EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The eighth EY FinTech Australia Census finds the sector needing new focus to continue to drive economic growth and remain a world leader.

In brief:

- After a decade of being a focused government priority, Australia’s fintech sector is demonstrating growing maturity and record-breaking success.

- But limited local capital, complex regulatory hurdles and overseas direct investment strategies are tempting success stories to focus their efforts offshore.

- Modern digital regulation and reinforced support for start-ups would allow Australia to establish itself as a home to fintechs of the future.

Download the EY FinTech Australia Census 2023 placemat

This year’s Census uncovers a crisis point for the funding of innovation in Australia. We need visionary investors and government focus to keep our brightest and best fintechs resident in Australia to power our nation’s economic vitality.

FinTech Australia has continued its successful collaboration with EY Australia to deliver this important piece of research. The Census remains the only detailed, industry-backed analysis of the Australian fintech industry, offering fine-grain detail about the industry’s increased maturity, with an impressive eight-year history of Australian fintech data and trends. Read on for an overview of the 2023 results.

Many of this year’s findings are some of the strongest the Census has ever seen in terms of the progress made by Australia’s vibrant fintech sector. This Census also underscores the evolution of the sector. Fintech is now essential to financial institutions, small businesses, the digital economy and Australian consumers alike. These innovative and disruptive companies are embracing new business models and technology to help improve financial services accessibility and literacy, better meet consumer expectations and solve other financial services challenges.

Among multiple innovative use cases, new fintech models are facilitating renters to access the housing market, changing how and when workers access their pay, managing and measuring diversity, equity and inclusion, improving money management and education, helping financial institutions to deliver new digital consumer services and even using banking data to track individual carbon footprints.

This is what a mature, innovative and successful fintech sector looks like.

Of the companies completing the 2023 Census, 90% have now been in business for three years or more, compared with 75% in 2022. The most common types of Australian fintech continue to be: payments, wallets and supply chain; lending; data analytics/information management/big data; business tools; and wealth and investment – the same top five as in 2022.

