EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY Studio+ helps organizations build differentiated experiences that adapt with customers and drive sustainable long-term value. Read more on studio.ey.com.

Read more

Wildcards to watch: Key factors shaping consumer sentiment

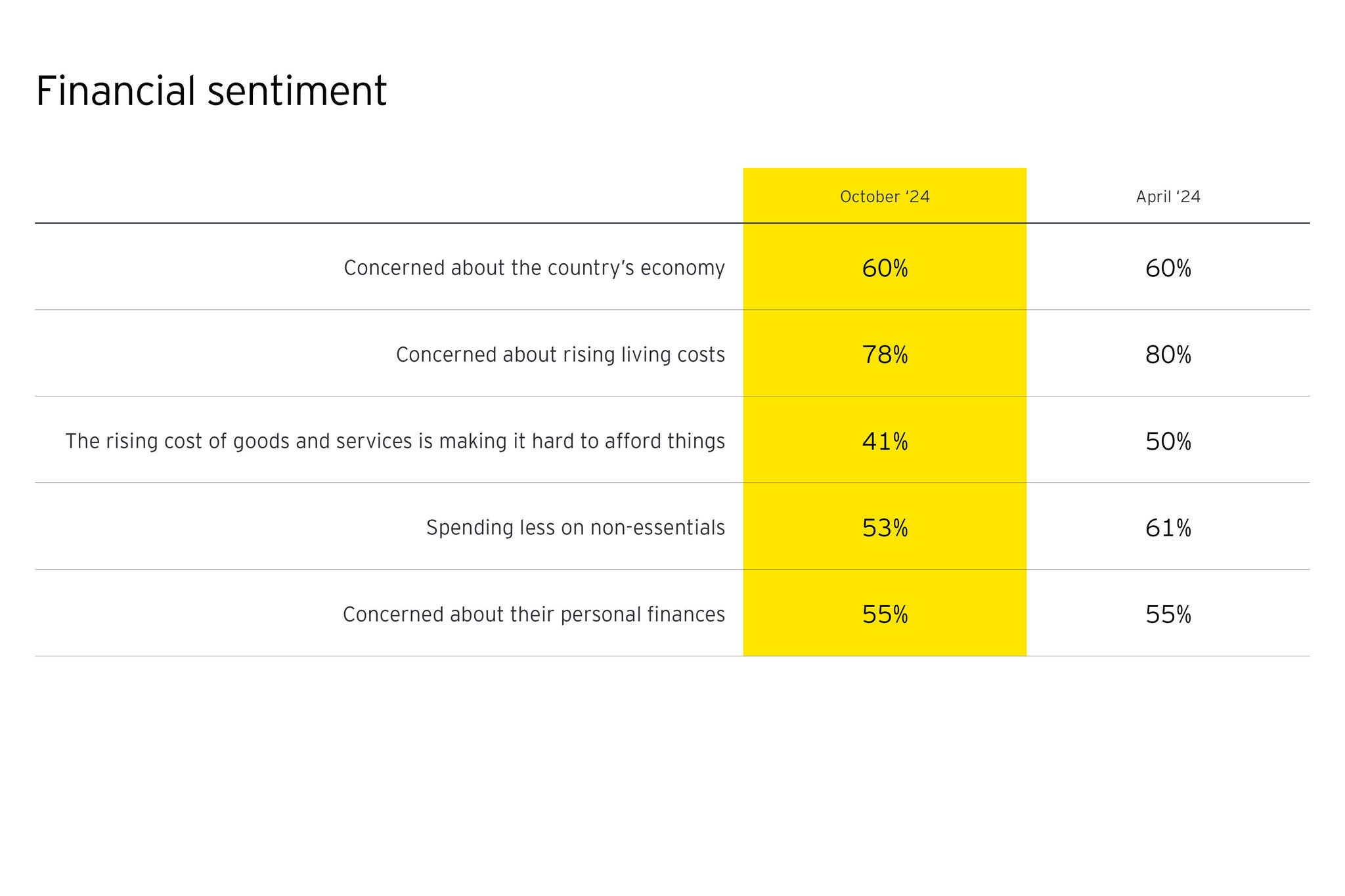

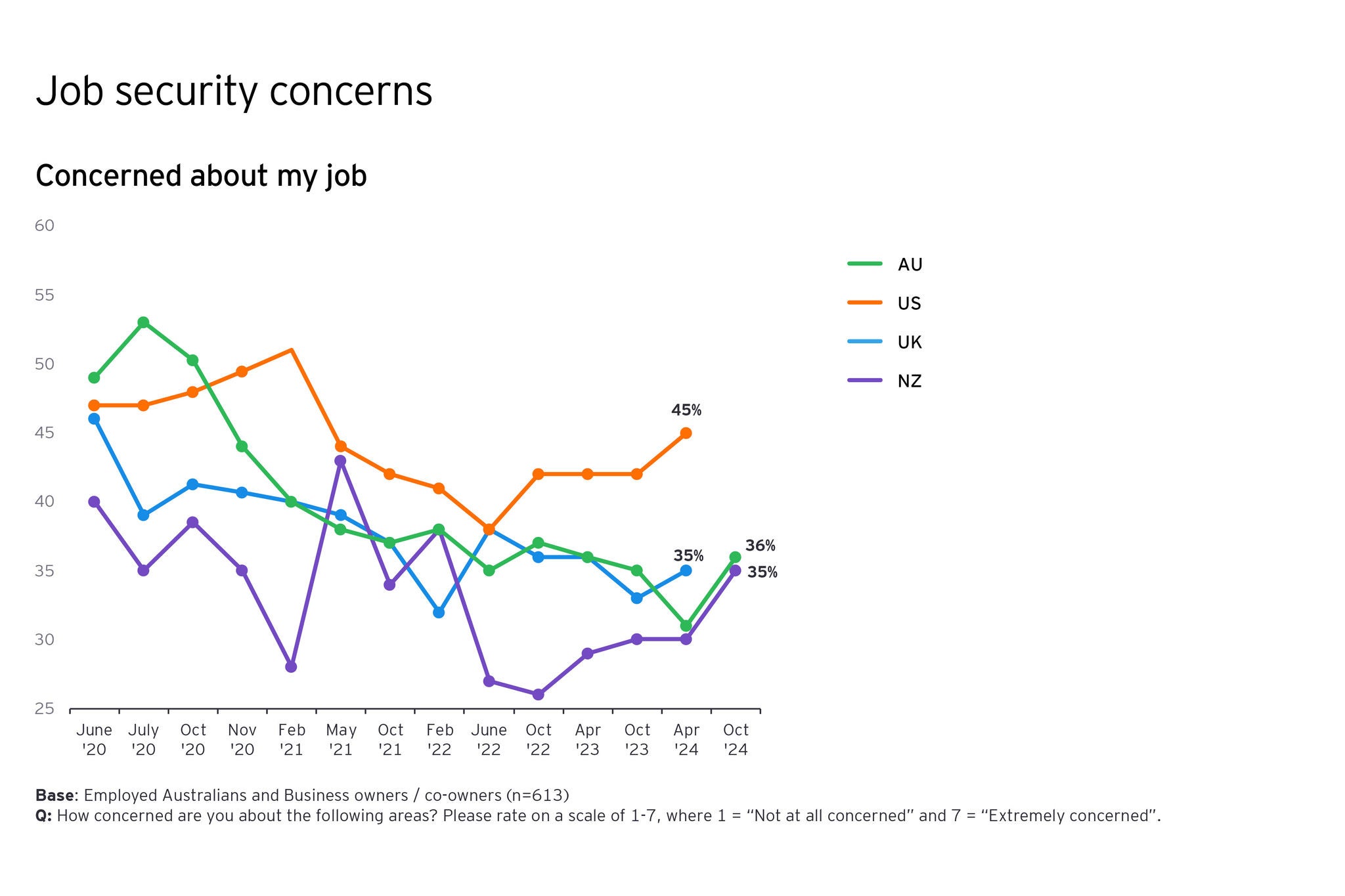

Now that we’ve covered the some of the different angles on consumer sentiment in Australia, we can look at the unpredictable factors – the wildcards – that could influence confidence and spending habits in the months ahead. These wildcards have the potential to tip the balance either way and understanding them is crucial for consumer-facing organisations as they navigate the path forward.

