EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

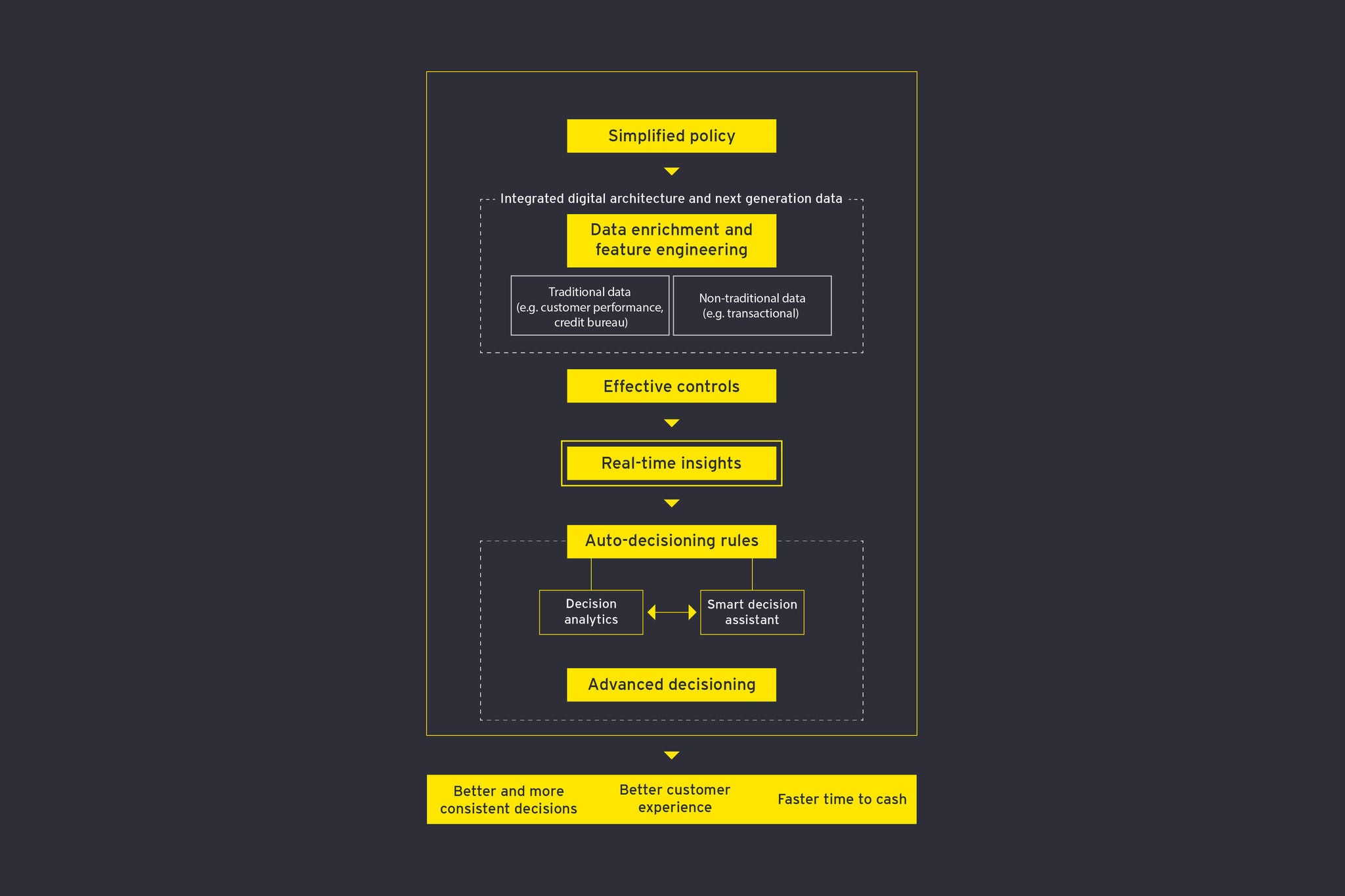

A “next-generation credit” decisioning framework for SME lending should be built around the following key design principles:

