EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

By the joint decision Α.1170/2023 (Government Gazette 6251 Β’/31.10.2023) of the Deputy Minister of Finance and the Governor of the Independent Authority for Public Revenue (IAPR), the decision Α.1138/2020, regulating the scope of application, the time and the process of electronic data transmission to myDATA digital platform, was further amended. Indicatively:

- As of 1.1.2024 onwards, the revenues included in VAT returns shall not be less and expenses shall not exceed those transmitted to myDATAdigital platform.

- The obligation to transmit delivery documents to myDATA platform is introduced and their minimum content is defined.

- The deadline for transmission of discrepancies/omissions by the recipient in case the corresponding obligation is not fulfilled by the issuer is limited to the time point before the expiration of the deadline for submission of the VAT return.

- The following are extended: (i) the obligation to transmit the retail transactions data issued via FIM to myDATA platform, through management programs (commercial/accounting, ERP) or the special entry form, and (ii) the deadline for transmitting data of transactions for the year 2022.

- An obligation to transmit the data of restaurant order forms, e-shops and transactions via POS is introduced, while new relevant types of documents have been also introduced.

- As of 1.1.2024 onwards, the obligation for marking with a QR code, is extended to all documents issued either via ERP or “timologio” application as well as to all the aforementioned data (restaurant order forms, POS transactions etc.).

Α. New provisions regarding the transmission of data

Α.1. Mandatory transmission of delivery documents data (e-delivery documents)

- An obligation to transmit delivery documents is introduced while their minimum content is determined, which includes the following:

1. Full (corporate) name, address and Tax Identification Number (TIN) of the contracting parties.

2. Type and quantity of the goods transported.

3. The date of transportation.

- To this end, new codes were added to Annex of A.1138/2020, while necessary amendments were made to the value lists.

- Based on the announcements made within the framework of 2023 Thessaloniki International Fair, e-delivery note is planned to be activated initially on a pilot basis in early 2024 and fully activated (aiming to the real-time monitoring of all transportations) before the end of 2024.

Α.2. Obligation to transmit retail data issued via FIM to myDATA platform

- Τhe obligation to transmit to myDATA platfrom retail data (revenue accounting entries) issued via FIM is extended also to transactions incurred from 1.1.2024 up to 31.3.2024, regardless of any transmission of data by FIMs to the special FIM Information System (e-send), which remains mandatory.

- The transmission of said transactions to myDATA platform shall be made either (i) in detail or (ii) aggregated per month, via ERP/commercial accounting software or through the special entry form, in all cases, even where no discrepancies are observed between the data transmitted by the FIM Information System (e-send) and the retail revenue accounting entries.

Α.3. Obligation to transmit restaurant and e-shop order forms as well as POS transactions – New document types

- An obligation to transmit the following data is introduced:

1. restaurant order forms;

2. order forms by entities operating e-shops;

3. POS receipts as well as POS refund receipts;

4. POS receipts issued on behalf of third parties, etc.

- New relevant types of documents were introduced to the Annex of A.1138/2020 for the implementation of the above obligation.

- A Ministerial Decision is expected to be issued in order the application scope to be specified and the transmission timeline, the exemptions and the enactment of the abovementioned obligation to be defined.

Α.4. Time of transmitting issuer’s discrepancies and omissions

- In case the issuer fails to comply with the obligation to transmit, the deadline for transmission by the Recipient is limited to the period until the VAT return submission deadline for entities keeping either double-entry or single-entry accounting books.

- If the issuer transmits data with discrepancy, the Recipient transmits within the same above-mentioned timeline, with a relevant note about the discrepancy.

- Especially with regards to Recipients not subject to VAT, the transmission of data of omissions and discrepancies is carried out until the submission deadline of the VAT return for entities keeping single-entry accounting books.

- In the event of either omission of the required data and transmission there of by the Recipient or transmission with discrepancy for which the Recipient has proceeded to the relevant note, the issuer, to the extent that the omission or discrepancy is accepted, transmits the relevant data with the corresponding indication of omission or discrepancy within a month following the deadline for submission of the VAT return for entities keeping a single-entry accounting books.

