EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

Supporting organizations with physical and transition risks associated with climate change, and assisting them with market and regulatory changes.

Read more

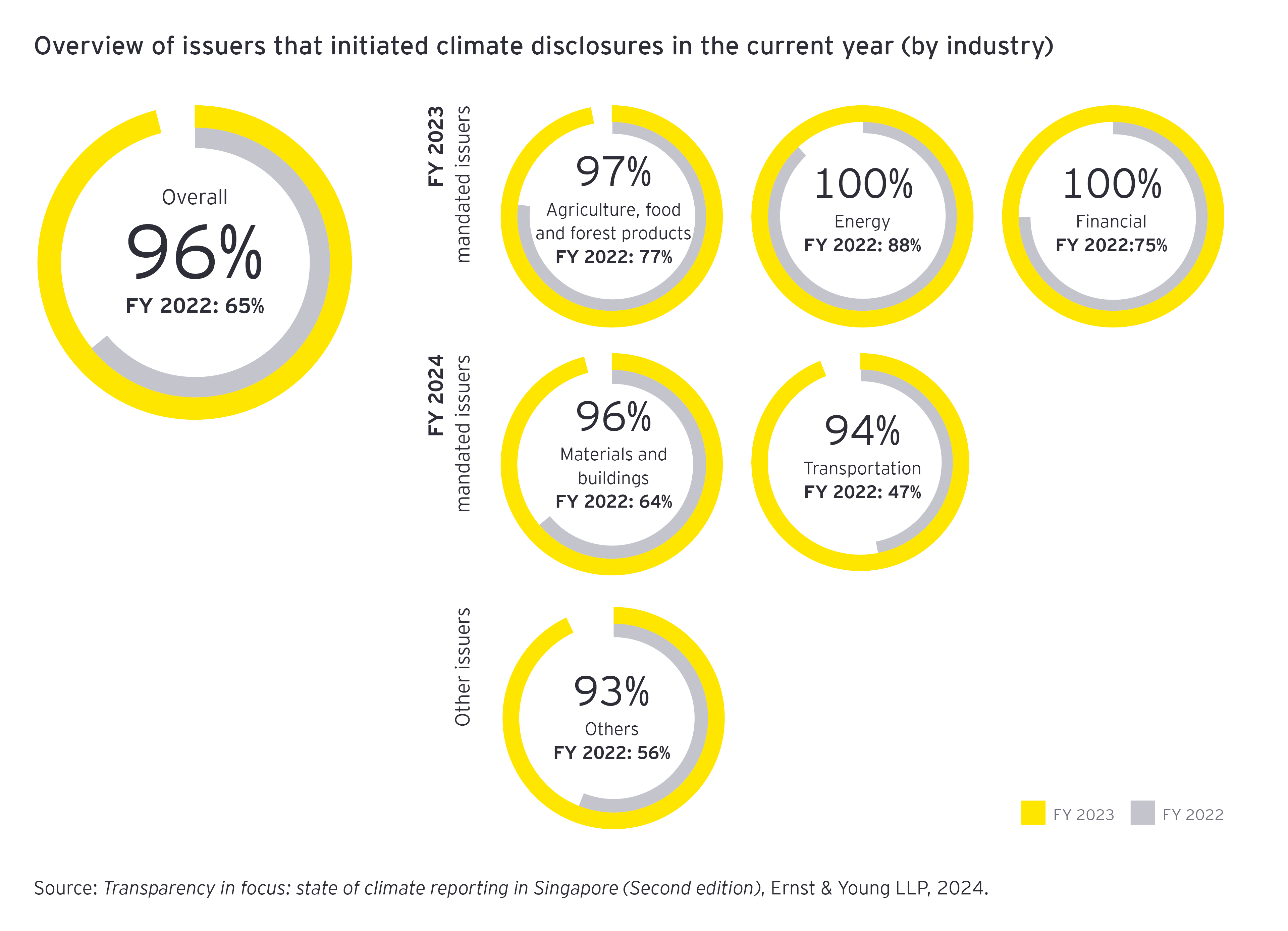

While the latest EY-CPA Australia study found encouraging year-on-year improvements in issuers’ CRD, more needs to be done quickly to stay ahead of the proposed ISSB-aligned climate disclosures requirement in SGX RegCo’s public consultation paper. Issuers should consider taking several core actions to accelerate their climate reporting journey. These include shifting from a mindset of mere compliance to one that leverages climate reporting to help gain a strategic advantage, building confidence in climate-related financial data through collaboration and integrating governance practices for climate-related data.