1) Maximize the use of data to generate customer insights

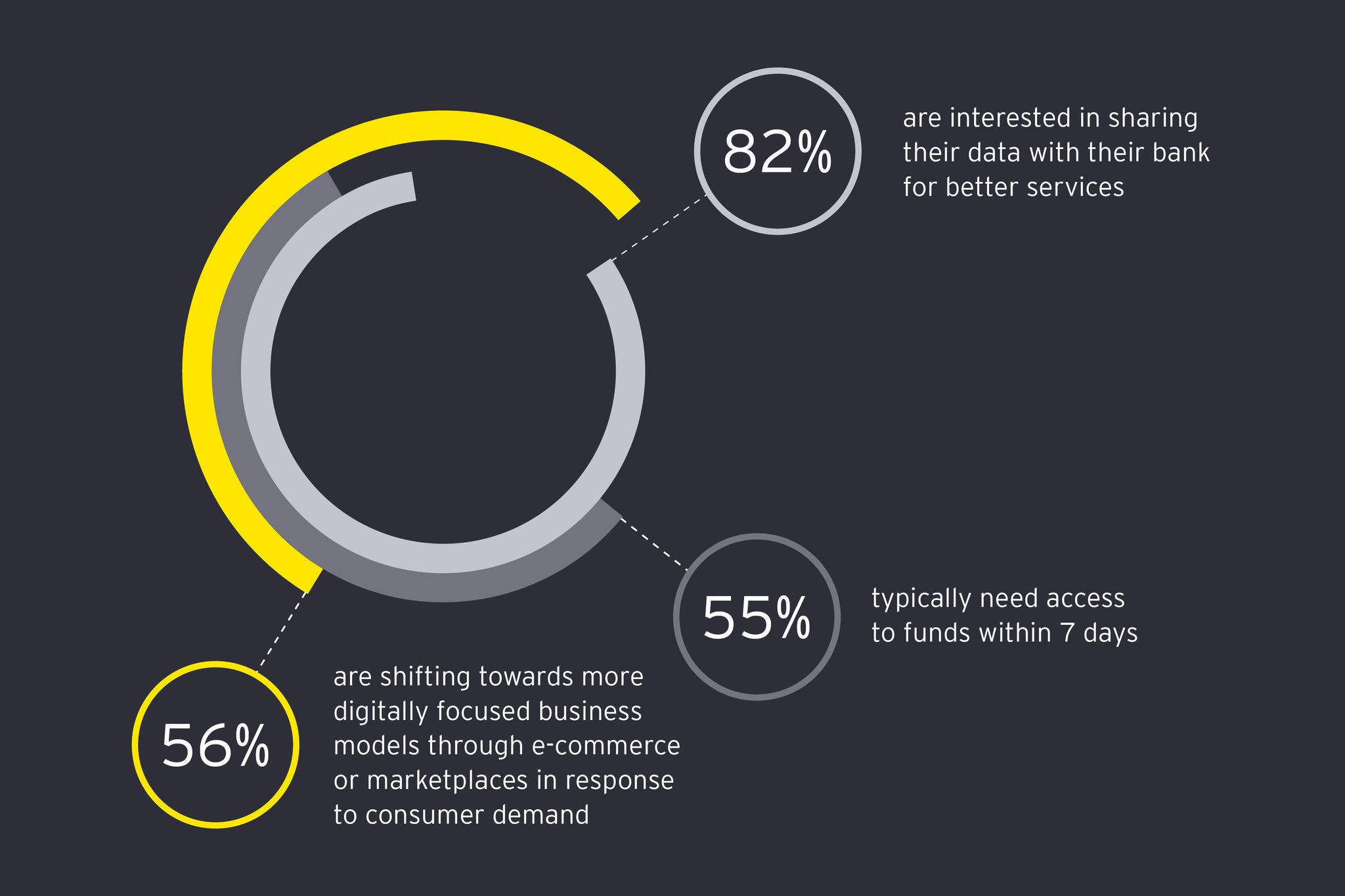

SMEs seek long-term relationships with their banking partners and expect them to understand their unique business challenges. Traditional decisioning frameworks have typically relied on outdated financial data which has limited the ability to accurately assess customer risk, particularly the "thin-file" population. Transaction data analysis offers much richer insights, is almost real-time, and - thanks to Open Banking - widely accessible even when the primary banking relationship is elsewhere. There is also increasing focus on harvesting the wealth of unstructured data from the application process itself. Customers clearly recognize the potential benefit, with 82% of SMEs interested in sharing their data with their bank for better services. The power of this data comes from augmenting them with traditional sources rather than replacing them.

Lenders face challenges with data volume, legacy approaches, and how to maximize the value of the insights from new and existing customers. Newer lenders and those with a clear vendor strategy typically have an advantage in this area, yielding better quality and automation of decisioning.

2) Automate to the optimal level

Smart automation, powered by richer data, is key to delivering the fast, streamlined digital lending experience SMEs desire, with some even willing to pay extra for speed.

To achieve intuitive, transparent, and reproducible auto-decisioning, deeper customer insights are essential, allowing for more up-to-date risk signals and new criteria for auto-reject rules. To fully reap the benefits, a broader process transformation is needed, with the quality and consistency of manual underwriting also enhanced through auto-collation of customer insights, pricing intelligence, and intelligent decision tools prompting next best actions. This can help drive down costs and improve operational resilience and scalability. Implemented well, a structured auto-decisioning engine can drive up straight through processing approval rates, lower operational expenses and increase wallet and market share from the top customers.

But while lenders are setting higher targets for auto-decisioning, it is important that decision quality, customer experience and cost efficiency are not sacrificed.

Automation also adds value beyond decisioning, from automating data ingestion to supporting post-sanction fulfilment, though SMEs have been clear that they still expect a human-led approach in customer-facing processes.

3) Simplify credit policies and align to strategy