- A discrepancy is transmitted by the Recipient only in the case where it is observed that the issuer has transmitted data with a transaction value lower than the actual one.

Α.5. Special provisions as of 1.1.2024 onwards

- With regards to the data of transactions subject to VAT, as of 1.1.2024 onwards, the revenues included in the VAT return shall not be less and the expenses shall not exceed those transmitted to myDATA digital platform.

- Non-profit legal entities governed by private law, as well as companies of Article 25 of Law 27/1975 (shipping companies) transmit data exclusively through Document Type 17.4 "Other revenue adjustment entries - Tax Base" for all their revenues and 17.6 "Other expense adjustment entries -Tax Base" for their total expenses. In any case, they are obliged to transmit the data of the accounting documents issued for transactions subject to VAT if they generate income from the exercise of business activity.

- In case of simultaneous transactions using POS and for the purpose of creating the Payment Signature YPAHES- FIM, the relevant documents are transmitted prior their issuance with the corresponding Document Types and the indication "Under Issuance".

- In case of POS receipts issued or appropriate accounting records created and not correlated with invoices or retail sales receipts until the submission of the income tax return for the relevant fiscal year, the corresponding amounts affect the accounting and tax result of the obligated entity. If the amounts of these receipts are invoiced in a subsequent period, they are transmitted, for the current fiscal year, as revenue of subsequent periods.

Α.6. Alternative way of transmitting expenses for the years 2022 and 2023 for which the Recipient has objective inability for transmission

- An alternative method for transmitting expenses (mirrored and self-billing expenses) for the years 2022 and 2023 is introduced in case the Recipient has an objective inability for transmission.

- In such cases, the following shall be transmitted in detail:

1. Revenue data from self-billing (expense for the self-invoiced entity) with

Document Type 11.3 "Simplified Invoice" and the corresponding

Document Type 11.4 "Retail Credit Note“ and

2. Invoicing expense data with Document Type 14.30 "Entity Documents stated by Itself (Dynamic)" with the corresponding Document Type 14.31 "Domestic/Foreign Credit Note".

In these cases, the obligated entity includes the indication "Unable to correlate" in the comments.

- This alternative way of transmission is allowed only in the following cases:

1. Inability to correlate mirrored documents due to discrepancies in value of VAT and other charges (withholdings, other taxes, stamp duties,fees and deductions) and only if the comparison cannot be made exclusively on the net value.

2. Foreign entity self-billing.

3. Invoicing assignment.

4. Transmission from the issuer with a transaction value exceeding theone the Recipient accounted either as invoicing expense or as self- billing revenue (detailed cases are introduced for the transmission of data of the said category).

5. Other Expenses Αdjustment Entries - Accounting Basis and opposite sign for proper allocation of expenses.

- In any case, the process of guarantee is not monitored in myDATA digital platform.

Β. Additions related to the content and identification of documents

Β.1. Obligation to mark with a QR code any invoices issued via ERP or “timologio” application as well as any data issued via POS.

- As of 1.1.2024 onwards, an obligation to mark with a QR code is introduced for the following:

1. Accounting data issued either via ERP or the “timologio” application.

2. Data of restaurant and e-shop order forms as well as POS (collection or refund) receipts.

- Upon the successful transmission of the document to myDATA digital platform (by the use of the SendInvoices method) a coded text is returned which is utilized by business management software to generate the QR code (URL type) through which the document may be reviewed.

Β.2. Identification of the Document Type

- The Recipient’s TIN is added as an identifier of each Document Type.

- Therefore, the identification is documented based on the issuer’s TIN, the issuance date, the installation sequential number, the document series and sequential number, the Document Type specified in the Annex of A.1138/2020 and the Recipient’s TIN in cases of either non-mirrored Recipient documents or mirrored documents if the Recipient is not an individual.

C. Other amendments

C.1. Special regime of transmission through Certified e-Invoicing Provider for specific entities

- Hellenic Post (ELTA) is added to the category of entities for which a special transmission regime applies (wholesale transactions are transmitted in detail by the day after the next from their issuance date whereas retail revenues issued without the use of FIM aggregated per month and until the second day of the following month) e.g. Public Power Corporation, Athens Water Supply and Sewerage Company, Bank of Greece, credit institutions , telecommunication providers etc.

