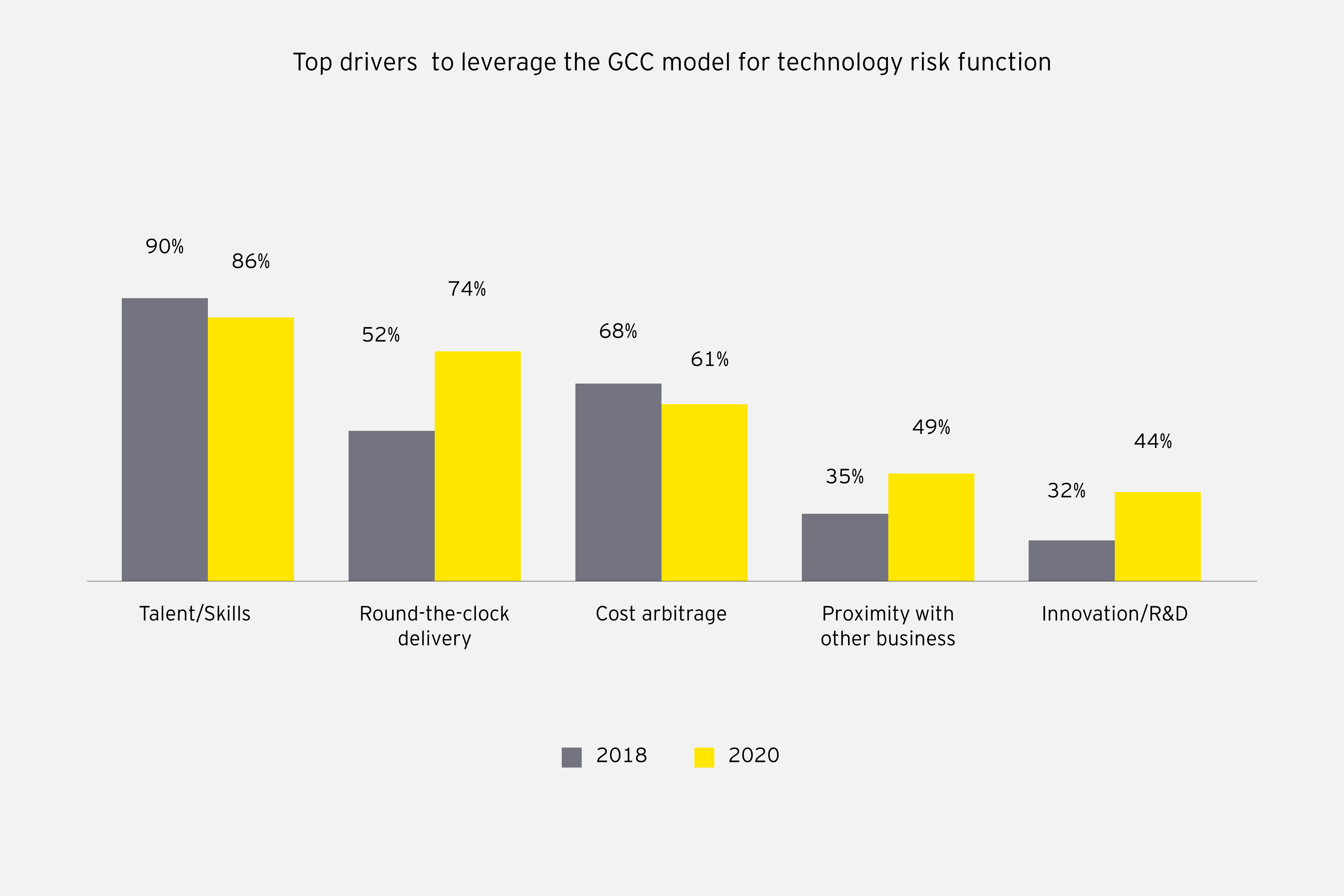

- 86% of GCCs, along with 80,000 to 85,000 digitally skilled graduates, believe that ‘skills’ are the primary driver.

- In 2020, 74% of GCCs compared to 52% in 2018, believed that cyber and technology-related risks should be managed across different time zones. The ‘Round-the-clock’ driver has gained 22 points since 2018.

- In 2020, 61% of GCCs believed that the ‘cost arbitrage’ driver makes managing functions from India much more efficient.

- 44% of GCCs consider faster innovation and research and development as key drivers.

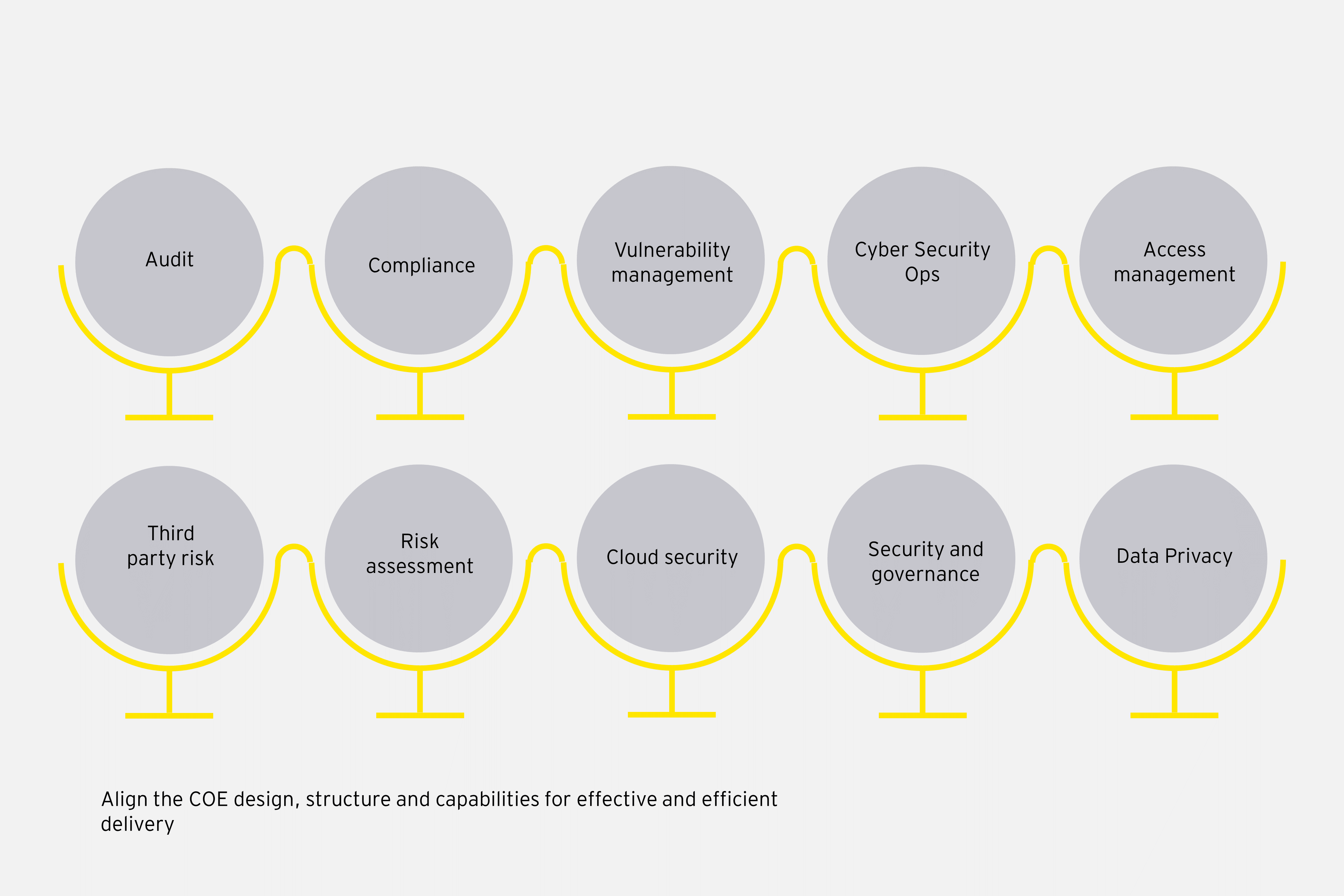

In their contemporary roles, these GCCs have surpassed traditional boundaries by actively engaging in delivering high-value activities, such as automation, risk data aggregation, cloud security, and governance. Serving as strategic partners, these centers have established CoEs for niche capabilities, acting as catalysts for innovation across the entire enterprise.

Services provided by cyber and technology risk functions of BFSI GCCs in India

With 41% of GCCs in India having at least a quarter of their information security staff located in India as of 2020, the number of security services provided and managed through India GCCs has only grown. Due to the complex nature of these services, the majority of the organizations now even have their cyber and risk leadership based out of India's GCCs only. Apart from the traditional services such as cyber strategy and governance, risk assessment, threat response and crisis management, BFSI GCCs have started to perform new-age functions due to emergence of new digital risks. The top five ‘Next gen’ cybersecurity functions being delivered from BFSI GCCs in India include emerging technology risk, cyber resilience, cloud security, cybersecurity operations and cybersecurity product management and automation.

Technology risk and cyber GCC function-wise spend

BFSI GCCs, over the years, have been delivering core functions, aligned with priorities and budget allocation of their global majors. However, it is interesting to note that not all cyber GCCs prioritize the same functions. This could be due to varied organizational and budget priorities.