EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Majority of European Financial Services Directors sit on multiple firms’ boards, raising investor concerns of ‘overboarding’

- BOARD COMMITMENTS: European financial services board members hold an average of three board positions, and just over a quarter (26%) hold at least four

- New EY poll finds that 82% of investors believe sitting on three or more boards – rising to 85% if one role is c-suite - could present challenge to directors’ abilities to govern effectively

- CHURN RATE SNAPSHOT: 10% of European directors departed their board positions in H1 2023, with new appointees replacing them at lower rate of 6%

- EXPERTISE: 25% of financial services board directors appointed in H1 2023 have professional sustainability expertise while 36% have professional tech expertise*

- GENDER: 28% of Europe’s financial services boardrooms are yet to reach the 2026 European Commission target of 40% female representation, a figure which rises to 47% within European asset management firms

Board directors serving Europe’s largest financial services firms currently hold an average of three board seats each, and over a quarter (26%) hold four or more, according to the latest EY European Financial Services Boardroom Monitor. This comes as new sentiment polling data finds 82% of European investors surveyed believe that holding board positions at three or more firms – rising to 85% if one is at executive level - could present challenge to board directors’ abilities to fulfil their duty of governing a company.

The EY Boardroom Monitor charts the profile, experience, training and skillsets of board directors across the MSCI European Financials Index and is supplemented with a sentiment polling survey of 300 European financial services investors.

Amongst the most senior board members – chairs and executive directors – the average number of positions held is two. Across all board members, sitting on more than one major financial services board is less common: only 3% of directors tracked hold two or more board roles at the largest European financial services firms.

When asked to identify the primary driver behind directors assuming multiple board positions, just over a quarter (26%) of investors cited board members’ desires to gain broader experience and over a fifth (22%) cited remuneration. Separately 19% of investors believe it relates to a shortage of female candidates with sufficient experience; however, current EY Boardroom Monitor data does not support this, finding that the proportion of both men and women sitting on three or more boards correlates with the gender split of the total director population tracked.