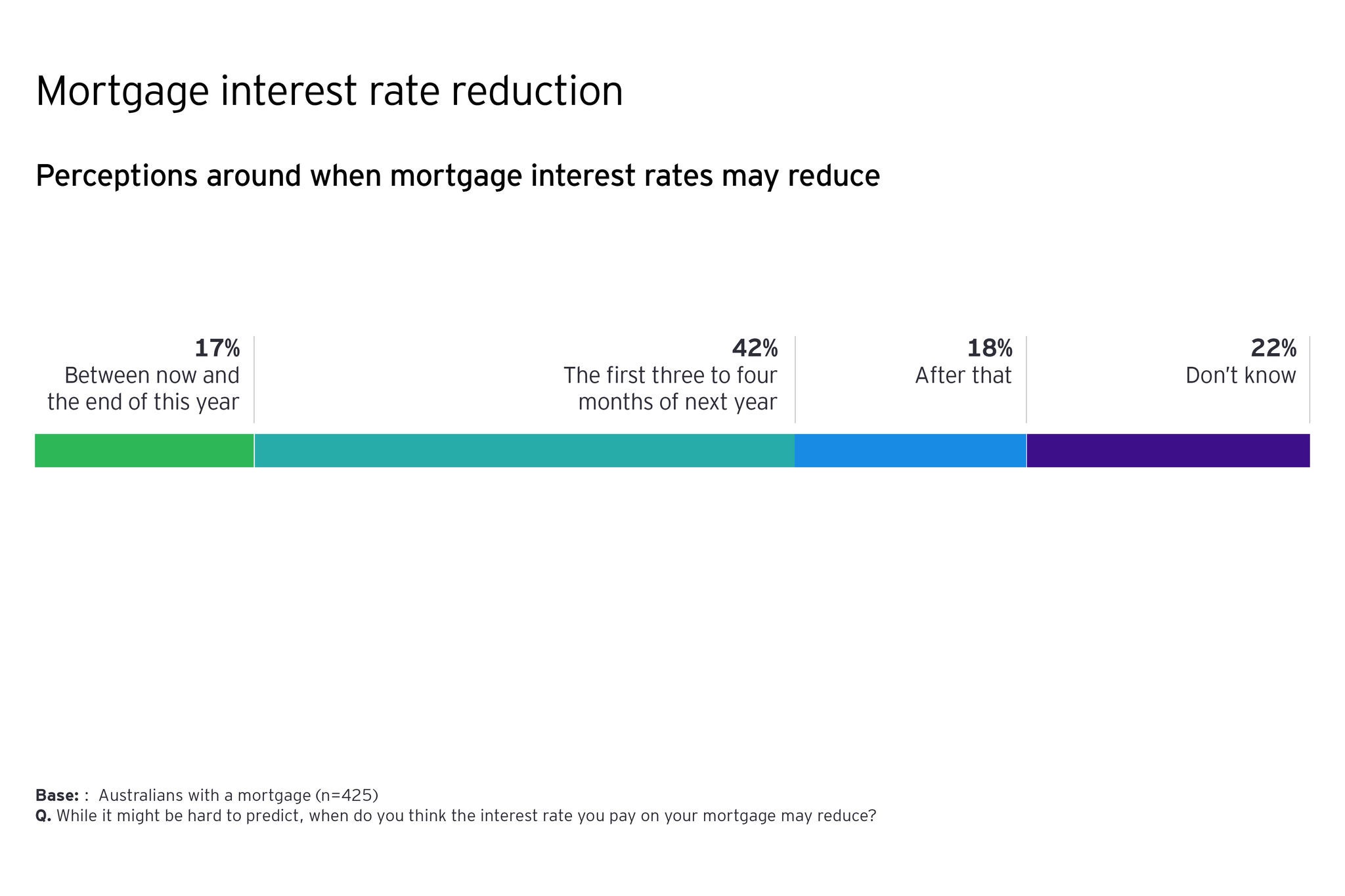

Wildcard #1: Interest rate cuts

A major variable for Australian consumers is the Reserve Bank’s cash rate, which influences borrowing costs and savings returns, and directly impacts the disposable income of households with mortgages. Beyond the economic ripple effects on consumer spending, investment, inflation and the rental market, the cash rate carries significant emotional weight in Australia.

