EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

BEPS 2.0 as a certainty

Under the current circumstances, BEPS 2.0 will be implemented in one form or another and the impact on the broader economy, investments, investment returns and jobs will remain to be seen.

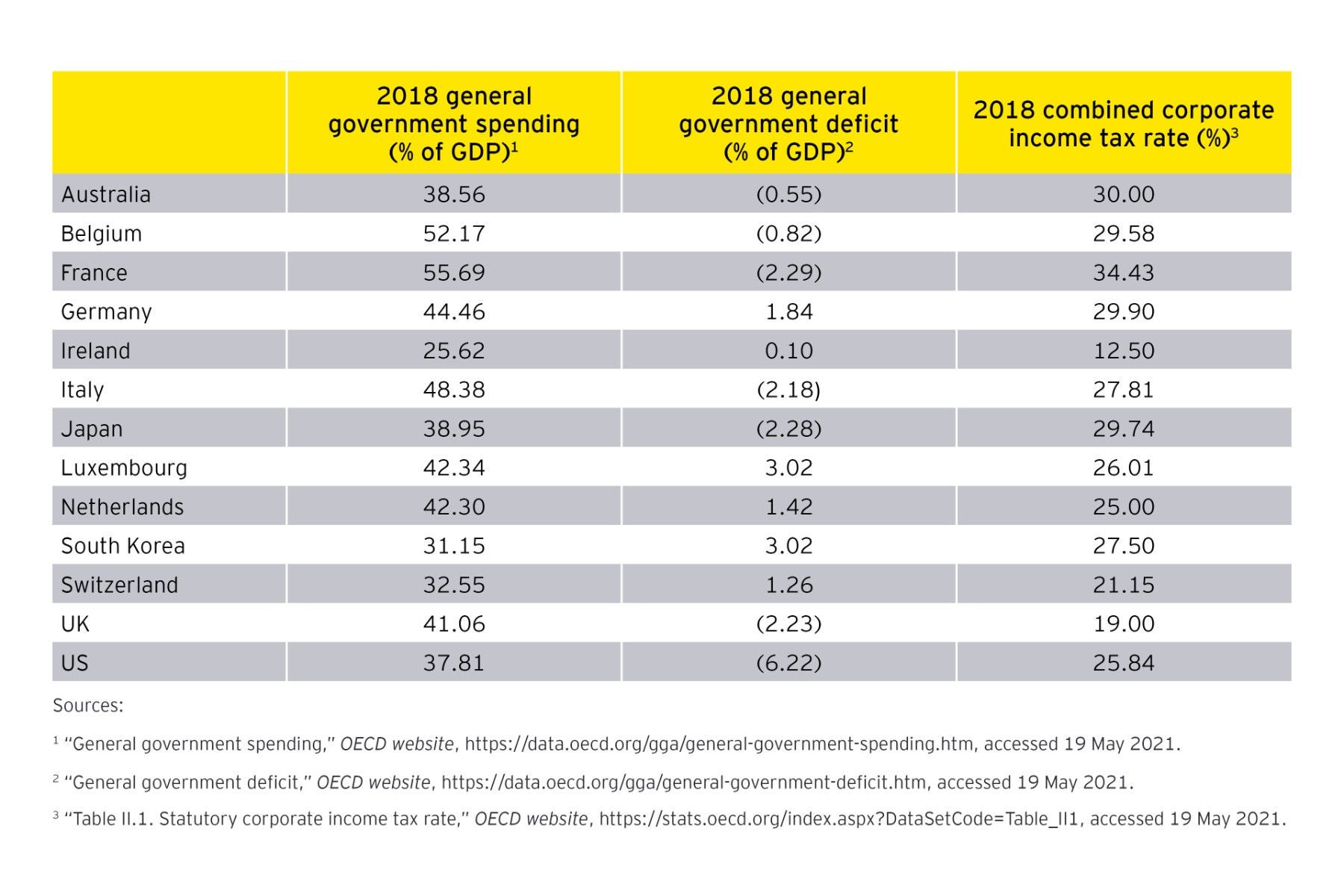

Even with the appropriate economic substance, the global push for a minimum tax is likely to make paying zero or little taxes and parking profits in tax havens a thing of the past. MNEs must come to terms with this reality and brace themselves for a higher effective tax rate (ETR) wherever they operate.

