EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

- Transmission of omissions and discrepancies

- Timing and mode of transmission

- Interconnection of electronic tax mechanisms with POS terminals

In relation to the implementation of the data transmission project on the myDATA platform of the Independent Authority for Public Revenue (IAPR), the following have been published:

- Decision A.1090/2022, which anew amended Decision A.1138/2020, regarding the obligation to transmit data to the myDATA digital platform,

- two modules on the omission and discrepancy of data transmission for the years 2021, as well as 2022 and onwards,

- updated technical specifications (version 1.0.6 – June 2022) for the transmission and reception of data for ERP system users, and

- Decision A.1098/2022, which stipulates the mandatory interconnection between electronic tax mechanisms (FIMs) and payment card terminals (EFT/POS).

In order to implement the changes, the companies' ERPs / commercial - accounting softwares should be updated and configured in accordance with the operational analysis and technical specifications, as well as the digital myDATA platform, in order to enable the transmission and acceptance of data.

The most important obligations introduced by Decisions A.1090/2022 and A.1098/2022 and the main issues addressed by the new modules and the updated technical specifications are as follows:

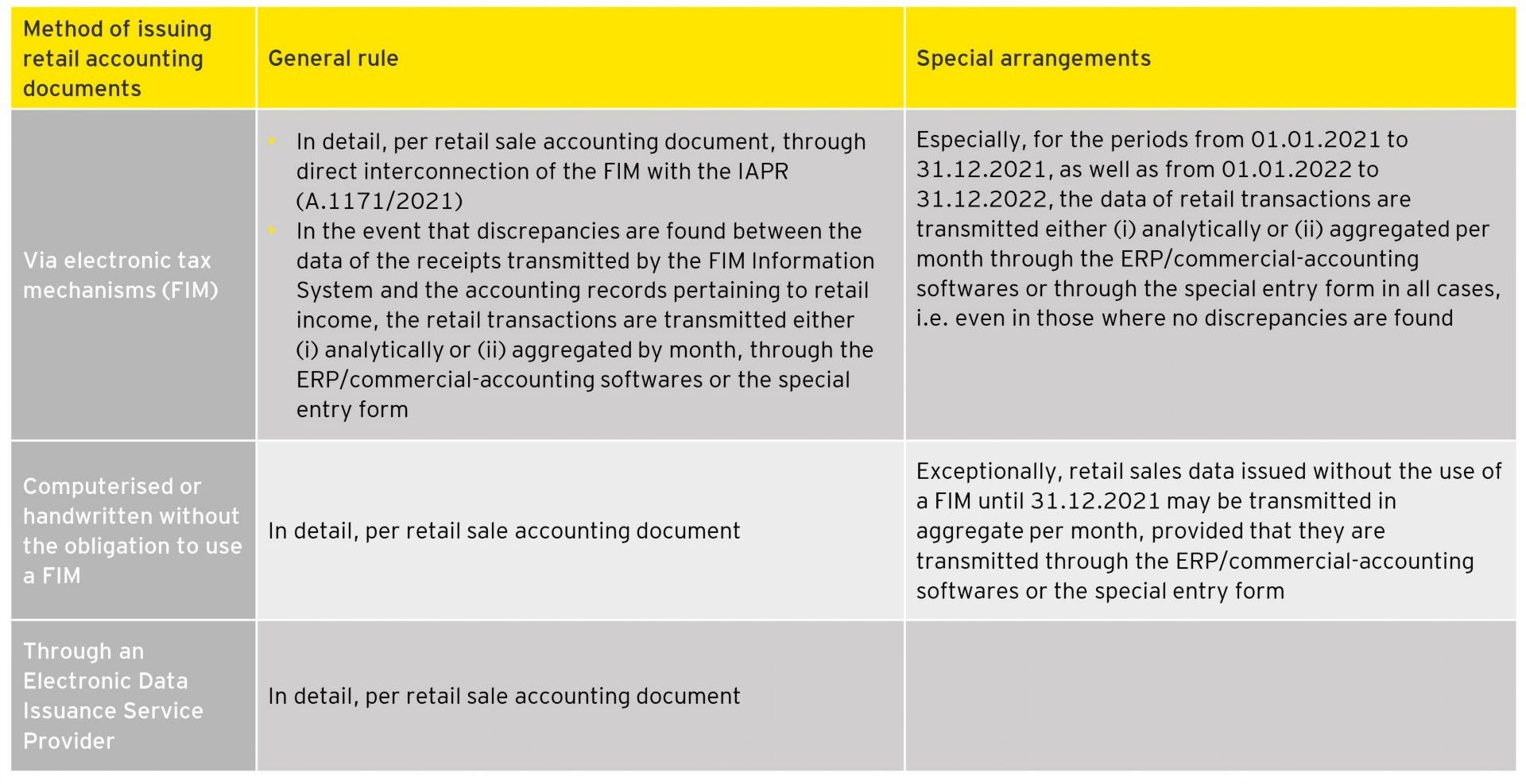

Α. What is the mode of transmission of retail transactions?

As defined with decision A.1090/2022, the transmission of retail transactions will be carried out as follows, based on the method the accounting documents are issued:

