EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Female appointments to European financial services boardrooms fell year-on-year in 2023

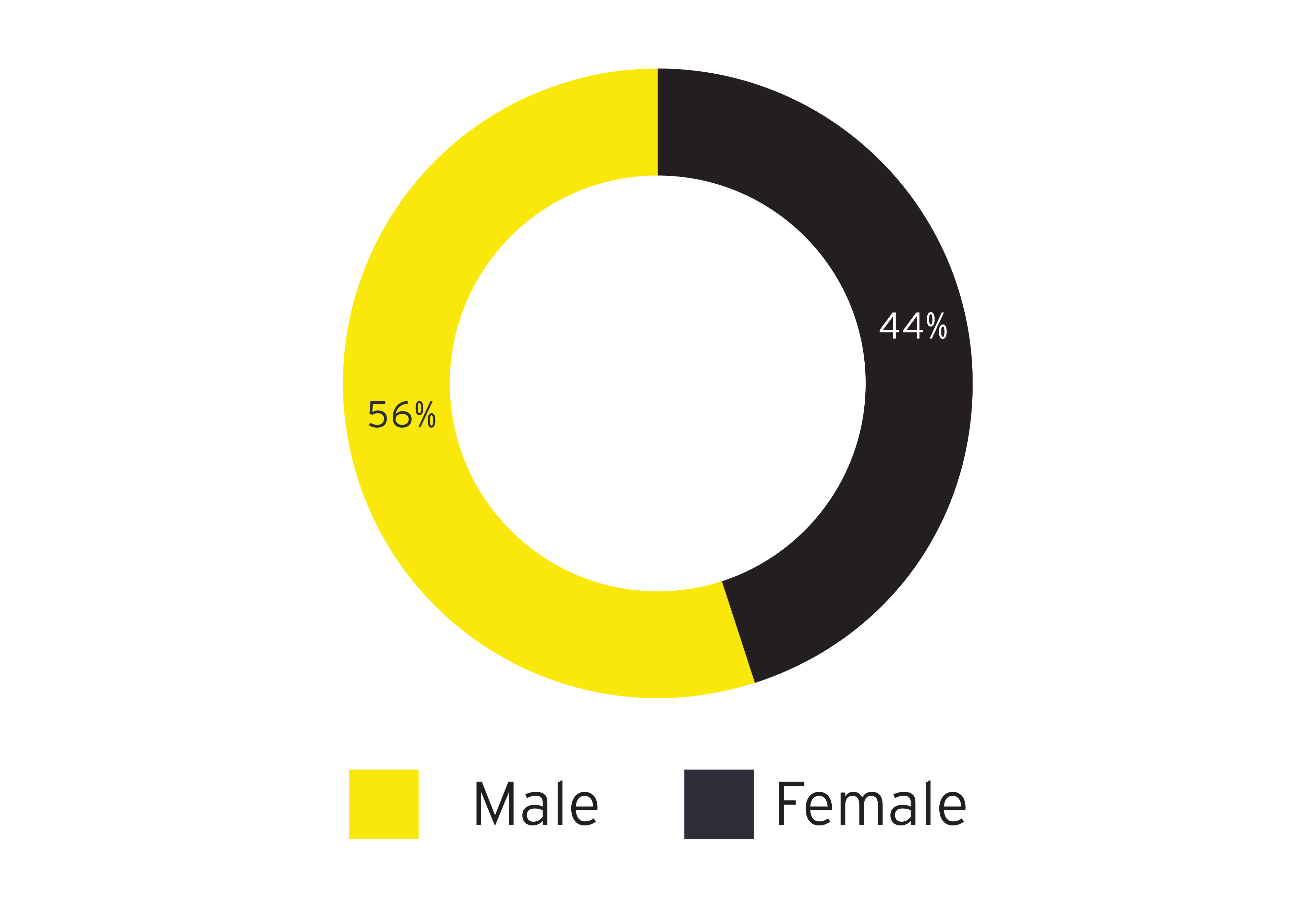

- Gender split: 44% of European financial services directors appointed in 2023 were female, down from 51% in 2022

