EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

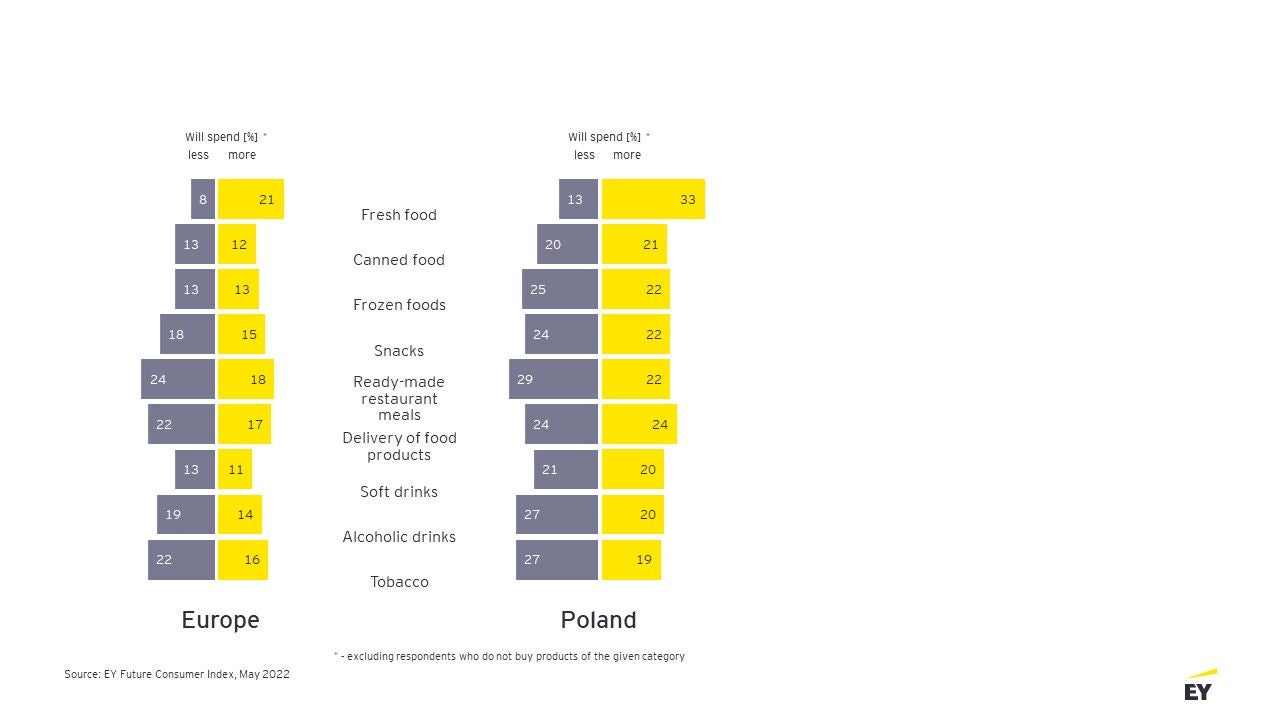

Compared with other Europeans, Poles plan to spend more for fresh food and less for alcoholic drinks.

