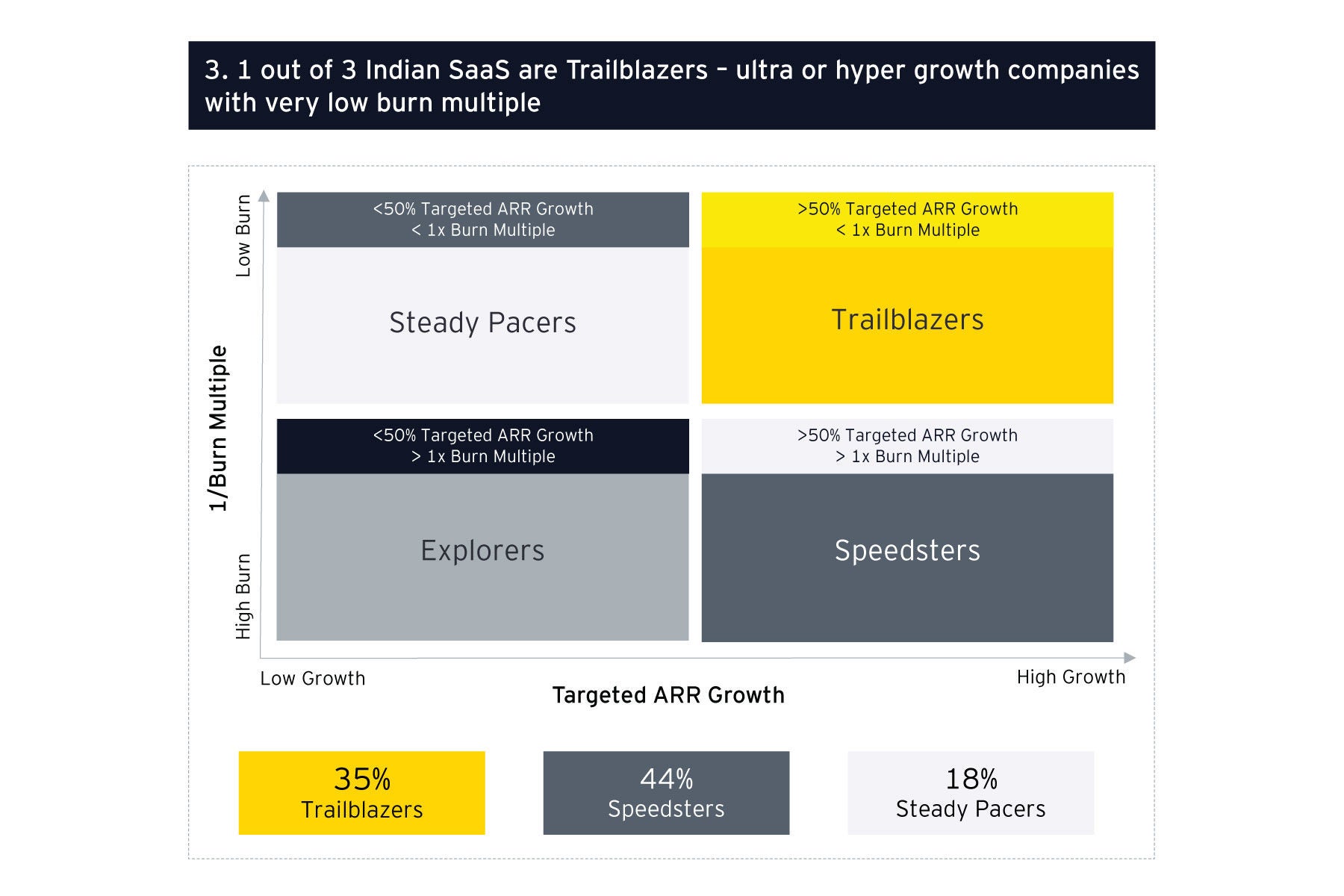

Trailblazers adopt product innovation strategies to win niche market opportunities and drive capital efficient growth. Dashers invest in sales leadership and build partner-led expansion strategies to scale enterprise accounts and optimize their sales and marketing operations.

Balancing growth and addressing key challenges

Indian B2B SaaS is targeting a positive growth for 2023 despite some weakening macro-economic trends. In the survey, only 20% companies indicated ARR growth targets of less than 50%. As many as 80% companies are aiming higher; equally split between hyper growth (50% to 100% ARR growth) and ultra-growth (more than double growth). In other words, eight out of 10 companies are targeting 50%+ ARR growth.