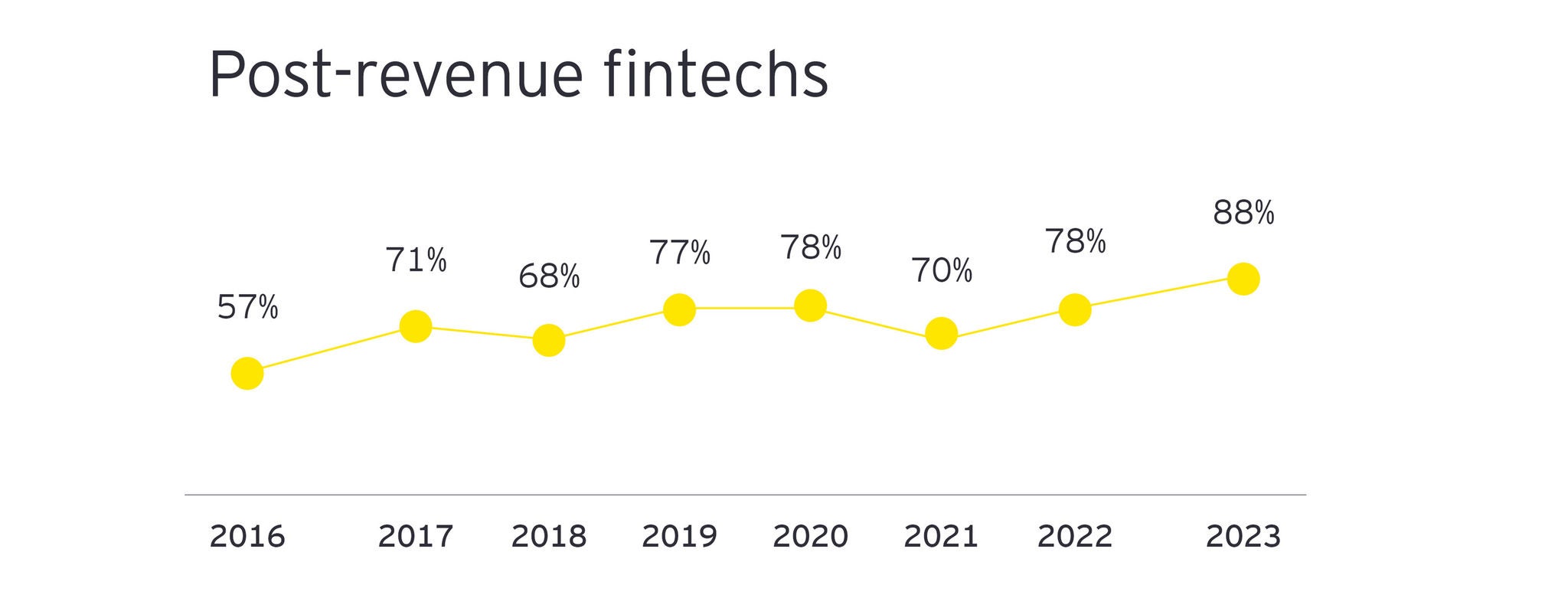

A massive 88% of our Census participants report that they are post-revenue – the highest proportion recorded since the study’s inception, up from 78% in 2022. The Census reveals 43% of fintech companies are now turning a profit, compared with 30% in the previous year. Not surprisingly, business valuations are continuing to travel in the right direction. The proportion of fintechs valued at more than $1b increased in the last 12 months, at 13% compared with 7% in 2022.

Interestingly, after increasing year-on-year since 2019, the number of paying customers among post-revenue fintechs has fallen over the last year. Thirty-five per cent of fintechs report more than 500 customers, compared with 45% last year. Given the uptick in profitability against an increasingly competitive and challenging consumer environment, qualitative research shows that mature fintechs are doubling down on marque accounts, enhancing pricing and services, and streamlining staffing models to improve profitability and revenue, how customers are served, and the efficiency of interactions, transactions and inclusiveness.

However, these positive findings are tempered by the fact that the EY FinTech Australia Census found significantly fewer younger companies in the fintech ecosystem. Just 3% are one year or younger, compared with 10% in 2022. This either suggests that start-ups are finding significantly higher barriers to entry than 12 months ago or that our sample has an overly high concentration of mature firms, which are more likely to be post-profit and post-revenue. Either way, we need to dig beneath the rosy topline picture from the Census results to get a clearer picture of the sector’s likely trajectory in the next year.

Chapter 1

Capital raising barriers and pressure

As fintechs focus on expanding cash runway, they are working to reduce costs and reinvesting for strategic advantage.

Positively, the last 12 months has seen consistency in capital raising across the fintech sector. This is impressive given the more challenging capital raising environment. Similar to last year, of those who have raised capital, 46% have raised more than $10m to date – mainly fintechs established for longer than three years.