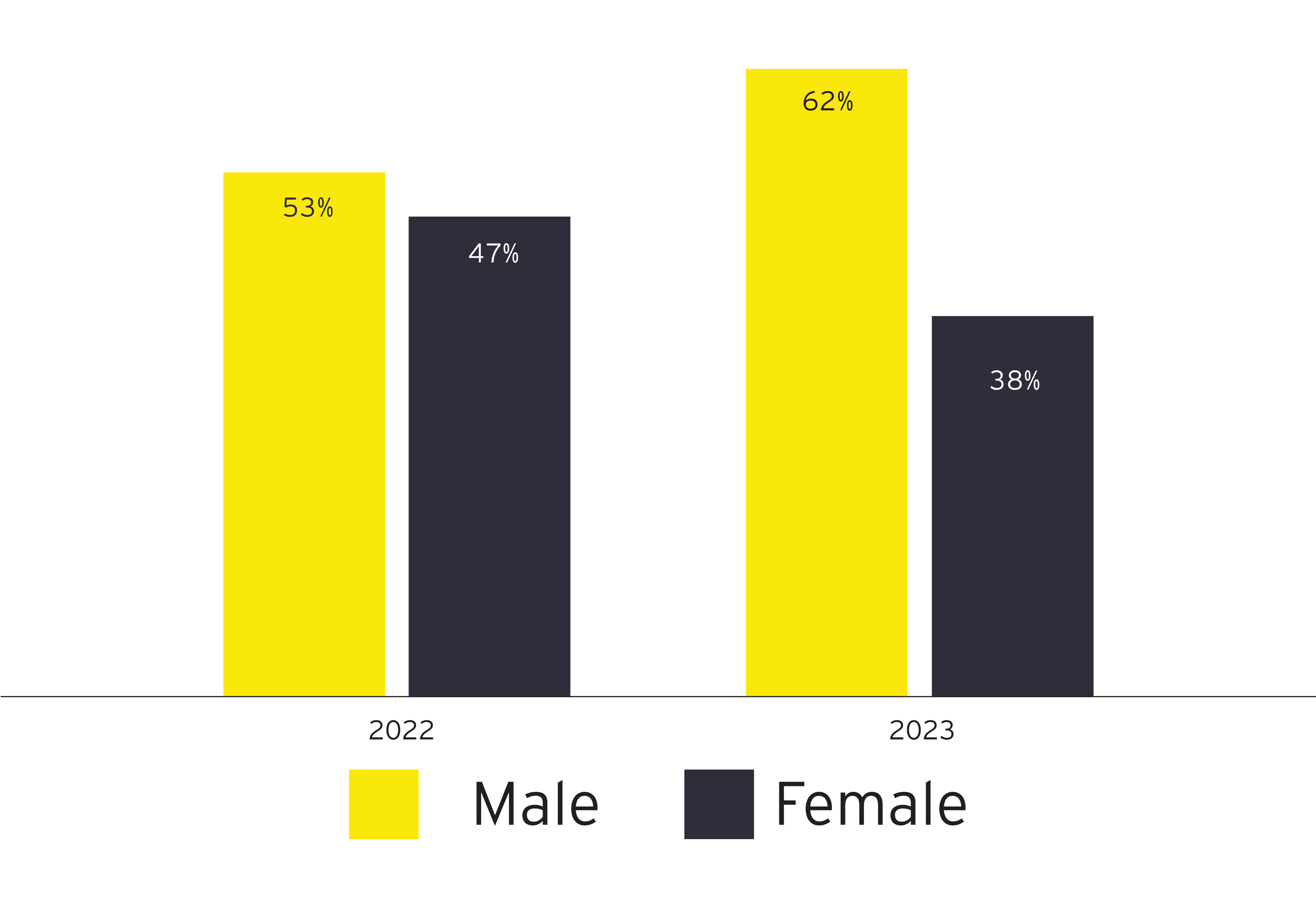

- C-suite experience: 59% of all directors appointed in 2023 brought C-suite experience, but just 38% were female, down from 47% in 2022

- Female representation: 31% of firms still report under 40% female board representation, with women holding the most senior board positions* at just 29% of firms

- Most in-demand experience: 36% of all directors appointed in the past year brought political experience to the boardroom, down from 41% in 2022; 27% brought tech experience, up from 22%; and 22% brought ESG / sustainability skills / experience, down from 23%

Appointments of female board directors to Europe’s largest financial services firms declined seven percentage points year-on-year, according to the latest EY European Financial Services Boardroom Monitor, which reports that 44% of all appointments last year were of women, down from 51% in 2022.

