EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY Nexus Digital Marketplace solution for banks

Empower your bank with agility and tech-enabled solutions to meet the evolving needs of today’s digital customer.

Discover how EY Nexus for Banking Digital Marketplace can enhance customer acquisition and engagement for banks.

Grow your customer base

Broaden the customer acquisition funnel, lower acquisition costs and increase conversion rates.

Uncover new revenue streams

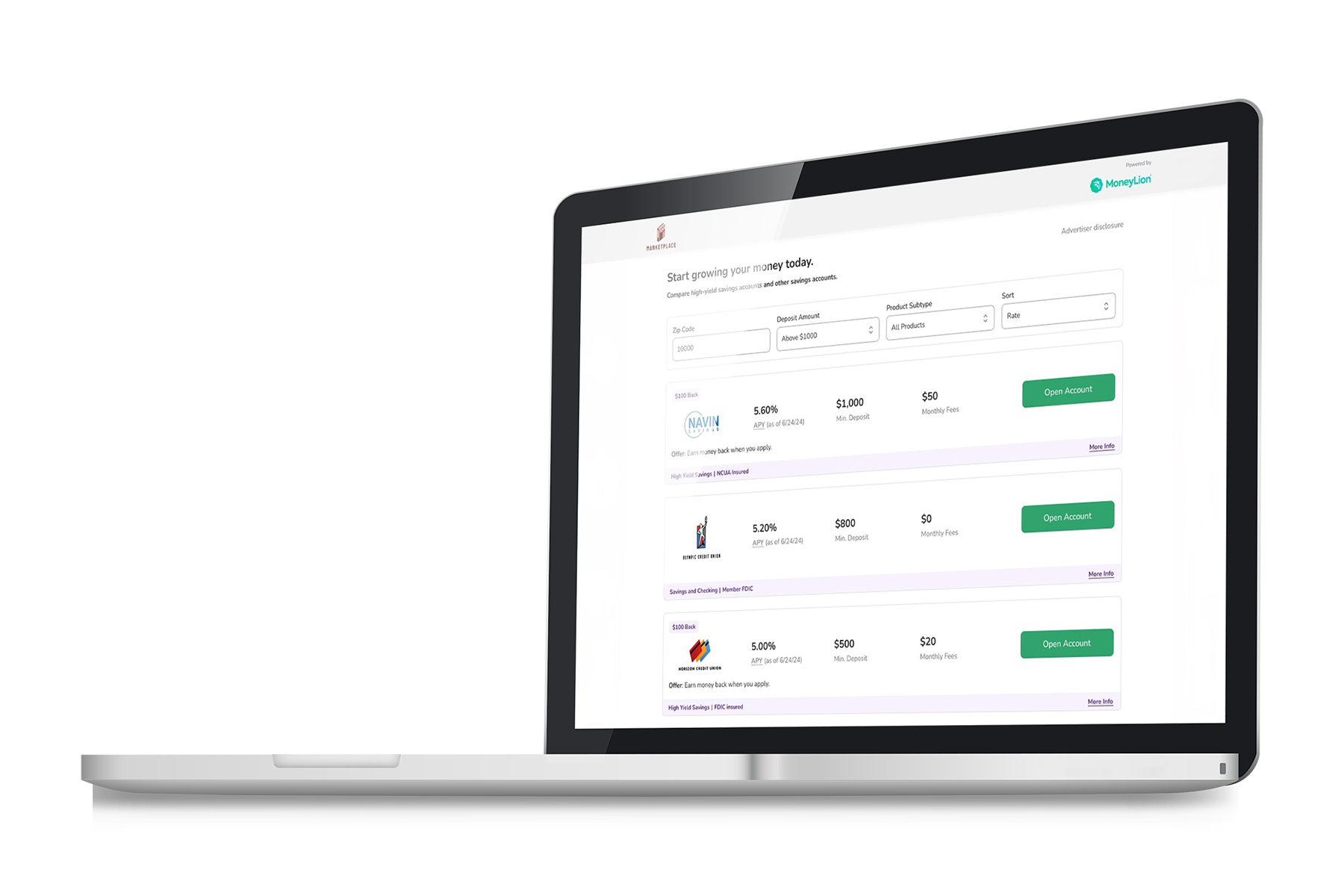

Offer customers personalized access to a wide range of digital financial products (e.g., savings, insurance, lending).

Increase efficiency

Unlock modern capabilities with an advanced infrastructure platform offering interoperability with core systems.

Marketplace activation

Attract new customers and delight existing ones with access to digital banking products through a network of 500+ product partners, available through a single integration and unified onboarding experience.

Digital onboarding and core banking integration

Offer new customers a fast, simple and intuitive onboarding experience leveraging a hosted digital onboarding infrastructure with supported KYC.

Personalized customer engagement

Prioritize your brand and control customer relationships. Unlock the power of consumer data insights to manage incentives, trigger timely new offers and curate dynamic, engaging experiences.

Jumpstart your engagement

Our Jumpstart activation program is designed to launch a bank's personal digital marketplace in a matter of weeks to begin driving deposit growth. It includes assessing risk and developing an executive business case.