EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

When Malaysia’s Budget 2023 was re-tabled on 24 February 2023, it was announced that the Government would study the introduction of a capital gains tax (CGT) on the disposal of unlisted shares by companies, at a “lower rate”. The Budget 2024 announcement on 13 October 2023 provided additional details on this proposal, including the proposed implementation date, tax rates, impacted taxpayers and possible exemptions.

Since the Budget announcement, the following have been released or announced:

i) On 7 November 2023, the Finance (No. 2) Bill 2023 (Bill) was released and tabled for its first reading.

ii) On 29 December 2023, the Finance (No. 2) Act 2023 (Finance Act) was gazetted into law. The Finance Act adopts all the changes proposed in the Bill.

iii) Also on 29 December 2023, the Income Tax (Exemption) (No 7) Order 2023 [P.U.(A) 410] (Exemption Order) was gazetted in relation to CGT, in order to defer the effective date for CGT in respect of certain disposals.

iv) On 15 January 2024, the Inland Revenue Board (HASiL) issued the Capital Gains Tax Return Form (CGTRF) Filing Programme, which is effective from 1 March 2024.

v) On 16 January 2024, the Honorable Finance Minister II announced that unit trusts will be exempted from CGT and income tax on foreign-sourced income, for specified periods.

We set out the responses below to some key questions you might have on the new CGT. It is expected that detailed guidelines will be issued on CGT, and it is hoped that the Guidelines will address the open questions highlighted in this alert.

1. Who is chargeable to CGT?

- A company

- A limited liability partnership (LLP)

- A trust body (e.g., unit trusts)

- A co-operative society

as defined under the Income Tax Act 1967 (ITA)

Disposals of the following will be impacted by the CGT:

|

Foreign-sourced |

|

|---|---|---|

|

a) Shares1 of a Malaysian-incorporated company not listed on the stock exchange2 b)Shares1 of a foreign controlled company with a nexus to Malaysian real property – see Item 11 |

All capital assets, not limited to shares

Gains from the disposal of a capital asset situated outside Malaysia will only be subject to tax when the gains are received in Malaysia.3 |

3. What is the effective date?

- The Finance Act indicates that CGT will apply from 1 January 2024. However, the Exemption Order provides that a company, LLP, trust body or co-operative society is given an income tax exemption in respect of any gains or profits received from the disposal of shares of a company incorporated in Malaysia not listed on the stock exchange. This exemption applies to such disposals from 1 January 2024 to 29 February 2024. Hence, CGT will only be payable on disposals of unlisted shares in Malaysian-incorporated companies from 1 March 2024.

The Exemption Order does not:

a) specifically cover the disposal of shares of a foreign controlled company with a nexus to Malaysian real property – see Item 11.

b) exempt a disposer from filing of any returns – see Item 4.

However, the CGTRF submission guide notes in HASiL’s CGTRF Filing Programme states that the exemption above will also apply to disposals of shares in a foreign controlled company with a nexus to Malaysian real property and that taxpayers are not required to submit a CGTRF for the disposal of the relevant capital assets within the exemption period. It is expected that a revised Exemption Order or a Supplementary Order may be released in due course to legislate this.

- In relation to the taxation of gains received in Malaysia on the disposal of foreign assets, the effective date needed to remain as 1 January 2024 as this is a requirement of the European Union. Singapore and Hong Kong are also imposing tax on remitted capital gains from the disposal of foreign assets from 1 January 2024.

Observations

- The Exemption Order does not “move” the date which provides an acquirer with the option to pay 2% tax on the gross disposal price on future sales, if an acquirer purchases unlisted shares in a Malaysian-incorporated company prior to 1 January 2024 – see Item 7. In other words, barring any further developments, if an acquirer purchases unlisted shares in a Malaysian-incorporated company between 1 January and 29 February 2024 and the acquirer sells the shares in the future, the acquirer would need to pay tax at 10% on the gains and does not have the option to pay 2% tax on the gross disposal price.

