EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

EY teams can help you understand the benefits and challenges of leveraging the ISO 20022 data standard across your organization. Find out how.

Read more

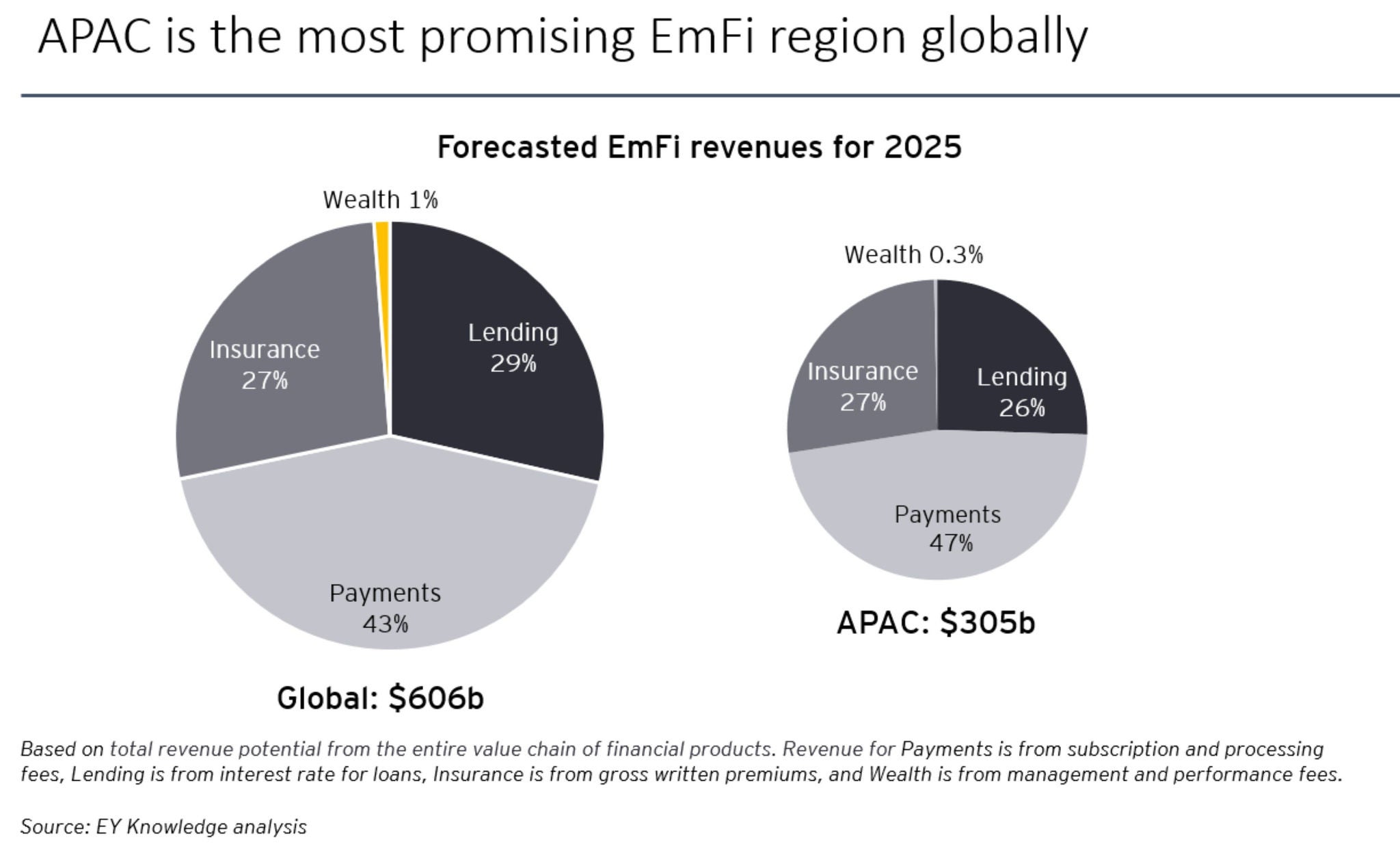

EmFi boasts diverse opportunities that span the entire FS ecosystem, empowering providers to seamlessly integrate into the value chain and deliver financial solutions at the point of need. This could see the FIs, tech enablers and platforms benefit from a flywheel effect as they collaborate to drive momentum that further enhances customers’ experiences, keeps them satisfied, and hence engaged and captive within that specific ecosystem. That in turn, enables providers to scale their product offerings vertically and acquire customers at a relatively low incremental cost — a win for all parties involved.

Here, we dive into the specific benefits of EmFi for each of these participants:

- Financial institutions: EmFi presents FIs with a unique opportunity to explore new markets and reinvent their core businesses by partnering with third-party platforms to offer interoperable FS. On the expense side of the equation, providing FS through embedded solutions within platforms enables FIs to simplify channel outreach with fewer distribution outlets and reduce acquisition cost per customer. Meanwhile on the revenue front, FIs can craft new income streams from enabling permissioned data access or getting their transaction revenue share from partners.

By keeping customers entrenched within the partner platforms, FIs not only expand customer connectivity but accumulate a plethora of data on a vast user base. This provides deeper analytical insights around customer behavior and preferences, thereby enabling them to offer personalized, context-aware financial solutions, while generating more granular risk profiling for individuals and businesses.

- Technology enablers and nonfinancial platforms: Non-FIs are already at the forefront when it comes to driving the EmFi revolution and can quickly integrate FS into their existing infrastructures and platforms. By providing the infrastructure and back-end functionality to incorporate EmFi solutions, tech providers benefit from recurring revenue streams. This initiative also enables them to develop adjacent services and explore cross-sell opportunities (for instance, a payment service provider may also offer a loan product to its customers).

For the platforms, having payments embedded in-app raises their conversion rates of individuals from browsers into customers, and enhances customer stickiness and retention from providing additional value-add along their journeys. More critically, EmFi facilitates non-FIs’ entry into a highly regulated FS market, and the opportunity to incorporate financial offerings into their portfolios without the encumbrances of being a regulated FIs themselves.

- Customers: With EmFi, individuals and businesses not only obtain easier access to FS and reduce their time spent researching and shortlisting, but access tailored offerings that are fit-for-purpose and based on their preferences and behavior, and perhaps even get these more competitively priced. Provider integrations that are done well also mean that users can conduct financial transactions effortlessly without switching between online merchants and FIs (or needing to seek credit elsewhere), leading to a more seamless and pleasant digital experience.