EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Insights

Asking the better questions that unlock new answers to the working world's most complex issues.

Services

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

Industries

Discover how EY insights and services are helping to reframe the future of your industry.

See more

Case studies

Advanced Manufacturing

How a manufacturer eliminates cost and value leakages with AI-ML

03 Jul 2024Vinayak vipul

Recent Searches

Trending

-

Diversify, innovate and decarbonize coking coal for India's steel vision

India's steel vision 2050: Enhancing coking coal security and sustainability with strategic policy and tech interventions for a competitive edge.

11 Dec 2024 Mining and metals -

Tech-forward preventive vigilance to enhance governance

Embrace tech innovation for proactive fraud risk management and foster a culture of integrity with our tech-forward vigilance strategies.

12 Dec 2024 Forensics -

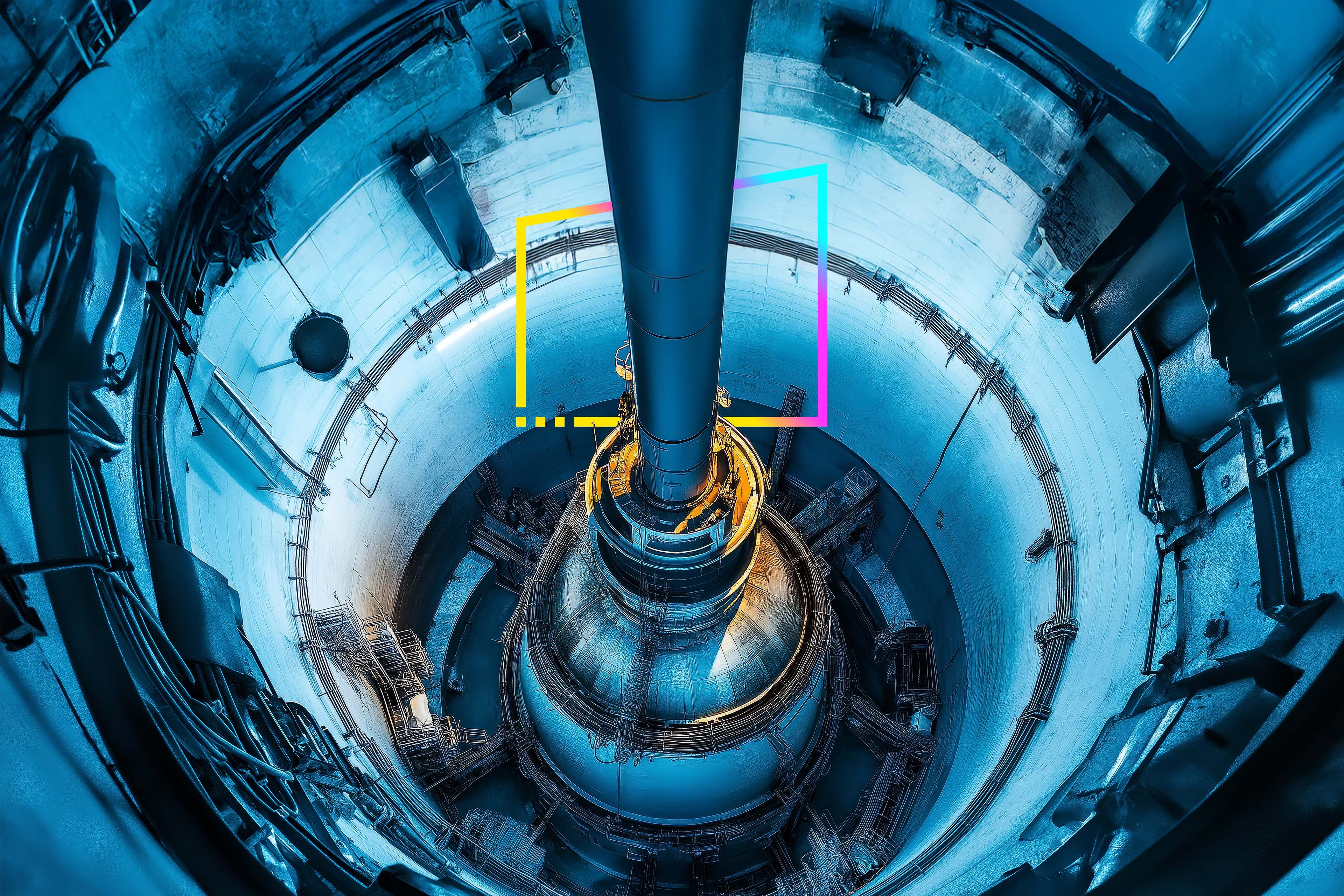

COP29: Why global efforts must reinvigorate towards nuclear power

COP29: Explore why tech companies' AI operations and advanced nuclear tech are key to revitalizing global clean energy efforts.Image – team will share with new brand identity

05 Dec 2024 Power and utilities

Consolidated tax and policy alert on tax and policy amendments proposed in Union Budget 2024

On Tuesday, 23 July 2024, the Hon'ble Finance Minister, Nirmala Sitharaman, presented Union Budget 2024 in the Lok Sabha.

We bring you the consolidated tax and policy alert on tax and policy amendments announced by the Hon'ble Finance Minister in the budget.

The key highlights are:

- Supporting medium-term growth with accelerated fiscal consolidation

- Budget 2024 unveils progressive reforms and relief measures

- E-commerce levy on e-commerce players withdrawn foreign companies to be taxed at reduced rate concessions for IFSCs

- Angel Tax abolished

- Buyback proceeds taxable as “dividend"

- Expansion in scope of TP audits and stated intent to streamline TP dispute

- Custom duty rate rationalization, measures to reduce ongoing GST litigations and trade facilitation

- Budget 2024 aims to incentivize the new tax regime and proposes the rationalization of capital gains tax