- A technical reading of the Exemption Order together with the relevant provisions of the Real Property Gains Tax (RPGT) legislation and the ITA suggests that where shares are disposed between 1 January and 29 February 2024, neither CGT nor RPGT would apply. It is unclear whether this is the policy intent of the legislation, as no “tax free” periods have been announced by the authorities – instead, the Exemption Order was intended to “move” the effective date for CGT for Malaysian-sourced share sales to 1 March 2024, in line with the Budget announcement. It is expected that further clarification will be made available on this point.

- Gains or profits will be ascertained separately for each disposal and treated as a separate source of gains or profits.

- For disposals of unlisted shares in a Malaysian-incorporated company or shares in a foreign company with a nexus to Malaysian real property, the disposer must submit an electronic return and make payment within 60 days from the disposal of that asset.

Based on HASiL’s CGTRF Filing Programme, taxpayers are required to submit the return form electronically (e-CKM Form) on the MyTax portal. A Tax Identification Number and Digital Certificate are required to access e-CKM.

- For disposals of foreign capital assets, it is not clear if separate returns need to be filed for each disposal, or whether the gains would simply be included in the annual tax return of the disposer.

5. What constitutes a “disposal” for the purposes of CGT?

For CGT purposes, “disposal” means to sell, convey, transfer, assign, settle or alienate whether by agreement or by force of law and includes a reduction of share capital and purchase by a company of its own shares.

Observation

The redemption of redeemable preference shares is not specifically included within the definition of “disposal” for CGT purposes. It is possible that further guidance will be provided on this point.

6. What is the date of disposal?

The date of disposal is as follows:

|

Where there is a written agreement for the disposal and no approval is required from the Government or State Government for the acquisition or disposal |

No written agreement |

Where there is a written agreement for the disposal and approval is required from the Government or State Government for the acquisition or disposal |

|---|---|---|

|

Date of the agreement |

Date of completion4 means: |

a) The date of approval, or b) If the approval is conditional, the date in which the last condition is satisfied. |

|

Description |

|

|

|---|---|---|

|

Either: Adjusted income (chargeable income)5 from the disposal; or |

10% |

|

|

Gross proceeds from the disposal at the option of the disposer |

2% |

|

|

B. Disposal of capital asset situated in Malaysia which was acquired on or after 1 January 2024 |

||

|

Adjusted income (chargeable income)5 from the disposal |

10% |

|

|

C. Disposal of foreign capital asset |

||

|

Adjusted income (chargeable income)5 from the disposal |

Prevailing tax rate of the disposer, e.g., generally 24% if the disposer is a Malaysian company |

8. Will traders in shares also be subjected to the lower CGT rates?

It is still necessary to consider whether gains from the disposal of shares are capital or revenue in nature. Where the shares represent stock-in-trade of the disposer, disposals would continue to be subjected to the prevailing income tax rates of the disposer.

9. Will RPGT still apply on the disposal of real property company (RPC) shares?

RPGT will no longer apply on the disposals of RPC shares by companies, LLPs, trust bodies or co-operative societies, hence there will be no “double tax” on such disposals. However, Labuan entities that are subject to the Labuan Business Activity Tax Act 1990 (LBATA) may still be subject to RPGT on the disposal of RPC shares – see Item 14. Other categories of taxpayers, such as individuals, will also continue to be subject to the provisions of the RPGT law when disposing of RPC shares.

10. Other compliance considerations

- Taxpayers are not required to submit a separate estimate of tax payable for a year of assessment for gains or profits for disposal of capital assets which fall within the CGT regime, and there is no requirement to include such gains or profits within the usual tax estimate form.

- Taxpayers are required to maintain sufficient records and documentation for seven years on the disposal of the capital asset.

- CGT will be on a self-assessment system. As such, relevant provisions in the ITA that are applicable to the income tax return will be applied to CGT, such as provisions relating to appeals and penalties.

