EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The Private Equity landscape is witnessing an unprecedented era of consolidation and the emergence of mega-managers,a trend significantly influenced by the evolving economic andregulatory environment.

Is the current shift, driven by fundraising challenges, and regulatory costs, signifying a new era where only the largest firms may thrive?

An accelerating consolidation trend in the last two years

Just recently, General Atlantic grabbed the spotlight in both the private equity and infrastructure sectors by strategically acquiring Actis(1).In a similar vein, last month, BlackRock(2) sealed a substantial $12.5 billion cash and share deal with Global Infrastructure Partners. Adding to these major developments, Wendel Group(3) made a strategic entrance into 2024 with its acquisition of IK Partners, further aligning with the broader trend of major firms diversifying their portfolios and bolstering their capabilities. These developments serve as clear indicators of the ongoing consolidation wave currently reshaping the asset management industry.

For private equity, recent high-profile transactions represent merely the visible portion of this massive consolidation wave that’s sweeping through. David Layton(4), CEO of Partners Group, is among the industry leaders predicting a significant reduction in the number of private market fund managers, envisioning a shift from over 11,000 players to approximately 100 significant ones in the next decade.

Notably, the acquisition fervor isn’t limited to mid-sized firms; industry giants are also stepping into the arena. For instance, TPG’s(5) jaw-dropping $2.7 billion acquisition of Angelo Gordon, a heavyweight in real estate and private credit, made waves in the sector. Similarly, Sweden’s EQT(6) made a historic move by acquiring Baring Private Equity Asia, a well-established player in the Asia-Pacific region, marking a momentous merger in the private equity landscape.

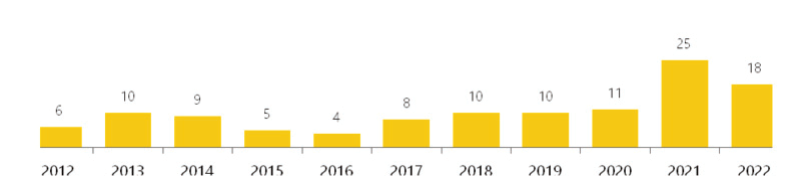

These developments underscore the rapid pace of consolidation in the industry, signaling profound changes ahead. Looking back, the number of strategic acquisitions announced or completed by the world’s 50 largest alternative asset managers more than doubled from 2020 to 2021, increasing from 11 to 25 in 2021. In 2022, there were 18 such transactions, marking the second-highest total over the past decade, with the trend expected to continue into 2024(7).

Number of global acquisitions by Top 50 alternative asset managers (8):

Unpacking the drivers of Private Equity consolidation

These consolidations are driven by a variety of factors:

The “race to AUMs” for publicly listed firms

Publicly traded alternative asset managers are dominating the mergers and acquisitions landscape, responsible for 84% of deals since 2012 (9). Their advantage stems from robust balance sheets and liquid assets and the constant pressure to maximize their asset under management across strategies, contrasting sharply with private firms’ struggles with self-funded mergers and valuation challenges for debt financing. Consequently, public companies target larger and more numerous acquisitions.

Notably, a minority of the top 50 alternative asset managers have engaged in strategic mergers and acquisitions since 2012, with public companies taking the lead(10). The pressure is on for these public entities, as shareholders expect at least 15% annual growth in fee-bearing assets under management (AUM). To meet these expectations, firms are diversifying asset classes, expanding geographically, exploring new customer channels, and utilizing strategic distribution. Mergers and acquisitions are pivotal in bolstering these growth strategies. This trend is exemplified by Sweden’s EQT, which, since going public in 2019, has conducted five strategic acquisitions, including the notable $7.5 billion purchase of Baring Private Equity Asia(11).

Responding better to investor preferences and diversification

Moreover, investors are increasingly drawn to firms offering a broader range of services, including wealth management and advisory services, beyond traditional Private Equity investments. One significant

driver of consolidation in the Private Equity sector is the pursuit of diversified investment strategies. Mega-man-agers are increasingly seeking to expand their capabilities and offer a broader range of investment options to their clients. This strategy allows them to tap into new markets, asset classes, and geographies, making them more attractive to a diverse investor base. Examples such as TPG(12) ‘s acquisition of Angelo Gordon, which brought together real estate and private credit expertise, and EQT’s(13) takeover of Baring Private Equity Asia, show-casing the expansion into the Asia-Pacific region, illustrate this trend.

Additionally, asset managers aspire to become comprehensive service providers for LPs, transitioning from specialized or niche firms to versatile multistrategy asset managers.

Diversification enhances mega-managers’ ability to navigate market fluctuations and capitalize on emerging opportunities, further fueling the consolidation wave.

