EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

FinTech and Ecosystems

The team

What EY FinTech services can do for you

FinTechs are essential to the future of an innovative and thriving financial services sector. We are focused on – and investing boldly in – their success in our roles as strategic advisers, capable operators, passionate advocates and relationship builders.

In supporting the FinTech market, we:

- Help early-stage FinTechs start strong with practical advice and connections that lay foundations for rapid growth

- Engage scale-up FinTechs for smarter growth, with advice, solutions and alliances that support innovation and reduce risk

- Facilitate impactful connections between investors, established financial services firms, FinTechs and RegTechs with the most promising offerings and greatest growth potential

- Work with established firms and investors interested in exploring the benefits of working with FinTech and RegTech firms

For FinTechs, scalable and sustainable growth requires access to the right resources, stakeholders and partners, and market opportunities at the right time. That includes connections with established banks, insurers and wealth and asset managers that engage FinTechs to transform key operations and processes.

The combination of FinTechs’ innovative solutions and established organizations’ scale promises to create a more customer-centric, inclusive and prosperous industry. To improve the impact, FinTechs must have a plan to scale-up sustainably, and large firms need a clear strategy and strong implementation capabilities.

While FinTechs have demonstrated impressive growth in recent years, they must continue to evolve and innovate for future growth. The next few years will see profound changes in business models across financial services, as technology advances and customer expectations rise. The EY organization aspires to continue to be the adviser of choice for a range of market players that want to maximize their growth potential.

Listen to EY FinTech Beyond Borders podcast on Apple or Spotify.

How EY teams increase the impact of FinTechs

With the EY global network, EY professionals help all types of financial services organizations – from early-stage and scale-up FinTechs to the largest multinationals – innovate and transform for growth.

We focus on areas of innovation across financial services, including RegTech, PayTech, InsurTech, ESG Fintechs, Neobanks, bank and payment-as-a-service, embedded finance, blockchain solutions, customer engagement tools, next-generation core platforms, data platforms and those applying artificial intelligence (AI) and providing transformational data and AI platforms.