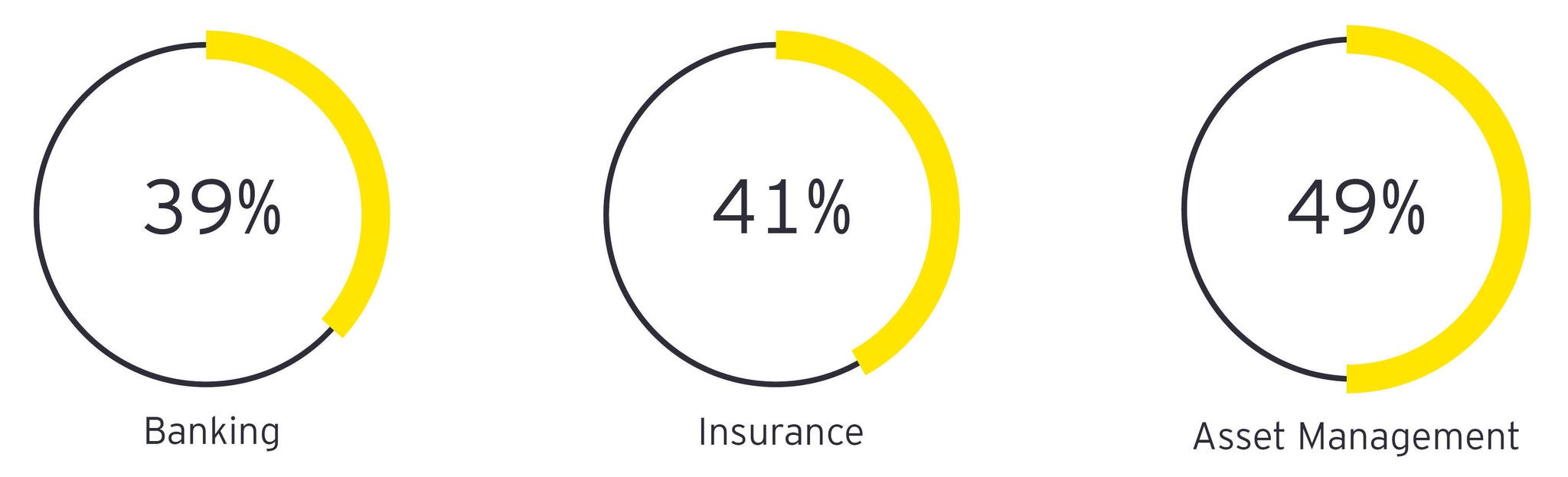

From a sector perspective, directors holding multiple board positions are most common within the asset management sector, where 49% of board members hold more than two board positions. It is least common in the banking sector, where 39% of board members hold more than two board positions.

Percentage of board directors holding more than 2 board positions - by sectors

From a regulatory perspective, while there are local market limitations to some director roles, there is no blanket regulation applied across European financial services markets to restrict or mandate the number of board roles that can be held by an individual.

Omar Ali, EY EMEIA Financial Services Managing Partner, comments: “Concerns about ‘overboarding’ and the knock-on effects it could have on governance are increasingly topical. A careful balance must be struck by companies and chairs to build a board with the requisite skills and breadth of experience to face new and increasingly complex risks while ensuring that all members have the capacity to dedicate the time and resources demanded by the board role. This is particularly the case for board directors serving on multiple boards of businesses that are facing into challenges at the same time, and when the talent pool of qualified candidates is small.

“Whilst there are a number of reasons board members hold more than one position, there are associated risks to monitor. Participants in the 2023 EY European Financial Services Chairs’ Interview Series spoke of concerns that the prestige of a board seat could affect willingness to challenge the status quo – an attribute deemed critical by chairs and regulators – and that some board members might be financially dependent on their board positions, which impacts their independence.”

A ‘changing of the guard’ across Europe’s financial boardrooms?

