EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

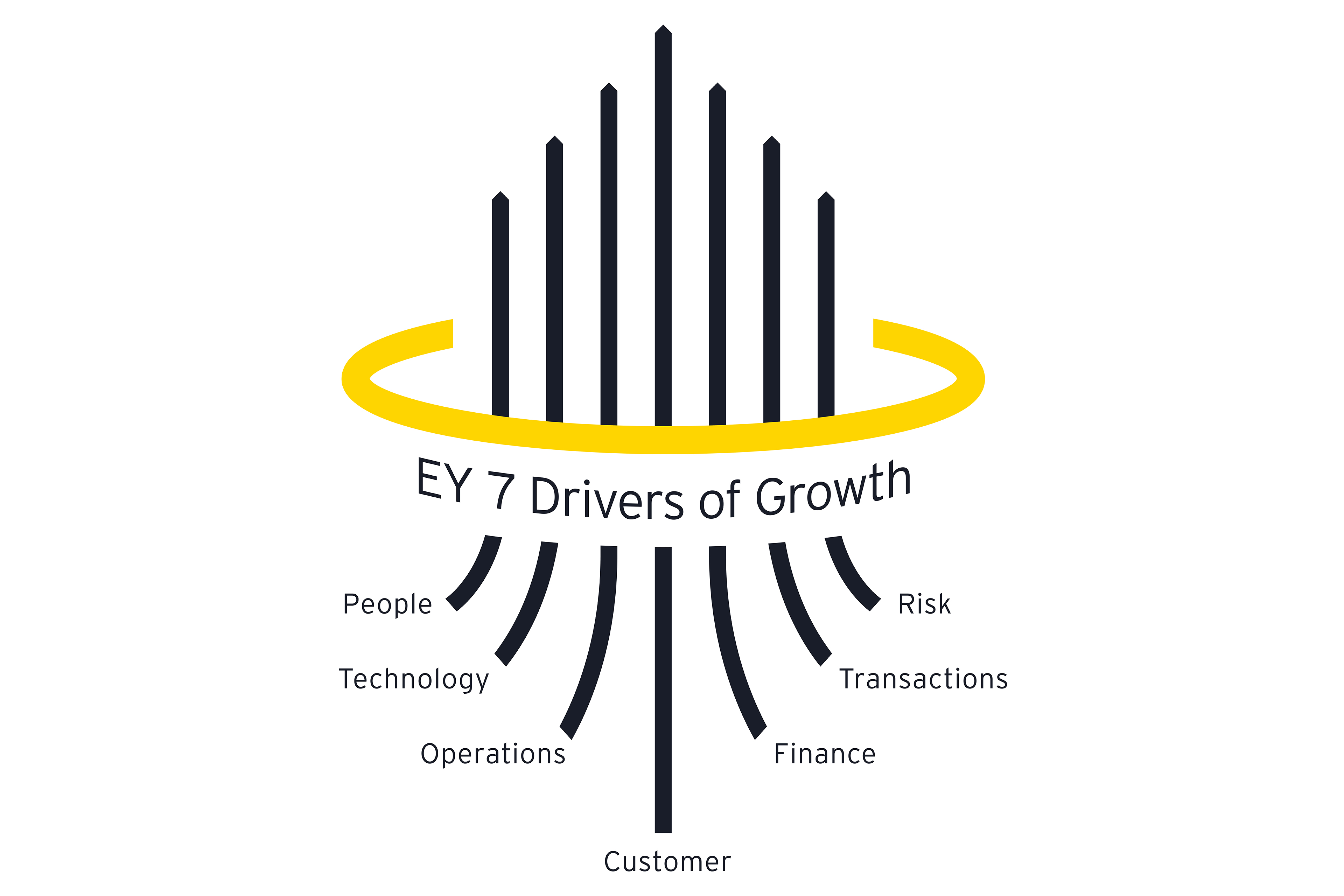

Our 7 Drivers of Growth framework can help your business successfully execute your growth strategy over the long term. Find out how.

Read more

Top five finance-related priorities for entrepreneurs today

EY Private’s analysis of around 750 recent strategic growth plans, created by business leaders from around the world, highlights that technology-driven finance transformation is a major focus area for entrepreneurial businesses. In fact, it is the overarching theme for their current top five finance-related priorities:

- Investing in automation and data analytics

- Funding growth ambitions

- Establishing finance as a business partner

- Proactively engaging with stakeholders

- Implementing dynamic business planning

1. Investing in automation and data analytics

Entrepreneurial business leaders recognize that they need to invest in automation and data analytics to fully realize the benefits of finance as a business partner. They are exploring how they can deploy new technologies at speed for a transparent, data-driven and smart function. In particular, they are looking at how they can use AI to automate finance processes end-to-end, achieving cost efficiencies while making the function highly agile and “future-ready”.