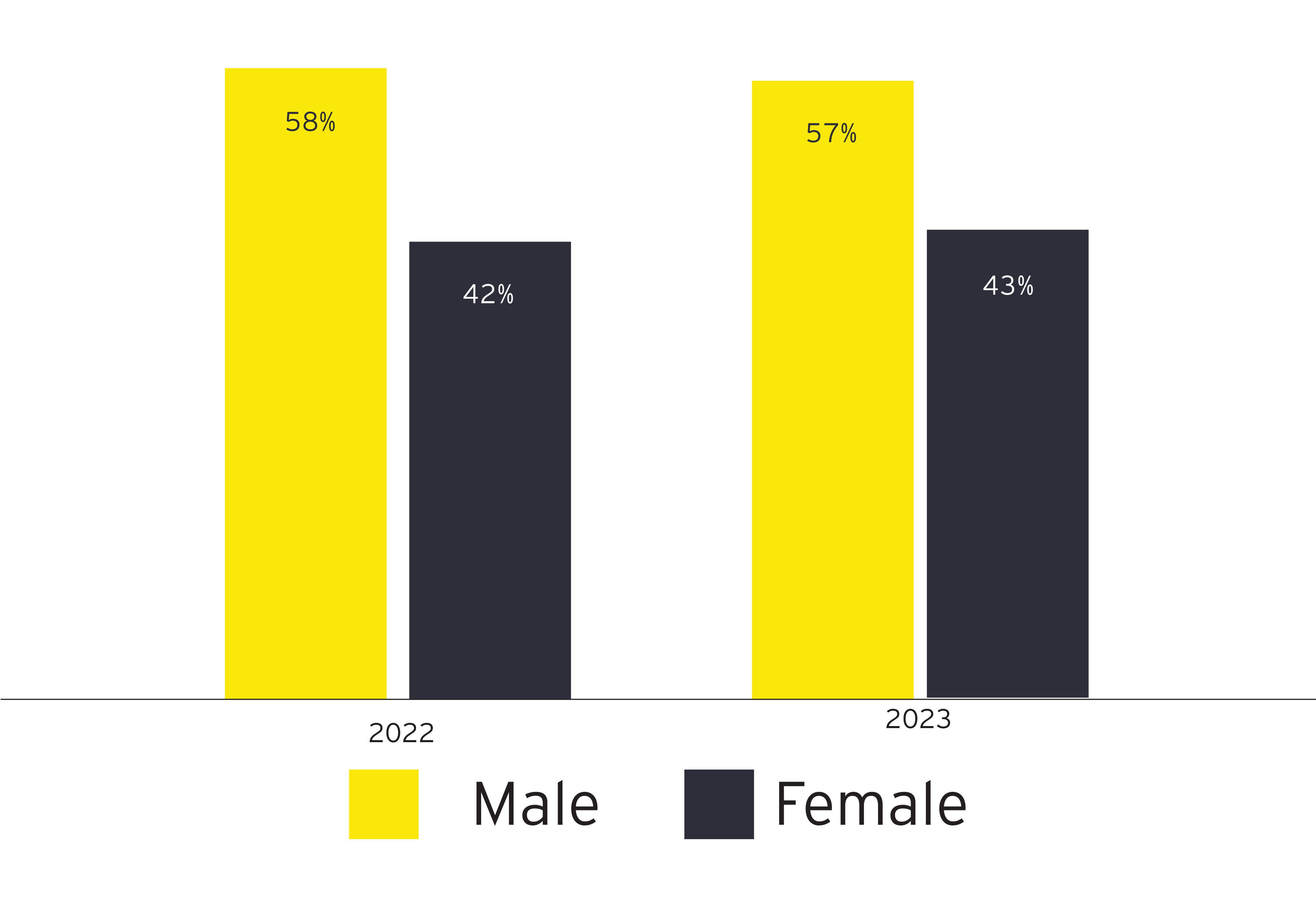

While all European financial services firms monitored have female representation at boardroom level, the current gender split across all firms stands at 57% male and 43% female (down from 58:42 in 2022), and 31% of listed European financial services firms are still reporting under 40% female representation in their boardroom. This is below the level required by June 2026 to comply with the European Commission’s European Women on Boards Directive, which requires all companies in EU member states to meet a 40% female target for non-executive boards or 33% for all board members.

Gender split of European financial services boardrooms

Appointments of new directors in 2023 by gender

The EY Boardroom Monitor charts the profile, experience, training and skillsets of board directors across the MSCI European Financials Index. The data is supplemented with a sentiment survey of 300 European financial services investors, where 82% of respondents state that boardroom gender diversity has a significant influence on their decision to invest.

C-suite experience in demand on European boards

C-suite experience was the top criteria for new board director recruitment in 2023 – for the second year running – with 59% of appointments during the year bringing current or past executive management team experience. However, of directors with c-suite experience appointed this year, just 38% were female, down from 47% in 2022.