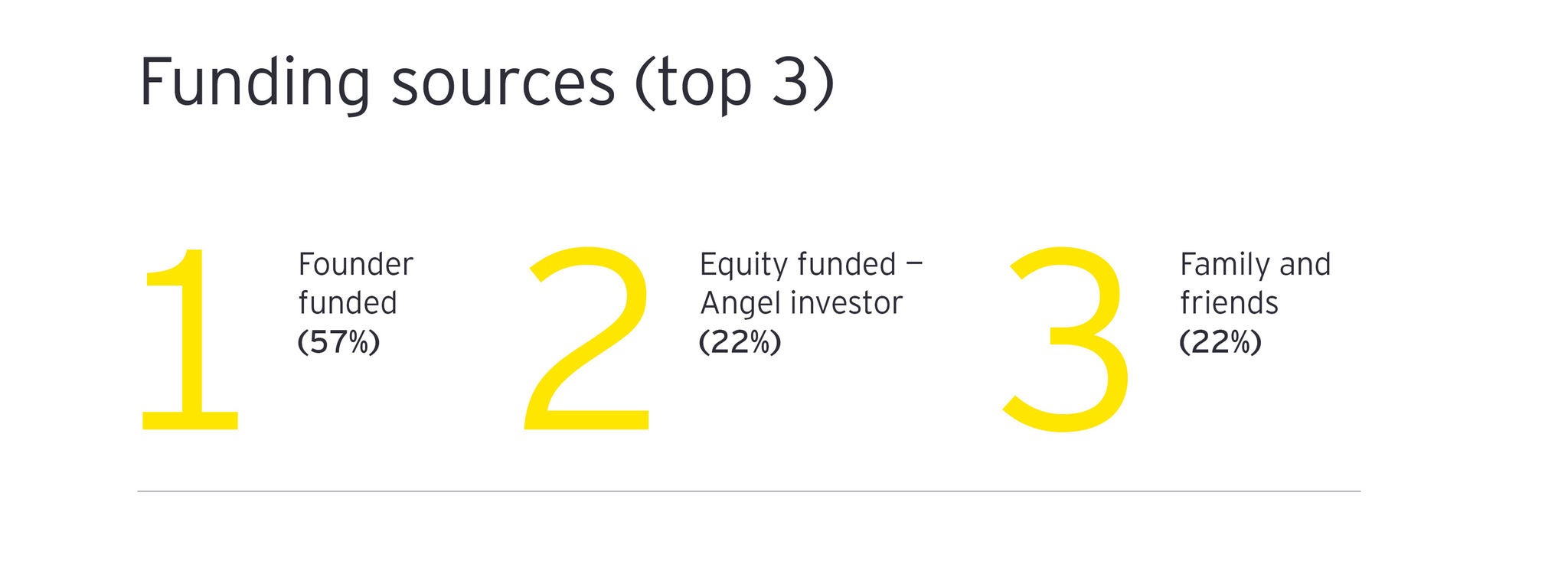

However, even though the amounts raised in the sector have remained consistent, the biggest indicator of tension in the sector comes from Census data showing this year’s capital raising is falling well short of company needs and ambitions. In 2022, 29% of fintechs said they had not met their capital raising expectations. This year, that figure surged to 41% – a level not seen since 2020. The proportion of companies equity funded through an angel investor fell this year, to 22%, compared with 30% in 2022, and closer to what was seen in 2021 (25%).

According to 2023 Census data, the big barriers to capital raising are the challenges of finding the right investors in Australia and macro-environmental factors. As traditional funding channels dry up in areas that saw strong interest during 2021/22, local fintechs are turning to other sources of non-diluted capital, including R&D incentives, crowd or non-bank debt financing – including from other fintechs.

As a result, fintechs are increasingly relying on founder funding. In 2021 and 2022, 50% of Australian fintechs were still using founder funding. This year, 57% of founders in the most mature Census cohort ever are dipping into their own funds to meet companies' goals.

This 2023 uptick in founder funding is a telling trend, reflecting a growing struggle to find early-stage investors. Notably, three in four (75%) fintechs in 2023 agree that investors are risk averse when it comes to supporting fintech companies. The perception is that local investors are unwilling to take on the risk required to develop and commercialise truly ground-breaking products or disruptive technology and services.

The Census data reveals a two-speed economy for fintechs, with early-stage start-ups struggling more than mature companies. Fintechs are focused on extending runways to maintain the status quo or support growth plans. Census participants rate raising equity capital as their biggest challenge over the next 12 months. Mentioned by 61% of respondents, fintechs are far more worried about this critical stumbling block than the uncertain economic climate (at 47%).

To extend their runways in an environment of rising costs, regardless of growth stage, more fintechs have become focused on operational efficiency and prioritising core business. But they are still laser-focused on growth, investing savings in growth areas that will deliver strategic advantage. In the next 12 months, fintechs are planning more investment in artificial intelligence and machine learning (85%), cybersecurity (77%), APIs (74%), cloud systems (61%), and mobile and internet applications (57%) than in the past 12 months.

With investors taking a more cautious approach and deals taking longer, Australia is running the risk that ambitious founders will come to the end of their own reserves. Their next moves may be to seek out visionary investors or foreign direct investment routes in other countries, move offshore or, worse, collapse.

The challenging investor landscape suggests an urgent need for more partnerships and collaboration between fintechs, large financial institutions and government. It also foreshadows a wave of mergers and acquisitions, consolidation and more partnerships on the horizon as competing or complimentary fintech companies, traditional banks and financial institutions look to strategic deals to achieve scale, diversify and remain competitive.

Chapter 2

Finding the path to resilience

Concerns over the local fintech environment as other countries offer increasingly attractive investment incentives.

Australia’s fintechs are strong and durable, but they need more support in the current challenging environment. In 2022, 59% agreed with the statement, the ‘Australian fintech environment is conducive to growth’. This year, that percentage fell to 50%.

The 2023 Census also demonstrates more pessimism about global competitiveness. Although 69% agree that ‘Australian fintech companies will be able to compete internationally’, just half (49%) believe ‘Australian fintechs will be able to win against international fintechs’, compared with 57% in 2022.