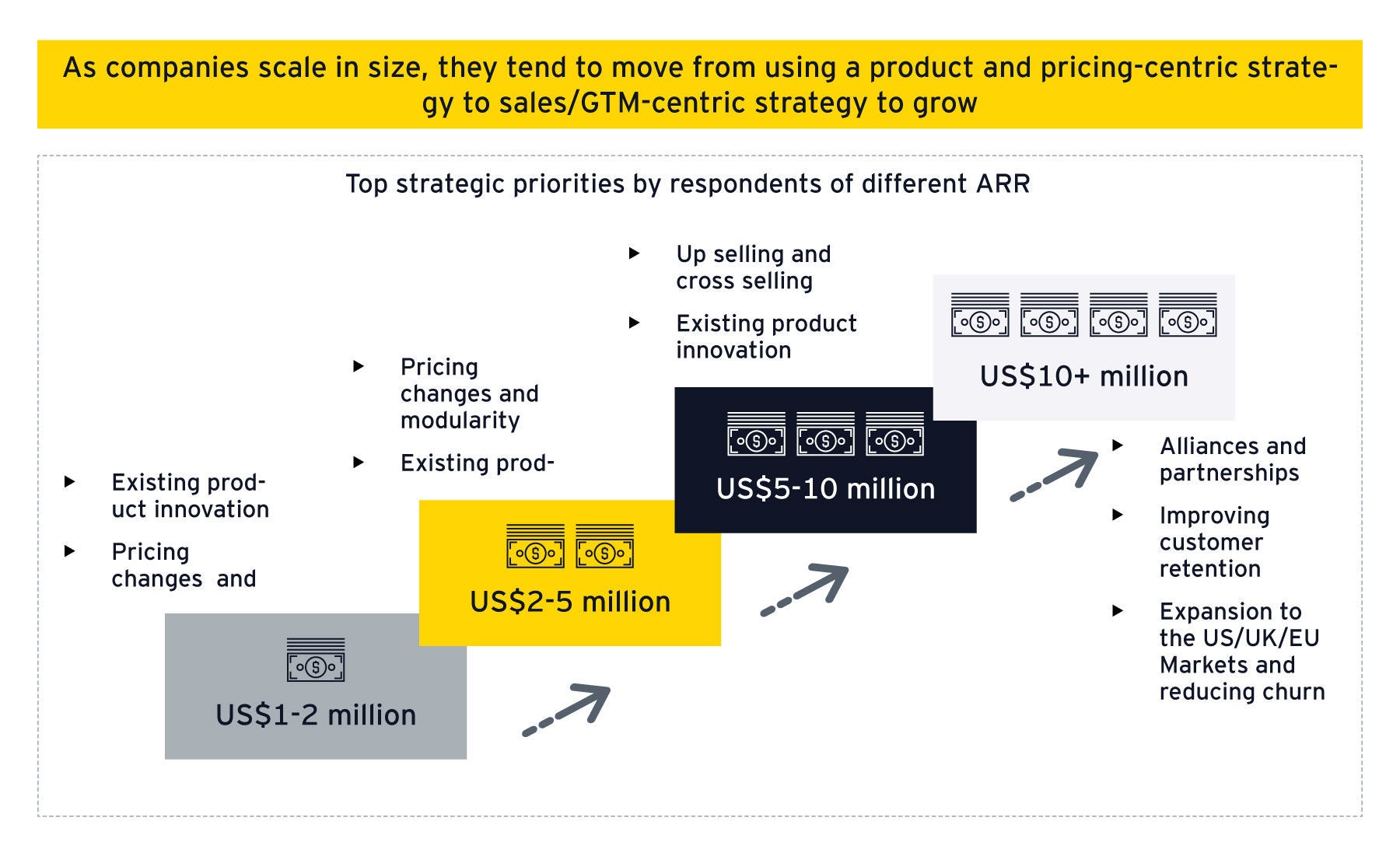

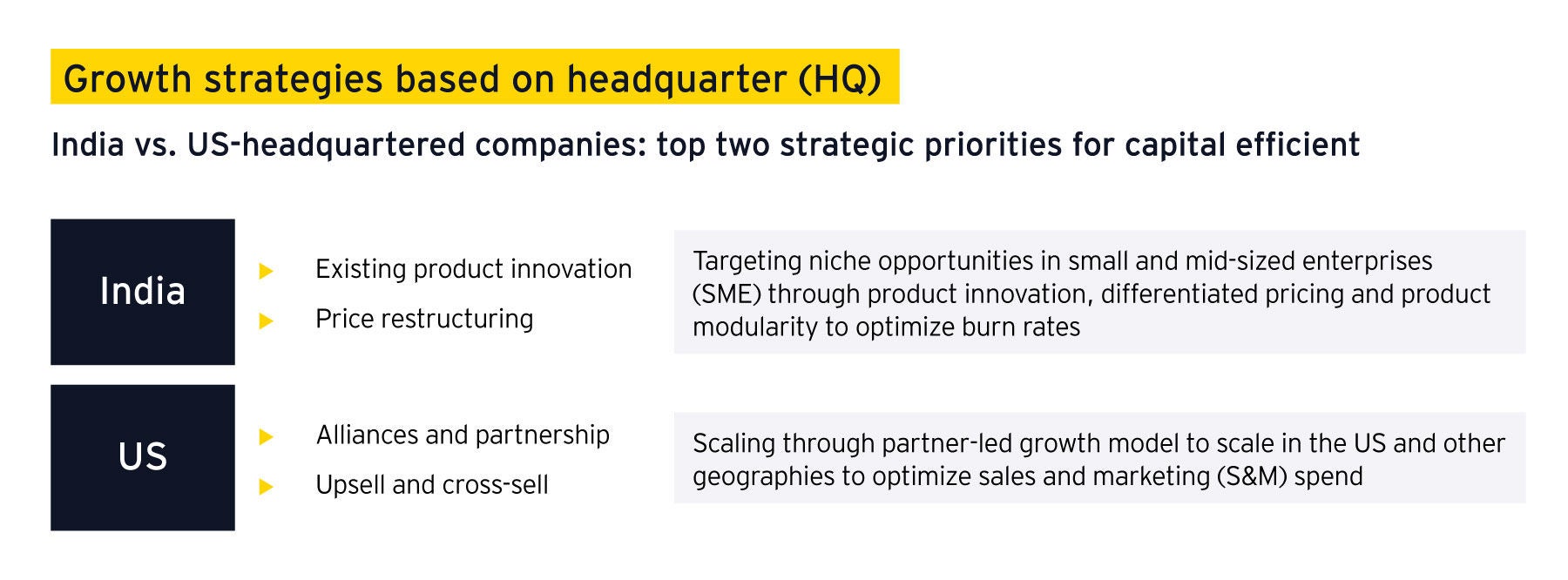

CXOs are prioritizing a combination of business strategies that accelerate growth while being capital efficient. There is a high emphasis on product-centric adoption through approaches such as innovation in existing products, upselling and cross-selling as well as promoting partnerships and new products. In addition to that, pricing structures are customized to meet the parameters that small and medium enterprises demand.

Another key strategy that CXOs choose is quick product iterations and building differentiation through automation and AI/ML capabilities which improves customer experience while building a strong initial value proposition.