Malaysian CGT could apply on the disposal of shares in a foreign-incorporated company under the following circumstances:

i) Where the foreign company directly or indirectly holds real property in Malaysia exceeding certain thresholds

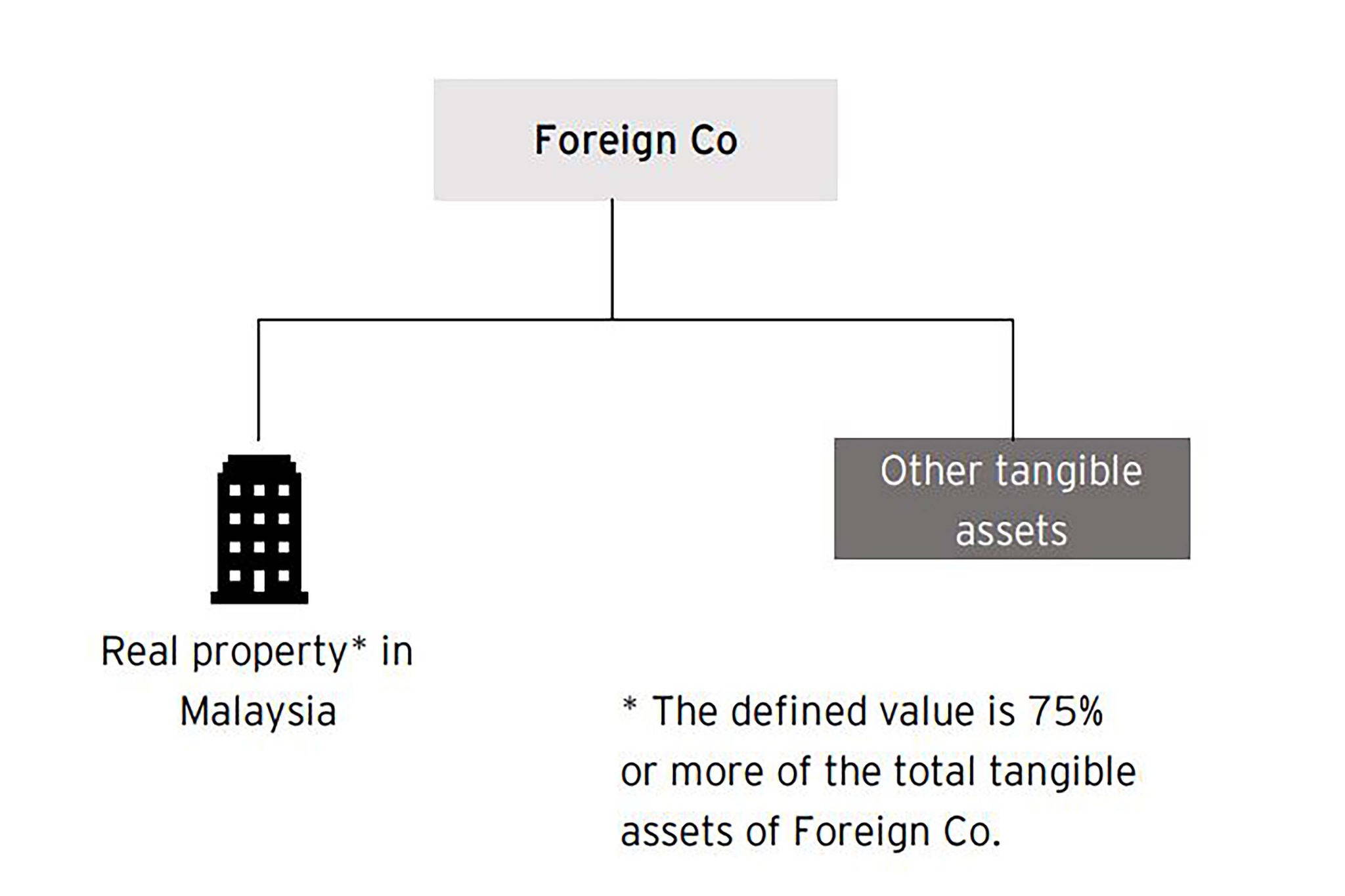

Scenario 1

Where a foreign company owns real property in Malaysia and the defined value (i.e. market value) of the real property on the date of acquisition of the shares in the foreign company (as determined based on complex CGT rules) is at least 75% of the foreign company’s total tangible assets, gains from the disposal of shares in the foreign company will be deemed to be Malaysian-sourced and subject to CGT.

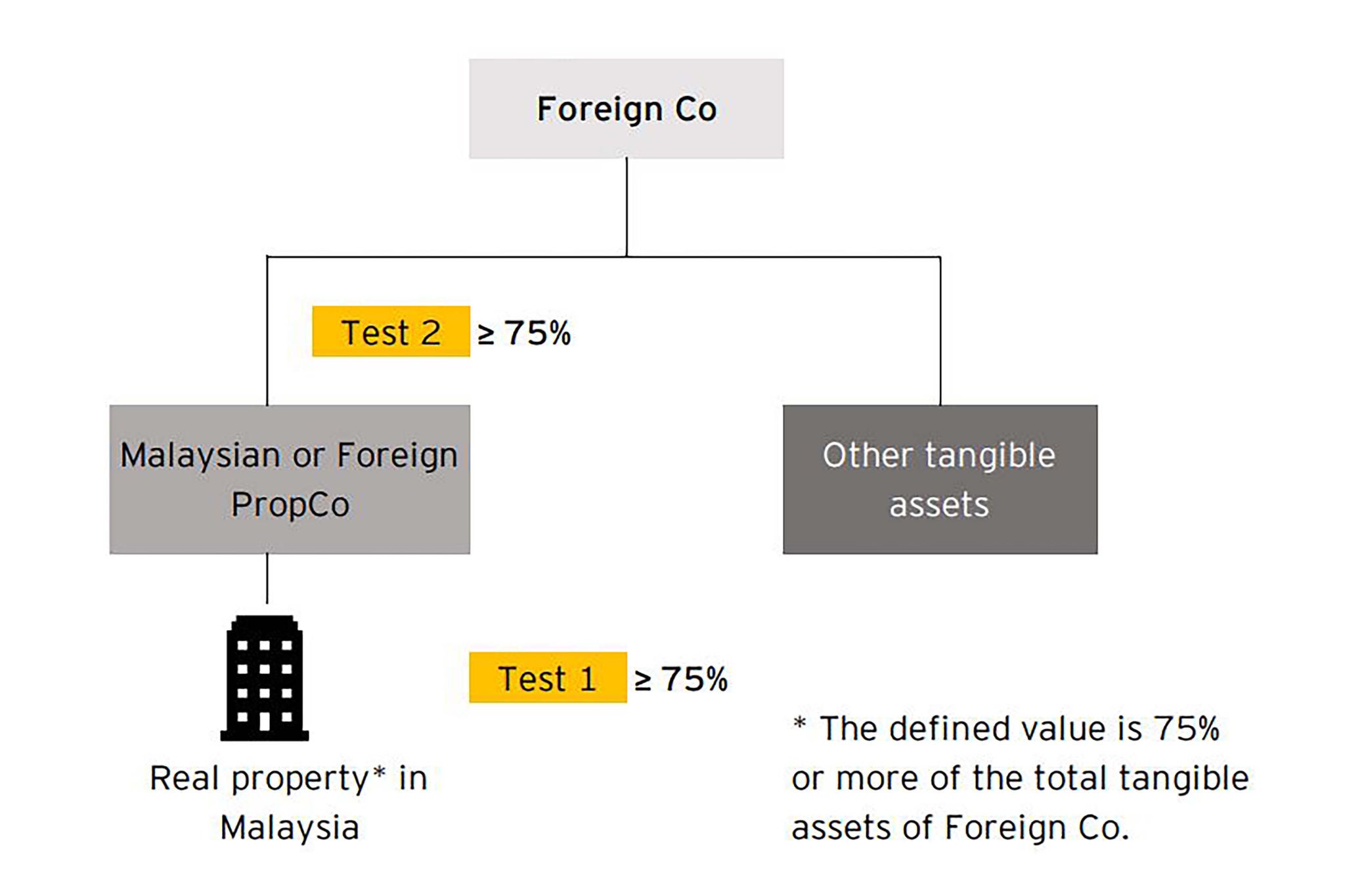

Scenario 2

Where a foreign company owns shares in another company which owns real property in Malaysia (PropCo), gains from the disposal of shares in the foreign company will be deemed to be Malaysian-sourced and subject to CGT if the two tests below are met on the date of acquisition of the shares in the foreign company (as determined based on CGT rules):

- Test 1: PropCo owns real property in Malaysia and the defined value (i.e., market value) of the real property is at least 75% of PropCo’s total tangible assets.

