EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Discover how EY's global renewables team can help your business transition to the world of renewable energy.

Read more

Indeed, smart grid technology is creating a new energy distribution model in markets without established national grids, whereby the overall grid is composed of microgrids that can switch to operating independently. This provides greater resilience for isolated rural areas, as well as for highly concentrated urban areas where brownouts or blackouts can result from surges in demand.

While their benefits are many, smart grids present several challenges, particularly in making them intelligent enough to manage the integration of DERs, bringing together a wide range of power sources and controlling the flow of electricity so that it meets demand.

In addition, cybersecurity will be an issue, given the interconnectedness of DER ecosystems, with the increased potential attack surface area making such systems more vulnerable to cyber attacks.

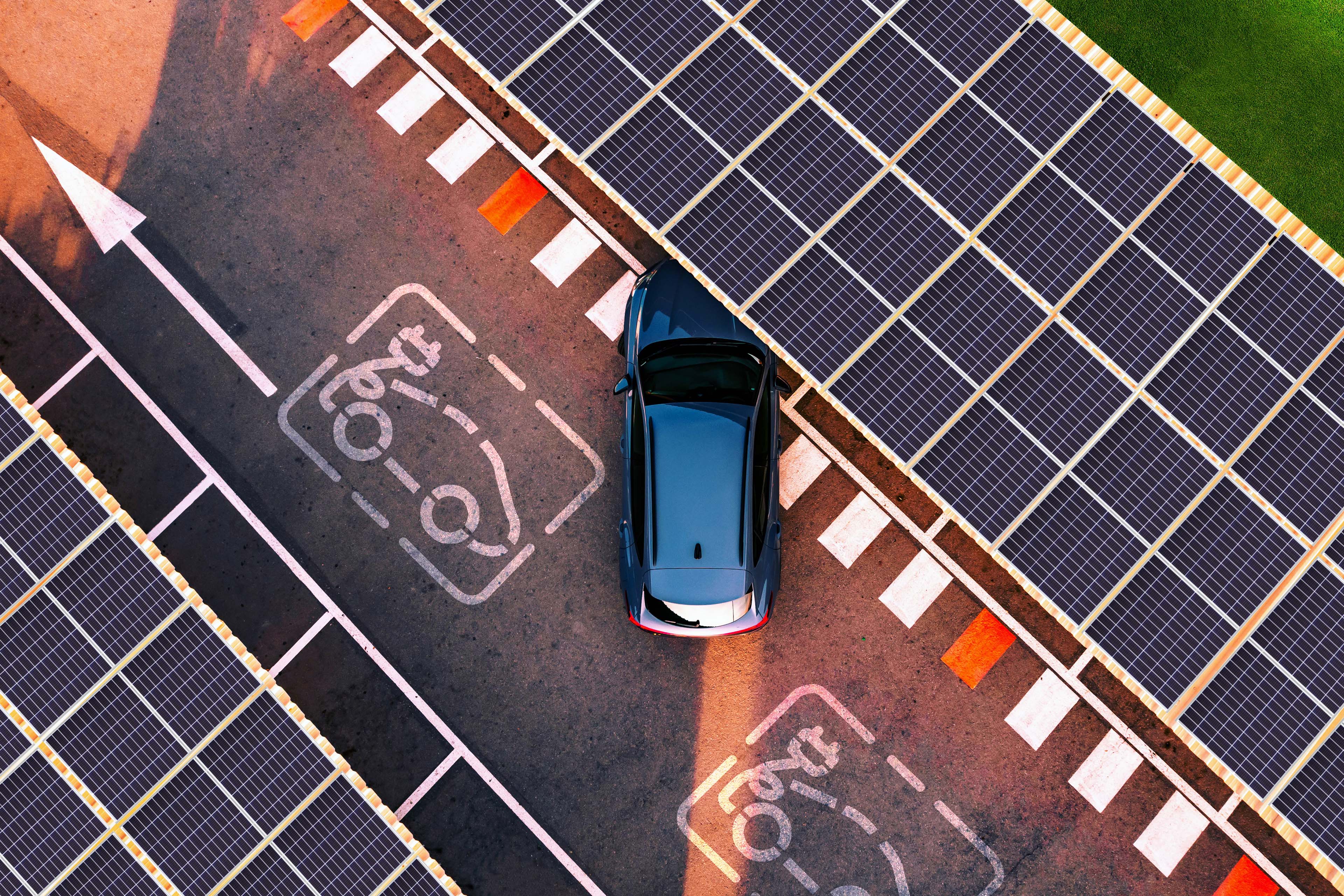

Storage and supply management can also be problematic. As EVs scale up, for example, they will be both a strain on the grid and a support, able to absorb excess generation from renewable energy resources, as well as acting as real-time demand response assets. But work still needs to be done on optimizing them as DERs.

Accelerating the use of renewable resources will require annual electric network investments to nearly triple by the late 2020s, to almost US$800b, according to the International Energy Agency. This will need to be matched by an eight-fold increase in investment in digital assets.1

Continued regulatory support for DERs will be required, therefore, if markets are to realize the potential of such technology to bolster energy resilience through increased grid flexibility and help achieve the world’s decarbonization goals.