It's an interesting data insight given half of the companies in the sector (50%) are now generating revenue outside of Australia, compared with 40% in 2022. This is a positive sign that, in the last 12 months, Australian fintechs have proved sufficiently strong and mature to successfully go global, despite a challenging economic environment. A sign that trade and investment programs are succeeding at encouraging fintechs to expand offshore.

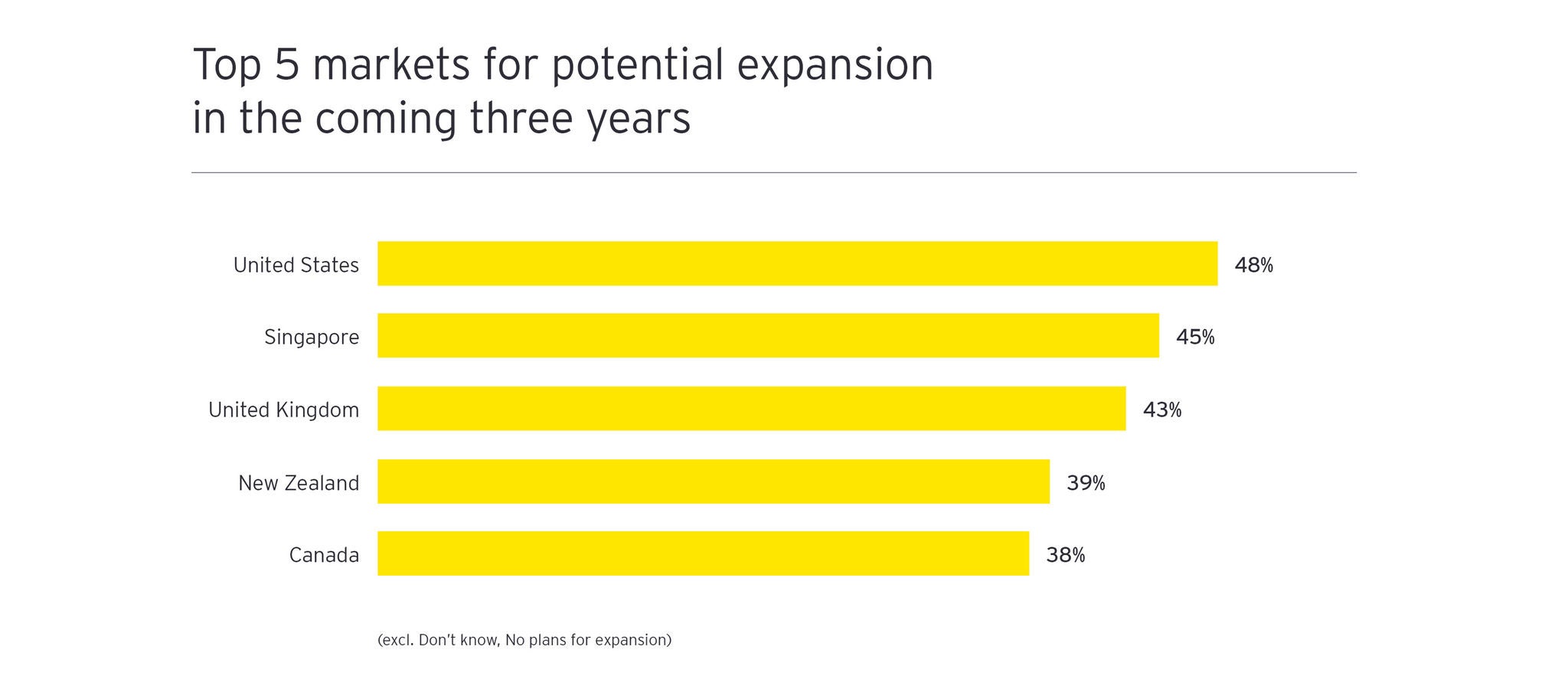

Destination global markets are also shifting. This year, Singapore – with its innovation hubs and the world’s largest fintech festival – has entered the top three markets fintechs are considering for expansion, beaten only by the United States. The United Kingdom and New Zealand are receiving less consideration compared to prior years.