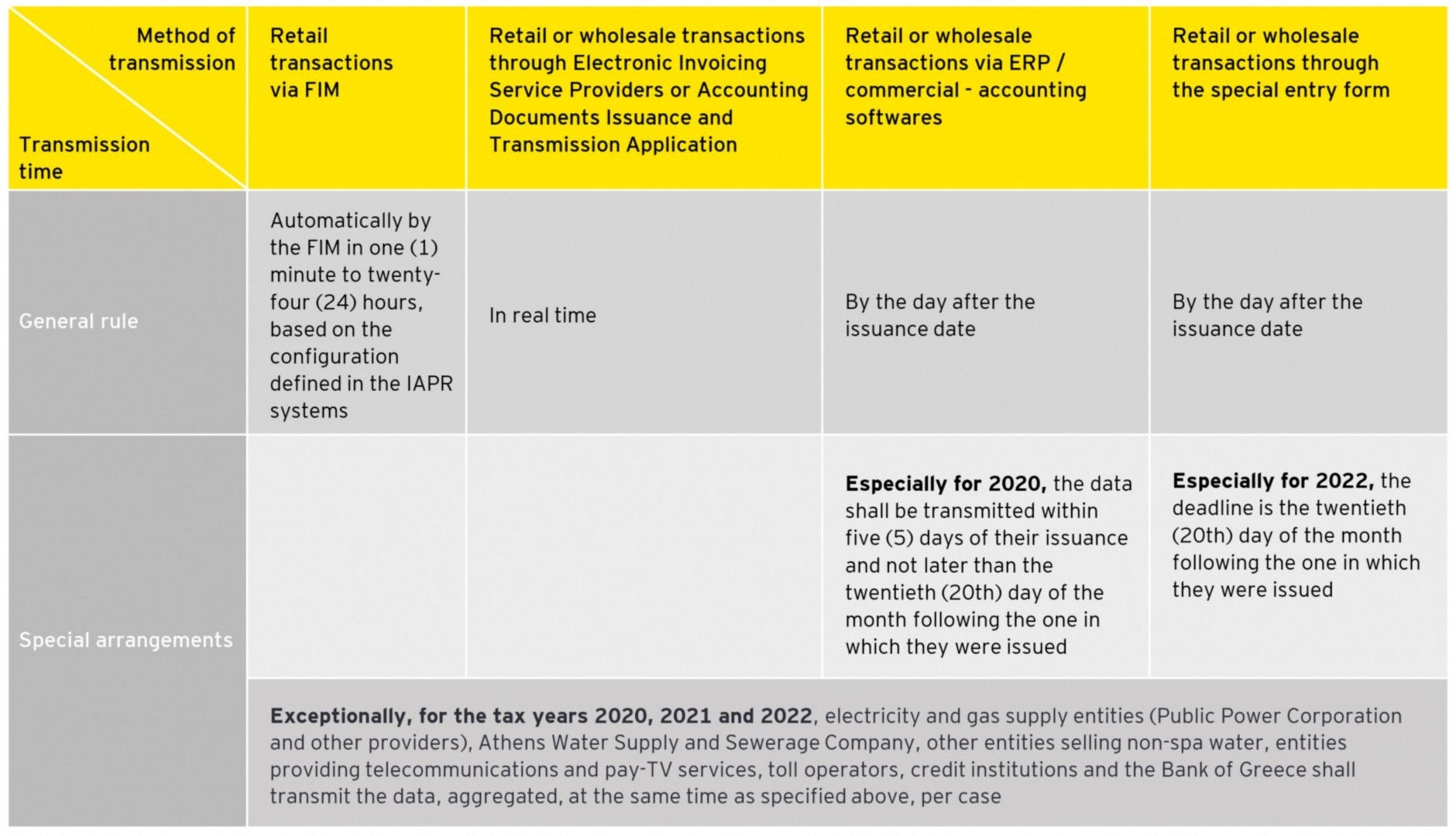

Β. What is the transmission time of the retail and wholesale transactions’ summaries?

In relation to the time of transmission of the retail and wholesale transactions’ summaries, decision A.1090/2020 stipulated the following:

C. Omissions and discrepancies in data transmission

In the event that the issuers of domestic mirrored accounting documents, i.e. invoicing expenses (expenses incurred by a company on the basis of invoices issued by its suppliers, Greek companies) and self-billing revenues (income of a company, a Greek customer of which is self-invoiced), either did not comply with the obligation to transmit the specified data ("Failure to transmit"), or transmitted them with a discrepancy ("Transmission discrepancy"), businesses as recipients have the obligation to transmit them to the myDATA digital platform, as follows:

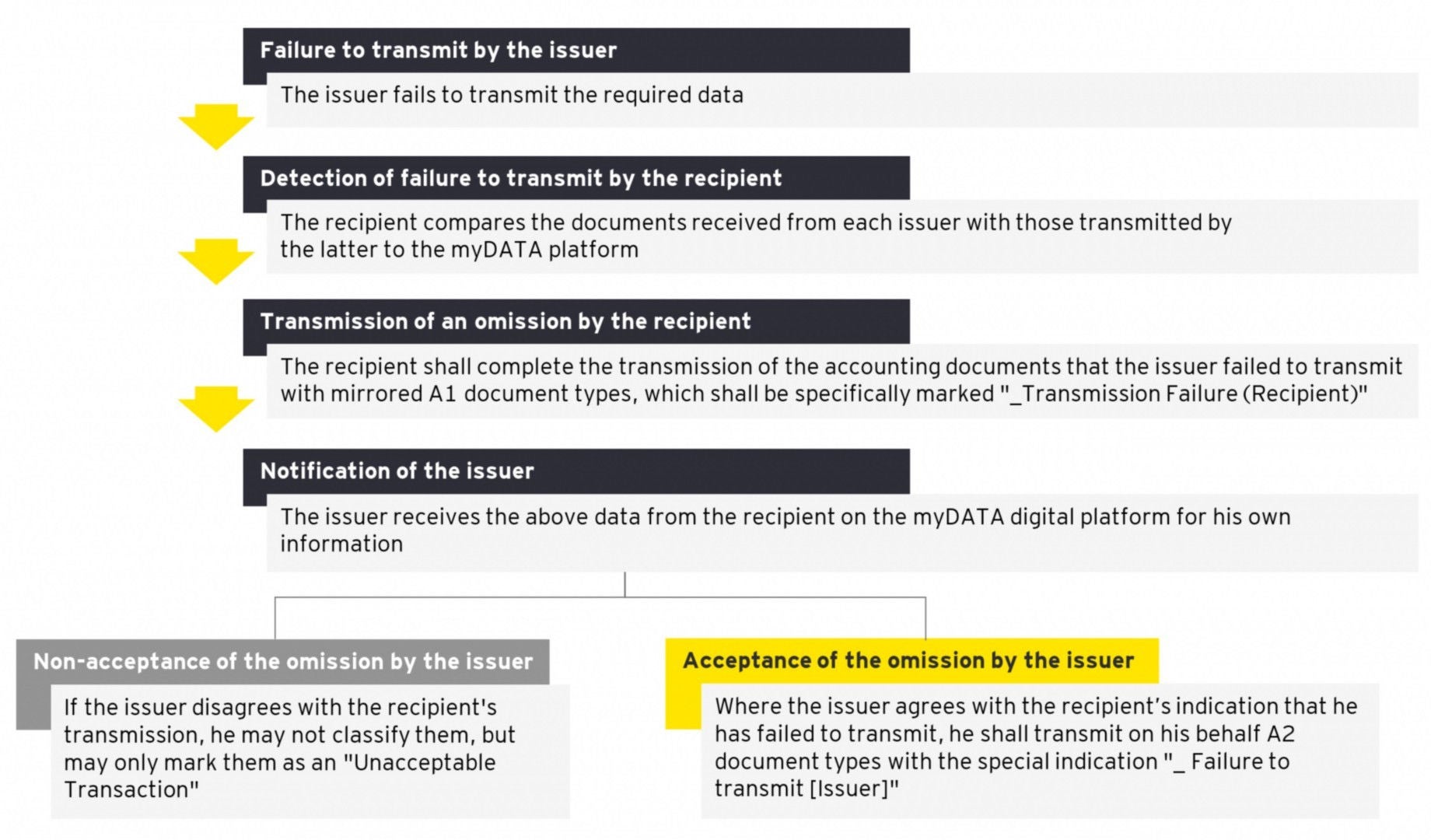

C.1. What actions are required in case of failure to transmit accounting documents by the issuer?

In case of failure to transmit accounting documents by the issuer, the following sequence of actions is required:

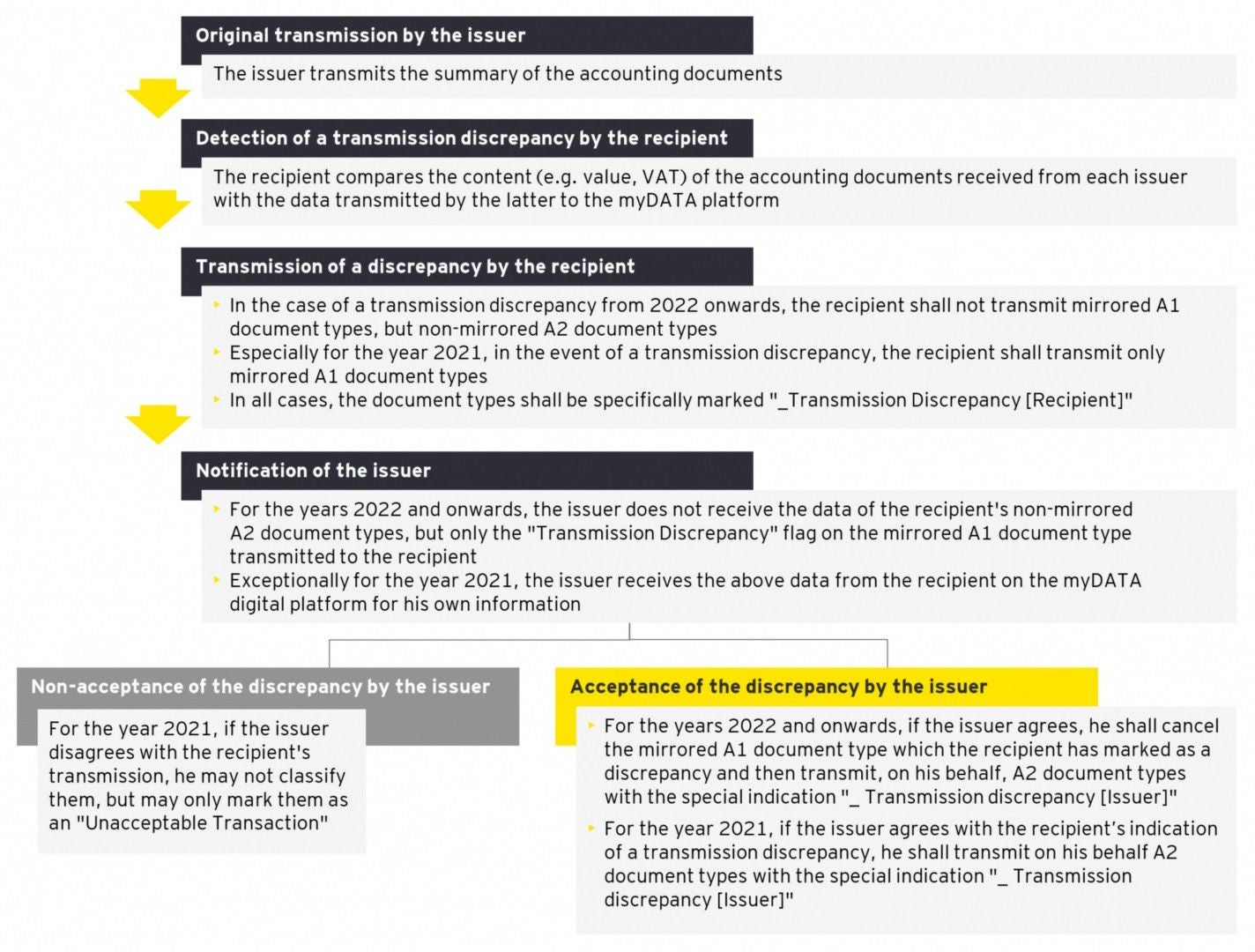

C.2. What actions are required in the case of data transmitted with a discrepancy?

In the case of data transmitted with a discrepancy by the issuer, the following sequence of actions is required:

C.3. What is the mode and timing for transmitting data on omissions and discrepancies?

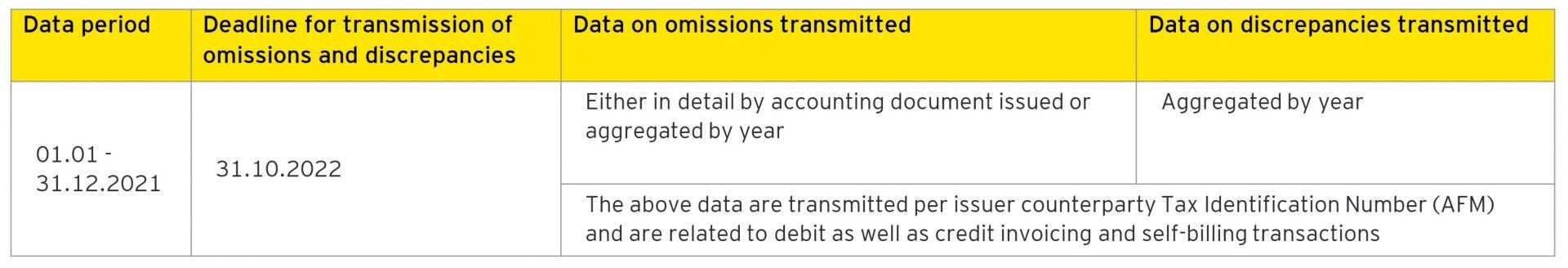

For the year 2021, data for omissions and discrepancies shall be transmitted as follows:

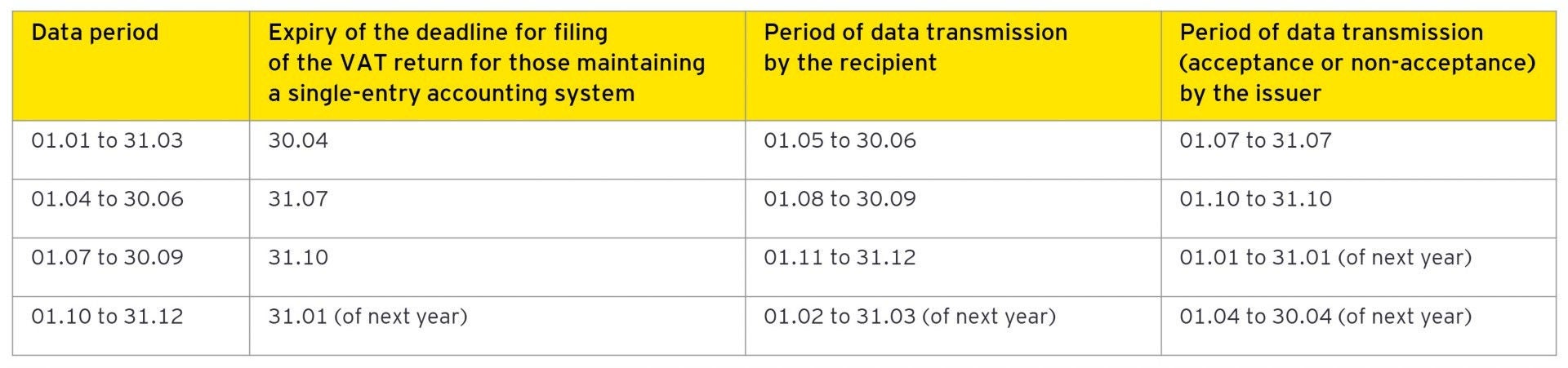

From the year 2022 onwards, omissions and discrepancies data shall always be transmitted, regardless of the category of accounting books maintained, as follows:

There is no obligation to transmit data, per case of either omission or discrepancy, per counterparty issuer, if the total value before VAT does not exceed one hundred (100) euros per counterparty tax identification number (AFM) and per tax year.

C.4. Through which "channel" will the data of omissions and discrepancies be transmitted?

The transmission will be carried out either through the ERP systems available to businesses or through the special entry form by businesses that meet the criteria.

D. What are the deadlines for data transmission for the year 2021?

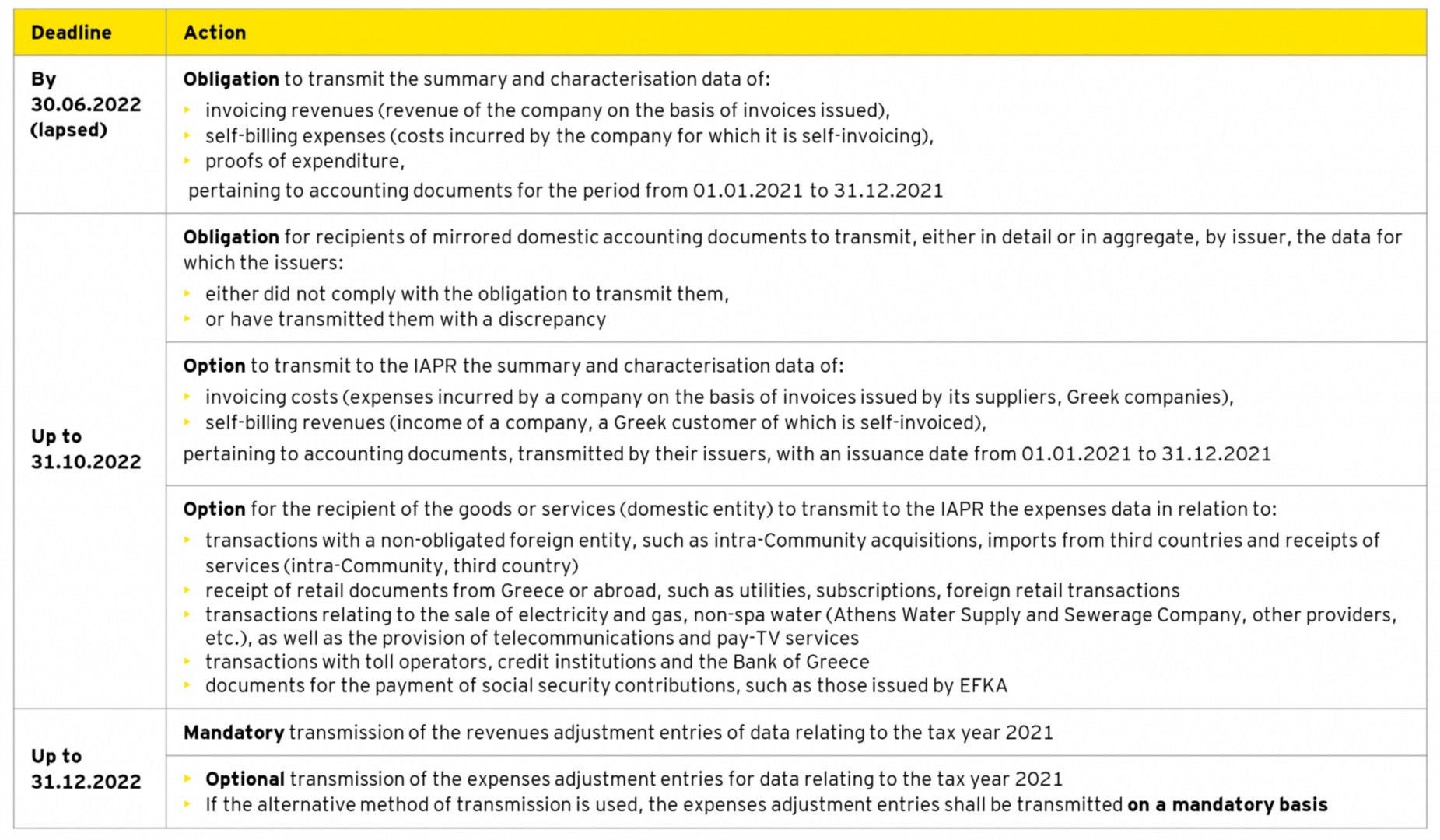

As regards the year 2021, there are the deadlines mentioned below for companies to take certain mandatory and voluntary actions:

E. How and when is data transmitted in case of loss of interface?

- "Loss of interface": It is the inadvertent inability to transmit the data at the scheduled time, by document type and transmission mode, due to a failure of either the internet connection or the electricity distribution system.

- Time and mode of transmission: In case of loss of interface with the myDATA digital platform, the data of the issued accounting documents are transmitted immediately upon restoration of the interface, with the indication "Loss of Interface". In any case, the data shall be transmitted no later than two (2) days after the deadline for their transmission, either from the transmission channel where they were issued or initially transmitted unsuccessfully, or from the business management softwares (commercial/accounting, ERP), or from the special entry form, provided that the conditions of its use are met.

- Other responsibilities: The entity must prove the loss of an interface by all reasonable means and take all necessary measures to prevent it from happening again.

F. What are the conditions for using the special entry form for the year 2022?

Regarding the conditions required to be met for the use of the special entry form and exceptionally for the year 2022, it is clarified that the gross income is determined on the basis of the income tax return for the tax year 2020, while in relation to the number of invoices, that of the submitted customers list (MYF) for the year 2020 will be taken into account.

G. What is the date of transmission and successful electronic data entry?

The date of transmission and successful electronic data entry in the IAPR is considered as the date of issuance of the Unique Registration Number (MARK). For documents transmitted via the direct interface between the FIM and the IAPR, this date is derived from the FIM information system.

H. How is each document type identified?

- The identification of each document type is documented by its identifier, based on:

- the issuer’s tax identification number (AFM) • the issuance date

- the establishment number

- the accounting document series

- the document number

- the document type

- In particular, in the case of either an omission or a transmission discrepancy, these are additionally included as indication in the identification of each document type.

I. What issues are addressed in the updated technical specifications published?

- In conjunction with the above, it is noted that the updated technical specifications published address, inter alia, the issues of:

- transmission of data by the recipient due to a failure to transmit or transmission of data with a discrepancy by the issuer, and by the issuer where he agrees with the recipient's indication of the omission or discrepancy.

- the use of a negative sign when transmitting adjusting entries with document type 17.1, 17.2, 17.3, 17.4, 17.5 and 17.6.

- transmission of accounting documents with VAT exemption under Article 24(b)(1) of the VAT Code (Tax Free), under Article 47b of the VAT Code (OSS non-EU scheme), under Article 47c of the VAT Code (OSS EU scheme) and under Article 47d of the VAT Code (IOSS).

J. What is stipulated regarding the mandatory interconnection between FIMs and EFT/POS terminals?

- With Decision A.1098/2022, it is stipulated that from 01.01.2023 the entities that issue accounting documents through FIMs and at the same time have the obligation to use payment card terminals (EFT/POS), are required to interconnect them based on a specific protocol, to ensure the issuance of documents for transactions paid by card.

- EFT/POS terminals that will implement the above protocol will not be allowed to operate autonomously for debit transactions (i.e. for card payments), as it will not be possible to enter the payment amount by typing. Instead, they will be allowed to operate autonomously for credit transactions (i.e. card refunds), which will be substantiated by the corresponding issued sales documents. Setting the number of instalments in the EFT/POS terminals will also be allowed.