In simple terms, the ETR is the percentage of earnings that a corporation pays in taxes. It drops when certain earnings are not taxable or taxed at a preferential tax rate, or when deductions are enhanced. Conversely, it rises with a denial of deductions or double taxation. As a result, the ETR can fluctuate year-on-year depending on the circumstances. In the BEPS 2.0 world, when the ETR falls below the agreed minimum tax rate, the “low-taxed profit” may consequently be picked up for tax elsewhere.

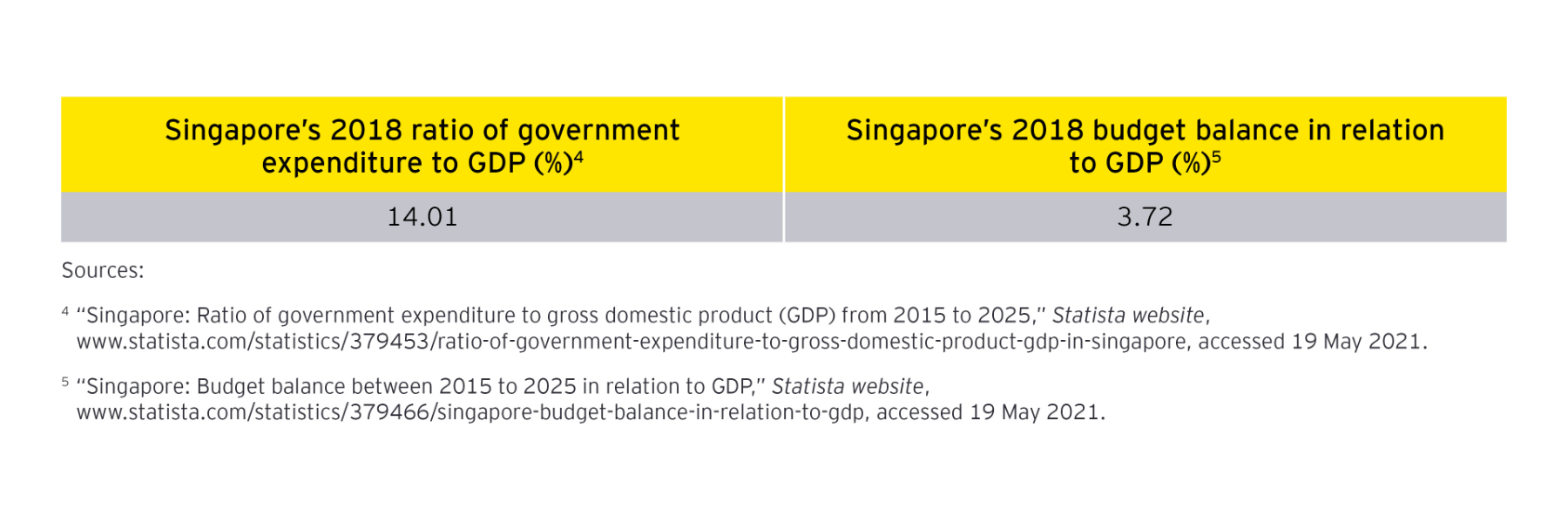

Some countries, such as Austria, India, South Korea and the US, have introduced some form of alternative minimum tax (AMT) in their tax regimes. AMT ensures that corporate earnings are subject to tax at a certain floor rate, and such a regime may help Singapore avoid any unintentional relinquishment of taxing rights when BEPS 2.0 is in place. The introduction of AMT could, however, increase the administrative burden on Singapore taxpayers. Simplifying the rules, such as aligning the ETR computation with that of the BEPS 2.0 proposal, will help with Singapore’s tax competitiveness.

The big tax reboot will transform the game for Singapore, where tax incentives have been instrumental to its investment promotion efforts. Having said that, Singapore’s long-standing merits in its institutions, infrastructure, labor market and financial and legal systems should continue to make it an attractive investment destination. As uncertainty looms around the world, may Singapore’s consistent performance and stable government policies keep this city-state shining as brightly as ever.

This article was first published in The Business Times on 12 May 2021.