Fiduciary management and investment governance

Institutional investing is an increasingly important, complex and resource intensive topic. At EY, we help pension schemes identify effective governance models and get the most out of their appointed investment advisors or fiduciary managers.

What EY can do for you

We have been providing independent investment governance and fiduciary management advice to pension scheme trustees and sponsors since 2010. We work with each of our clients to truly understand their investment needs and constraints, then identify and help implement a practical governance model aligned to their unique requirements.

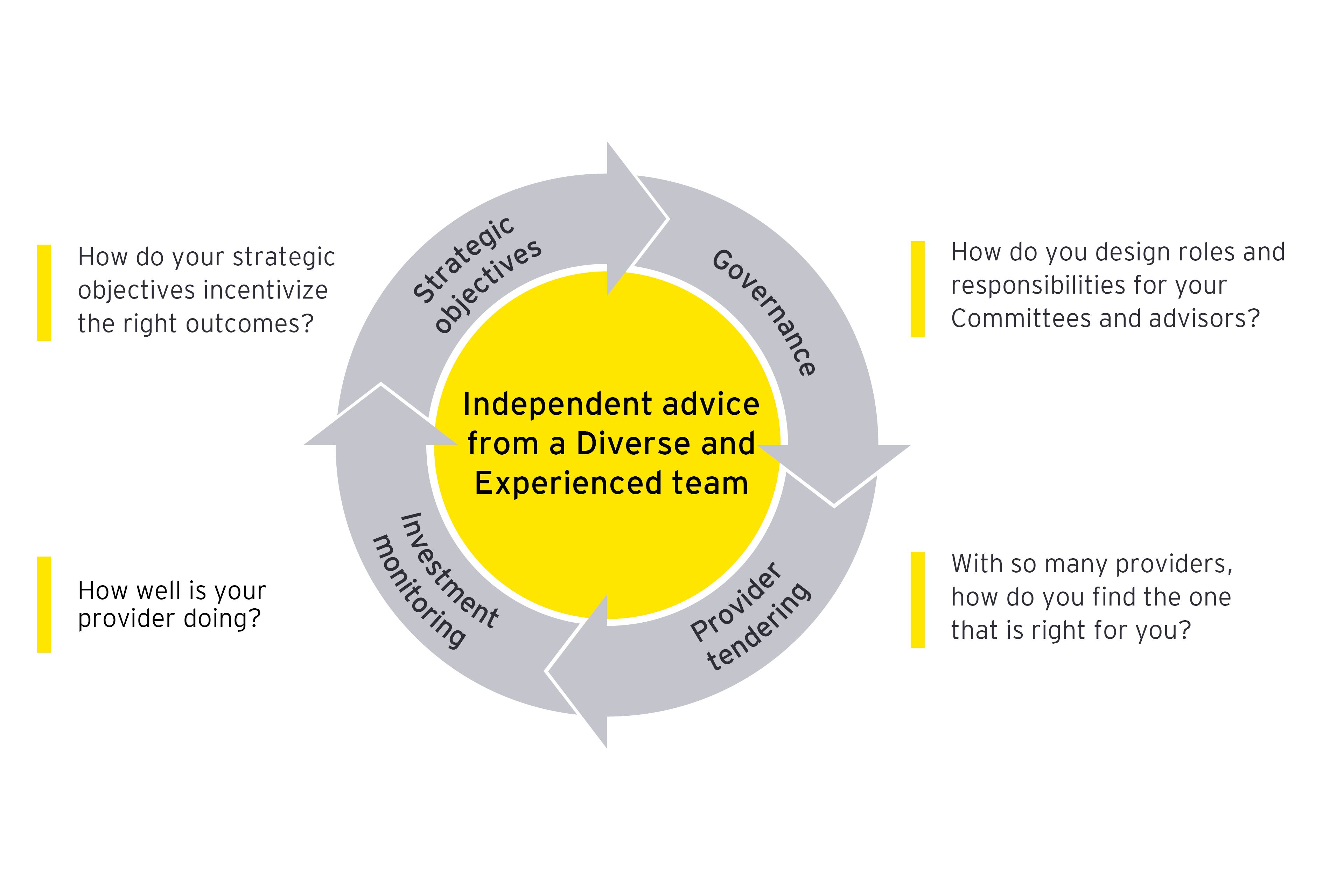

Our framework for providing advice and the areas we look to explore are below:

- Governance: How do you design roles and responsibilities for your committees and advisors?

- Provider tendering: With so many providers, how do you find the one that is right for you?

- Investment monitoring: How well is your provider doing?

- Strategic objectives: How do your strategic objectives incentivize the right outcomes?

Fiduciary management

Fiduciary management is an investment governance solution that involves investment decision-makers, such as pension schemes trustees, delegating certain elements of their investment process to a third-party fiduciary manager.

The delegation of certain investment decisions has become increasingly popular with pension schemes and other asset owners. Commonly, it is motivated by the desire to free up time to focus on key strategic issues, improve implementation speed and efficiency, access a greater variety of asset classes and risk management techniques economically, and ensure there is a dedicated investment resource looking at the investment strategy on a daily basis.

There is a spectrum of delegation available from fiduciary managers, and investment decision-makers can implement the approach that best suits their needs and objectives.

Typical levels of delegation used by UK pension schemes: