EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How a global pharma leader saved INR500 cr trapped in receivables in India

Deploying a strong governance around AR management enabled the company to enhance its AR performance and implement stronger credit controls.

The better the question

How can we achieve sustainable AR reduction?

The pharmaceutical and healthcare company’s India division needed a strategy to reduce its AR.

A leading global pharmaceutical and healthcare corporation's India division faced a daunting challenge with an outstanding accounts receivable (AR) balance amounting to INR 2,600 crore as of March 2022. The organization aimed to devise a strategy to reduce the accounts receivable balance while identifying improvement opportunities within its accounts receivable management processes. The goal was to analyze the company's current practices, procedures, and policies to streamline operations, reduce inefficiencies, and enhance the overall effectiveness of the credit and collections procedures.

The organization engaged EY to help rapidly reduce the aged AR and implement strong governance for continuous AR monitoring and management. The company needed a solution that could manage its receivables and mitigate potential risks associated with delayed or unpaid invoices. They also wanted to ensure that they have a mechanism in place focused on regularly monitoring and assessing the status of AR, ensuring prompt identification of delinquencies or potential issues.

The core requirement of the company was the implementation of a process which could result in better AR management, optimized cash flow, and enhanced customer relations with clear and timely communication about outstanding payments.

The better the answer

We designed a collections strategy to reduce overall aging AR.

The tracking system manages multiple aspects across processes and stakeholders.