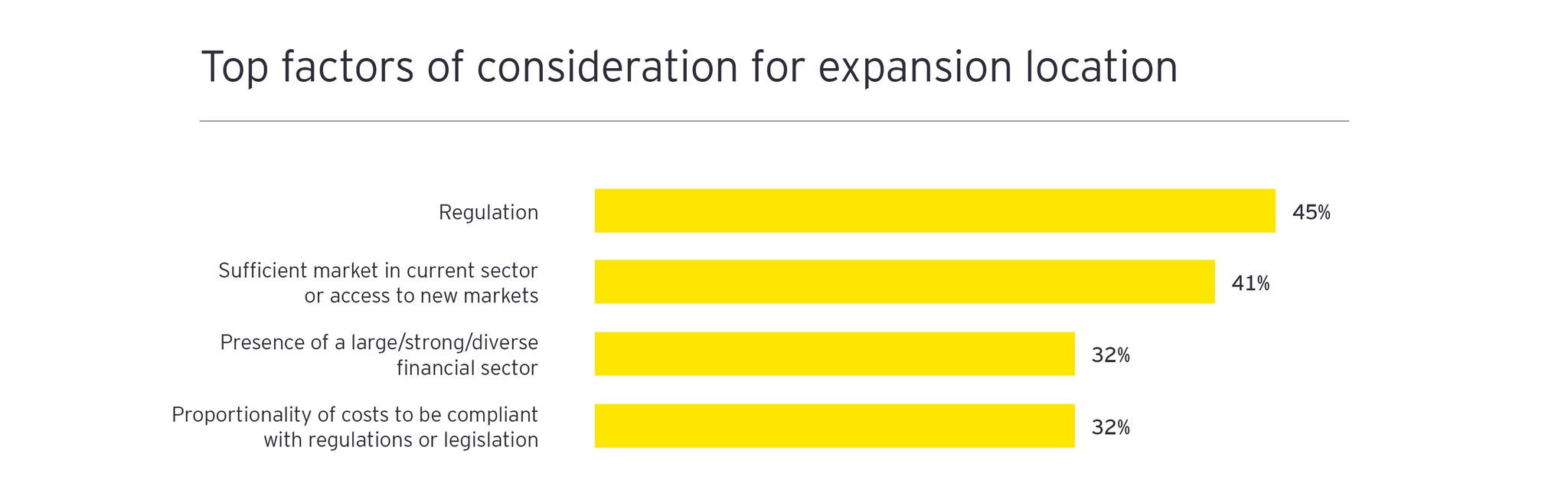

In light of anecdotal evidence suggesting successful founders are looking at alternative geographies for their headquarters, this year’s Census introduced a new question asking what determines a fintech’s country of residence. The top factors of importance when determining where to grow a fintech business are regulation, size of market, financial sector strength and the cost of compliance.

These are important elements for policy makers to consider, given Australia’s productivity and prosperity depends on our nation being a great place to start and grow a business.

Regulatory complexity is not new to the financial sector, but it continues to be a barrier to entry and growth for many early-stage companies. It’s also the top factor fintechs consider when determining a country of residence to grow a business.

Fortunately, a raft of reforms across payments, licensing, cryptocurrency and the Consumer Data Right are on the horizon. Reforms will make it easier for Australia’s maturing and important fintech ecosystem to grow by reducing barriers to entry, promoting positive competition, maintaining contemporary, secure and stable regulations, and ensuring financial services regulation keeps pace with global best practice, while also balancing innovation with consumer protection.

In an uncertain market, government also has a role to play as a multiplier, using incentives and grants to expand and attract domestic and foreign investments. Offering globally competitive incentives and maintaining contemporary, secure and stable regulations will build on our strong foundations as an important regional financial centre.

Over the past few decades, the fintech sector has built a strong track record of innovation, transformation and growth. But whether this continues will depend on immediate changes to make Australia a more attractive environment to start and grow a business. After a decade of investment in fintech success, we cannot let this important growth sector fall behind other global financial hubs just as it is about to move to the next level.

Malia Forner

Government & Investment Incentives Partner at EY Australia and EY Oceania Fintech Leader

Chapter 3

Canary in the productivity coalmine?

The intense difficulty in finding technical skills is easing, but sales roles are harder to fill as the sector prioritises profitability.

Despite experiencing fewer hiring hurdles in 2023, fintechs are still battling to fill certain roles locally. Attracting engineering and software talent is proving somewhat easier than a year ago. But fintechs are finding it harder to attract people into sales roles, perhaps indicating a greater focus on profitability and cash burn rate protection. Interestingly, 34% of fintechs say that they have had no challenges in attracting talent - the highest rate since the Census asked this question.