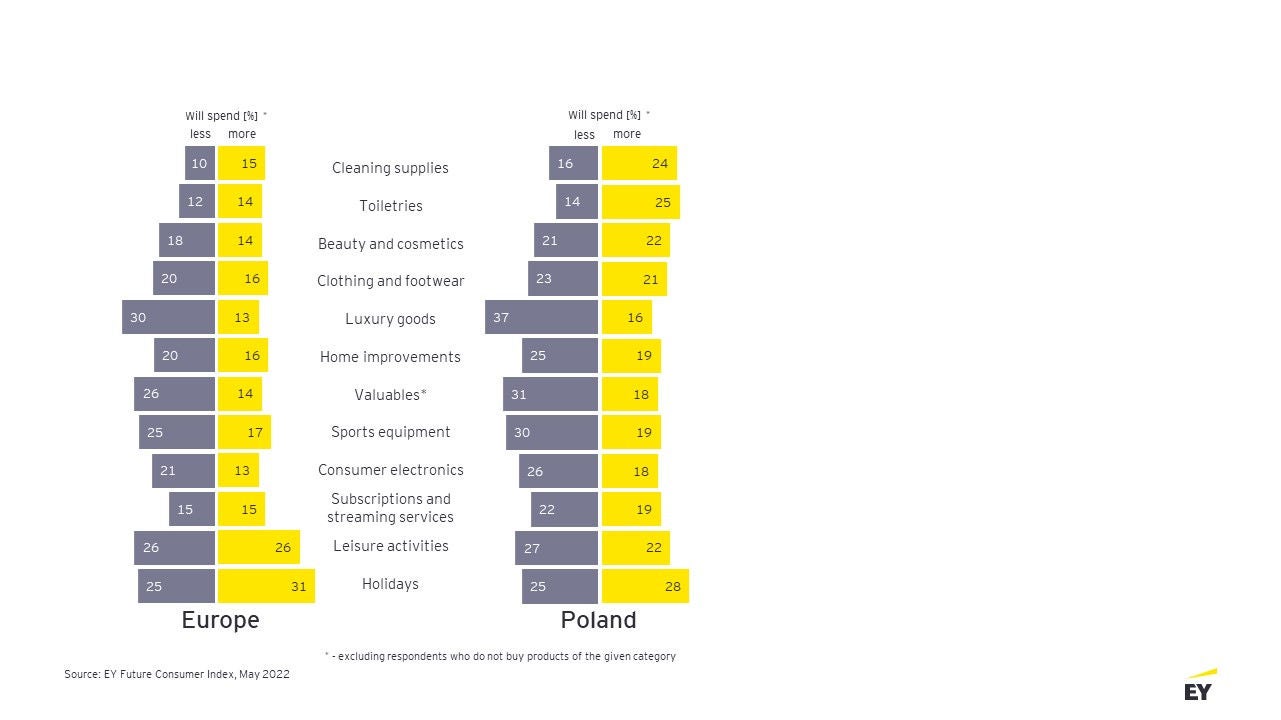

EY’s survey – Future Consumer Index – indicates that, compared with other Europeans, Poles, due to different inflation perception, expect a greater increase in spending for fresh food (33% vs. 21%) and cleaning supplies (24% vs. 15%), whereas they plan to significantly reduce purchases of alcoholic drinks (27% vs. 19%). At the same time, Poles – similar to other Europeans (28% and 31%) – plan to increase their spending for holidays and reduce spending for luxury goods (37% and 30%).

EY’s survey – Future Consumer Index – indicates that, as a result of rising inflation, many consumers – both in Poland and Europe – change their buying behaviors and decisions. This is illustrated very well by the category of fresh food, where as many as 33% of Poles expect an increase in their spending. At the same time, this is more by as much as 12 percentage points than the average for Europe. A difference exceeding 5 percentage points, in the area of an increase in spending, has been noted in 8 out of 9 of the surveyed categories. This may indicate differences in the level of inflation between individual countries and, consequently, different perceptions and expectations concerning the rise in prices.

Nonetheless, the results of EY’s survey – Future Consumer Index – show that the food and beverages segment may reach a stagnancy. This especially concerns processed products, where in the categories of frozen foods, snacks and soft and alcoholic drinks, a greater percentage of consumers plan to reduce rather than increase their spending.

Poles will, in a natural way, seek to make savings in the categories that are easiest to give up or find cheaper substitutes, e.g. ordering ready-made meals in restaurants (29%), tobacco (27%) and alcoholic drinks (27%). Besides frozen foods (12 p.p.), it is in the category of beverages – both alcoholic and soft drinks – that we can observe the greatest differences between Poles and other European countries – 8 percentage points.

- Inflation affects all the countries in Europe; however, the perceptions of the inhabitants of the particular countries are different. This is due to not only the level of their affluence, but also the size of the rise in prices. In the recent months, Polish consumers have been hit by the effects of inflation and changes in prices particularly hard, and their expectations for the following weeks are equally pessimistic. This can be seen particularly well in the food sector. While shopping, our countrymen focus on the most needed products, and they avoid the products that were once a standard item on their shopping lists, such as alcoholic drinks, frozen foods or snacks – says Łukasz Wojciechowski, Assurance Partner, Leader for EY’s Consumer Products and Retail Sector.

Priority - holidays

Both Poles and the inhabitants of other countries in Europe plan to increase most their holiday spending (28% and 31% respectively). The lifting of Covid-19 restrictions has aroused a great desire to relax, even at the expense of making a dent in one’s personal budget. At the same time, the significant rise in prices – compared to the pre-pandemic period – causes that the cost of going abroad for holidays often exceeds the financial capacity of Poles; hence, they decide to spend their holidays in their own country. However, it is also worth noting that the percentage of people seeking to reduce spending in this category is equally high (25%), which is the direct consequence of rising inflation over the recent months.

The greatest percentage of Poles expect that, in the coming months, they will have to increase spending for cleaning supplies (24%) and toiletries (25%). The European average is 15% and 14%, respectively. The differences of 11 p.p. (toiletries) and 9 p.p. (cleaning supplies) may, similar to fresh food, arise from the difference in the level of inflation, and the resultant different “perception” of the rise in prices in specific categories.

Poles and other Europeans are in agreement on in which market segments to seek savings. These are, respectively, luxury goods (37% and 30%), valuables (31% and 26%), sports equipment (30% and 25%) and leisure activities (27% and 26%). What’s interesting, subscriptions and streaming services have noted one of the smallest indication percentages (22% - Poland, 15% - Europe). This shows that, despite the more demanding times, consumers want to retain access to at least some of their leisure activities.

- In the face of rising inflation, consumers in Poland and Europe behave in a similar way. They expect to spend more in similar categories, even if the amount of purchased goods will not increase. Alternatively, they will try to reduce spending by buying less products going up in prices that are not necessities. However, the scale of this phenomenon is different. In the area of necessities, for Poles the expected size of spending will be higher than the European average. Undoubtedly, this is due to the different level of inflation in Poland as well as the still lower level of wages. It should be expected that, being aware of rising prices, it will be in the basic categories that consumers will be most willing to seek substitutes. In other segments such as alcoholic drinks, visits at restaurants or sports equipment they will simply reduce spending - concludes Grzegorz Przytuła, EY-Parthenon Partner, Expert for Consumer Products and Retail Sector.

About the survey

The fifth Polish edition of EY’s survey - Future Consumer Index, prepared by EY Poland, was carried out on 17-27 May 2022 on a group of 1,000 persons aged 18-65.

The survey covered the whole country and all social groups. Respondents answered questions concerning their current buying behaviors, moods and expected attitudes in the near future.

About EY

EY is a leading global professional services firm in assurance, tax, strategy and transaction and consulting services. Worldwide, nearly 300,000 best professionals operating from more than 700 EY member firms based in more than 150 countries share EY values and commitment to deliver exceptional client service. Our mission is “Building A Better Working World”, as a better working world is a better working economy, society and ourselves.

EY in Poland has about 4,000 professionals operating from 7 offices across Poland – Warsaw, Gdańsk, Katowice, Kraków, Łódź, Poznań, Wrocław and EY SSC. EY Poland has been announced the “Best and Most Successful Tax Advisory Services Firm” several times in the business media rankings, and has also topped the “Best Accounting Firm” lists.

Since 2003 EY Poland has been running the EY Entrepreneur Of The Year Poland programme, with the country winners representing Poland to vie for the EY World Entrepreneur Of The Year title in the finals held annually in Monte Carlo.

EY is also one of the best employers in Poland. The firm has been honoured with Uniwersum’s “Best Employer” title and the “Most Desirable Employer” in the “Employer Of The Year®” ranking by AIESEC. EY has also received the “Great Place to Work” awards in the category of firms with more than 500 employees.