Director appointments in 2023 that bring c-suite experience, by gender

Across European financial services boardrooms, female directors remain significantly less likely than their male counterparts to have the experience of C-suite role or hold a senior board position. Just over half (51%) of female directors have the experience of an executive management team role, while 64% of male directors have similar experience. Across the population of directors tracked, senior board positions (defined under the FCA’s proposed changes to UK Listing Rules (pdf) as Chair, Chief Executive Officer, Senior Independent Director or Chief Financial Officer) are held by women at only 29% of listed European financial firms.

Omar Ali, EY EMEIA Financial Services Managing Partner, comments: “Building a diverse board with the requisite experience to steer large financial firms in the current volatile environment is complex. Given this context, the demand for c-suite experience in the recruitment of new directors is understandable and to be expected. It should not, however, come at the cost of better balancing gender representation across Europe’s financial boardrooms and undo much of the excellent progress of the past few years. Recruitment of new board directors should encourage new skills and expertise entering the boardroom. It has been evidenced time and again that boardroom diversity is a driver of outperformance.

“Of course, increasing appointments of female directors with C-suite experience can only take place if there is a strong talent pool and a growing pipeline. Positively, the 40% gender diversity threshold under the European directive should help to galvanise firms' efforts to recognize and nurture female talent throughout career paths – not just towards directorships, but at all levels. The 40% level of female representation at board level is a minimum to build from, not a level to work towards.”

Boardroom skills in demand

Data from the EY Boardroom Monitor shows that 14% of European financial services board directors left their role in 2023, with new appointments lagging departures at 11%.

However, financial services firms have used new appointees to continue to deepen political, technology and sustainability skill sets and experiences on their boards. Of directors appointed in 2023, 36% bring political experience (down from 41% in 2022), 27% have professional experience in tech (up from 22% in 2022), and 22% have professional experience in sustainability or ESG (down from 23% in 2022).

New appointments are still more likely than existing directors to have sustainability, tech and political knowledge and experience. Across all board members, 15% have experience in sustainability, 18% have experience in tech, and 33% have political experience.

In the past year, a greater proportion of female directors have brought experience in tech (33%) and ESG (27%) relative to male peers, 23% of whom have tech experience and 18% have ESG or sustainability experience.

Omar Ali comments: “As global geopolitical dynamics continue to evolve, and technology and sustainability demands on firms grow ever more complex, bringing new skills and breadth of experience to the boardroom is a priority for financial services chairs across Europe. The need for tech and sustainability experience will only increase from here, but that does not mean there is any less need for directors with more traditional financial services boardroom skills. Structuring a board that is sufficiently broad in scope, but also has the depth and experience to respond to old, new and ongoing market challenges is a delicate balancing act with constantly moving goalposts.”

Quick data overview as at 31 December 2023

- Total number of firms tracked across Europe: 84

- Total number of European board directors monitored: 1014

- Total number of female board directors monitored: 432

- Total number of male board directors monitored: 582

- Total number of European board director exits in 2023: 146

- Total number of new European board directors in 2023: 110

Notes to editors:

- This is the fourth launch of the EY European Financial Services Boardroom Monitor, and data is current to 31st December 2023

- The EY European Financial Services Boardroom Monitor does not track the race and ethnicity of board members, as there is no standardized format for directors to disclose against

- This release incorporates a survey of 300 European and UK-based fund managers undertaken in June 2023, who have, or are able to have, exposure to European financial services companies within their portfolios.

- * Most senior board positions refers to defined under the FCA’s proposed changes to UK Listing Rules (pdf) as Chair, Chief Executive Officer, Senior Independent Director or Chief Financial Officer

About the EY Boardroom Monitor

- The EY Financial Services European Boardroom Monitor tracks the experience, background, and skillsets of board members across a defined universe of financial services firms to create a broad picture of the gaps in experience and possible pressure points within the listed European financial services markets.

- The EY Financial Services European Boardroom Monitor tracks and analyses data across a wide range of factors, including gender and age, as well as professional experience and skills.

- The EY Financial Services European Boardroom Monitor is comprised of disclosable, publicly available data on board appointments at listed banks, wealth and asset managers, FinTechs and insurers across the UK, Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden and Switzerland, using the MSCI European Financials Index as the core universe.

- This release incorporates a survey of 300 European and UK-based fund managers who have, or are able to have, exposure to European financial services companies within their portfolios. The survey asks about the biggest risks to European Financial Services companies and where investors see the biggest skillset gaps within boardrooms.

- These two data sets are compared to assess where European financial services boardrooms in different markets and sectors appear to have skillset and diversity gaps relative to shareholder priorities. This allows an ongoing assessment of how the composition of boardrooms compares to the expectations of investors.

