Technology companies rethink their supply chains after the unanticipated impact of the pandemic and a host of new “black swan” events.

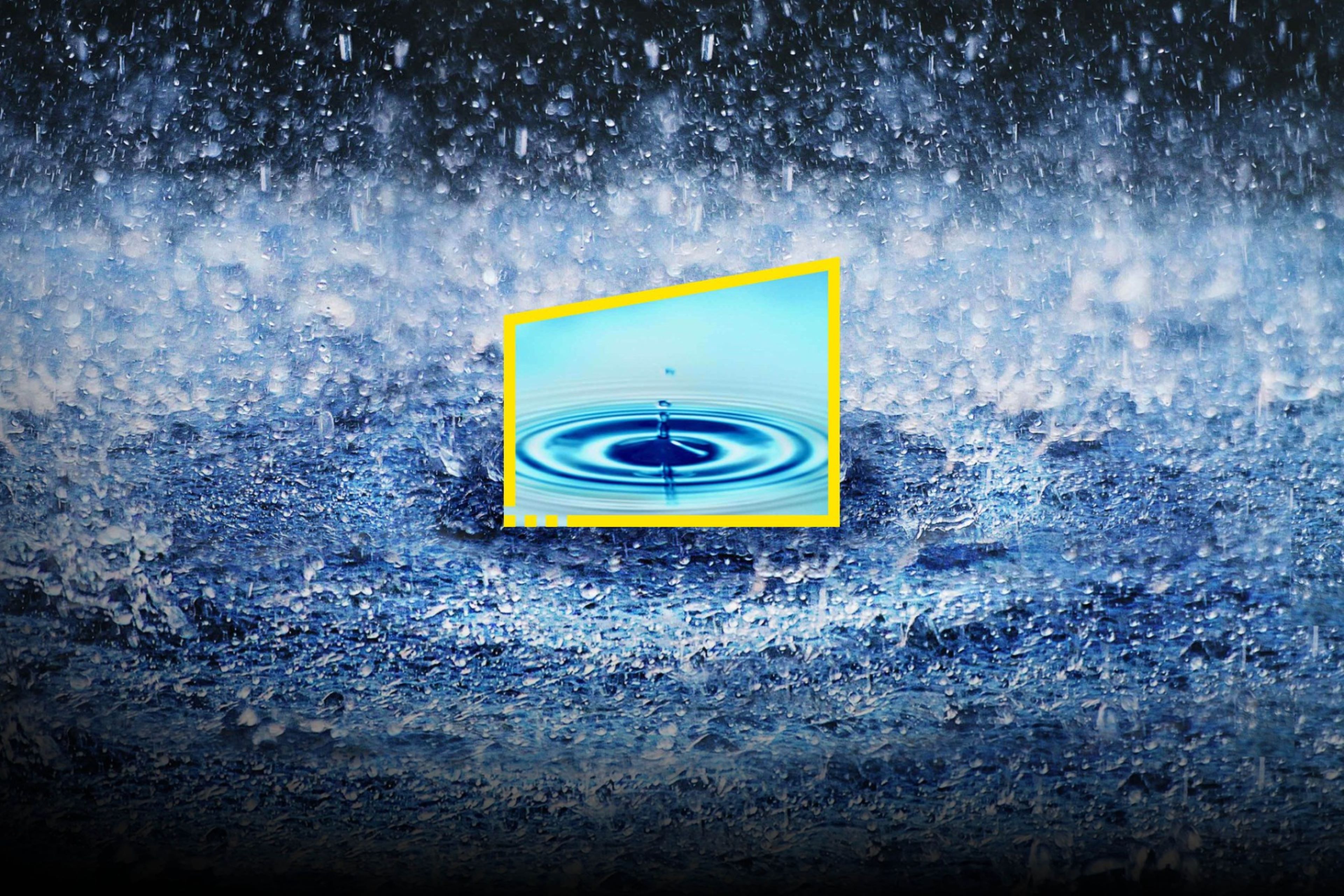

The global supply chain, which was already absorbing the impact of the US and China trade challenges, came under additional stress during the global COVID-19 pandemic.

Driven by a global shutdown of factories and a shortage of shipping containers, importers experienced delays in receiving manufacturing components, while exporters faced challenges in getting bookings on shipping vessels.

Perhaps not surprisingly, 95% of the executives surveyed indicated their companies are taking action to change their supply chain and operating model. The semiconductor sector stands as an example of the “perfect storm” that is leading executives in this sector and across many sectors to rethink their supply chain operating model.

