EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Capital Operations and Innovation Suite

In sector:tmt

To keep up with innovation and stay ahead of their competitors, TMT companies must continuously invest in capital in various areas of their business. While the precise focus of this investment varies between the different industry subsectors, an efficient and predictable capital life cycle is critical to the profitable growth of every TMT business.

What EY can do for you

Companies often struggle to connect and align the teams, processes and tools to manage their entire capital life cycle in the most effective and agile way and capture the full value of their strategy. In a recent EY survey, 83% of business executives agree that companies need a much more agile way of managing capital. Still, several pain points prevent companies from achieving an optimal capital life cycle.

For example, a lack of connectivity and visibility between finance and operations can mean investment allocation decisions become disconnected from their related deployment, limiting efficiency and predictability in the capital life cycle while also reducing agility and responsiveness of capital investment. In the same EY survey, 82% of all companies said that they believe that there is a lack of accountability and interconnectivity across the capital life cycle that needs to be solved.

Also, it’s often difficult to track spend granularly against the original business case and KPIs, meaning deviations and value leakage cannot be quickly identified and corrected. Our research found that leading TMT companies are more than twice as likely to deploy and utilize advanced analytics based on a trusted data foundation (77% vs. 33%) to manage their capital life cycle.

Only a minority of TMT companies have a robust approach across capital spending and deployment, leading to a significant opportunity to improve efficiency and predictability to overtake the competition.

An efficient and agile capital life cycle is critical to the profitable growth of every TMT business.

Capital investment pain points now have a solution

But now, there’s a way for these companies to wrest back full control and oversight of their capital investments. The EY Capital Operations and Innovation Suite (EY COInS) is a set of solutions specifically developed to help TMT companies make better decisions about their capital investments and drive operational efficiency across the capital life cycle.

Bringing together advanced technologies and robust governance and operational processes, EY COInS strengthens the connectivity between finance and operations. It embeds efficiency, agility, visibility and, most importantly, predictability across capital allocation and operational deployments — helping TMT companies deliver successful market growth strategies, innovation and wide-ranging ecosystems and business collaborations.