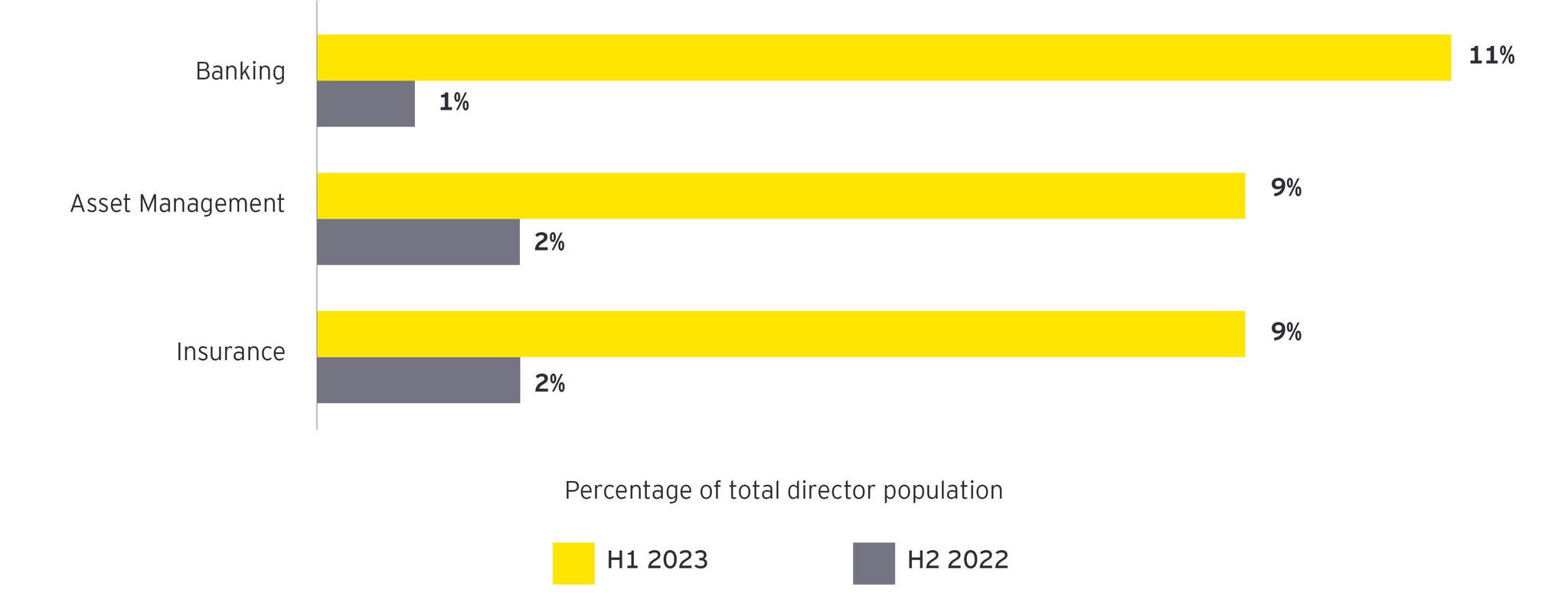

In H1 2023, data from the EY Boardroom Monitor shows that boardroom exits constituted 10% of total boardroom members, with new appointments marginally lagging departures within the six-month snapshot**, at 6% of the total director population.

The banking sector had the greatest proportion of boardroom exits: 11% of board members at banks left their roles in H1 2023. In comparison, 9% of board members at asset management and insurance firms departed in the same period.

Board director exits in H1 2023 and H2 2022 - by sector

The average tenure of members departing financial services boardrooms during H1 2023 was 87 months, relative to 85 months across all boardroom members.

Against a backdrop of high recent board turnover, almost three quarter of investors (74%) anticipate an increase in investor action during AGMs – whether voting against board members or proposing new board members – over the next five years to rectify any perceived lack of experience or diversity in specific areas.