- Test 2: (If Test 1 is satisfied) The defined value (i.e., acquisition price based on CGT rules) of the PropCo shares owned by the foreign company is at least 75% of the foreign company’s total tangible assets.

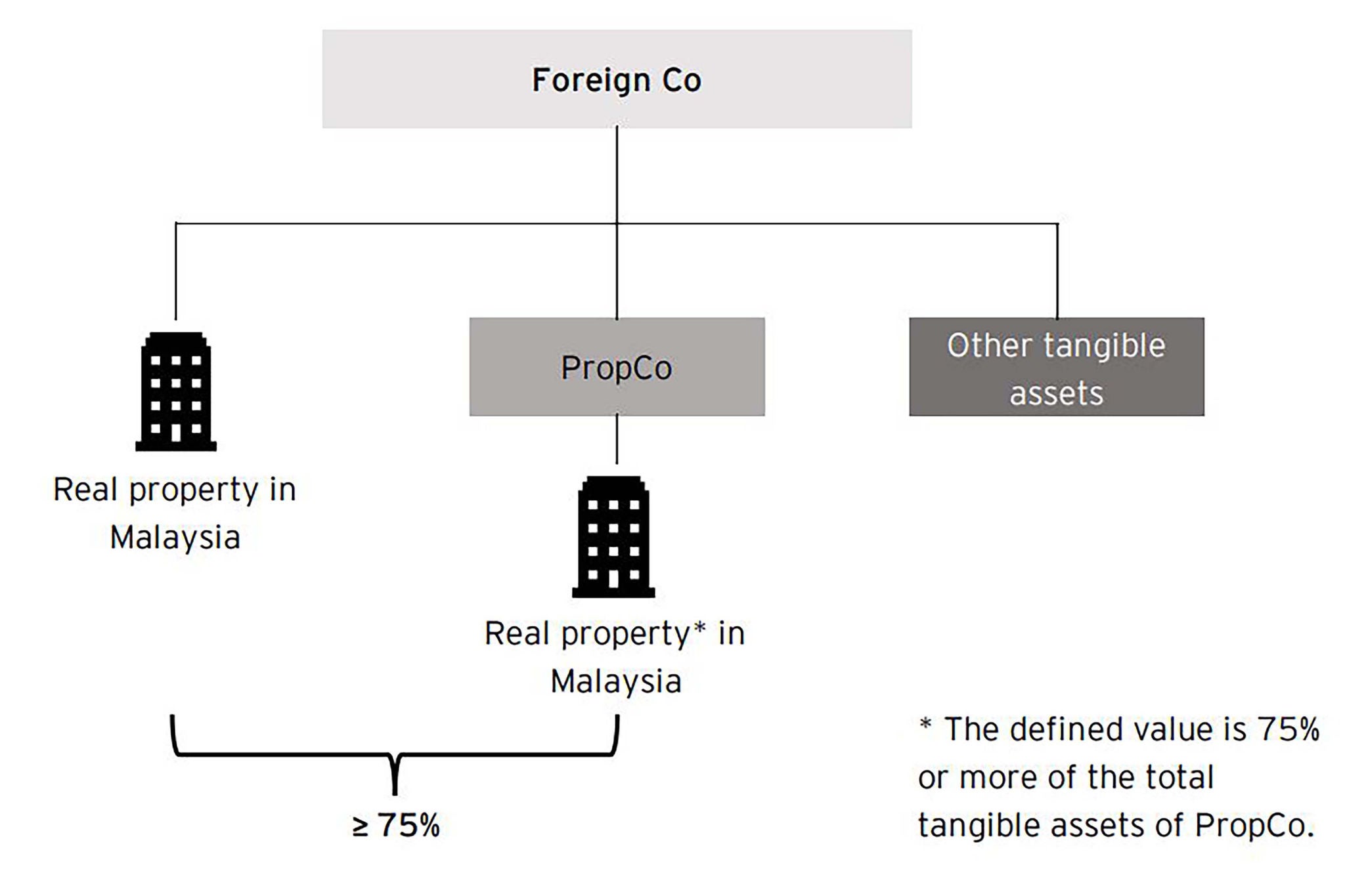

Scenario 3

Where a foreign company owns real property in Malaysia (Scenario 1) and shares in another company which owns real property in Malaysia (PropCo) (Scenario 2), and the defined value (i.e., market value) of the real property and PropCo shares (i.e., acquisition price) is at least 75% of the foreign company’s total tangible assets, gains from the disposal of shares in the foreign company will be deemed to be Malaysian-sourced and subject to CGT.

- The rate of CGT would be 10% of the gains, with the disposer having the option of paying CGT at 2% of the gross disposal price if the shares were acquired before 1 January 2024.

- Once the 75% test above is met, gains from the disposal of shares of the foreign controlled company are continued to be deemed as Malaysian-sourced gains, notwithstanding that at the time of disposal of the said shares, the defined value of the real property and/or shares of PropCo is less than 75% of total tangible assets.

- In terms of acquisition date, the shares of the foreign controlled company are deemed to be acquired on:

a) The date the 75% test above is met, if the foreign company shares are already owned before it acquires or is deemed to acquire real property in Malaysia or PropCo shares such that the 75% test is met; or

b) The actual date of acquisition of the shares of the foreign controlled company, if the 75% test has already been met.

ii) Sales of shares in a foreign company which does not meet the real property thresholds in (i) above, but where the gains are received in Malaysia

Where a Malaysian resident company, trust body, LLP or co-operative society disposes of shares in a foreign company which does not meet the real property thresholds discussed in (i) above, the gains will only be subject to tax if received in Malaysia. The rate of tax will be the prevailing tax rate of the taxpayer, e.g., generally 24% in the case of a company.