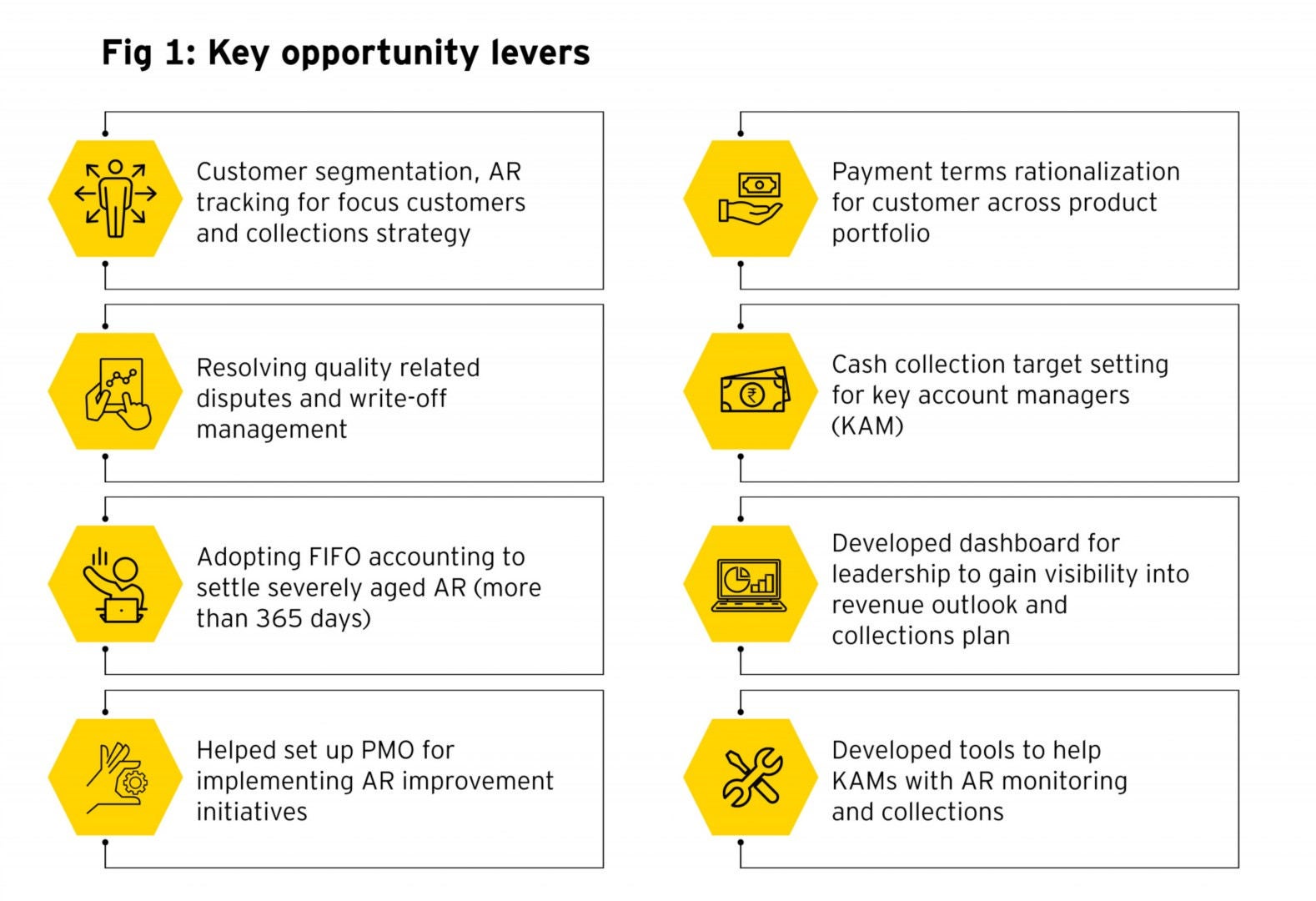

EY identified and effectively implemented key opportunity levers in the pursuit of organizational growth and financial optimization. With our assistance, the company adopted an advanced AR tracking system to monitor and manage their focus customers efficiently, ensuring prompt and targeted actions to collect outstanding payments, reducing the overall AR aging and improving cash flow. To manage severely aged AR (over 365 days), the company embraced the First-In, First-Out (FIFO) accounting method, which prioritized the oldest invoices for collection, minimizing the risk of further bad debts and maximizing cash recovery.

Next, we conducted a detailed review of aged AR and segmented customers based on specific criteria, such as historical payment behavior, credit rating, geopolitical triggers etc. to tailor the credit and collections strategies, leading to enhanced collections while maintaining customer satisfaction and sales performance. EY rationalized customer payment terms across the product portfolio to help the business achieve a balanced and sustainable approach to invoicing and collections.

We also assisted the company to set cash collection targets for Key Account Managers (KAMs) and aligned individual performance with the overall financial objectives. To support the KAMs in their AR monitoring and collections efforts, we developed specialized tools that provided valuable insights and automation, empowering KAMs to efficiently manage their accounts. We set up a monthly cadence of finance leadership and commercial leadership to review the current month collections status and collections forecast.

Lastly, EY developed and deployed a comprehensive leadership dashboard with real-time visibility into revenue projections and collections forecasts. We also established a Project Management Office (PMO) to oversee the implementation of AR improvement initiatives and supported the company in addressing quality-related disputes, which helped in building positive customer relationships and reduced the instances of bad debts.

The better the world works

Cross-functional effort and process improvement reduced AR.

The improved AR management enhanced company’s financial health, reinforcing its market standing.

After implementing the solution, the pharmaceutical and healthcare organization accomplished a remarkable feat by reducing its AR by INR500 crore. It signified a substantial improvement in the management of outstanding payments from customers, resulting in enhanced cash flow and financial stability.

Additionally, the end-to-end process assessment enabled the company to identify an additional INR900 crore opportunity for AR reduction.

INR500 crore reduction in outstanding AR

The efficient AR management process not only enhanced the company's financial health but provided additional working capital for growth and investment while reinforcing its reputation as a financially robust organization among its competitors in the market.

How EY can help

-

EY Infrastructure advisory consulting services offer to plan, finance & deliver sustainable, bankable projects across transport, energy & urban sectors.

Read more - Read more

-

Our team can help respond to the challenges of COVID -19, providing trusted leadership in complex situations to help companies recover and preserve value.

Read more

Related content

How demand forecasting helped a company retain market leadership

Discover how EY helped a national ATM managed service provider improve inventory replenishment accuracy & reduce lost sales and holding costs effectively.

How Government of India implemented a global emission protocol

Discover how EY explores the intricacies associated with strategizing phaseout management plan of Hydrochlorofluorocarbons in India.

How an alco-bev major reduces IT costs with software asset management

Discover how an alco-bev major reduces IT costs with software asset management. Learn more about the IT asset management case study.