This Census reveals that fintech companies are strongly leaning into the changed work trends. Many see other companies reducing head count as an opportunity to attract and retain talent, with flexible working considered important to reduce churn and improve wellbeing. The vast majority (81%) of fintechs support hybrid working. One in two (45%) support full remote working, with 36% supporting it domestically and a similar proportion (35%) supporting it globally. Only 5% support only office-based work.

At the same time, there are mixed views in the sector on the effectiveness of hybrid and remote work. In places, concerns are being raised about how remote working impacts workforce culture, with some fintechs saying that productivity is travelling in the wrong direction. Of the businesses supporting remote working arrangements, half (50%) believe it creates a positive impact on culture, a quarter (25%) see a negative impact and the remaining quarter (25%) don’t believe it affects culture either way.

The productivity issue may be compounded by reduced collaboration opportunities, especially given the reduction in state-based co-working hubs where many early-stage companies co-locate. Australia needs co-working spaces and collaboration friendly workspaces that can be a hub for social connection, innovation, team building and cultural experience, to organically bring together diverse experts, investors, advisors, mentors and other collaborators, supported by government funding. This is important to maintain, expand and attract growth.

This new reality of work is one that highlights the need for agility and intention. The EY Work Reimagined Survey shows that for knowledge workers, like those employed by fintechs, work flexibility is a baseline expectation, with more than a third wanting to be fully remote. Businesses should assess which roles can be most efficiently done remotely and build touchpoints, technologies and processes to customise hybrid work, learning and culture for this new normal.

Chapter 4

DEI and ESG focus wanes

In a challenging environment, fintechs are paying less attention to improving DEI and ESG implementations are stalling.

The challenging environment is compelling many leaders to focus more sharply on near-term performance rather than long-term ESG and DEI investment. These areas will continue to gain importance. There is a major risk for companies that don’t pursue a sustainable and equitable path.

Malia Forner

Government & Investment Incentives Partner at EY Australia and EY Oceania Fintech Leader

The fintech industry – and its financiers – need to continue to move the needle on diversity. The 2023 EY FinTech Australia Census found fewer fintechs focused on diversity, equity and inclusion (DEI). A marginal growth in representation of females in leadership positions (31% vs. 28% in 2022) and as founders (29% vs. 28% in 2022) was offset by a decrease in broader female representation within the sector (32% vs. 34% in 2022). Culturally and linguistically diverse (CALD) participation in the industry also dropped this year. The average proportion of employees identifying as CALD fell (20% vs. 28% in 2022) as did the average proportion of leadership positions held by CALD employees (16% vs. 21% in 2022). We expect the positive reform in Australia’s skilled migration program, which will be implemented in 2024, will help to increase fintech’s CALD labour force.

Although diversity has improved markedly since the first years of the Census, the sector has work to do to achieve appropriate and value-creating diversity. DEI will continue to gain importance for government, customers, the media and employees. Companies must not only maintain but improve DEI to retain their social license to operate.

The EY Innovate Finance fintech report, From glass ceiling to open doors: championing equality and career progression for women in FinTech, suggests ideas that would also be helpful in Australia.

Despite increasingly robust regulatory requirements for environmental and social governance (ESG) disclosures, the Census findings also suggest that ESG prioritisation has dwindled as near-term performance takes up more of a fintech leader’s bandwidth.

The Census recorded a small increase in the proportion of fintechs that deem themselves to be a ‘green fintech’ (10% vs. 6% in 2022). But broader ESG focus in the sector is stalling or going backwards. In 2022, 30% of fintechs were measuring their own sustainability or carbon footprint. This year, that figure fell to 25%. In line with last year, one in five has a sustainability goal (22%), one in four (24%) has implemented sustainable business practices and one in three (35%) supports the use or purchase of carbon credits.

The challenging environment also appears to be leading fintechs to focus less on sustainable business practices. Of the fintechs yet to identify a sustainability goal or implement sustainable business practices, a decreased proportion (36% vs. 46% in 2022) intend to do so in the next 12-24 months. The remaining businesses (32%) are unsure.

This lack of ESG focus may also be due to fintechs correctly reading the short-term sentiment in the room. The 2023 EY Future Consumer Index found that, while consumers who prioritise the planet are gaining ground, affordability remains the leading consumer priority in markets like Australia and the US. To this point, seven in ten (69%) of the fintechs surveyed say customers rarely or never ask about their sustainability metrics or policies – and 77% say the same about current or prospective employees.

