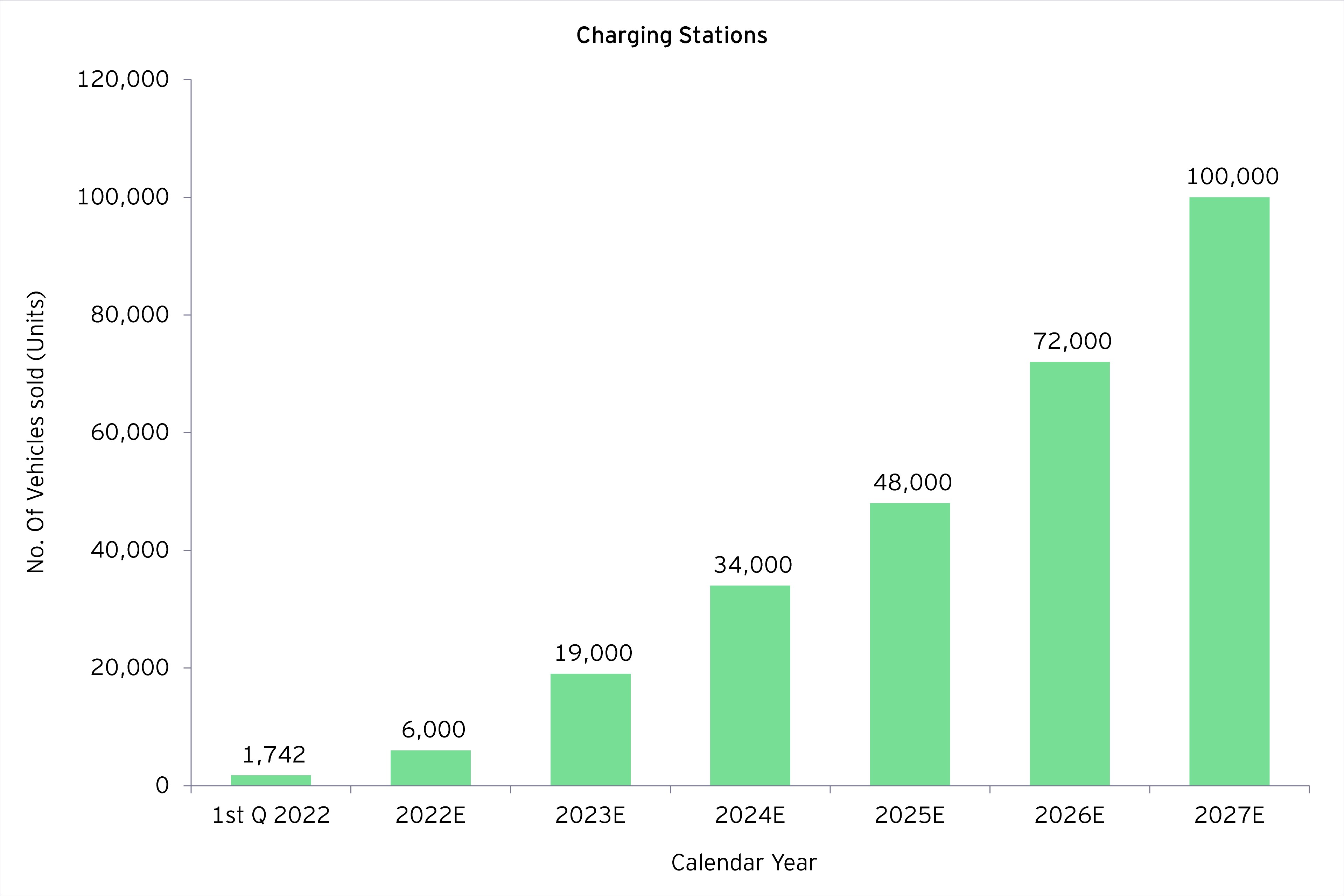

Charging infrastructure: With only 1,742 charging stations in the country, the lack of charging infrastructure is currently one of the biggest challenges for the EV sector in India. High operating costs, uncertainty in utilization rates of charging stations, and additional load on electricity discoms are some of the other factors creating a hostile environment for operators, resulting in an insufficient number of charging stations.

However, policymakers are taking steps to address this issue and provide regulatory support for setting up charging infrastructure for EVs. The number of charging stations is likely to increase to 100,000 by 2027 to accommodate the ~1.4 million EVs expected on the roads.

Batteries used in EVs: Most EVs use lithium-ion batteries that require metals like lithium, magnesium, cobalt, and nickel. Countries deficient in these resources depend on imports to realize their EV manufacturing dreams. However, imports increase the procurement costs, thus making EVs expensive. In FY20, India spent nearly US$865 million to import ~450 million units of lithium-ion batteries. These batteries also have a substantial environmental impact as extraction requires large quantities of water, is harmful to the soil, and causes air contamination. In addition, the current recycling procedures for lithium-ion batteries are inefficient; the components degrade over time and cannot be used in new batteries. Some manufacturers are developing alternatives to lithium-ion batteries used in the automobile industry, but their use is limited at present.

Research and development: India lags in R&D capability and manufacturers mostly rely on their foreign counterparts’ technological know-how in EV components, especially in battery technology. However, the scenario is fast changing. The Automotive Research Association of India, for example, is among those conducting research on electric vehicle trends in India and fast-charging technologies as per the needs of the Indian market.

Pollution: Compared to traditional ICE vehicles, EVs are a cleaner and greener alternative and, therefore an important part of the plan to reduce greenhouse gas emissions. However, the manufacture and use of EVs contribute to environmental degradation. For instance, operating the charging stations means depending primarily on polluting thermal power plants. Therefore, it is vital to ensure that the power source is clean energy, such as solar, wind, or hybrid power plants. Similarly, alternate methods are needed to reduce the environmental impact on soil, air, and water caused by the extraction of metals used in lithium-ion batteries.

Looking ahead

Government intervention at various levels, ownership of EV infrastructure, fast decision-making, collaboration and coordination with stakeholders, and commitment to short and long-term goals are required to ensure rapid adoption of EVs in India, suggests the report.

The EY report also suggests action points for battery manufacturers, policymakers, and auto companies to facilitate wider acceptance and infiltration of EVs in India.

Despite the challenges, global EV market trends continue to influence Indian consumers, resulting in an upward shift in the preference for EVs. There is increased familiarity with EVs thanks to the introduction of e-rickshaws, which have replaced traditional rickshaws in the public transportation sector due to their low cost, energy efficiency and cheaper maintenance. Besides the increased willingness of Indian consumers to use EVs, government incentives and subsidies will sweeten the deal and boost EV market growth in India.