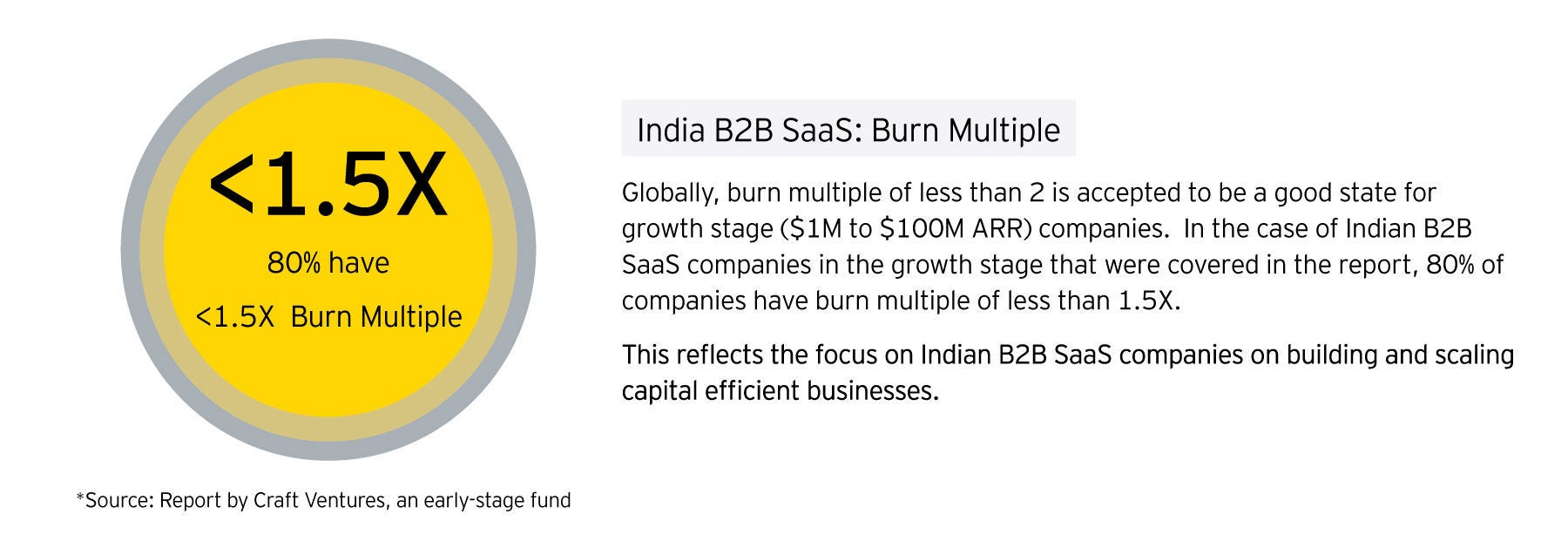

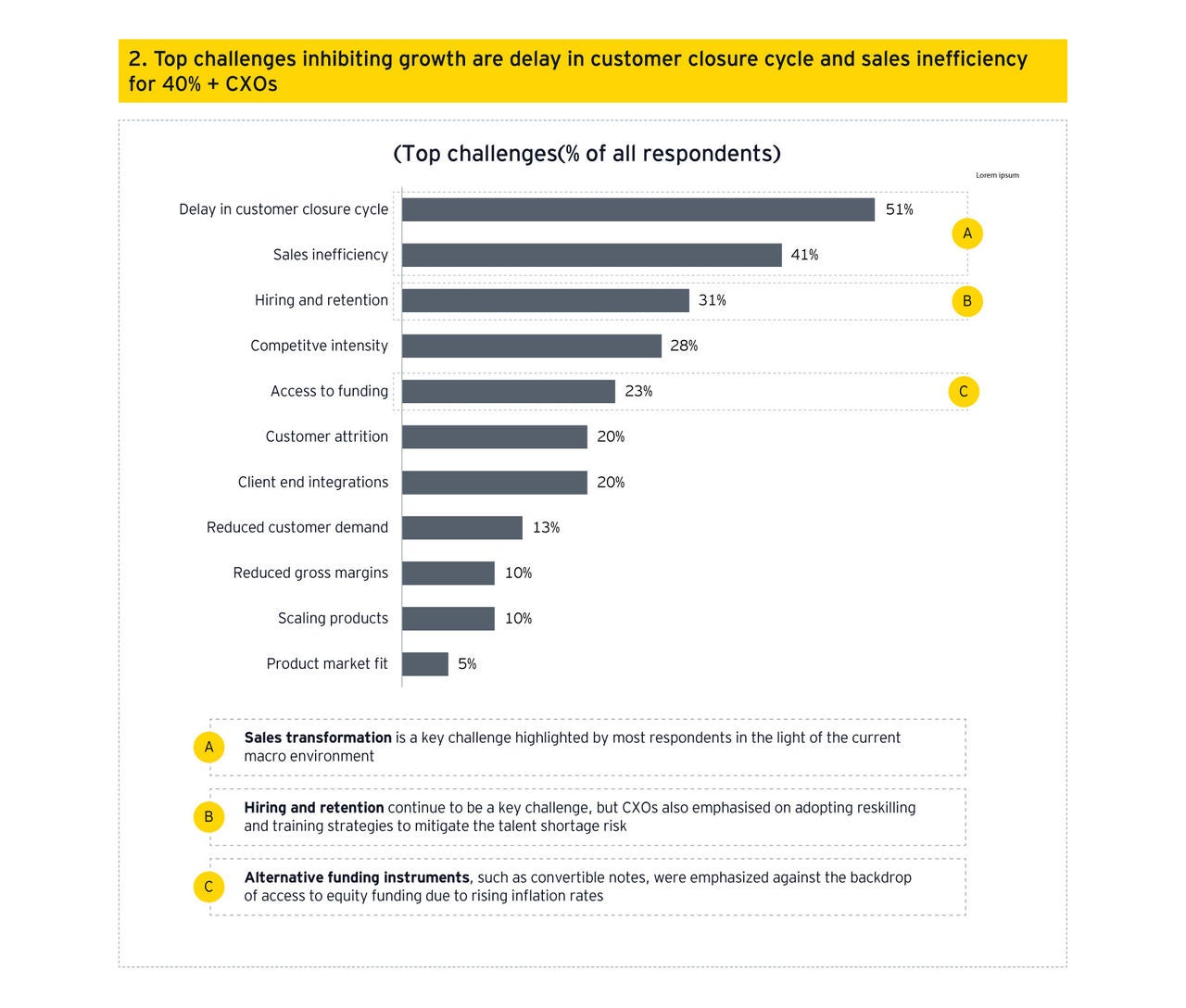

HCM, CRM/CDP, AI platforms and FinTech are the top sub-segments targeting ultra-growth. Planning for the next level, Indian B2B SaaS companies are at present targeting niche opportunities in small and mid-sized enterprises through product innovation, differentiated pricing and product modularity to optimize burn rates. 60% of the companies surveyed have reported these as their top strategic priorities. The trends in the survey also indicate that companies are shifting from product-centric growth to sales-centric growth as companies scale in size. However, there are challenges inhibiting capital efficient growth. One of the top challenges is delay in customer closure cycle and sales inefficiency. Here, sales transformation is a key challenge highlighted by the majority of respondents in the light of current macro environment.