EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Our Strategy Consulting teams help CEOs achieve maximum value for stakeholders by designing strategies that improve profitability and long-term value.

Read more

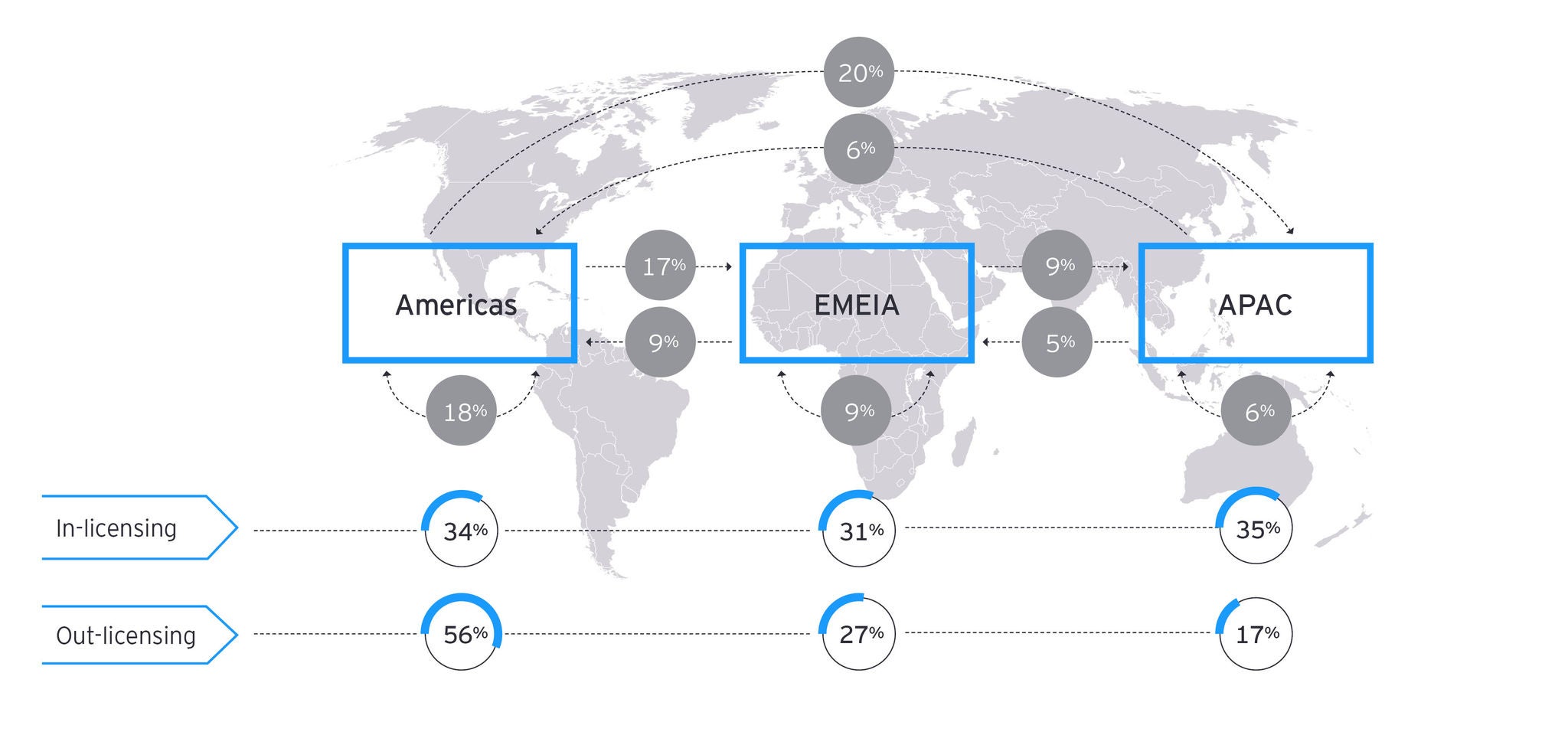

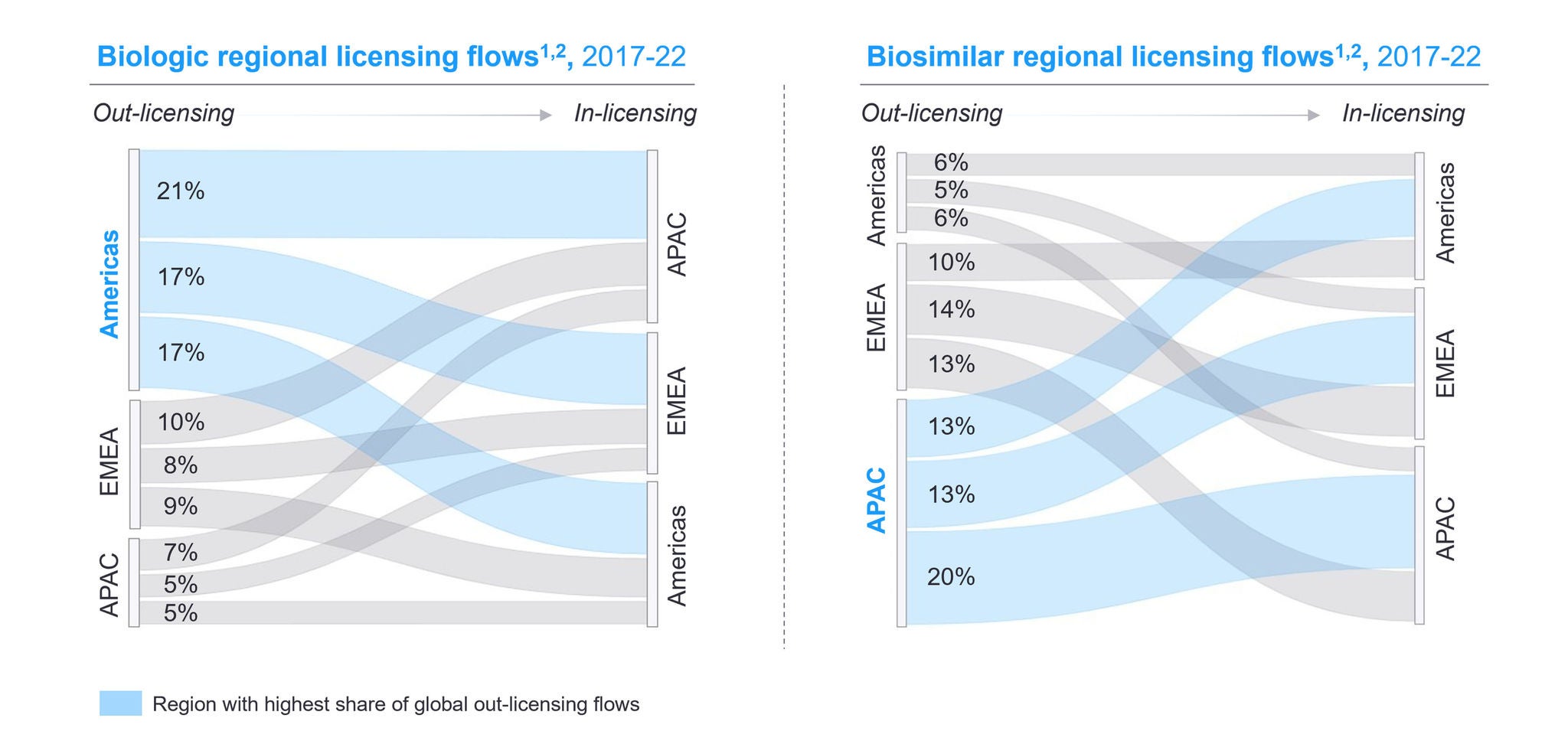

In-licensing deals are a powerful tool to enable pipeline and portfolio replenishment. Pharmaceutical companies facing patent expirations need to take action to close revenue gaps. Identifying the right opportunities is essential to establishing successful partnerships and de-risking investments.

While patent cliffs are a challenge for originators, they are an opportunity for generics and biosimilars. These assets can be out-licensed to maximize market reach. Several dimensions like commercial footprint and market capabilities need to be analyzed to find the right partners.

2. Licensing as a tool to increase the cost efficiency of innovation

As technology becomes more advanced, the cost of innovation is increasing. The R&D spend per new molecular entity approved by the FDA has increased by almost US$1b since 2014. Although new modalities, orphan and complex drugs offer promising therapeutics and high growth potential, they incur high development costs, raising pressure on innovation efficiency.

While innovation is more expensive, there is increased public attention to pharmaceuticals’ pricing. This might reduce the ability of pharmaceutical companies to spend on innovation and attract investors. Licensing allows access to assets at diverse development stages and thus, at diverse cost levels.

In-licensing at early development stages has increased. The deal value of early assets is typically lower than that of assets closer to market, allowing companies to access innovation while keeping costs low. Instead of betting on a single expensive asset close to market, some companies prefer to diversify investments, gaining access to several early-stage assets at lower costs.