To address concerns around trust and bring the law in step with technological developments, the EU has also been working on a draft Artificial Intelligence Act (AIA) – the first law on AI by a major regulator anywhere in the world. The regulation takes a risk-based approach and seeks to position Europe as a global hub for trustworthy AI through harmonized rules governing the development, marketing, and use of AI in the EU. By fully understanding the regulation at an early stage, including its opportunities and limitations, financial institutions can realize a competitive advantage.

For further insights, refer to our article here: The EU AI Act: What it means for your business

Banks and insurance companies have access to an extremely large pool of data. In the past, this was not used optimally, not least due to human limitations on the way we process and analyze data. AI changes that. Before looking into opportunities, the implications of managing AI need to be understood. Understanding the technologies is the first step. For instance, robotics process automation is not a system that is capable of learning and improving. In a second step, the focus should be on re-designing the process and defining which steps can be done by the machine and which ones should be left to humans. Additionally, managers should promote augmentation and make sure that machines act as partners of human beings. Last but not least, they need to consider that data-driven decisions are better decisions.

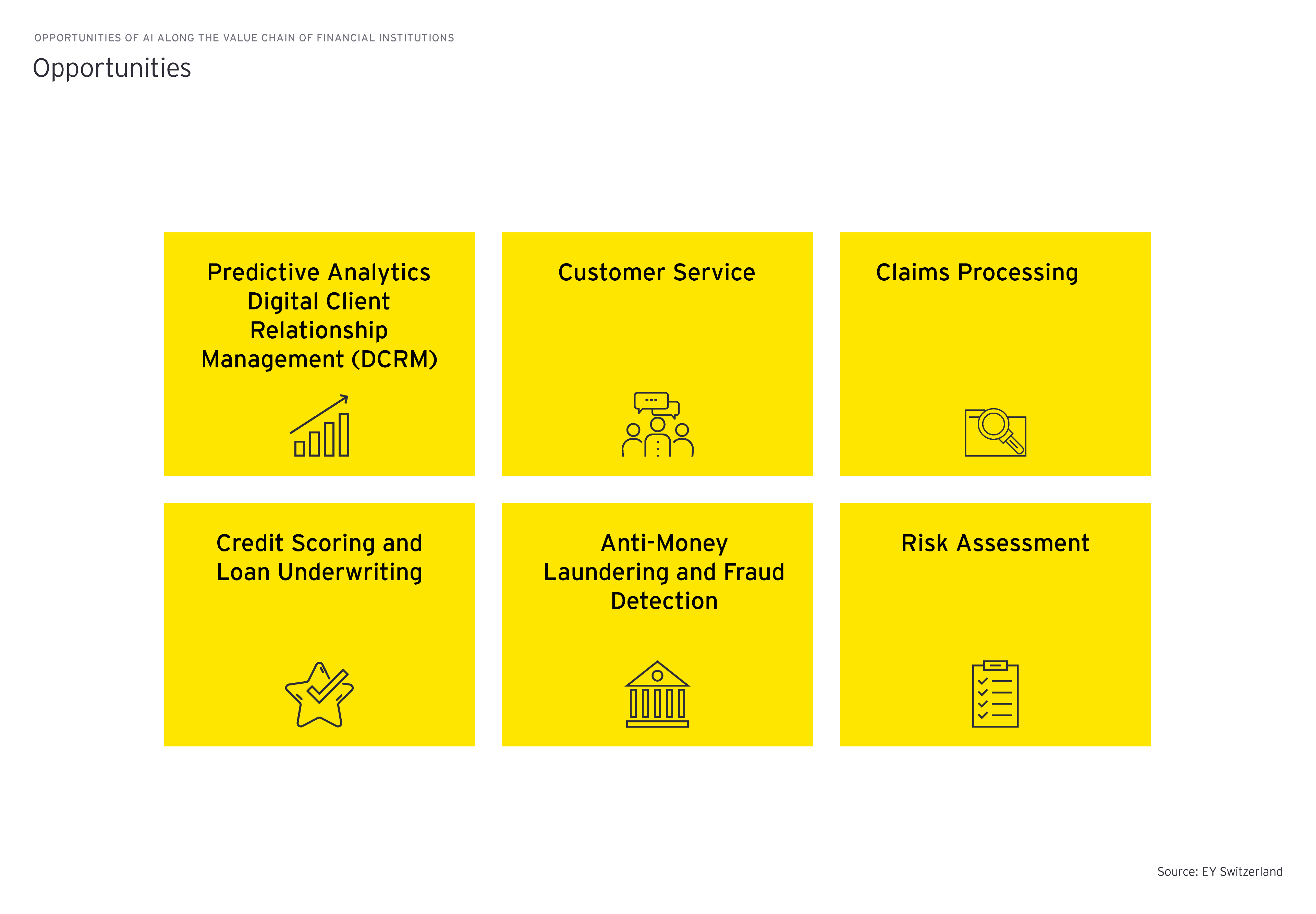

Currently, many financial institutions have not yet moved from selected AI use cases to scaled AI across the entire organization. They often lack a clearly defined AI strategy, with many also maintaining a legacy core system, fragmented and siloed data management and outmoded operating models that prevent proper collaboration. Across the entire value chain, there are a magnitude of opportunities to tackle.