Incoming board members increase c-suite, sustainability, and tech expertise

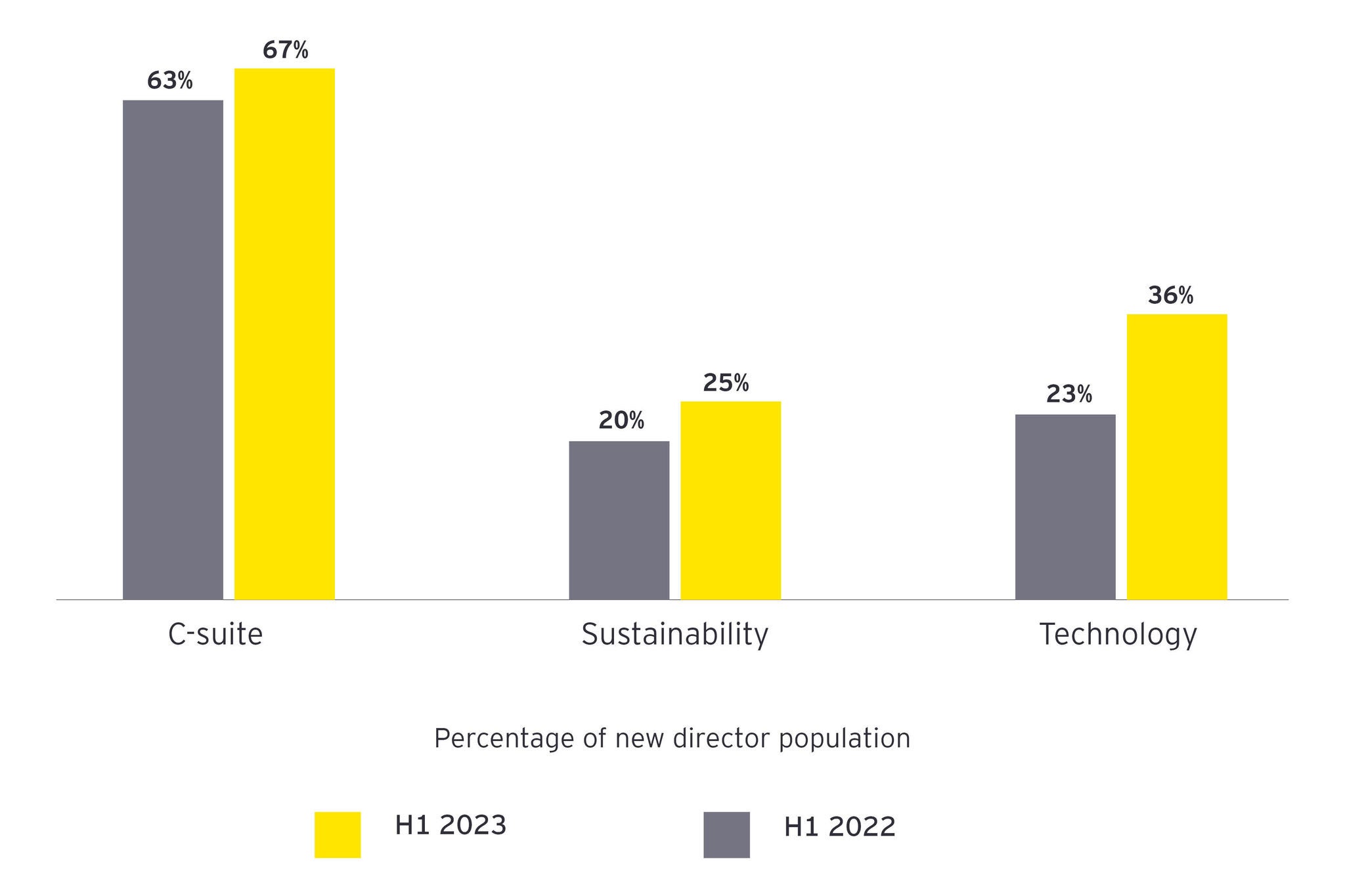

When assessing the collective skills, expertise, and experience of board members in the context of investing in a European financial services firm, 87% of investors state that experience in both digital/tech and ESG/sustainability is valuable, and 83% state that c-suite experience is valuable. Professional experience indicates official qualifications or roles previously or currently held in the related field.

Of board members appointed in H1 2023, 25% have professional experience in sustainability/ESG, while 36% bring experience in tech, and 67% bring the experience of an executive position (outweighing the 64% with c-suite experience who departed their roles in H1 2023). This is a comprehensive year-on-year rise: of board members appointed in H1 2022, 20% had professional experience in sustainability, 22% had professional experience in tech, and 63% brought the experience of an executive position. For context, of the full EY Boardroom Monitor director population, just 14% of board members bring sustainability experience and 18% have tech experience.

Expertise within new board director appointments

European asset management firms lead on ESG hires but banks led on tech – H1 2023

Just over a fifth (21%) of Europe’s asset managers appointed board members with professional experience in sustainability/ESG in H1 2023, compared with 19% of banks and just 9% of insurers.

When it comes to tech expertise, 24% of European banks appointed board members with professional experience in tech in H1 2023, compared to 19% of asset managers and insurers during the same period.

Omar Ali comments: “Against a volatile market backdrop and, at times, major pressures on the European banking sector, financial services boardrooms have visibly evolved in a short period. Director turnover in the first six months of this year has given space for chairs and executive teams to actively address any perceived skill or experience shortfalls in their boardrooms, ensuring new appointments add specific skillsets.

“Consensus from chairs we spoke to is that a mix of skills and more c-suite experience is crucial to cover all aspects of board activity, and it is encouraging to see this coming through in new appointments. Chairs are looking for new non-exec directors to have a strong understanding of the firm’s current performance in relation to the economic cycle and its operating environment.”

28% of Europe’s financial boards are yet to reach 40% female representation

Eighty-two per cent of European financial services investors state that the gender diversity of the boardroom has a significant influence on their decision to invest, compared to just 6% who say it does not influence their decision at all.