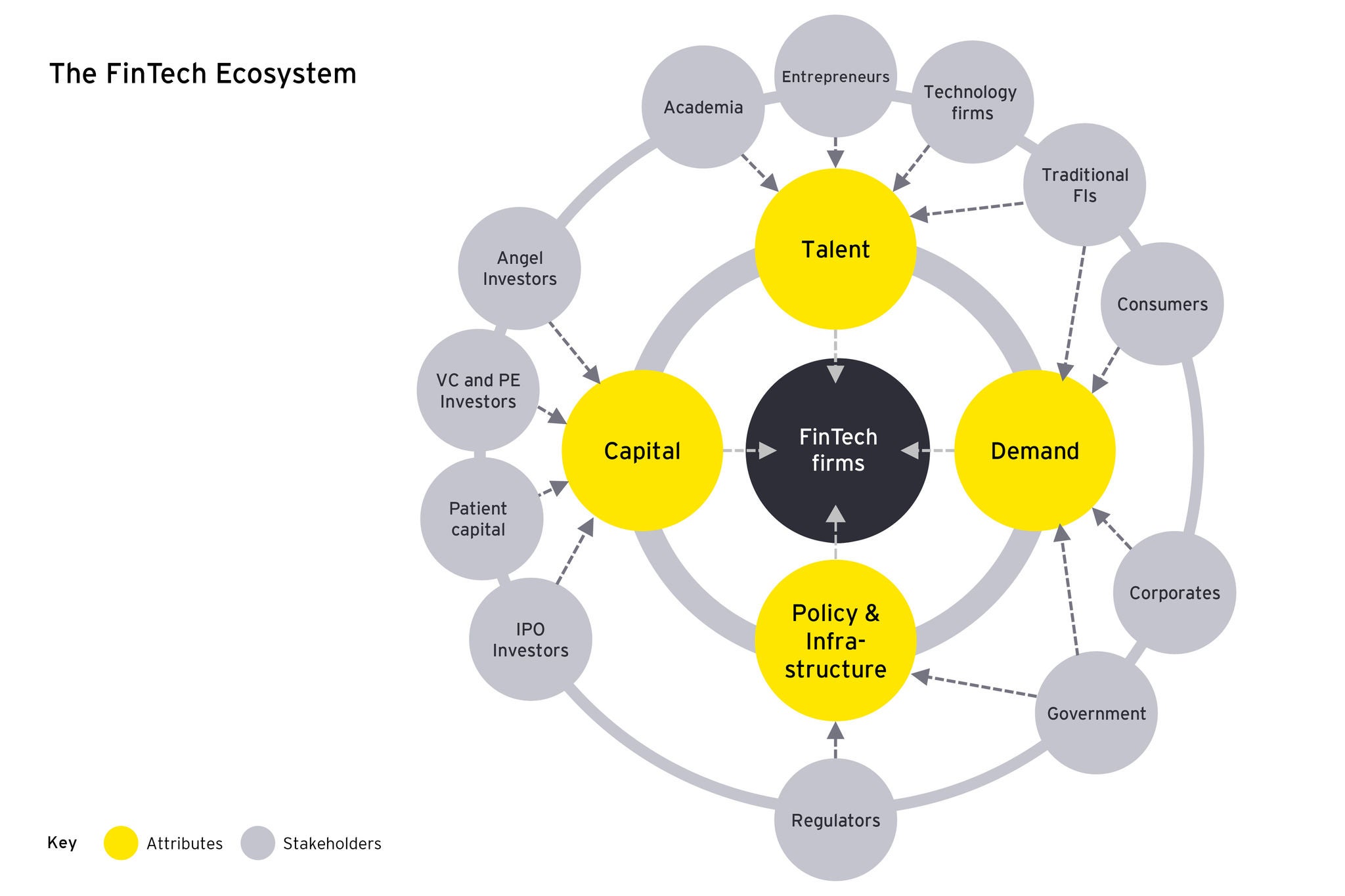

EY teams view of the FinTech ecosystem

High-performing FinTech ecosystems are built on four core attributes:

- Talent: Technical, functional, sector and entrepreneurial skills, knowledge and experience

- Capital: Sufficient financial resources for startups and scale-ups

- Policy: Policy and regulation that promotes innovation, including tax and growth incentives and digital public infrastructure

- Demand: Demand for innovative products and services across consumers, financial institutions and governments

EY capabilities include:

- Collaboration: Oversee and advise on FinTech ecosystem facilitation, procurement process support and process management

- Regulatory compliance and audit: Navigate compliance and regulation (regulatory strategy, risk management and audit)

- Digital strategy and platforms: Provide services effectively via web, mobile and API channels; provide advice on building digital ecosystems, embedded finance and "bank-as-a-service" offering; leveraging the FinTech ecosystem

- International expansion: Capitalize on global opportunities (new market strategy, international tax and legal services)

- Talent: Attract, motivate and retain talent (organizational design, employee management incentives)

- Fundraising and valuations: Raise, invest, improve and preserve capital (transaction support, M&A advisory, IPO preparation, Special Purpose Acquisition Company (SPAC) and De-SPAC support)

- Tax and finance: Improve financial management and reporting functions

- Cyber and IT risk: Assess and manage technology-related risks

Our latest thinking

How banks are staking a claim in the embedded finance ecosystem

Finance in the experience age heralds a new era for customers and banks alike, with embedded finance the key to success. Learn more.

Insurance ecosystems: six steps to set and execute the right strategy

Early adopters of ecosystems in insurance demonstrate how to create near-term value and build a foundation for long-term success. Learn more.

The CEO Imperative: How mastering ecosystems transforms performance

Read the EY Ecosystem Study, a first-of-its-kind deep dive into how ecosystem mastery leads to higher performance.

How can banks transform for a new generation of customers?

EY’s consumer banking survey reveals how banks need to transform to meet rising customer expectations. Find out more.