Behind consolidations: The new reality of PE fundraising

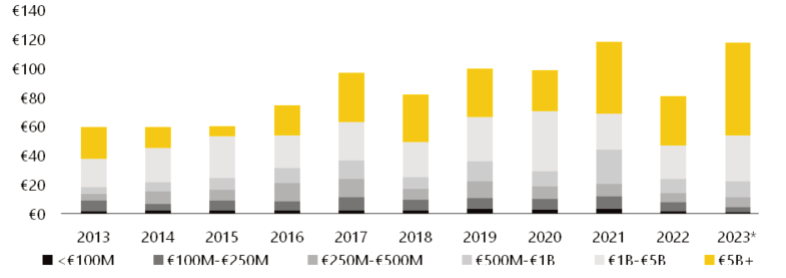

The dominance of mega-funds, while slightly easing, remains significant. In Europe, Private Equity funds over $1 billion represent nearly 82% of all capital raised(14), indicating a clear investor preference for larger, more established players:

Private Equity capital raised by size bucket – Europe (Q4 2023) (15)

According to Pitchbook, fundraising in the European PE sector nearly set a new record, with around €120 billion raised across 117 funds. Interestingly, this robust fundraising was largely driven by megafunds, as the top five funds accounted for over half of the total capital raised, highlighting a trend towards larger, more established fund managers attracting the majority of investor interest. Investors are becoming more selective, often preferring to allocate their capital to established firms with proven track records “flight-to-quality”. This trend leads to a concentration of funds in the hands of a few large players, leaving smaller firms struggling to raise sufficient capital.

Regulatory pressures and compliance costs

The Private Equity sector is facing heightened regulatory scrutiny, leading to increased compliance costs. Smaller firms often find it challenging to bear these costs, which include the expenses of adhering to evolving regulatory standards and employing necessary legal and compliance staff. This pressure further incentivizes smaller firms to merge with larger entities to share the burden of compliance and regulatory requirements.

Succession planning

Succession planning is another pivotal factor contributing to the wave of consolidation. As the founders of specialized boutique firms approach retirement, they initiate succession plans, making them attractive prospects for larger Private Equity acquirers.

What’s next?

Anticipated consolidation opportunities are on the horizon for the next 5 to 10 years, offering established fund managers transformative chances to solidify their positions. This trend is expected to persist, allowing existing players to enhance their positions as the industry matures. Similar to the banking sector’s transformation in the 1990s, the Private Equity industry is moving toward dominance by large, diversified firms, potentially sidelining smaller niche players.

However, this consolidation and emergence of mega-managers are not without potential downsides. The reduction in the number of players in the market could lead to less competition, higher fees, and reduced choice for investors. Furthermore, integrating different firms and cultures poses its own set of challenges, potentially impacting the long-term success of these consolidations.

As Private Equity enters an era of rampant consolidation, the repercussions will ripple across the financial landscape. With fewer but more powerful players, the dynamics of investment, risk, and reward are poised to undergo a profound transformation. This consolidation is not just a reshaping of an industry but a reflection of broader economic shifts and a harbinger of the financial world’s future direction.

1) General Atlantic adds sustainable infrastructure strategy, as Actis joins platform to create a $96 billion AUM diversified global investor – General Atlantic website (General Atlantic adds sustainable infrastructure strategy, as Actis joins platform to create a $96 billion AUM diversified global investor| General Atlantic)

2) BlackRock Agrees to Acquire Global Infrastructure Partners (“GIP”), Creating a World Leading Infrastructure Private Markets Investment Platform – BlackRock website (BlackRock Agrees to Acquire Global Infrastructure Partners (“GIP”))

3) With the acquisition of IK Partners, Wendel initiates its development strategy in third-party asset management – Wendel website (With the acquisition of IK Partners, Wendel initiates its development strategy in third-party asset management - WendelGroup)

4) Private equity M&A set to whittle sector down to 100 ‘next generation’ firms – Financial Times

5) TPG to Acquire Angelo Gordon – TPG website (TPG to Acquire Angelo Gordon | TPG Inc.)

6) EQT combines with BPEA to capture growth opportunities in Asia – EQT website (EQT combines with BPEA to capture growth opportunities in Asia (eqtgroup.com))

7) Top 50 measured by capital raised in private equity, real estate, infrastructure, and private debt funds over the past decade – Source: Financial Times “Private equity is in for rampant consolidation” / Bain & Company

8) Top 50 measured by capital raised in private equity, real estate, infrastructure, and private debt funds over the past decade – Source: Financial Times “Private equity is in for rampant consolidation” / Bain & Company

9) Is Strategic M&A Finally Catching On in Private Capital? – Bain & Company

10) Is Strategic M&A Finally Catching On in Private Capital? – Bain & Company

11) Is Strategic M&A Finally Catching On in Private Capital? – Bain & Company

12) TPG to Acquire Angelo Gordon – TPG website (TPG to Acquire Angelo Gordon | TPG Inc.)

13) EQT combines with BPEA to capture growth opportunities in Asia – EQT website (EQT combines with BPEA to capture growth opportunities in Asia (eqtgroup.com))

14) Pitchbook – 2023 Annual European PE Breakdown

15) Pitchbook – 2023 Annual European PE Breakdown

Summary

The Private Equity landscape is witnessing an unprecedented era of consolidation and the emergence of mega-managers,a trend significantly influenced by the evolving economic andregulatory environment. Is the current shift, driven by fundraising challenges, and regulatory costs, signifying a new era where only the largest firms may thrive?