However, it would be a mistake for fintechs to engage in ‘green waiting’ until stakeholder pressure builds. Fintechs do not yet have the mandatory ESG disclosures required of banks. But if they are third- or even fourth-parties in the banking ecosystem, they will soon need robust sustainability disclosure capabilities. Operating in a sustainably responsible way will also be important to attract the Millennials and Generation Z who make up a large proportion of the current and future local fintech workforce and customer base.

Banks are already moving away from loans or investments in entities that are not managing climate risks appropriately and towards green finance. Fintechs should not just be moving in the same direction but doubling down to innovate in sustainability, which will be an increasingly important pillar of business success. This is a huge opportunity for fintechs to lead the way. Especially as larger financial institutions look to them for solutions.

Sufficiently supported, there is a real opportunity for Australian fintechs to lead the ESG charge. With increasingly granular and robust global regulation coming online that directly speaks to financial information, fintechs could help financial institutions deal with their data, processing, controls and reporting needs. Banks in particular are looking for solutions for the ESG agenda, carbon and climate focus.

Chapter 5

How to sustain a world-class fintech export sector

Maintaining the sector’s globally competitive trajectory and keeping rising stars onshore will require a continuation of incentives, stimulus and cash grants.

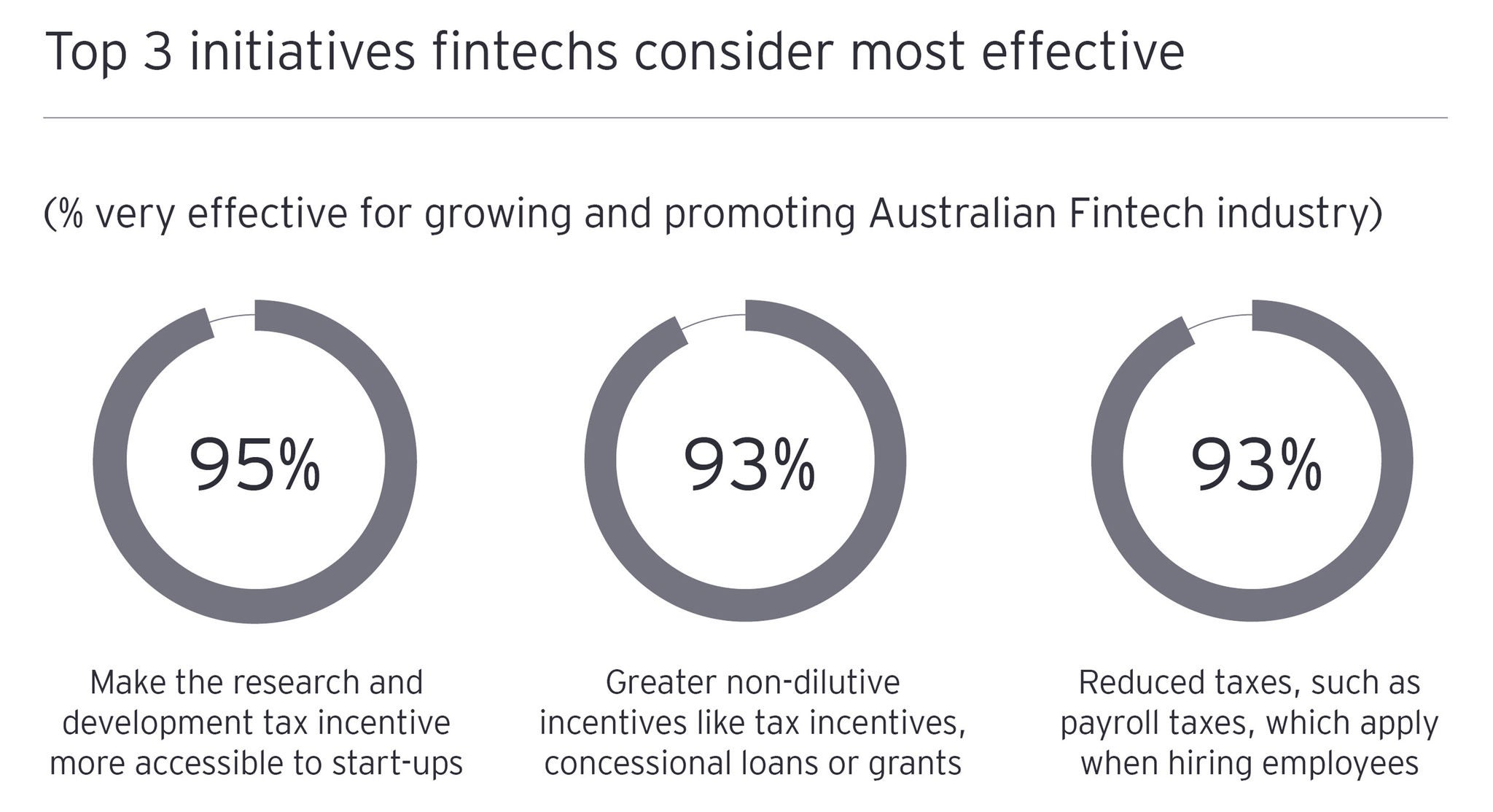

The Census points the way to how government can support the sector, reporting a greater effectiveness of government-driven growth initiatives compared to 2022. The number of fintechs successfully applying for the R&D tax incentive increased from 43% to 52%. Four in five (78% vs. 72% in 2022) believe that the incentive increases the likelihood of keeping business in Australia. Similarly, a strengthened majority (85% vs. 79% in 2022) of surveyed fintechs say that the R&D tax incentive improves the sustainability or growth of their businesses.

When asked about additional government levers to increase Australian R&D, fintechs are most supportive of improved clarity and guidance of software R&D for the R&D tax incentive, followed by lower tax rates for income attributable to Australian IP/technology/patents, and tax support for collaboration with universities and publicly funded research organisations.

A critical inflexion point

Australian fintech funding ended the Q1 2023 quarter at $226m, the lowest reported in the past five years1. According to FinTech Australia General Manager, Rehan D'Almeida, the ecosystem has reached a critical inflexion point from which it will either spring up or spiral down. “When the really resilient fintechs come out of this, they will either fail, shift headquarters to a different country or lead Australia to stable digital growth success,” he said.