The move to remote working led to a surge in sales of electronic devices, and this, combined with the digitalization of everything, created and continues to create unprecedented demand for semiconductors and sensors for a wide range of historically non-digital products. Combined with other unanticipated supply bottlenecks, including natural disasters taking select chip fabricators offline, it created a huge scarcity for semiconductors — impacting 169 industries ranging from consumer products to automotive.1

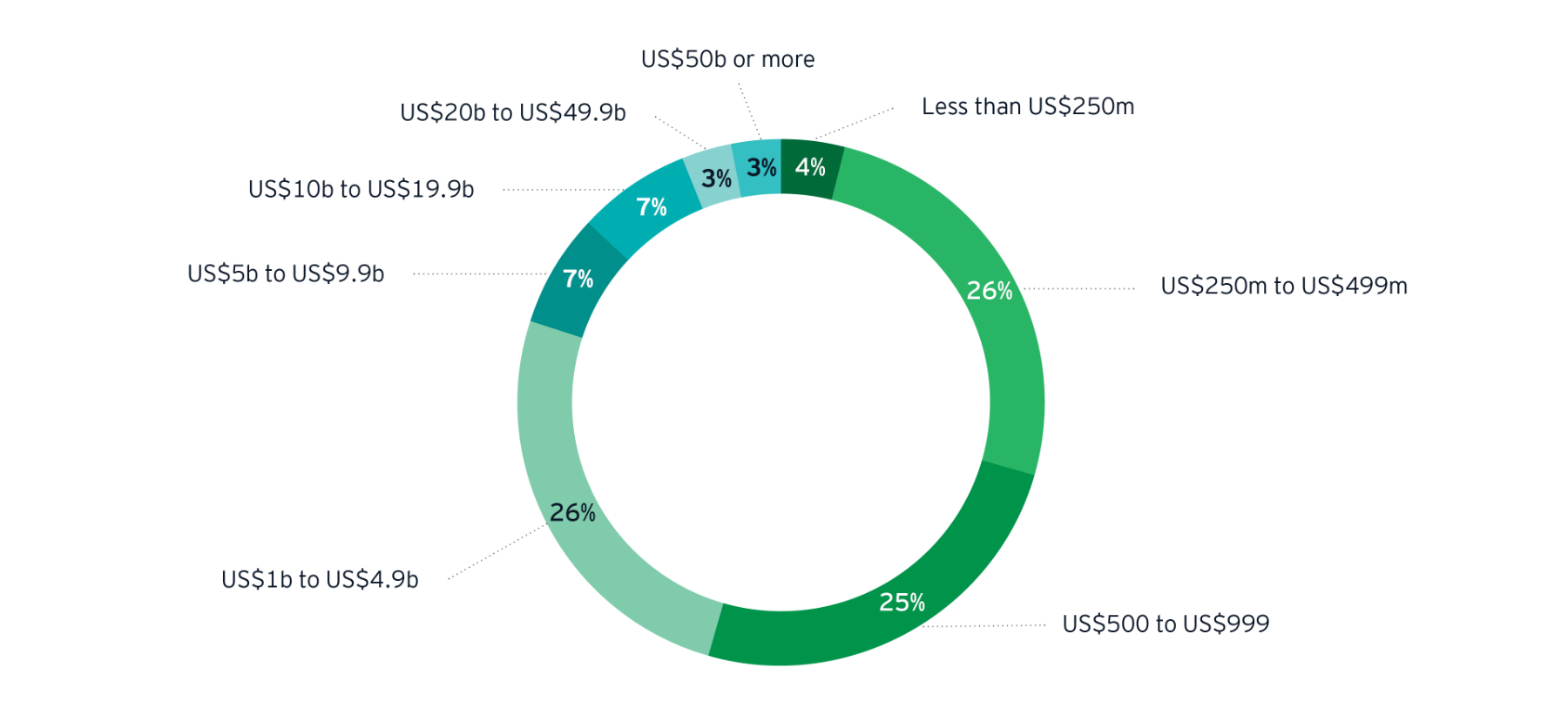

If we look closer at the survey respondents who indicated that they have passed these additional costs onto their customers, an interesting subplot arises, indicating that emerging technology companies have not been as successful in increasing their prices:

- 73% of industry leaders have passed additional costs on to customers vs. 53% of industry followers.

- 65% of large technology companies (US$10b-plus) have passed additional costs to customers, compared with 53% of small technology companies (US$50m–$499m).