Core components

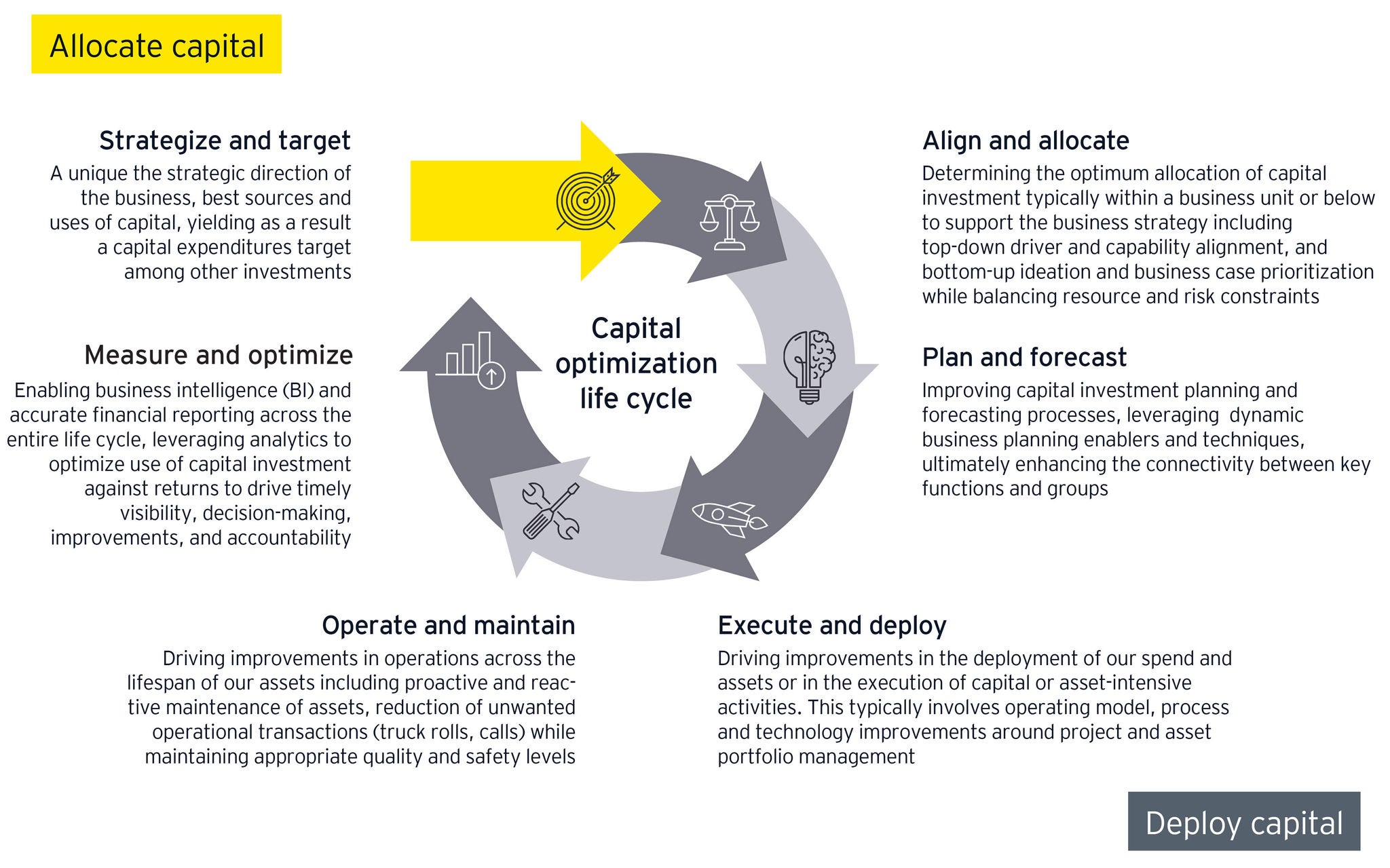

EY COInS helps to deliver value to TMT companies across the entire capital life cycle. At its core, the suite has two key components:

- Capital allocation capabilities: End-to-end capital allocation decision support solutions that assist in the development, evaluation and monitoring of capital strategies and allocation alternatives, with the ultimate goal of creating value for organizations

- Capital deployment capabilities: Solutions that add value to capital deployment by innovating in-field operations and asset tracking, increasing real-time visibility of spend across business units and promoting better capital management behaviors

EY COInS offers a distinctive approach to the capital investment life cycle, enabled by proprietary leading-edge tools and enablers. It leverages experience from a wide breadth of EY teams capabilities, including robust capital allocation, efficient capital project deployment and asset maintenance, capitalization policy, tax incentives and other tax benefits, ESG drivers and optimal reporting considerations.

Used together in conjunction with existing ecosystems (ERP, operational systems, etc.), these innovative capabilities seamlessly connect and improve the capital life cycle from end to end — and provide TMT leaders with better capital outcomes. These are all underpinned by EY leading-edge technology and unsurpassed global experience and capabilities in areas including capital allocation, capital deployment, capitalization policy, tax, ESG drivers and reporting.

The EY Capital Operations and Innovation Suite can help you:

- Bring transparency and predictability throughout the capital optimization life cycle and help accelerate speed to value in capital investment deployment

- Align capital allocation to strategy by optimizing the capital expenditure portfolio

- Plan, forecast and deploy capital investments and returns accurately and efficiently

- Build a culture of accountability for capital returns

- Help improve return on invested capital (ROIC)

Contact us

Your TMT business already operates at digital speed in delivering your products and services. EY COInS can help your business make better decisions about your capital investments and drive agile operational efficiencies across your entire capital investment life cycle.

To find out more about what we can do for you, contact us today.

Our latest thinking

How the M&E sector can tackle India’s growing piracy menace

Explore effective strategies for India's M&E sector to combat the escalating challenge of content piracy and protect intellectual property. Learn more

Reinvent: India’s M&E sector is innovating for the future

M&E Sector's Transformation & Growth: EY highlights Indian M&E sector crossed INR2.3 trillion in 2023, and is expected to reach INR3.1 trillion by 2026.

Online gaming in India – the GST conundrum

EY outlines the implications under the GST laws on the emerging online gaming industry. Learn more about GST regime for Online gaming Industry.