About EY

EY exists to build a better working world, helping to create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

Related news

European financial services M&A deal volume fell in 2023, and total deal value hit a decade-low

LONDON, 19 JANUARY 2024. The European financial services industry announced a 3% year-on-year fall in M&A deals in 2023, with 641 deals across the region, compared to 661 deals in 2022, according to the latest EY financial services M&A analysis.

London, Monday 15 JANUARY 2024: Appointments of female board directors to Europe’s largest financial services firms declined seven percentage points year-on-year, according to the latest EY European Financial Services Boardroom Monitor, which reports that 44% of all appointments last year were of women, down from 51% in 2022.

LONDON, MONDAY 11th DECEMBER 2023: Mortgage lending across the eurozone is expected to record decade-low growth in 2023 and 2024, according to the latest EY European Bank Lending Economic Forecast, as high borrowing costs, weak economic growth and falling housing market sentiment drive down demand.

LONDON, 12 JULY 2023: The European financial services industry announced a nine-year deal high in the first half of 2023, with 382 deals across the region, compared to 337 in the same period in 2022 (a 13% year-on-year rise), according to latest EY financial services M&A analysis.

Financial boardrooms across Europe accelerate female and sustainability appointments

LONDON, 9TH JANUARY 2023: Europe’s largest financial services firms are taking proactive steps to increase female representation and enhance their sustainability expertise at boardroom level – both identified as priority areas for investors – according to the latest EY European Financial Services Boardroom Monitor, which charts the profile, experience, training and skillsets of board directors in the MSCI European Financials Index.

LONDON, 6 February 2024. For the second consecutive year, the EY and Institute of International Finance (IIF) Bank Risk Management Survey finds that cybersecurity is the top concern for European banking Chief Risk Officers (CROs).

LONDON, WEDNESDAY 17TH MAY 2023: UK and European headquartered global banks are reporting strong progress towards Basel III compliance, well ahead of the January 2025 implementation deadline, according to new EY research.

London, 11th January 2023: Amid unprecedented levels of global volatility and uncertainty, cybersecurity has risen to the top of the list of near-term risks for banks around the world, according to the latest EY and Institute of International Finance (IIF) bank risk management survey.

London, Monday 5th December 2022: Bank lending across the eurozone is expected to rise 4.6% by the end of this year but will contract 1.8% in 2023 – the first decline since 2014 – as eurozone economies slip into recession, according to the latest EY European Bank Lending Economic Forecast.

LONDON, WEDNESDAY 25 OCTOBER 2023: Leaders across Europe’s financial services sector expect Generative Artificial Intelligence (GenAI) technologies to deliver a windfall to productivity, according to the new EY European Financial Services AI Survey, which finds that 77% of respondents are bracing for a significant impact to their workforce and operations.

LONDON, 17 JULY 2023. Board directors serving Europe’s largest financial services firms currently hold an average of three board seats each, and over a quarter (26%) hold four or more, according to the latest EY European Financial Services Boardroom Monitor.

London, Wednesday 14th August 2023: CEOs across Europe’s financial services sector are embracing opportunities created by artificial intelligence (AI), yet nearly two-thirds (63%) remain wary of unintended consequences, according to the latest EY CEO Outlook Pulse Survey.

London, 10 August 2023: Dealmaking is currently a top priority for CEOs across Europe’s financial services sector, according to the latest EY CEO Outlook Pulse Survey, which found 94% of respondents expect to actively pursue strategic transaction activity over the next 12 months.

London, 4 May, 2023: European banks lead globally on overall ESG (Environmental, Social and Governance) efforts, according to the latest EY Sustainable Finance Index.

LONDON, 24 April 2023.The appetite of European ‘millennial’ investors (those born between 1981 and 1996) to make riskier investments amid market volatility is higher than the generations above them, according to the EY Global Wealth Research Report 2023, as younger investors more actively respond to and are influenced by external market events.

London, 29 March 2023. Andrea Ward, Data Protection Partner, EY Law, comments: “Data protection is a priority topic for businesses, but it’s not one with an easy shortcut to successful compliance.

LONDON, 1 MARCH 2023: Following an 11% fall in assets under management (AUM) last year, growth in the European exchange-traded fund (ETF) market is expected to rebound over 2023, reaching US$1.7tn by year end, according to latest EY European ETF research and analysis.

EY announces appointment of Phil Vermeulen to EMEIA Insurance Leader

LONDON, 4 JULY 2023. EY has appointed Phil Vermeulen to EMEIA Insurance Leader, effective 1st July 2023.

Learn more about our Insurance team and how they can help your business navigate disruption, manage regulatory change and integrate technology to transform and achieve growth.