- A possibility is provided, until 31.12.2025, to the above entities for transmission within two (2) days from the issuance date in case they use einvoicing Providers.

C.2. Transmission of transactions with the aforementioned entities by the Recipient

- The obligation of transmission of the expenses by the Recipient in cases where the latter either have not received their expenses from the abovementioned entities with the special regime as mirrored expense documents of domestic origin (Document Types A1) or they are received with the indication of an objective inability of correlation with accounting entries, is extended up to 31.12.2024.

- In this case, the Recipient continues to transmit the aforementioned expenses as Document Types of category B2, 14.30 - Entity Document as indicated by itself (Dynamic) and 14.31 - Domestic or foreign credit note.

C.3. Loss of connectivity

- The transmission of transactions due to loss of connectivity with myDATA digital platform is reduced to 1 day (instead of 2, as previously applied).

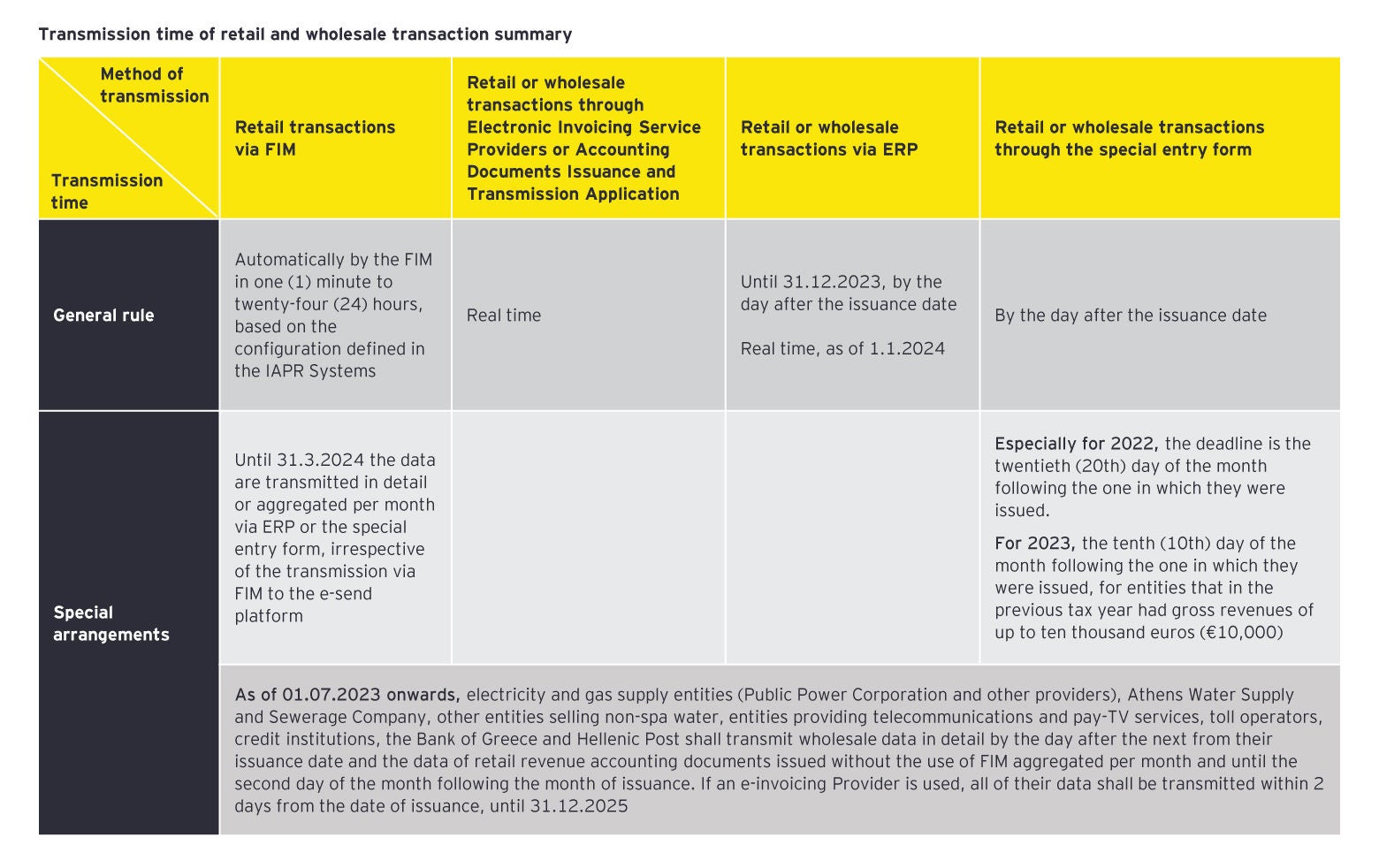