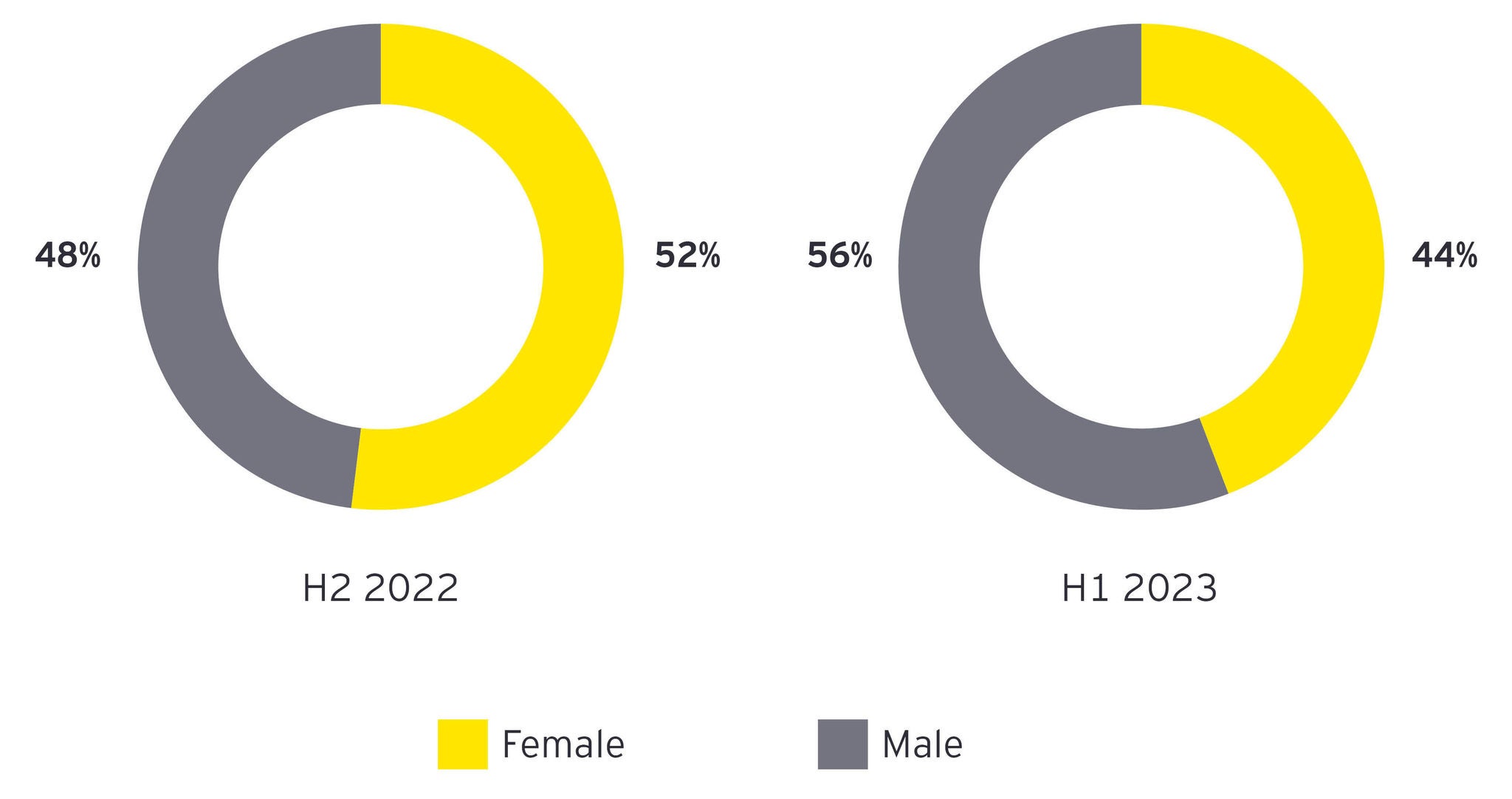

Of board appointments made over the past year (July 2022 – June 2023), 44% were female candidates, representing an eight-percentage point fall year-on-year from 52% in the year to June 2022. Of board appointments made in the first six months of this year, 44% were female and 56% were male. Overall, the current gender split of European financial services board members stands at 43% female and 57% male.

