EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The developments in the digital tax environment in Greece are rapid. Taking into account the announcements made by the Prime Minister during the 87th Thessaloniki International Fair as well as the Draft Bill of the Ministry of National Economy and Finance under public consultation, the most significant developments are the following:

- Extension of mandatory e-invoicing to all transactions (not limited only to B2G but also extended to B2B transactions).

- Universal implementation of e-books (myDATA) within 2024 with the purpose of ensuring that: (i) declared revenues are not lower than those derived from electronic information and (ii) tax deductions and deductible expenses are not taken into account, both for income tax and VAT purposes, to the extent that the tax documents on which the latter are based on, have not been previously transmitted electronically.

- Activation of the electronic delivery note (e-delivery note) on a pilot basis as of early 2024 and full implementation before the end of the same year.

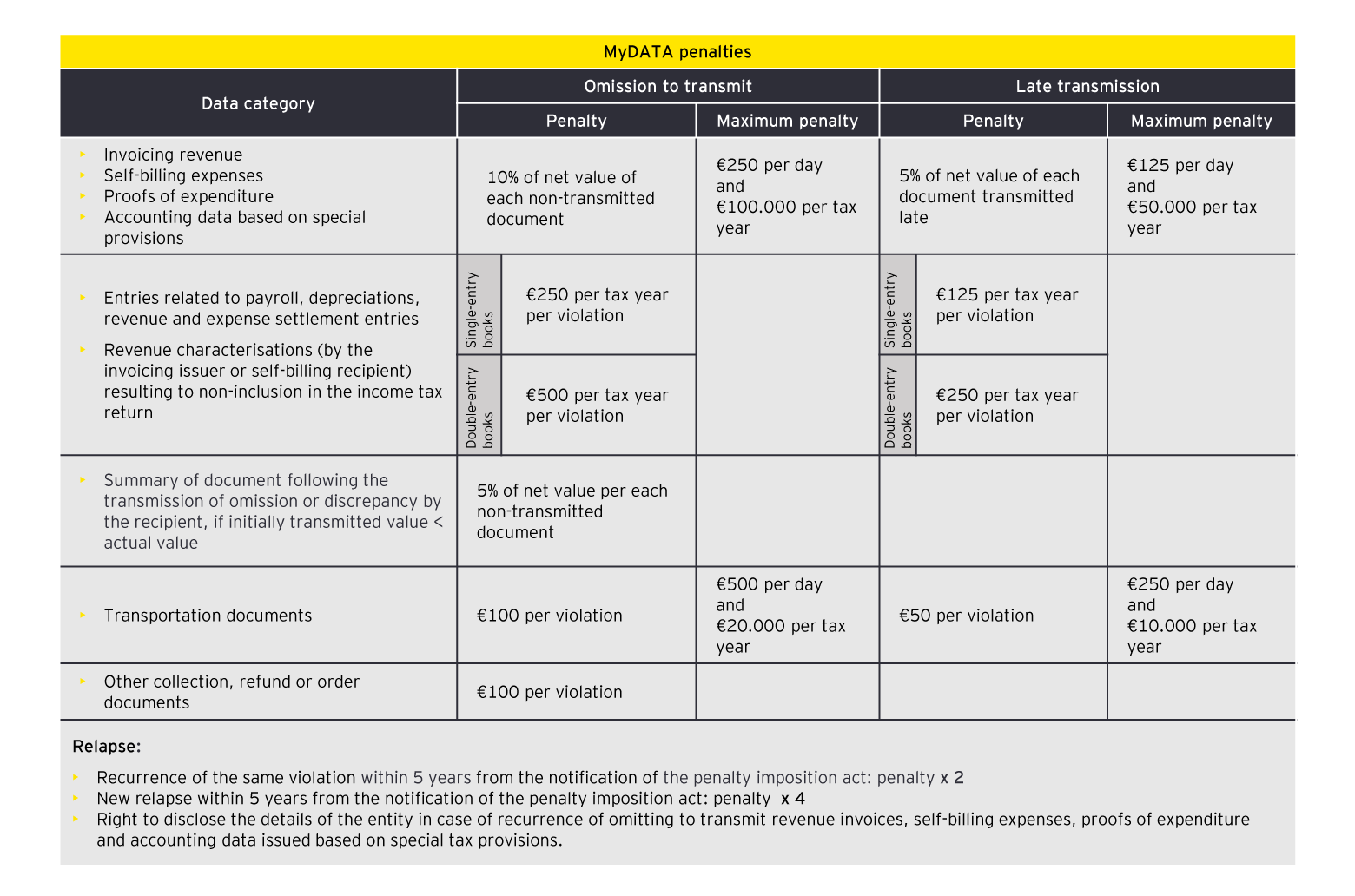

- Penalties related to omission and late transmission of data to the digital platform myDATA.

- Mandatory POS interconnection with the Tax Administration as well as expansion of the obligation for their use to all sectors of retail market.

- Declaration of compliance by Payment Service Providers (Acquirers) and Network Service Providers (NSPs).

- POS upgrade.

1. Actions for extending the mandatory e-invoicing to all transactions (B2G and B2B)

- According to the provisions of law 4601/2019 (articles 148-154) and Joint Ministerial Decision 52445 EΞ 2023, e-invoicing becomes mandatory for transactions with the Public Sector (B2G transactions). Also, according to the instructions provided by the Administration, e-invoicing on B2G transactions appears to be carried out only via a Certified e-invoicing Service Provider.

- Pursuant to Article 4 par. 6 of Decision 1138/2020, in case that mandatory e-invoicing applies for B2G transactions, it seems that the same obligation arises for the issuance and transmission to myDATAplatform of any other invoices (B2B transactions) in the same way i.e. through a Certified e-Invoicing Service Provider.

- In addition to the above, as announced, the Greek Government has submitted a request to the European Commission in order to obtain the necessary approval for the mandatory implementation of e-invoicing within 2024 (i.e. not only on B2G but also on B2B transactions as well). It seems that the Tax Administration’s intention is the e-invoicing to be carried out only through Certified Providers or/and “timologio” application.