The ecosystem has reached a critical inflexion point from which it will either spring up or spiral down. When the resilient fintechs come out of this, they will either shift headquarters to a different country or lead Australia to stable digital growth success.

As the RBA noted in its September 2023 bulletin, weak business investment is a contributing factor to below-trend labour productivity growth2. It should be a government priority to close the funding gap to ensure fintech capabilities are there to support value creation across the economy in a potentially recessionary environment.

According to the EY CEO Outlook Pulse – January 2023 (pdf) findings, 98% of global CEOs expect an economic downturn, with 55% believing that a downturn could be worse than the global financial crisis in 2008. In this environment, 96% of CEOs intend to continue their digital and technology transformations to boost growth.

EY Oceania Fintech Leader, Malia Forner, points out that embedded finance and other fintech trends are essential components of the digital commercial infrastructure required to support this transformation. “A vibrant and innovative fintech sector will be critical to support the next stage of growth in Australia’s financial and non-financial sectors. With 57% of fintechs in 2023 saying they are still in growth stage, the case is strong for concerted action to support the sector,” she said.

A vibrant and innovative fintech sector will be critical to support the next stage of growth in Australia’s financial and non-financial sectors. With 57% of fintechs in 2023 saying they are still in growth stage, the case is strong for concerted action to support the sector.

Malia Forner

Government & Investment Incentives Partner at EY Australia and EY Oceania Fintech Leader

Two in five (41%) Australian fintechs not meeting their capital raising expectations is a cause for concern. Early-stage companies vying to establish new business models, products and services are particularly vulnerable to the current inflationary environment and choppy macroeconomic conditions. If we want Australia to have the flourishing fintech sector needed to support growth in a digital economy, we must address the ecosystem’s current issues, build on the solid groundwork made over the past decade and not lose momentum.

Summary

Australia’s fintech sector is demonstrating growing maturity and record-breaking success. But limited local capital, complex regulatory hurdles and overseas direct investment strategies are increasingly tempting local success stories to focus their efforts offshore. Given the critical role of fintech in supporting the growth of Australia’s digital economy, the sector needs ongoing support in the form of globally competitive incentive models, streamlined regulation and continued trade and investment programs.

Thank you to everyone who contributed to the 2023 EY FinTech Australia Census, helping to build this vital dataset for our vibrant Australian fintech ecosystem.