Gender split of new board director appointments

Twenty-eight per-cent of listed European financial services firms have under 40% female representation in their boardroom, which is the level required by June 2026 to comply with the European Commission’s European Women on Boards Directive. The Directive requires all companies in EU member states to meet a 40% female target for non-executive boards or 33% for all board members.

On a sector basis, the gender diversity of wealth and asset management boardrooms lags the insurance and banking sectors. Almost half (47%) of wealth and asset management firms have under 40% female representation within the boardroom, compared to 24% of banks and 17% of insurance firms.

The EY Boardroom Monitor also provides clear evidence that women on boards continue to be less likely to have worked in c-suite roles. Across Europe’s financial boardrooms, just 53% of female board members hold or have held a c-suite position, relative to 65% of their male counterparts. This is up marginally on January 2023 data, which showed 51% of female board members had c-suite experience, relative to 62% of their male counterparts.

Age of board directors remains around 60 years old

Eighty-four per cent of European financial services investors state that the age diversity of the boardroom has a significant influence on their decision to invest, compared to just 6% who say it does not influence their decision at all.

The average age across European financial services boardrooms is 59. For women it is 58, up from 57 in January 2023, and for men it is 61, up from 60 in in January 2023. Overall, just 10% of companies monitored have board members under the age of 40.

Omar Ali concludes: “Financial services boardrooms have changed over the last few years, and chairs and executive teams have actively replaced departures with appointees who bring new and needed expertise – namely in sustainability and tech. As the dynamics of global business continue to change, we expect to see international experience and diversity of background rise in importance as boardrooms navigate an increasingly challenging macro backdrop, and the need for more female board members with c-suite experience remains a priority. However, such appointments can only take place if there is a strong talent pool and a growing pipeline offering an ever-wider range of candidates, both of which are crucial to avoid ‘overboarding’.”

Quick data overview as at June 30th 2023

- Total number of firms tracked across Europe: 83

- Total number of European board directors monitored: 1010

- Total number of female board directors monitored: 433

- Total number of male board directors monitored: 577

- Total number of European board director exits in H1 2023: 103

- Total number of new European board directors in H1 2023: 75

Notes to editors

- * Professional experience indicates official qualifications or roles previously or currently held in the related field

- ** The EY European Financial Services Boardroom Monitor does not yet have historical data on boardroom churn rates; board director movement reported in this press release is presented as a snapshot

- This is the third launch of the EY European Financial Services Boardroom Monitor, and data is current to 30th June 2023

- The EY European Financial Services Boardroom Monitor does not track the race and ethnicity of board members, as there is no standardized format for directors to disclose against

- This release incorporates a survey of 300 European and UK-based fund managers undertaken between May-June 2023, who have, or are able to have, exposure to European financial services companies within their portfolios.

About the EY Boardroom Monitor

- The EY Financial Services European Boardroom Monitor tracks the experience, background, and skillsets of board members across a defined universe of financial services firms to create a broad picture of the gaps in expertise and possible pressure points within the listed European financial services markets.

- The EY Financial Services European Boardroom Monitor tracks and analyses data across a wide range of factors, including gender and age, as well as professional experience and skills.

- The EY Financial Services European Boardroom Monitor is comprised of disclosable, publicly available data on board appointments at listed banks, wealth and asset managers, FinTechs and insurers across the UK, Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden and Switzerland, using the MSCI European Financials Index as the core universe.

- This release incorporates a survey of 300 European and UK-based fund managers who have, or are able to have, exposure to European financial services companies within their portfolios. The survey asks about the biggest risks to European Financial Services companies and where investors see the biggest skillset gaps within boardrooms.

- These two data sets are compared to assess where European financial services boardrooms in different markets and sectors appear to have skillset and diversity gaps relative to shareholder priorities. This allows an ongoing assessment of how the composition of boardrooms compares to the expectations of investors.