- With the aim of promoting invoicing through Certified Providers, the bill of Ministry of National Economy and Finance "Measures to limit Tax Evasion“ which is under public consultation (hereinafter “Draft Bill”) includes a provision for the extension of the tax incentives of article 71ΣΤ of Law 4172/2013 up to tax year 2024 (incl).

2. Universal implementation of myDATA within 2024

- With the Draft Bill under consultation, the amendment of article 15A of Law 4987/2022 (“TPC") is proposed, with the aim to introduce the universal implementation of e-books so that the revenues declared are not less than the ones transmitted electronically to the Independent Authority for Public Revenue (IAPR).

Furthermore, it is provided that the expense invoices are taken into account for tax purposes only if they have been transmitted electronically to the digital platform "myDATA“.

- In particular, it is provided that the value of taxable transactions and revenues taken into account by the Tax Administration for the determination of VAT and income tax for each entity shall not be less than those resulting from the tax documents electronically transmitted to IAPR.

- Respectively, tax deductions and deductible expenses, both for income tax and VAT purposes, are not taken into account unless the tax documents on which they are based, have been transmitted electronically to IAPR.

- With a decision of the Minister of Finance and National Economy, upon recommendation by the Governor of IAPR, the following shall be determined:

I. the time of transmission, scope of implementation, specific obligations of companies and any exemptions from the application of the provision for specific sectors, for as long as any companies do not have the technical infrastructure which allows electronic data retention and transmission, and

II. the commencement of the implementation of the abovementioned rules regarding the universal application, any exceptions as well as the limits of acceptable discrepancies from the abovementioned restriction regarding the value of taxable transactions and revenues taken into account by the Tax Administration, which cannot exceed thirty percent (30%) of the value of the tax documents electronically transmitted to IAPR.

- In the immediate plans of the Tax Administration is also the "locking" initially of the VAT returns and subsequently of E3 form, which results to the taxpayers not being able to intervene in the amounts that have already been pre-populated based on the data retrieved by the myDATA platform.