Observations

- The term ‘real property’ is not explicitly defined under the ITA and further guidance is required on this. It is unclear if the ‘real property’ definition in the Real Property Gains Tax Act 1976 (RPGTA)6 will be used for CGT purposes.

- At this stage, it is not clear when the 75% test needs to be performed. The way in which the law is drafted suggests that this is a “continuous” test. It is hoped that further clarity will be provided on this.

- In the Budget 2024 speech, it was indicated that the Government is considering exemptions for share disposals in connection with Initial Public Offerings approved by Bursa Malaysia, internal group restructuring and venture capital related investments, subject to stipulated conditions.

- In the National Tax Seminar for Budget 2024 conducted by HASiL, it was indicated that exemptions would be available for foreign-sourced gains on disposal of capital assets which meets economic substance requirements. This would be consistent with the positions adopted by Singapore and Hong Kong.

Observations

The exemptions mentioned in the Budget Speech and the National Tax Seminar were not included in the Finance Act. It is expected that the exemptions will be included in subsidiary legislation.

Further, no guidance is available on the economic substance requirements which would need to be met to exempt foreign-sourced capital gains from Malaysian tax. In order to be eligible for tax exemption on foreign-sourced dividend income received in Malaysia, companies and LLPs must also comply with economic substance requirements, in addition to meeting other conditions. These requirements are set out below. It is possible that similar economic substance requirements will be adopted for CGT exemption:

a) The taxpayer must have employed adequate number of employees with necessary qualifications to carry out the specified economic activities in Malaysia; and

b) The taxpayer must have incurred adequate amount of operating expenditure for carrying out the specified economic activities in Malaysia.