To stand out and attract and retain creditworthy clients, banks need to build focused, customer-centric strategies and offer a customized suite of products that match SME requirements. Transformation of decisioning is most effective when it starts with a clear business vision and lending strategy that can be translated into a streamlined credit policy aligned with risk appetite.

Many larger lenders operate in a complex policy landscape and are making significant efforts to streamline and modernize this process. From a decisioning perspective, this includes simplifying requirements to remove unnecessary friction in the approval process and enabling more dynamic segmentation based on cross-product risk characteristics and risk drivers to maximize flow through auto-decisioning pathways.

Flexibility to update and deploy credit policies is also a design requirement. The pandemic experience highlighted to many lenders a need for greater agility to enable the business to pivot when needed.

Regulatory scrutiny is also increasing, which raises the risk of unforeseen changes. The next generation decisioning framework needs to be able to adapt to the evolving commercial and risk priorities of the bank, such as sector or product strategy. Lenders need to consider how to future-proof their framework as part of any transformation effort. For auto-decisioning, this could involve designing a system that supports expansion to higher thresholds and across products through a set of ready-to-go model blueprints, including critical risk drivers, weight mix of variables, and model performance. Generally, a greater level of standardization across processes (while retaining the ability to adapt and tailor offerings) combined with well-designed, modular technology solutions enables greater agility.

4) Embed effective controls and governance across the end-to-end credit cycle

Deploying credit strategies effectively and managing increased volumes of customer data present new control challenges across the credit cycle. The use of new data and analytics, especially Machine Learning techniques, requires appropriate governance to maintain transparency and trust. Decision criteria must be understandable and explainable. Strong and clear governance is necessary to provide clarity on when manual intervention is required and when full automation is the goal.

Compared to traditional models, extra care is needed to avoid unintended consequences, such as selection bias resulting from data and model training methods. A robust update approach is also necessary, where recent customer experience is used to recalibrate models and decision-making approaches at an appropriate frequency and implemented in a well-controlled way.

Most banks have been slow to adapt to these requirements, but it is clear that regulatory authorities are monitoring this area so lenders should also make it a focus.