- 59% of legacy technology companies have passed these costs to customers, compared with 53% of emerging technology companies.

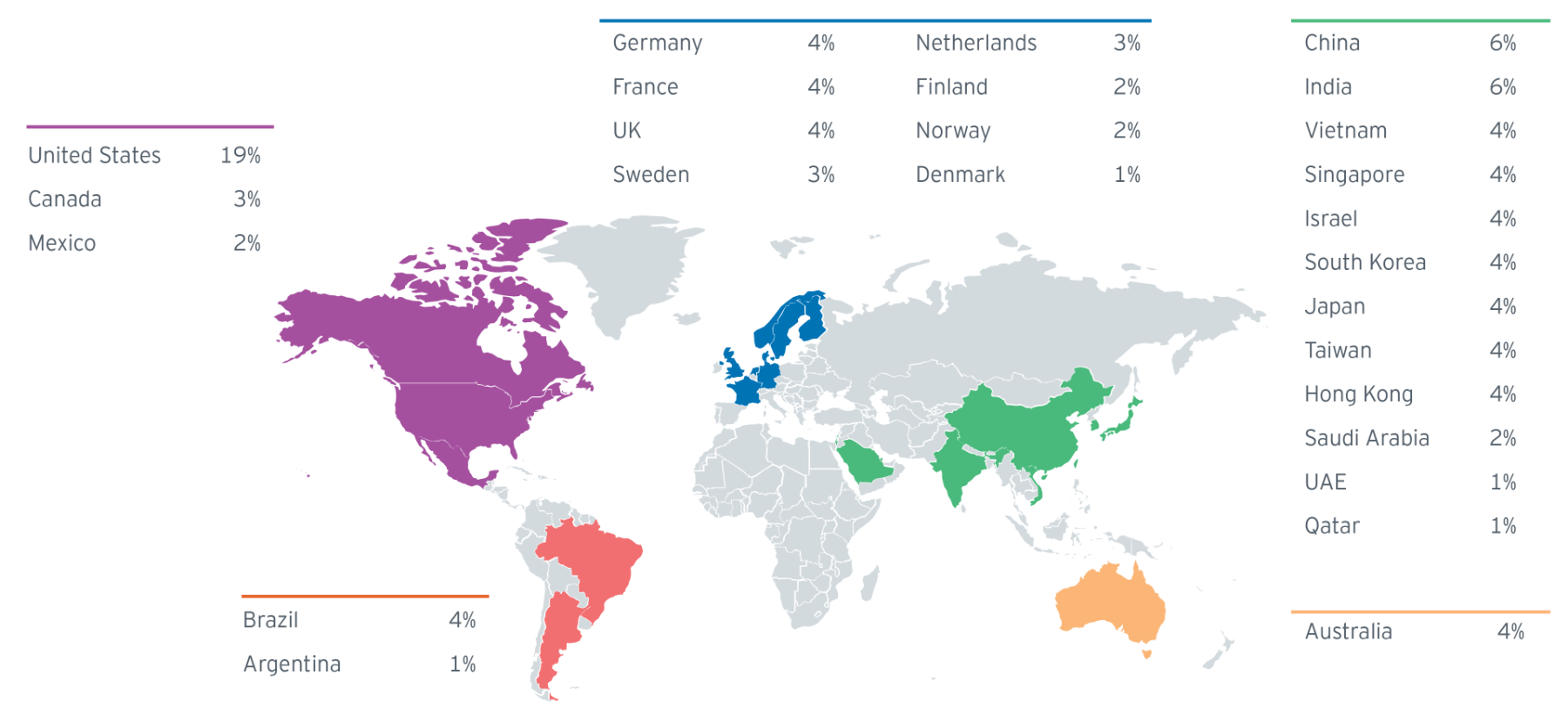

With the pandemic’s effects on supply chains intensifying the focus on resiliency and sustainability, the desire of technology executives and their companies to nearshore and reshore their supply chains was prominent in the survey results. While 19% of executives indicated their companies have already moved their manufacturing to be onshore or more localized, 71% indicated they plan to do the same over the next three years. A related factor that also builds the case for near/reshoring is likely the fact that 68% of the executives indicated that tech firms will need to take stronger actions to reduce global emissions over the next three years.

When we asked how executives planned to adapt their operations, respondents indicated that recent changes triggered by the global pandemic and the challenges throughout the supply chain have led to increased business resiliency throughout the organization and across their value chains and ecosystem.