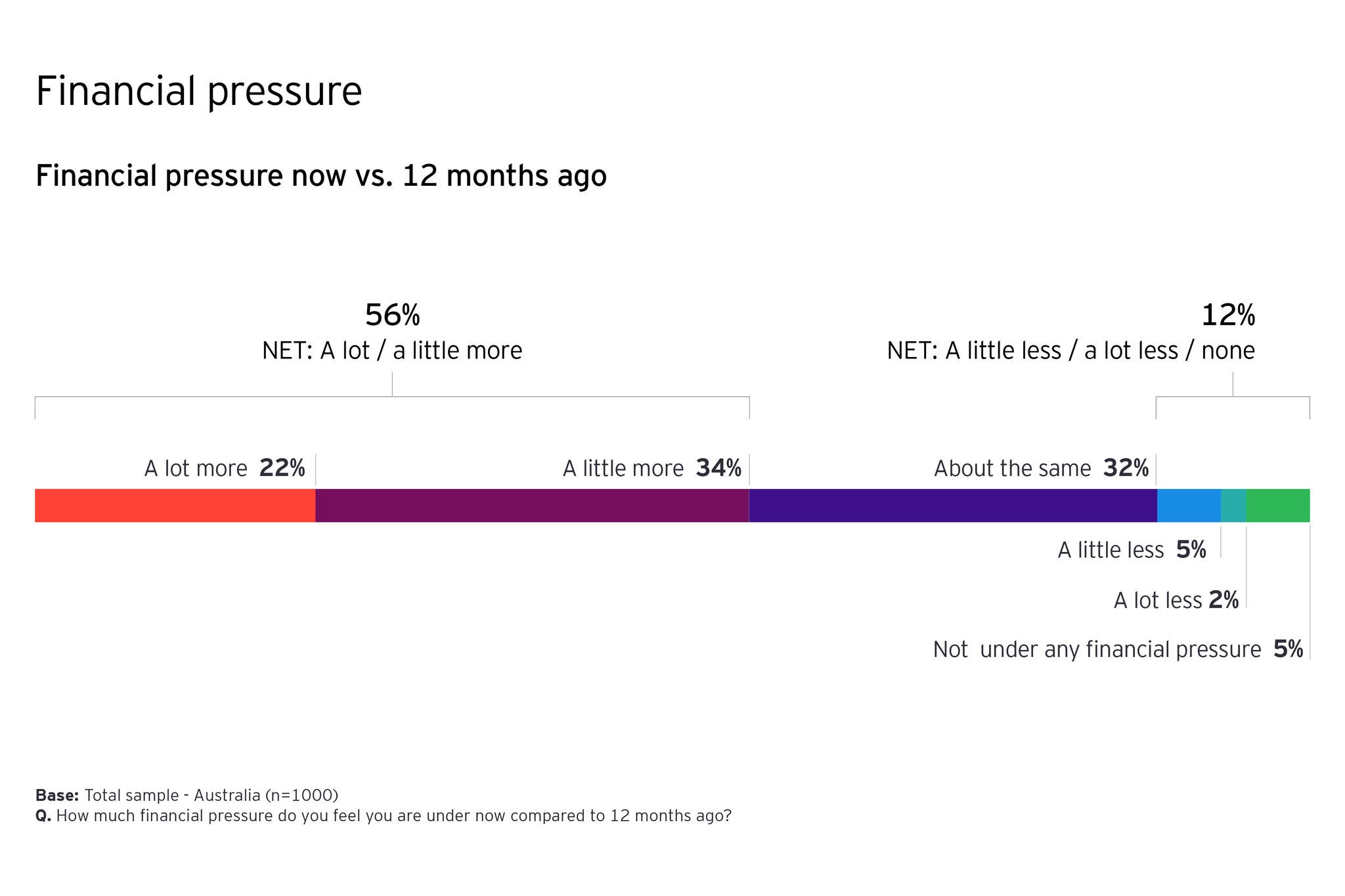

Our data underscores the cumulative pressure bearing down on households with mortgages. Across the six areas of mortgage stress we track, we have seen a noticeable uplift over the past 12 months. Close to a third (32%) of Australian mortgage holders are worried they may be forced to sell their home due to high mortgage repayments and cumulative financial pressure.

According to the RBA2, housing loan arrears rates have increased steadily from low levels since late 2022. While arrears rates continue to hover at pre-pandemic levels, major banks expect them to increase.

Current cash rate forecasts from lead economists for December vary from 4.00% to 4.35%, and for March 2025 from 3.75% to 4.35%. Australians with a mortgage are reasonably bullish about what the coming months hold on the interest rates front, with 17% expecting a cut by the end of the year and a sizeable 42% anticipating a change in the first few months of 2025. While this is speculative, it holds significance for attitudes and it captures the expectation of consumers. A rate reduction would act as a powerful catalyst that redefines consumer behaviour across many categories.