3. Transport e-documents

- According to article 5, par. 9A-9C of Law 4308/2014 (“Greek GAAP"), as amended by Law 5036/2023 and applicable as of 28/3/2023, transportation documents are issued digitally, bear special specifications and markings and are transmitted electronically directly to IAPR.

- With the recent Decision 1170/2023, which amended decision Α.1138/2020, the obligation to transmit the transportation documents to myDATA digital platform was introduced.

- In line with the minimum content provided by article 5 par. 8 of the Greek GAAP for transportation documents, the following details are transmitted as a minimum:

I. Full name/business name, address and Tax Identification Number (TIN) of the counterparties;

II. Type and quantity of the goods transported;

III. Date of transportation.

- To this end, new codes were added to the annex of decision A.1138/2020 whereas the necessary amendments were made to value lists.

- It is noted that based on the announcements made in the context of Thessaloniki International Fair 2023, the e-delivery note is going to be activated in principle on a pilot basis as of early 2024 and fully implemented, with the aim of real-time monitoring of transported goods, before the end of 2024.

- In this context, the issuance of a relevant decision is expected for the purposes of specifying the scope of implementation, the time of transmission, the exemptions as well as the entry into force of the obligation to transmit transportation documents.

4. MyDATA penalties

- By article 7 of the Draft Bill under public consultation, the introduction of a new article 54ΙΓ in the Tax Procedure Code (TPC) is proposed, for the provision of penalties related to violations of non transmission, inaccurate or late transmission of data to IAPR.

- The commencement as well as the scope of the penalties will be determined upon issuance of a Ministerial Decision.

- The below table summarizes the relevant provisions of the Draft Bill:

5. Mandatory interconnection of POS with the Tax Administration

- According to the announcements made at Thessaloniki International Fair 2023, the interconnection of cash registers with POS terminals is going to be implemented within the first months of 2024 in order to secure the recording of any transactions conducted via POS to the cash register as well as their real-time transmission to the digital platform myDATA.

- In this context, businesses using EFT/POS terminals of domestic or foreign providers are obliged to interconnect and provide information to the Tax Administration regarding transactions carried out through them:

I. either via interconnection of those terminals with FIM;

II. or directly with the information systems of the Tax Administration (article 15Β TPC).

- The technical specifications for interconnection of FIM with POS have been determined by Decision 1098/2022.

- The scope of implementation as well as the procedure for interconnection of POS with the companies’ cash systems, the Payment Service Providers and IAPR were determined by Decision 1155/2023.

- The aforementioned interconnection of POS with the Tax Administration will serve as a tool for the further automated population of tax returns whereas the obligation to possess POS is expected to be extended to all sectors of the retail market.

6. Declaration of compliance by Acquirers and NSPs

- Companies (domestic and foreign) operating in the sectors of:

I. payment services via cards (Acquirers) and

II. provision, management of terminals and services related to POS (NSPs) are obliged to comply with the requirements of operation and interconnection with IAPR.

- For this reason, Acquirers and NSPs are required to submit to IAPR a declaration of compliance. The type, content, procedure and time of submission of said declaration was determined by Decision 1156/2023.

- Acquirers and NSPs are subject to penalties ranging from €1,000 up to €200,000 and cessation of POS legal operation in case of non-compliance with the operational and interconnection requirements of IAPR.

- For businesses-users of POS terminals which do not comply with the requirements of operation and interconnection with IAPR despite the submission of declaration of compliance, penalties ranging from €200 to €10,000 are provided.

7. POS upgrade

- The time and procedure for POS upgrade by NSPs was determined by Decision 1157/2023.

- Businesses-users of POS are obliged within 30 days from the receipt of a relevant message by IAPR and -in any case- until 29.02.2024 (if less than 30 days remain from the message delivery) to take all necessary actions in order to upgrade their cash systems and interconnection with POS.

- Within the abovementioned deadline and no later than 15.1.2024, businesses-users of POS intending to replace their cash systems or POS with new ones must declare said intention in the POS Registry in the digital portal myAADE.

- In case of non-compliance, a penalty of €1.000 up to €50.000 per tax year is imposed.