13. Will exemptions be provided to unit trusts?

On 16 January 2024, the Honorable Finance Minister II announced that unit trusts will be exempted from tax on the gains on disposal of capital assets. It was also announced that unit trusts will be exempted from tax on foreign-sourced income. The exemptions will apply for the following periods:

- CGT: From 1 January 2024 until 31 December 2028

- Foreign-sourced income: From 1 January 2024 until 31 December 2026

The exemptions above have yet to be legislated.

- A Labuan entity which is taxed under the LBATA will not be subject to CGT. A Labuan entity which has made an irrevocable election to be taxed under the ITA will be subject to CGT.

However, if the shares disposed by the Labuan entity which is taxed under the LBATA are RPC shares, the Labuan entity could still be subject to RPGT on the disposal.

- Disposal of unlisted shares in a Labuan company would be subject to CGT as the shares are considered to be capital assets situated in Malaysia.

As the CGT is taxed under the ITA, tax treaty protection should technically be available where the disposer is a tax resident in a jurisdiction which has an in-force tax treaty in place with Malaysia and the relevant treaty conditions are met such that taxing rights are granted to the jurisdiction in which the disposer is resident. It is important that the wording of each treaty be studied to assess the appropriate position. Thus far, no comments or guidance have been provided by HASiL on treaty protection.

- The gains which will be subject to CGT are calculated as follows:

|

RM |

RM |

|

|---|---|---|

|

Value of the consideration for the disposal of the capital asset at the time of disposal |

XX |

|

|

(Less):

|

||

|

Value of the consideration for the acquisition of the capital asset |

||

|

Add: Incidental costs of the acquisition7 |

||

|

(Less):

|

||

|

Chargeable income/adjusted income |

XX |

- Consideration is deemed to be the fair market value of the asset in certain cases, such as transfers by way of gift or transactions between connected persons8.

17. How are losses treated?

Losses on the disposal of capital assets are to be tracked separately. Such losses can be used to reduce the adjusted income on a subsequent disposal of capital assets, either in the same year as the loss-making disposal or in the next ten consecutive years of assessment. If a company sells shares for a gain in, say, January of a year and then sells other shares for a loss in, say, June of the same year, the loss cannot be “carried back”.

Observation

It is not clear if losses on the disposal of domestic assets (which are taxed at 10% of the gain) would be grouped together with losses on the disposal of foreign assets (which are taxed at 24% of the gain for disposals by companies).

18. Some transaction considerations

Some of the key considerations in a merger or acquisition transaction from CGT perspective are as follows:

- Whether the disposal of unlisted shares in a Malaysian-incorporated company will qualify for any CGT exemptions – see Item 12

- Whether the disposal of shares in a foreign controlled company would be subject to CGT upon disposal, or only upon remittance of gains into Malaysia – see Item 11

- Whether treaty protection is available – see Item 15. To apply treaty relief, taxpayers may need to demonstrate that the holding structure was developed based on commercial justifications.

- Whether there are any capital losses from previous restructuring exercises, which can be utilized –see Item 17

- Whether (and when) the transfer of capital assets situated outside Malaysia is subject to CGT. As mentioned in Item 2 above, the scope of capital assets situated outside Malaysia is wide and not just limited to shares. This may include fixed assets such as building and plant, and intellectual property.

19. Observation

It is interesting to see how the legislation for the taxation of capital gains in Malaysia has been structured. The ITA deems gains or profits from the disposal of a capital asset as “income”, and “capital asset” is defined to be movable or immovable property including any rights or interests thereof. This indicates that as a base, gains or profits from the disposal of all capital assets will be subject to tax. Paragraph 38 of Schedule 6 of the ITA then provides a tax exemption on gains or profits from the disposal of a capital asset situated in Malaysia, except for the following:

a) Disposal of shares of a company incorporated in Malaysia not listed on the stock exchange; and

b) Disposal of shares of a foreign controlled company with a nexus to Malaysian real property (see Item 11)

As such, if the Government decides in the future to expand the scope of CGT to cover all capital gains, this can be done simply by removing Paragraph 38 of Schedule 6 of the ITA, potentially with relevant amendments to other areas of the tax legislations.