EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY Studio+ helps organizations build differentiated experiences that adapt with customers and drive sustainable long-term value. Read more on studio.ey.com.

Read more

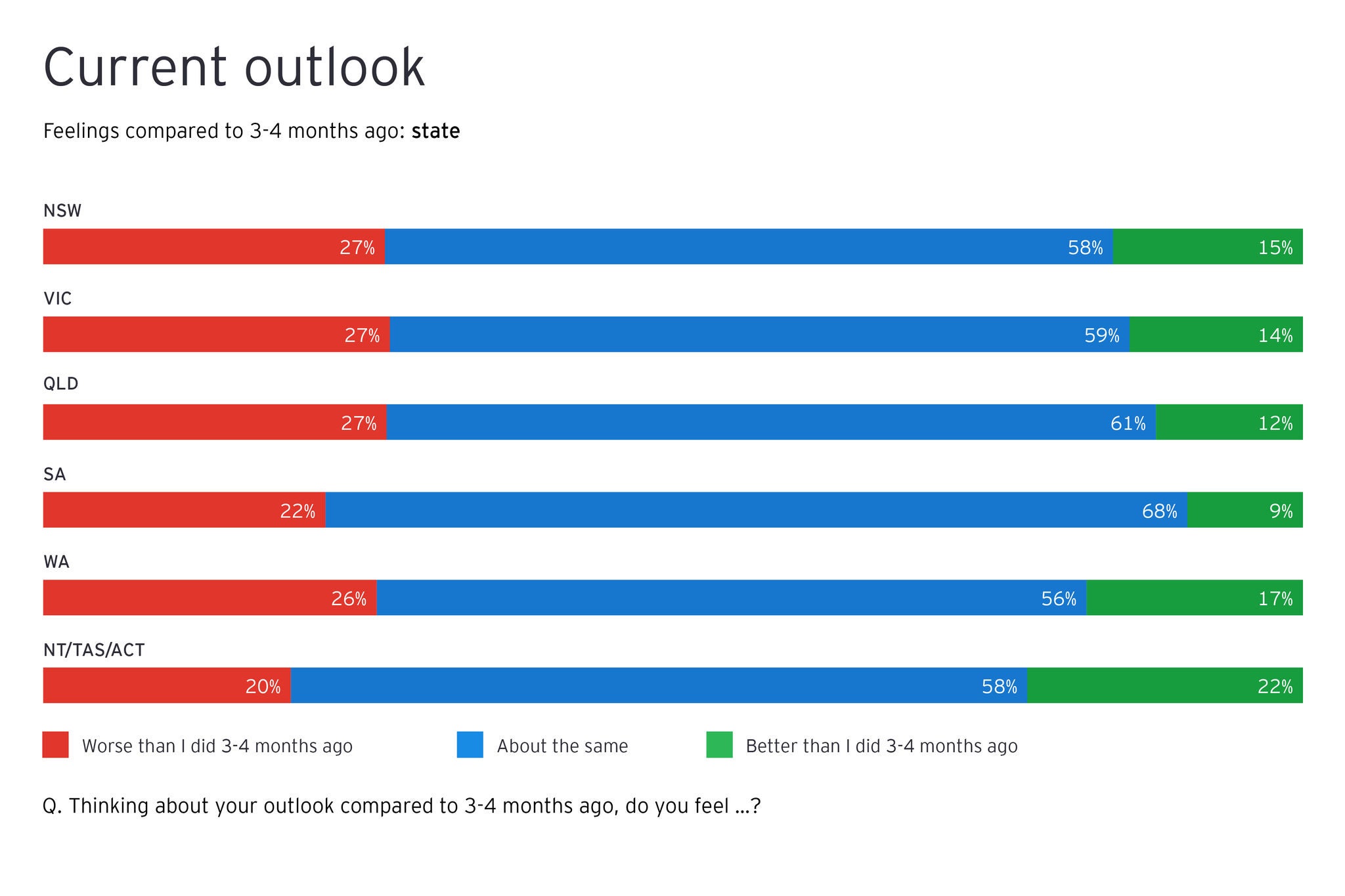

“It’s the vibe.” These words, immortalised by Dennis Denuto in the Australian cinematic classic The Castle, help explain why a stark one-quarter of Australian consumers feel worse than they did just three months ago, even though economic conditions have not markedly deteriorated.

Entrenched despondency and growing fatigue defines the mood and mindset for most, with Australians feeling like they are in a Groundhog Day holding pattern with little to be excited about anytime soon.

It is this elusive emotional ‘vibe’ of consumer sentiment – essentially how people feel about what is happening and what will play out – that Australian businesses must tune into if they are to successfully navigate the terrain ahead as the balance of 2024 unfolds and beyond.

EY has been capturing data on consumer sentiment and behaviours since 2020 in our EY Future Consumer Index. In our 14th wave of research, undertaken in March and April 2024, we surveyed 23,000 consumers across 30 countries, including 1,000 in Australia.