Transmission time of retail and wholesale transaction summary

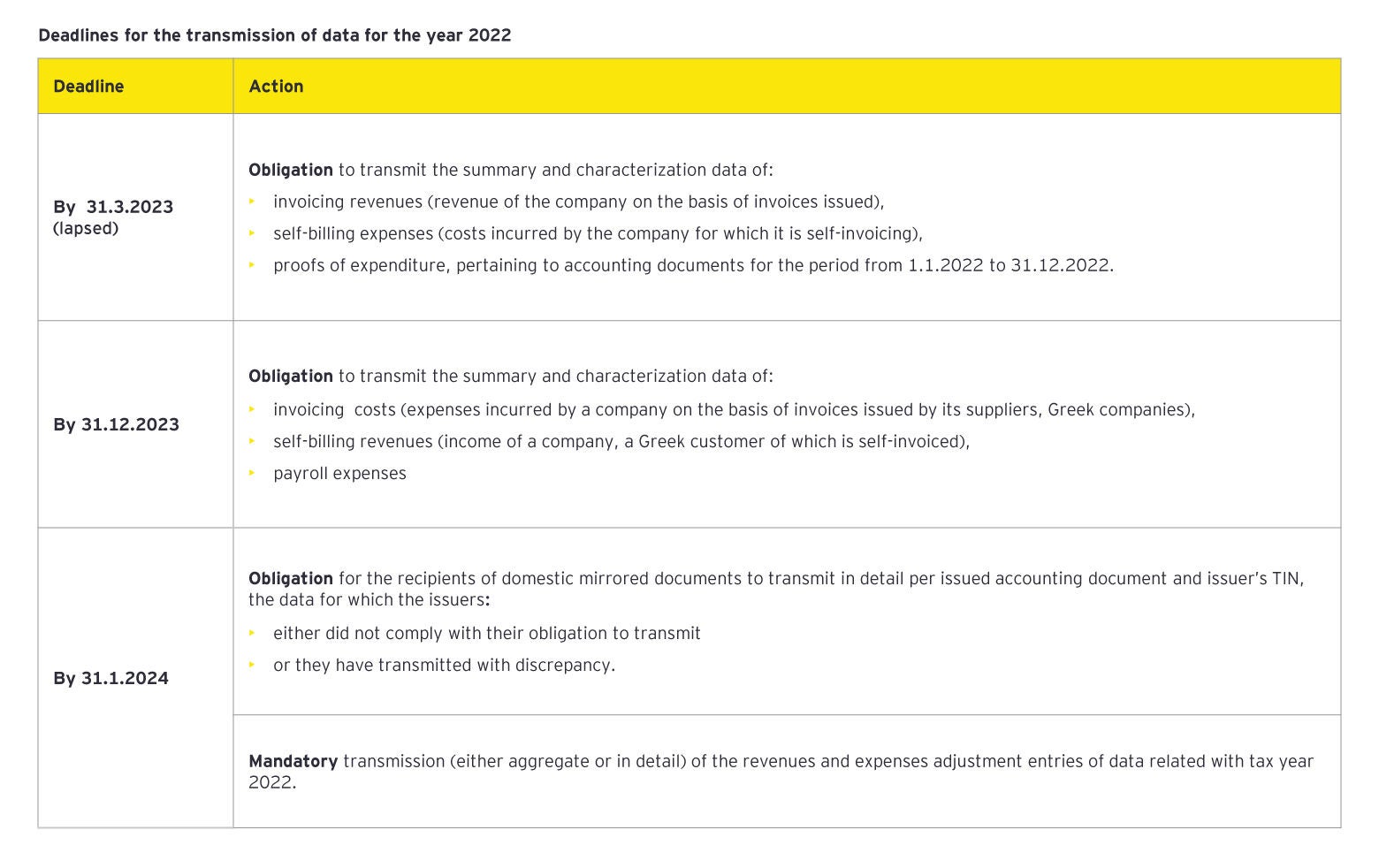

Deadlines for the transmission of data for the year 2022

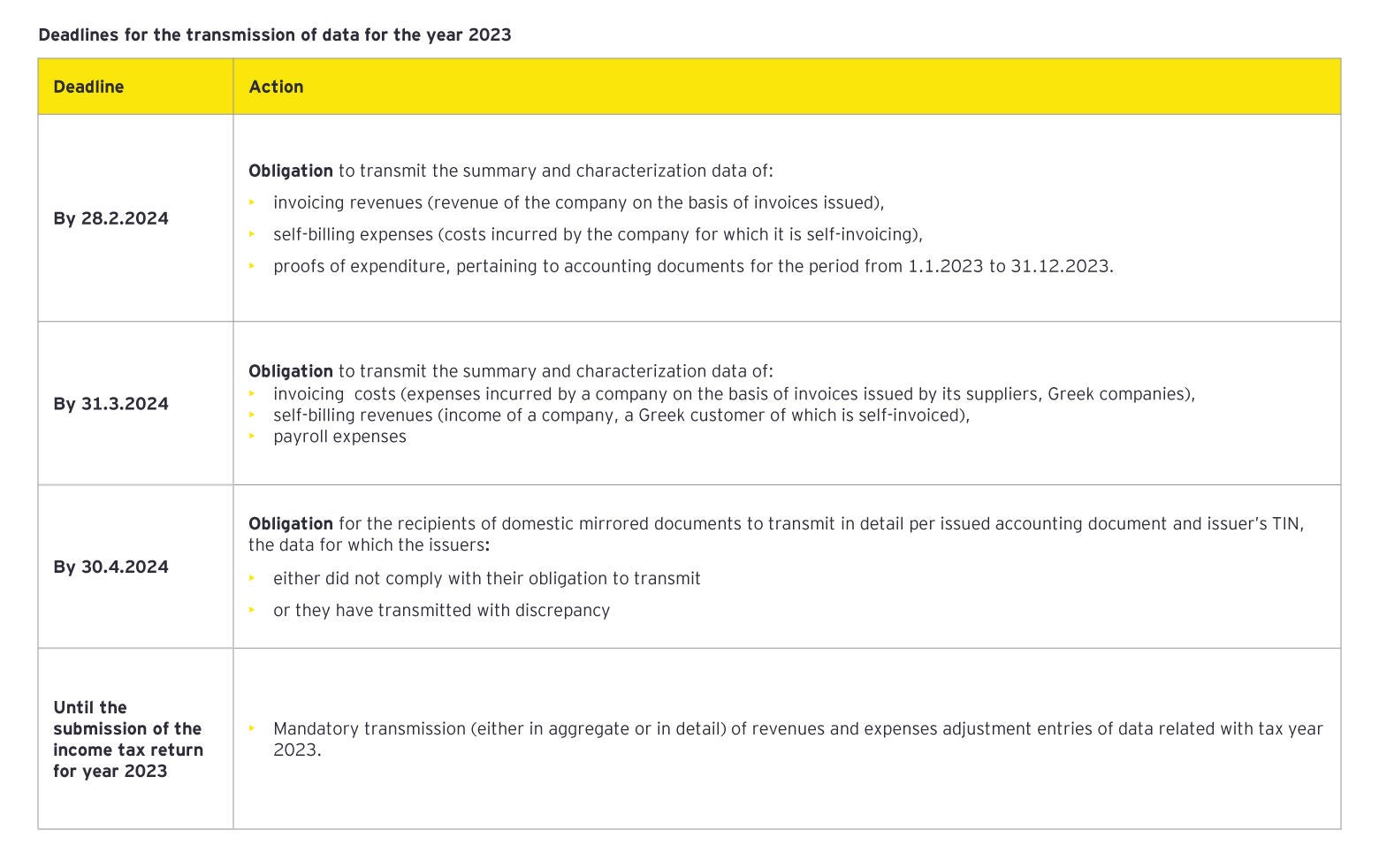

Deadlines for the transmission of data for the year 2023

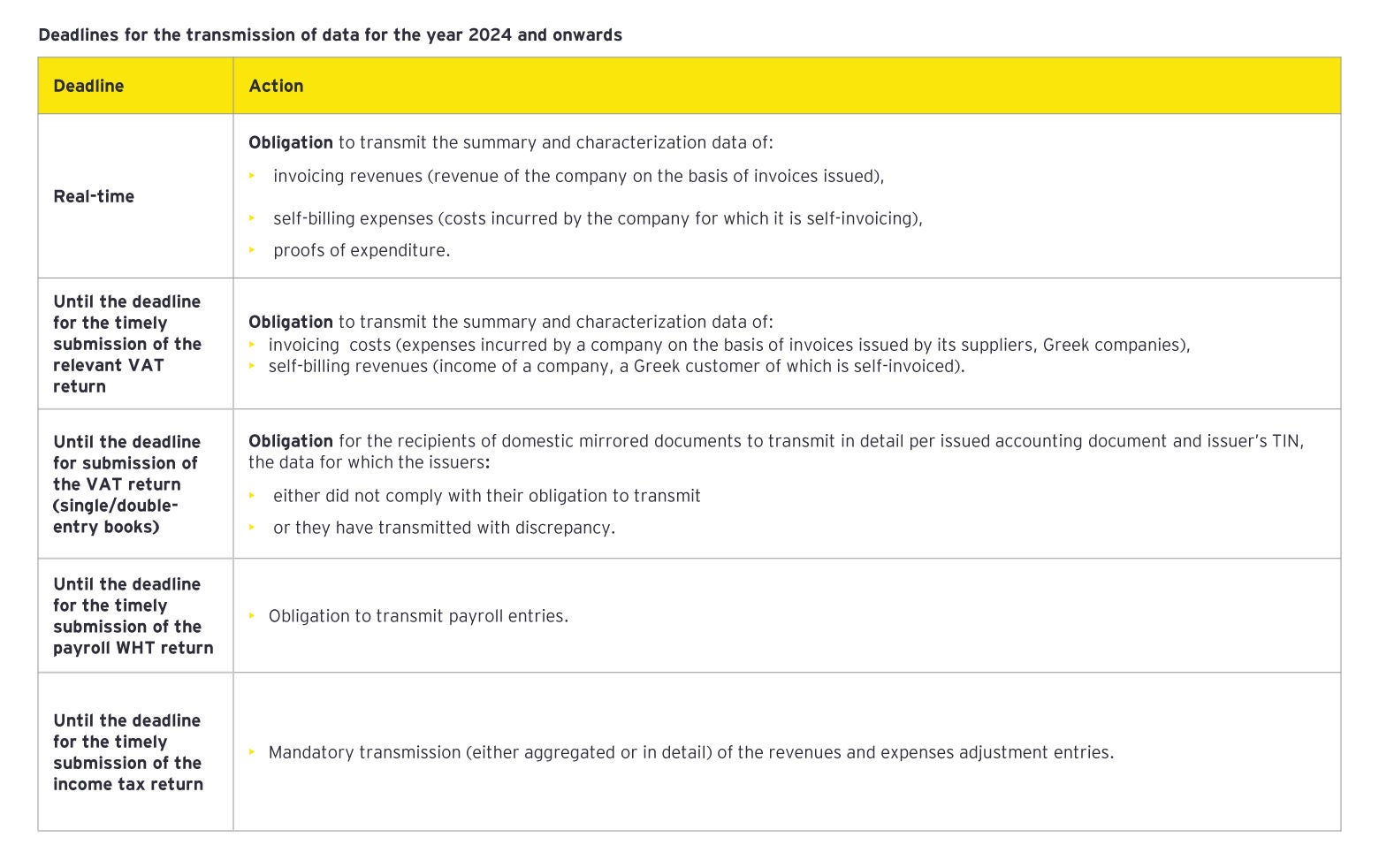

Deadlines for the transmission of data for the year 2024