Drive incremental value through working capital optimization

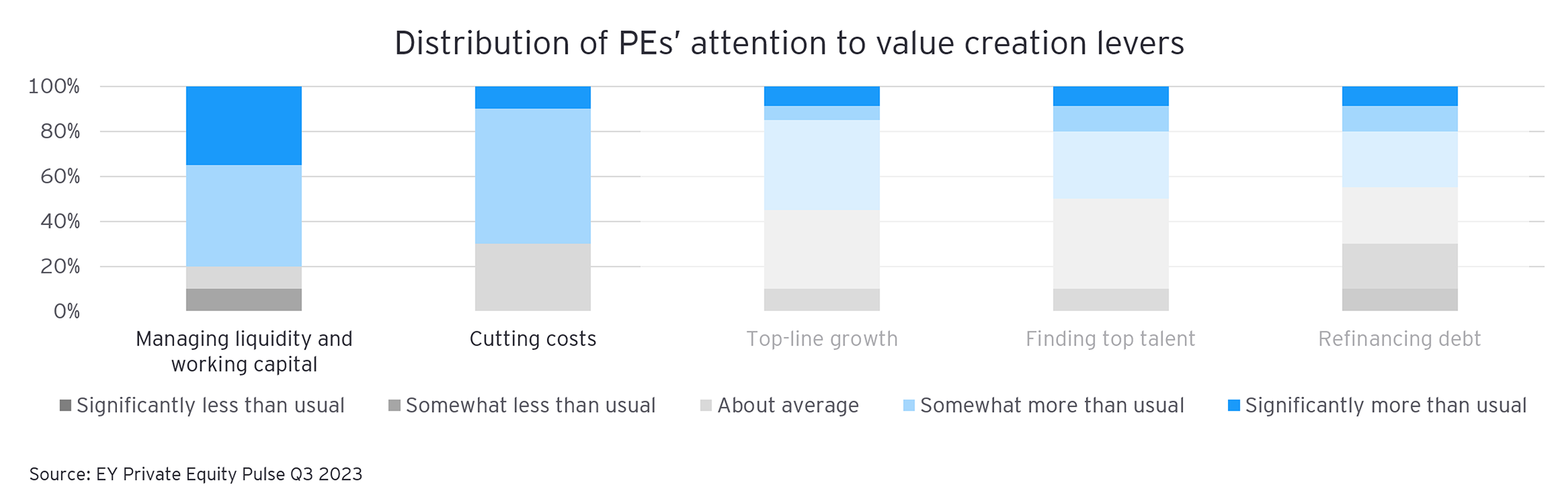

As interest rates were near zero in the past years, PE funds were especially focused on EBITDA maximization rather than cash management and working capital optimization. However, with the recent rise in interest rates, working capital and cash performance have become critical levers for value creation and building resilience, especially in the following scenarios:

- Decline in revenue and raised interest rates having impacted liquidity: Working capital improvements can help release locked liquidity to prevent supply chain disruptions and lost revenues, offset margin/ cost erosion, improve service, and reduce net debt.

- Underperformance in working capital compared to peers: Bringing working capital to industry standards can improve exit valuation.

- Lack of funding for value creation initiatives: Liquidity released through working capital improvements can support funding.

- Distressed situations: In times of distress, working capital management becomes a matter of survival.

To manage working capital more effectively, many PE-owned businesses have followed typical cash improvement methods, such as extending supplier terms, running down old stock or factoring some of the debtor book. While these tactics can help to some extent, PEs should also consider adopting holistic tools that enable firms to optimize working capital management.

A possible initiative would be to employ tools and processes to sharpen cash forecasting. Increased accuracy in predicting what is needed where and when and the inclusion of cash pooling and repatriation measures, will help optimize the use of existing cash. While cash flow forecasts are a requirement for most businesses, they are not always deployed effectively. A short-term (bottom-up) direct cash flow forecast for at least 13-weeks, with a weekly cadence of variance analysis, re-forecasting and mitigation actions typically proves most effective.

Another potential opportunity to improve working capital could be the use of advanced data analytics for managing receivables, payables, and inventory. Leveraging advanced technology can improve trend tracking and digital processes. Moreover, transactional data analytics increases transparency and provide the business with actionable insights enabling improved cash performance .

Furthermore, the treasury management discipline is critical for supporting the cash forecasting and process improvements, as well as optimizing the liquidity of a portco’s cash position through cash pooling, releasing trapped cash and flexible financing structures.

Address missed opportunities in costs

In the past favorable economic environment, most PEs pursued growth and executed buy-and-build strategies. Now that growth is more challenging to attain in the present economy, PEs need to reexamine cost streamlining possibilities that were previously ignored when the value creation strategy was centered on growth.

Streamlining operating costs starts by determining and implementing a well thought-through cost optimization strategy (COS). An effective COS typically aims at strengthening cost structures and providing transparency in processes. This increases operational leverage, leading to short-term profitability and long-term competitive advantage.

To determine the scope and intensity of the COS, PE operational partners need to have a true understanding of the real cost drivers of the business and benchmark these to peers. The benchmark study should identify best in class performers and indicate areas for improvement. PE operational managers need to evaluate the time and associated costs required for improvement initiatives and identify quick wins.

Four key areas for cost reduction and value creation are:

- Control Spending: Focus on both direct and indirect spending, harmonize product ranges, and apply value engineering.

- Simplify Operations: Reduce complexity and increase productivity by building an efficient operating model. Remove redundant roles and systems, unprofitable products and services, and right size the operations and overhead.

- Efficient and Resilient Supply Chain: Optimize supply chain costs, integrate ESG agendas, and ensure tax efficiency.

- Focus on Talent: Manage labor costs by enhancing productivity and talent retention, and developing high-quality leadership.

Looking ahead

To drive value creation and even avert distress, PEs and their portcos must streamline working capital and cost structures. Prior to doing this, PE operational managers should ask themselves whether their portcos demonstrate the right competencies and mindset to rapidly deliver on value.

Interested in how we at EY-Parthenon assist PE portcos on their value creation journeys? EY-Parthenon provides professional services to PE firms to unleash hidden value through various initiatives, such as working capital- and cost optimization. For more information, please contact one of the experts below.